In It for the Long Haul: Continuation Funds on the Rise

Continuation funds are extending the runway for companies that might not be ripe for an exit, especially as market conditions get choppier

Continuation funds are here to stay.

This investment structure has gained a foothold as a tool for private equity general partners to release their investors from commitments if they’re interested in moving on, or it can provide more exposure to familiar assets for those that want to stay.

This section of the report originally appeared in the Winter 2023 issue of Middle Market DealMaker. Read the full story in the archive.

The vehicle is usually set up by a GP to house one or more investments from a previous fund that the PE firm is not ready to sell. The GP can then roll existing limited partners into the new structure or find new investors.

For a fund with an underperforming asset, a continuation vehicle provides an alternative to selling during volatile market conditions. Meanwhile, for companies in growth markets with strong assets that are just starting to catch on, the continuation fund is a way for LPs to keep supporting them.

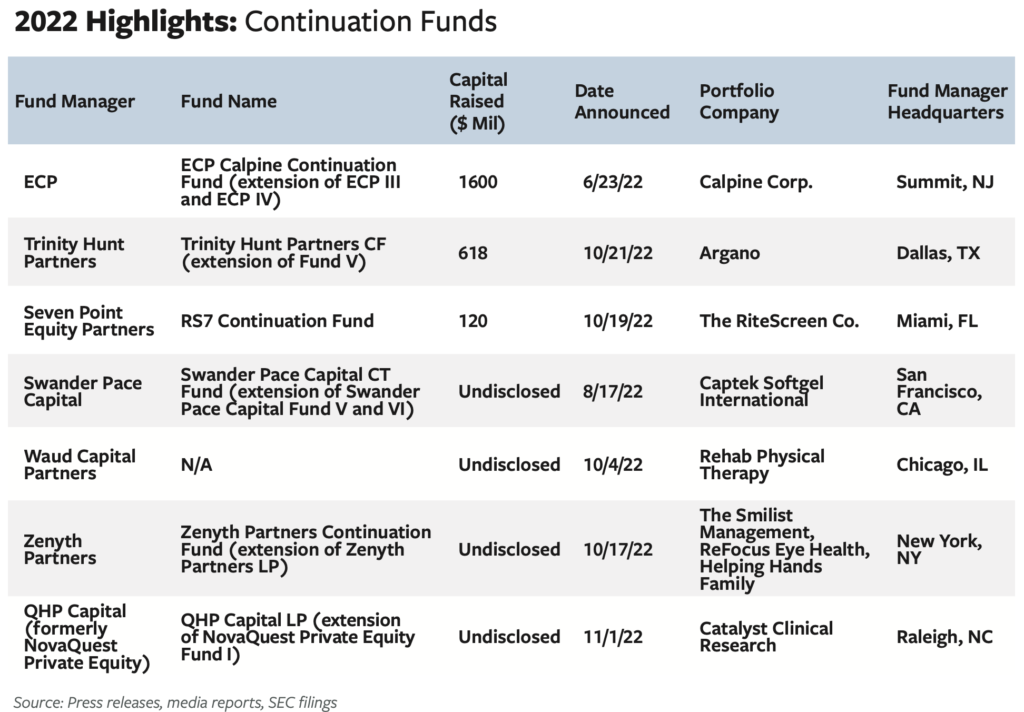

ECP, Zenyth Partners, QHP Capital and Waud Capital Partners are among the fund managers that closed continuation funds in 2022, taking advantage of the market appetite for this type of investment. Of that set, ECP’s raise was the largest, with $1.6 billion in capital commitments. ECP in June 2022 announced that the fund had signed an agreement to acquire a portion of power company Calpine Corp., along with a consortium of investors from its funds ECP III and ECP IV.

If market conditions worsen this year and LPs have less capital to deploy, continuation funds can offer a way for investors to stick with names they like. “I think they’re going to be completely relevant,” says Jeff Edwards, partner at Raleigh, North Carolina-based private equity firm QHP Capital, which in November announced a single asset continuation fund backing global contract research organization Catalyst Clinical Research. “They’re an extra tool for the industry to use,” he adds. And if the global economy goes through a recession, he says these funds can balance investors’ needs for liquidity without forcing GPs to sell in an arbitrarily low valuation environment.

Gaining Momentum

The use of continuation funds has dramatically increased in the last few years, though they have been around for about a decade, says Peter Laybourn, a partner with law firm Ropes & Gray’s asset management practice. The firm was involved in $110 billion worth of continuation fund transactions on the LP and GP sides in 2021, according to Laybourn. The firm advised QHP and ArcLight Capital Partners on the formation of their continuation funds.

The standard holding period for private equity is often five to seven years; continuation funds started out as a tool for sponsors to manage assets they couldn’t easily unload after that time frame. Continuation funds offered a way to return capital to LPs or move assets to be able to liquidate an existing fund.

Related content: No Uncertain Terms: Shifts in Key Deal Terms Ahead

In both single- and multi-asset continuation funds, companies are moved from legacy funds to give sponsors another exit opportunity and a broader market for capital. “In particular, lots of the sponsors we have been speaking to over the years have expressed a real desire in holding a specific asset for a longer period of time, controlling an asset because they think it will continue to perform well,” Laybourn says. “You may have other sponsors willing to take over the asset, but there’s a lot of appeal to having the sponsor that knows the asset, that has generated attractive returns, manage the asset.”

Lots of money has pooled into funds that are designated to participate in continuation vehicles, he says, adding that sponsors are increasingly raising dedicated pools of capital for this purpose.

“For the secondary fund making the investment in the continuation vehicle, they know which asset they’re acquiring,” Laybourn explains. “The potential for better economics is there and management fees are usually lower than you’d see in a blind pool private equity fund, so there’s some economic incentive to do these direct deals versus direct deals with a blind pool.”

Setting Up Shop

With many constituents to satisfy, the amount of work necessary to execute a continuation vehicle makes it a less attractive option for some firms than raising a blind pool. “I was surprised how difficult it is, but the investors that do these said it was very easy. I don’t have any plans to do another one anytime soon, but it is a structure that is available to us,” says Edwards.

Edwards also acknowledges that, when viewed from an LP standpoint, continuation funds raise concerns about conflicts of interest that GPs should take seriously. “You can’t just say, ‘We’re going to go create a continuation fund’ and get someone to put capital in the fund and buy the fund,” he says.

Related content: Tracking the Independent Sponsor Ecosystem’s Evolution

The consent of LP advisory committees is key to mitigating conflicts of interest. LPs need to be consulted every step of the way, Ropes & Gray’s Laybourn adds. “There’s a healthy dynamic that keeps some checks and balances on it,” he says. “The existing investors or advisory committee will have to provide consent to do the transaction. They’ll give the sponsor some real-time feedback on what they think about it.”

QHP Capital’s recent continuation fund is primarily made up of new capital, although most current investors rolled over into the fund. Some LPs that had available capital increased their stakes, while others rolled what they could, Edwards says: “When you’re in Q3 or Q4 of a funding year, allocations are spoken for.”

It’s unusual for such a high number of investors to opt into a continuation fund, as many LPs want to take their money off the table and allocate it elsewhere, Edwards notes. “People must really like the asset or believe in what you can do with it,” he adds. His firm used a placement agent as part of its process, though it was speaking with investors that were already involved with multiple continuation vehicles. “I think we have a very global footprint, so our investors see the churn of these vehicles so often that they’ve gotten quick at looking at them and underwriting,” he says.

Weighing the Options

Sponsors with continuation vehicles have more time and capital to maximize value for investors, explains Mark Boyagi, a partner in Kirkland & Ellis’ Investment Funds Group. In 2022, Kirkland’s secondaries practice advised on more than $100 billion in deal volume, including transactions for Wind Point Partners, Trinity Hunt Partners, Waud Capital Partners and Vance Street Capital.

“From a sponsor perspective, you don’t want to sell a crown jewel asset to a third party if you believe there’s room for significant additional growth and you’re best placed to realize it over an extended hold period,” says Boyagi. “At the same time, LPs are subject to their own internal drivers, and so offering them an option to lock in gains at an attractive price can carry a lot of value. At its best, a continuation fund deal is an ‘everybody wins’ kind of transaction.”

In most cases, LPs elect to sell instead of taking part of the continuation fund, adds Boyagi. “Sell rates at the moment are high, which I think is a reflection of macro conditions and the desire for liquidity among LPs,” says Boyagi.

At its best, a continuation fund deal is an ‘everybody wins’ kind of transaction.

Mark Boyagi

Kirkland & Ellis

Changing market conditions could slow deal flow in the short term, says QHP’s Edwards, since in a downturn, it takes time for prices to fall in the private markets. “You may have a period where fewer deals are being done because investors and sponsors may not be willing to take a reduced price for an asset, especially when you have market conditions that could turn right around,” he says. That means sponsors with single-asset continuation vehicles might be more likely to wait to lock in the desired return for investors, if they can.

There’s a difference of opinion at present between secondary buyers and GPs on valuation, Boyagi explains: “There’s been a bit of a staring contest in the last six to eight months between the buy-side and the sell-side on these deals. I think it’s a temporary phenomenon—the underlying rationale for these transactions isn’t going anywhere, whether you’re a GP, a secondary buyer or an existing LP.”

In the first half of 2022, before macro conditions worsened, there was movement back toward multi-asset deals, he says, largely because of secondary fund LPs’ desire for diversification. Single-asset deals are still getting done, just not with 2021’s frequency.

In any case, Boyagi points out that GPs overall remain incentivized to do deals, LPs want the transactions to be offered to them for accelerated liquidity, and secondary buyers are dedicating pools of capital to it: “We think it is just going to continue to grow.”

Karen Schwartz is a business reporter who has covered M&A, loans and trends in the U.S. and Latin American markets.