Healthcare Evolves to Embrace Next-Gen Tech

As healthcare IT solutions grow more sophisticated, M&A dealmakers say rising adoption is inevitable

While healthcare has proven a resilient investment target amid an M&A slowdown, IT designed for healthcare settings has not always been in acquirers’ crosshairs.

Although complex regulatory barriers and a low risk appetite for digital transformation have slowed digitization among healthcare providers, practice groups are gradually unlocking the benefits of healthcare IT (HCIT) in both the front and back office. As adoption grows, so does the attraction of healthcare IT investments to middle-market dealmakers.

This section of the report originally appeared in the Special Digital Report: Healthcare issue, sponsored by Sourcescrub. Read the full report here.

“Healthcare IT brings M&A investors the potential for highly recurring revenue, good visibility and sticky client bases—regardless of subsector,” says James Clark, managing director in the Healthcare & Life Sciences Group of investment bank Harris Williams. “While we saw a slowdown in 2022, as we did in many sectors, there are many great healthcare IT businesses looking to drive growth through M&A and new platform investments in 2024.”

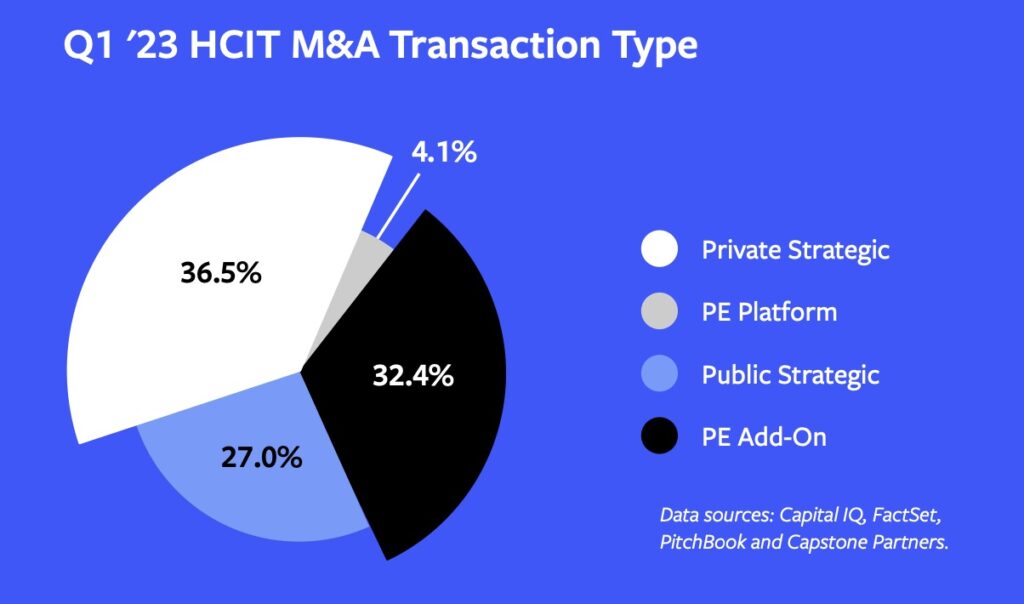

Middle-market HCIT M&A volume is strong compared to pre-pandemic levels. A Capstone Partners report noted that 74 transactions were completed or announced in Q1 2023, representing an increase from Q1 2019 and 2018 of 23.3% and 54.2%, respectively. Nearly one-third of healthcare IT M&A deals in Q1 2023 were private equity add-ons, while 63.5% were led by private and public strategic acquirers, the report noted.

Middle-market HCIT M&A volume is strong compared to pre-pandemic levels. A Capstone Partners report noted that 74 transactions were completed or announced in Q1 2023, representing an increase from Q1 2019 and 2018 of 23.3% and 54.2%, respectively. Nearly one-third of healthcare IT M&A deals in Q1 2023 were private equity add-ons, while 63.5% were led by private and public strategic acquirers, the report noted.

Thanks to continued technological innovation, new HCIT solutions are enabling workflow automation, unlocking value in healthcare data, increasing productivity and helping to improve patient outcomes. The result is a diversifying range of potential investment targets for both PE sponsors and strategics.

From Back Office to Patient Care

Among the most popular healthcare IT investment targets are revenue cycle management (RCM) and electronic records management (ERM) technologies. Experts say the market for these solutions is fragmented: Data from M&A deal sourcing platform Sourcescrub finds 852 RCM businesses and 709 ERM companies.

The state of healthcare today has created powerful use cases for these solutions. “Due to the sector’s complexity and inefficiency, healthcare businesses spend billions of dollars collecting revenue,” notes Clark. “Factor in labor challenges related to medical claims coding and processing, and the strong value prop of outsourced RCM software and services becomes clear.”

Related content: Dealmaker Q&A: Halifax Talks Acquisition of Sodexo’s Worldwide Home Care

Ben Herman, a partner at private equity firm LightBay Capital, says RCM and ERM solutions can be particularly useful to a business after a merger, allowing for data consolidation on a single system across a newly combined healthcare network. “Having everyone on the same technology system allows our people to execute on standardized protocols across our population, which leads to better outcomes for our patients, and fewer headaches and less manual workflow for our doctors and providers,” he says.

Back-office HCIT solutions, particularly ERM, can have narrower applications to healthcare niches, potentially supporting investors’ thematic investment strategies. “That dynamic enables healthcare and technology investors to dive deeply into applicable subsectors, apply previous experience and articulate well-defined value creation plans,” says Dan Linsalata, a managing director in Harris Williams’ Healthcare & Life Sciences Group and Technology Group.

HCIT innovation hasn’t merely focused on behind-the-scenes administrative processes. Patient-facing technologies are quickly shifting from a competitive advantage to a must-have.

HCIT innovation hasn’t merely focused on behind-the-scenes administrative processes. Patient-facing technologies are quickly shifting from a competitive advantage to a must-have.

“Telehealth is most certainly one of the big patient-facing technologies,” says Brian Greenberg, CEO of investment bank Greenberg Advisors. “We’re seeing firms like the Amazons and Walmarts now entering the telehealth space—often through acquisition.”

Indeed, earlier this year Amazon completed its $3.9 billion acquisition of One Medical to augment its healthcare business with telehealth capabilities. Walmart, meanwhile, acquired telehealth company MeMD in 2021.

While initial patient engagement solutions tended to offer a one-size-fits-all approach, next-gen solutions like personalized, step-by-step care plans are beginning to crop up—and entice investors, according to Clark.

Herman agrees that IT organizations today are “pushing the envelope” around how to improve the customer experience with advances in digital patient communication, scheduling, bill review and call support. “Healthcare doesn’t have the best reputation for customer service,” he notes. “But that is changing.”

Herman also highlights the recent shift in the healthcare ecosystem toward value-based care, which bases provider payment on patient outcomes. HCIT solutions can facilitate that shift by improving patient experiences while limiting the impact on providers’ bottom lines and labor needs. To support that effort, LightBay portfolio company Rancho Family Medical Group, for example, implemented value-based care strategy solution provider Lumeris.

As healthcare delivery, reimbursement and treatment models evolve and become more complex, there will be a persistent need for more and better technology and analytics to support that evolution.

Dan Linsalata

Harris Williams

Innovation Driving M&A

As HCIT innovations improve productivity in the back office and enhance patient experiences, healthcare providers and their sponsors are driving demand for cutting-edge solutions.

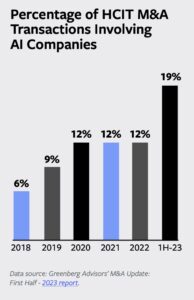

Healthcare players and investors are closely watching how artificial intelligence could impact HCIT, for example, though experts say it’s too soon to tell what the outcome will be. Both Greenberg and Herman acknowledge that the healthcare industry’s stringent regulatory requirements can make AI adoption a challenge.

Manual workflows like repetitive data entry will likely be among the first areas impacted by AI. For more complex applications, AI will first have to prove its return on investment and accuracy to gain trust and adoption among providers, they say.

Related content: Investors Bet on High-Growth Pharma Companies

Proving its worth remains a hurdle for any HCIT solution, notes Herman, especially as economic uncertainty weighs on spending behavior. “If customers aren’t as confident around what the future may hold, they’re going to be less inclined to make a multiyear commitment to an outsourced tech-enabled solution or technology vendor,” he says.

Harris Williams’ Linsalata adds that some providers lack the expertise to use software tools to their full potential. In the meantime, he says, HCIT consultants are gaining a stronger footing in the market, adding another pool of potential investment targets. This trend was reflected in the recent acquisition of eCloud Managed Solutions, which guides healthcare clients through cloud migration, by HCIT staffing and consulting company Optimum Healthcare IT, a portfolio company of PE firm Achieve Partners.

Harris Williams’ Linsalata adds that some providers lack the expertise to use software tools to their full potential. In the meantime, he says, HCIT consultants are gaining a stronger footing in the market, adding another pool of potential investment targets. This trend was reflected in the recent acquisition of eCloud Managed Solutions, which guides healthcare clients through cloud migration, by HCIT staffing and consulting company Optimum Healthcare IT, a portfolio company of PE firm Achieve Partners.

With evidence of stabilizing valuations and a comeback in deal volume, financial and strategic investors alike are expected to add more HCIT targets to their deal pipelines.

“Healthcare IT solves problems that are not going away,” says Linsalata. “As healthcare delivery, reimbursement and treatment models evolve and become more complex, there will be a persistent need for more and better technology and analytics to support that evolution.”

Carolyn Vallejo is Middle Market Growth‘s digital editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.