QBE North America: Assessing and Managing Risk

Companies faced an unprecedented array of risks in 2020. Here's what business leaders should know as those risks evolve in the year ahead.

This story originally appeared in the Winter 2021 print edition of the Middle Market Growth Outlook Special Report. Read the full report in the archive.

Q. As the volatile risk environment drives up insurance rates, how can companies get the most value from their insurance program?

In 2020, companies faced an unprecedented array of risks, including the repercussions of the COVID-19 pandemic, record-setting storm and wildfire activity, and civil unrest. As those and other risks evolved, putting increased financial stress on many, companies also had to contend with the rising cost of insurance.

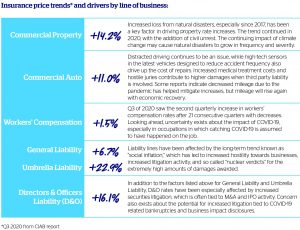

In 2021, we will likely see a continuation of this trend due to the events of 2020 and long-term issues at work before the COVID-19 pandemic. The most recent report from the Council of Insurance Agents & Brokers (CIAB) notes that premiums increased by an average of 11.7% overall in the third quarter of 2020, which was the 12th straight quarter to increase.

To best navigate this situation, insurance buyers should understand the factors driving increased rates and the services available from leading insurance providers that maximize the performance of their insurance programs.

Other lines such as Trade Credit and Transactional Liability for M&A deals have also been undergoing rate increases as loss costs continue to escalate. Trade Credit has been especially affected by the pandemic. For companies with self-funded health insurance plans, rates for Medical Stop Loss had been rising before COVID-19 but have recently softened, partly due to deferred medical treatment utilization.

Due to the rate increases, many companies are asking their insurance brokers to help them review their carrier relationships and look for more cost-effective solutions to managing risk. In a June/July 2020 survey that QBE jointly commissioned with The Association for Corporate Growth, 68% of midsize businesses said they considered switching their property and casualty insurance providers at least once per year.

As they work with their brokers, companies can benefit by looking beyond price and coverage and considering carriers’ industry knowledge and pre-loss and post-loss services. These capabilities will help insurance buyers build a program that is tailored to their unique risks, while helping to minimize the frequency and severity of loss.

Key questions to ask include:

Q. Do they understand the unique risks of the industry? Are they responsive and willing to take a tailored approach?

As QBE’s Mid-Sized Company Risk Survey found, risk concerns can vary widely by industry. For instance, manufacturers are significantly more concerned about liability risk, especially product liability, than tech/computer services companies are.

At a very high level, examples of some of the risks more prevalent in certain industries are listed below.

With greater industry knowledge, an insurer can more accurately tailor insurance programs to the company’s risk profile and act with greater confidence and agility to changing circumstances. For instance, the COVID-19 pandemic rapidly changed the risk profiles of many businesses. Hotels no longer had guests. Non-essential retail closed. Factory operations shut down, slowed or moved to shifts to allow greater social distancing. While some insurers took a blanket approach to premium adjustments for all customers, others took a bespoke approach on how to adjust premium mid-term for each customer based on their unique circumstances, and industry knowledge played a role in that capability.

Q. Does the insurer have robust services to help minimize the risk of loss?

If midsize companies, insurance brokers and carriers can agree on one thing, it is that the best loss is the one that never happens. For this reason, carriers offer services to help prevent or reduce losses. Ironically, many midsize businesses express an interest in engaging with these services but fail to do so frequently. In QBE’s Mid-Sized Company Risk Survey, 99% of midsize businesses reported being either very interested or somewhat interested in engaging their insurance provider’s loss control services, but 26% said they interacted with the department only once a year or less often—unless the company had recently filed a claim.

Midsize companies should ask about these services during the annual review when their policies come up for renewal. The best insurers will have a wide range of services backed by trained experts and the latest technology. Examples include:

- Fleet safety programs: These programs offer proactive policies and procedures to guard against vehicle damage, worker injury and third-party liability.

- Worker safety: Advances in ergonomics and utilization of mobile and wearable technologies are revolutionizing the methods for helping ensure worker safety. In one case, a mobile phone app using AI can analyze videos of worker activities, such as stocking shelves, and identify stress points that could lead to injury. Wearables can help employees recognize and reduce higher-risk bending or twisting motions.

- Return-to-work: These programs help employees who have suffered a work-related injury or illness return to work in a safe and timely manner by providing temporary, modified jobs suited to their physical limitations. Studies show that such programs help lower both the risk of litigation and the number of lost workdays, and raise workers’ return rate.

- Property risk: Loss control experts can advise on a range of issues such as sprinkler protection, fire protection impairment, new construction design and builders’ risk.

- Business continuity planning: Loss control experts can assist companies in developing a plan to promote worker and customer safety during a disaster while maintaining business continuity.

- Product safety: Risk assessment and control services by trained loss control consultants can help companies minimize the risk of product liability and errors and omissions liability.

- Employment practices advice: An insurer may provide complimentary access to professional services that can advise on specific employee issues as well as help build employment policies, guidebooks and employee training to navigate the complex and rapidly changing regulatory environment for employment practices.

Q. Does the insurer offer a claims service that pays claims quickly and fairly while also minimizing costs that can lead to higher rates?

Insurance has always been based on a commitment by the insurance carrier to deliver on its promises when a claim is made—the proverbial moment of truth. Aside from the table-stakes reassurance that the insurer will have the financial capacity to pay the claim, how can companies feel confident that claims will be paid accurately, swiftly and with ease?

Companies will certainly depend heavily on their broker’s advice, but they can also probe deeper to understand the insurer’s claims service philosophy and capabilities. Areas to ask about include:

- Claims relationship management: Insurance buyers should understand the relationship between broker and carrier claims teams, and how that may impact the claims process. The best relationships feature dedicated teams. Sophisticated insurers will offer a tiered service structure that includes claims relationship managers to coordinate all aspects of the carrier’s service, not just claims. This can include periodic claims reviews to identify loss trends and recommend steps in concert with Loss Control to reduce risks and help keep premiums from increasing.

- Feedback mechanisms to drive constant improvement: How seriously does the company gather and act upon feedback on service after a claim has concluded? Service-minded carriers will have systematic processes to gather feedback through a variety of mechanisms and offer transparent data on how likely other companies would recommend the carrier based on their claim experience.

- Effective worker injury treatment: When a worker gets injured, the choice of treatment provider can factor greatly in the length and cost of recovery. But the information to make the best decision has historically been hard to access. Advances in big data and AI are changing that. Pioneering insurers are leveraging these tools to identify the most effective treatment providers at an early stage to better manage costs and get the worker back on the job quicker.

- Medical risk management team: For companies that use Medical Stop Loss insurance for their self-funded health insurance plans, the expertise and services of the insurer’s medical risk management team can make a material difference. These services include case management oversight and facilitation of referrals to outcome-based providers with the goal of ensuring that the claimant always receives the highest quality of care at the most appropriate cost.

- Mediation services: Mediated claims typically result in better outcomes than litigated claims. Innovative insurers are leveraging new tech platforms that engage opposing parties in creative ways to speed the arbitration process.

- Major case team: Just one loss involving serious injury and/or high stakes litigation can upend an insurance program and put company management under stress. Sophisticated insurers will have a team of highly experienced experts dedicated to handling these types of claims. Such teams can help make sure all available defenses are being contemplated, stage mock trials to help polish the defense and negotiation strategy, and much more—all to achieve the best possible outcome.

As companies look ahead in 2021 and consider how to manage risk, knowing the right questions to ask when choosing an insurer can make a significant difference in getting the best protection while mitigating against the impact of rate increases.