Investors Bet on High-Growth Pharma Companies

While deal count is down across the board, a select crop of successful pharma businesses continues to trade for high multiples

Any given sector is under pressure from market headwinds this year, and deal volume is down across the board.

Experts in the pharmaceutical sector note that their specialty is no exception but say there is still robust activity across select pockets of pharma and pharma services, where some companies are trading for EBITDA multiples as high as 20x. Sector bankers say the businesses selling at these valuations are usually able to show strong growth potential through organic channels, add-on acquisitions, geographic expansion and diversification of services.

This section of the report originally appeared in the Special Digital Report: Healthcare issue, sponsored by Sourcescrub. Read the full report here.

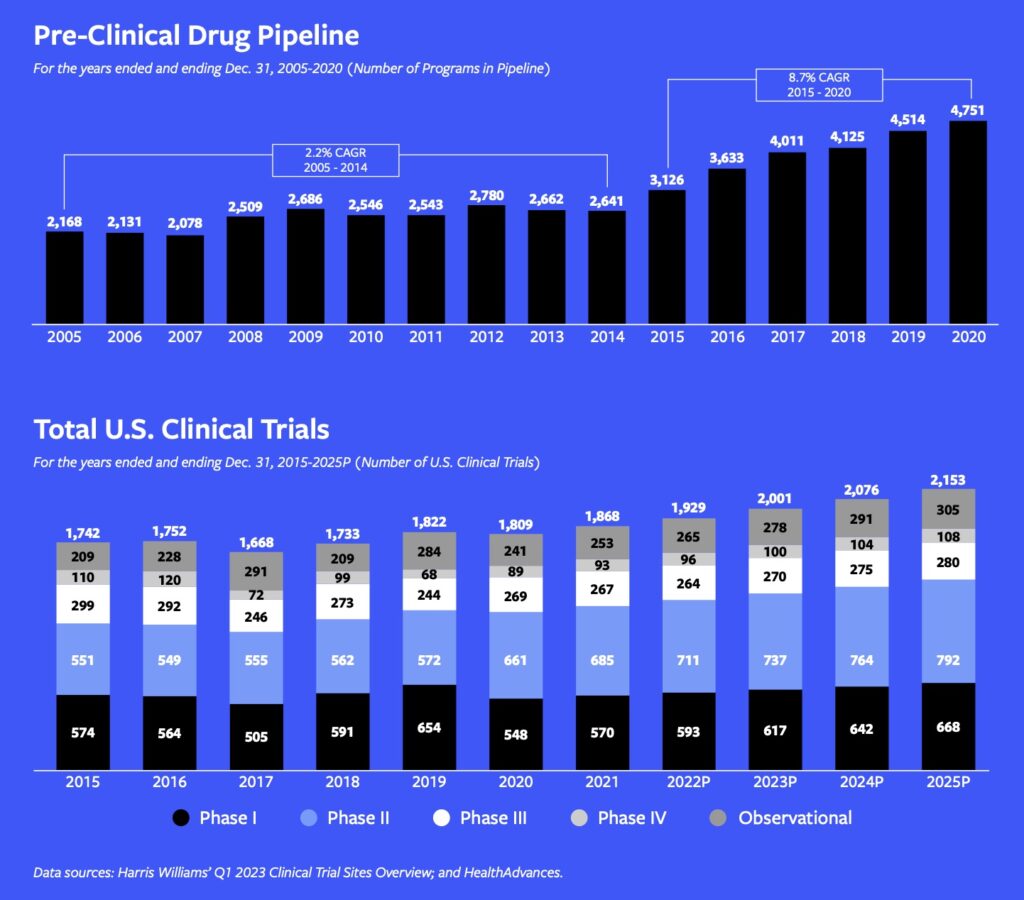

Industry experts say some clinical research organizations (CROs), contract development and manufacturing organizations (CDMOs), clinical trial site companies, and research and data companies are garnering high prices. “Activity across all these sectors is slower in 2023 than 2022, but deals are still trading at attractive multiples,” says Brian Doyle, managing director and head of healthcare services at investment bank William Blair.

High Fliers

Clinical research companies Worldwide Clinical Trials and Ergomed, and data provider CorEvitas are among the recent pharma companies that have sold for a premium.

Kohlberg & Co. announced it was buying a majority stake in Worldwide Clinical Trials, a North Carolina-based CRO, in August. The deal, which is expected to close in the fourth quarter, valued the company at $2 billion, or an 18x multiple on EBITDA, according to 9fin.

Worldwide partners with biotechnology and pharmaceutical companies to create customized solutions that advance new medications. The company’s capabilities span bioanalytical laboratory services, phase I-IV clinical trials, and post-approval and real-world evidence studies. With 3,200 employees across 60 countries, Worldwide focuses on cardiovascular, metabolic, neuroscience, oncology and rare diseases.

In September, European private equity firm Permira agreed to buy U.K. biopharmaceutical company Ergomed in a take-private deal valued at $886.4 million—a 28% premium to Ergomed’s closing trading price.

“There haven’t been as many deals in CROs, but activity continues for businesses that are seen as leaders or differentiators,” says Doyle.

According to Sourcescrub data, there are 523 middle-market CROs in the U.S., 282 of which are independent. The average headcount of middle-market CROs is about 181.

CROs with advisory boards that have access to pharma companies and drug development before studies are even announced have a competitive advantage in the market, says James Castro, senior managing director at B. Riley Securities. “The history of CROs has been very fragmented in terms of being able to provide a very specific service to the pharma community. Now, we’re seeing integration across all functions,” he adds. This fits the private equity playbook well. “Private equity firms are really good at saying: There’s no reason why we can’t offer these complementary services to the exact same customer, and that will further entrench us to steer the business our way.”

Related content: Healthcare Services Sector Gains Strength

In a notable transaction in the pharma research niche, CorEvitas fetched $912.5 million in its sale to Thermo Fisher Scientific. The company, which was formerly backed by Audax Private Equity, is poised to generate $110 million in revenue for 2023, an announcement from Thermo Fisher said. The Waltham, Massachusetts-based data intelligence company provides biopharmaceutical companies with data and clinical insights that demonstrate the value of their products to clinicians, patients, payers and regulators.

William Blair’s Doyle, who advised on the deal, says the high valuation underscored the need for continued evaluation of pharmaceutical products as they are launched and vetted, and as their usage and effectiveness is monitored on an ongoing basis.

What’s Next for Clinical Trial Site Companies

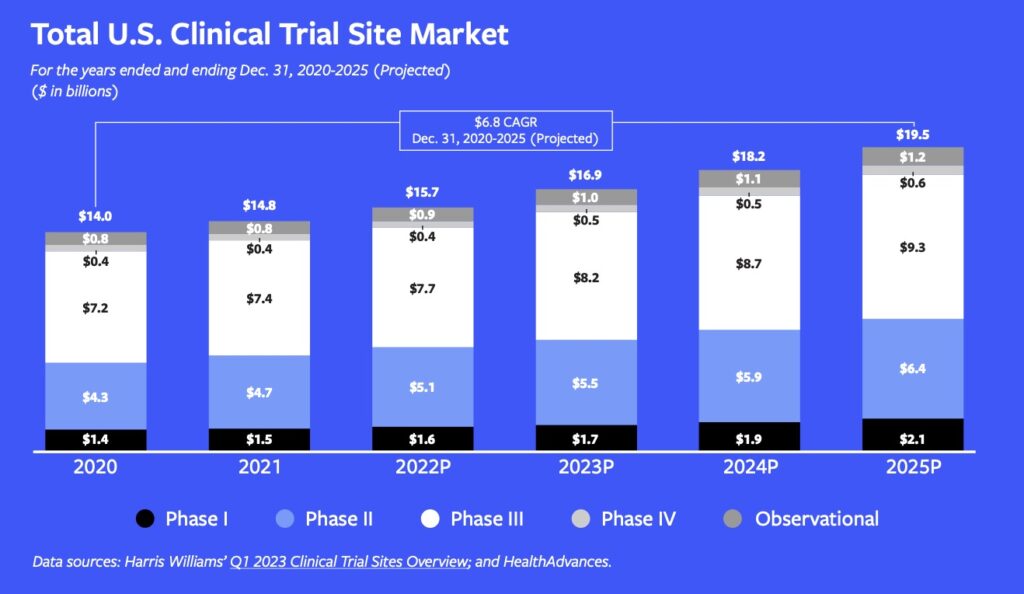

When it comes to testing drugs, treatment or therapy, companies that oversee clinical trial site management have been popular investment targets for private equity sponsors in recent years. Private equity firms that have bought or built platforms in the space have been tacking on countless add-ons and consolidating the highly fragmented sector, which comprises many companies that could benefit from an expansion in services, geography and diversity of study participants across demographics.

London-based private equity firm GHO Capital acquired one of the larger companies in the space, Velocity Clinical Research, from NaviMed Capital in 2021 for $500 million. The company’s EBITDA was around $30 million-$35 million at the time, though it projected $50 million in forward EBITDA for 2021, according to PE Hub.

Related content: Thriving in the Evolving Healthcare Private Equity Market

Both Velocity and Webster Equity Partners-backed CenExel, some of the largest clinical trial site companies in the U.S., have bought a slew of other sites in recent years and significantly broadened their geographic footprint.

B. Riley’s Castro says interest among private equity sponsors continues to be strong amid growing demand for clinical trial site management services. “There has been an enormous amount of continued spending in central nervous system studies, as well as anything related to oncology,” he says. “Even early detection of cancer is going to continue to fuel a huge spend, which means drug developers will need more support from the biotech and outsourced pharma communities.”

Even early detection of cancer is going to continue to fuel a huge spend, which means drug developers will need more support from the biotech and outsourced pharma communities.

James Castro

B. Riley Securities

Here too, companies have been trading for high multiples—15x or more, according to Castro—but private equity firms still have a viable path to successful exits, given the growth of some of these businesses. “Private equity investors believe there is potential to generate greater than 20% IRR on those transactions,” Castro says, adding that sponsors can achieve healthy exits by diversifying services and geographies, and continuing to buy single-site companies.

Recent deals in the space included VSS Capital Partners’ growth capital investment in Eximia Research Network, and New Harbor Capital’s investment in Monroe Biomedical Research. Eximia is a multi-therapeutic clinical trial research company that serves pharmaceutical companies, biotech companies and CROs. Monroe is a clinical trial site business that recruits patient populations for complex trials across a variety of therapeutic areas.

Castro thinks there is a lot more room for growth, and companies can continue to trade to other private equity sponsors as they grow or merge among themselves. “I’ve been involved in a lot of discussions where some of these larger entities are talking to each other about potentially merging,” he says.

Anastasia Donde is Middle Market Growth‘s senior editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.