Why Private Equity Likes Radiology

Private equity's interest in radiology is growing for many of the same reasons behind the growth of emergency care and anesthesia.

This article is brought to you by CliftonLarsonAllen. It originally appeared in the 2018 Middle-Market Trends Report.

With the passage of the Affordable Care Act in 2010, private equity activity involving hospitals and contract-based specialty practices began to increase significantly. Early on, much of this activity involved emergency medicine, and several practice consolidators emerged during this period. Anesthesia followed emergency medicine as the next top specialty focus area for consolidators and private equity firms. Ironically, while radiology has long been viewed as a leading field for adopting new technologies and practices, it has lagged behind emergency medicine and anesthesia when it comes to private equity activity. That appears to be changing now; private equity interest in radiology is now growing for many of the same reasons behind the growth of emergency care and anesthesia.

Radiology is a highly fragmented $18 billion-plus industry. As reimbursement continues to shift from volume to value, hospital consolidation continues, and technology and infrastructure needs increase. More and more independent radiology groups are determining that they need to partner in order to prosper—and in some cases, to survive.

In today’s health care environment, imaging is increasingly becoming more critical to improving the overall quality of care, including for care coordination, utilization management, big data, and improved quality and outcomes.

Core market drivers that make radiology appealing to private equity include:

- Market size

- Highly fragmented market

- Favorable demographics (i.e., aging population)

- Increasing technology costs

- Need for improved back-office operations

- Increasingly central role in population health management

- Importance of scale for success

Private equity groups recognize the tremendous opportunity to scale the business model. There are many groups that can act as platform investments to scale to regional or national providers. In fact, the largest independent radiology groups in the country continue to grow.

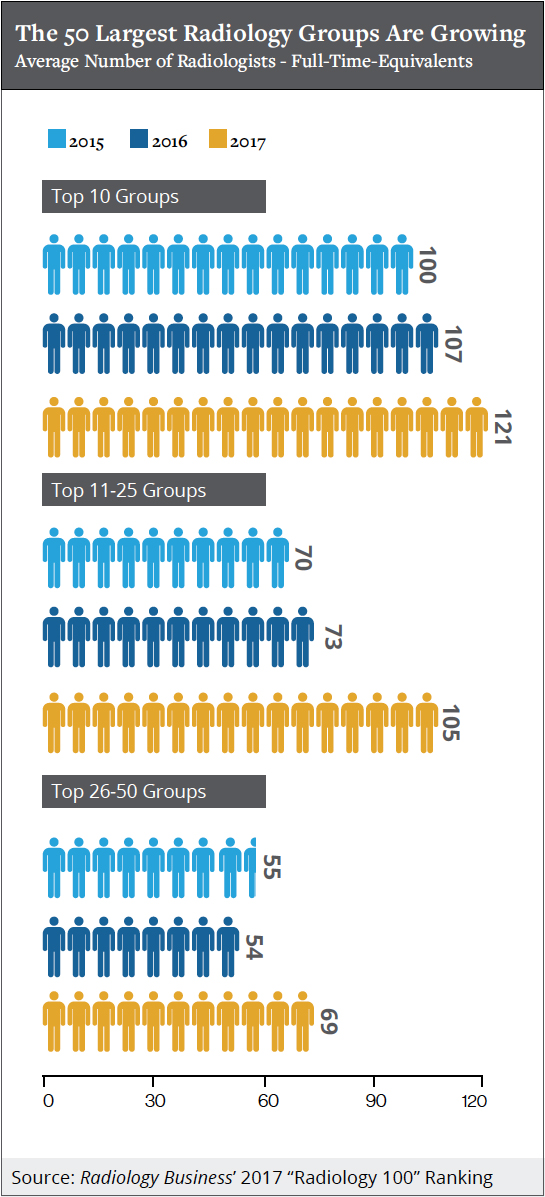

Radiology Business reported in its 2017 Top 100 listing that the number of groups with 65 or more full-time-equivalent, or FTE, radiologists grew to 28 in 2017 from eight in 2009. The average number of FTEs in the top 10 groups increased to 121 in 2017 from 100 in 2015.

In addition, there are a tremendous number of add-on opportunities. The Radiology Business 2017 ranking showed that the top 50 groups had a combined 3,837 radiologist FTEs—only 12 percent of the more than 30,000 radiologists estimated nationally.

Several factors that make private equity attractive to radiology groups include:

Physician leadership – First and foremost, quality of care is the most critical factor when deciding to partner. Unlike acquisitions by hospitals, radiology groups acquired by private equity often retain control over things like care protocols, hospital relationships, scheduling and other patient-centered activities.

Increasing technology needs – Compared with other specialties, radiology requires much higher technology capital expenditures. Faced with increasing costs, many groups recognize that their future compensation may likely decrease.

Shifting radiologist demographics – As baby boomers age, a large number of retirements are expected in the coming years. These retirees are often being replaced by younger radiologists who are less interested in running the business side of a practice.

Personal liquidity – Often a radiologist’s largest personal asset is the value of his practice. By selling the practice to a private equity firm, the radiologist can better diversify his personal portfolio and mitigate risk.

Long-term gain – Almost every private equity transaction will require the radiologists to roll over part of their equity. However, it allows the radiologist to participate in potential gains when the private equity group exits its position in five to seven years.

All these factors are increasing private equity investment in the radiology space, and this trend is expected to continue for several years.

This article originally appeared in the 2018 Middle-Market Trends Report, featuring expert insights from ACG partners and featured firms. Find it in the MMG archive.

Steve Stang is a principal at CliftonLarsonAllen with more than 26 years of experience. He currently serves as the firm’s health care transactions services practice leader.