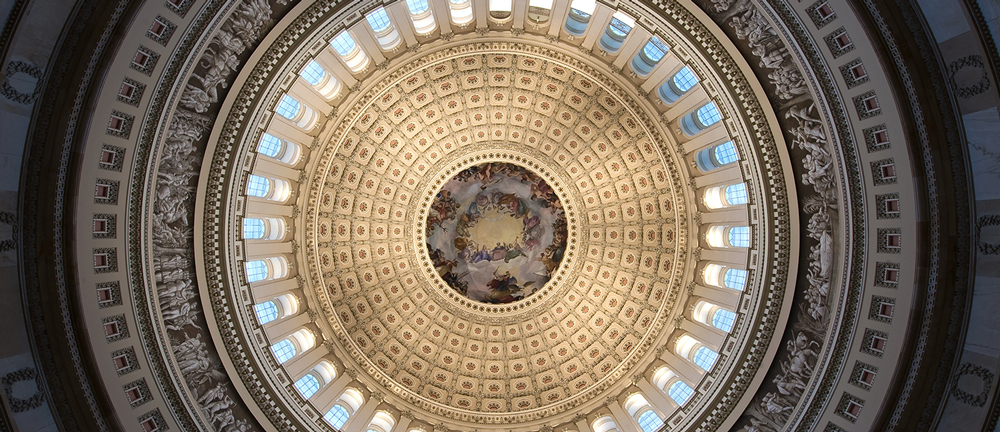

Middle-Market Public Policy Roundup

Democrats reintroduced a bill to kill carried interest tax rate and the Department of Labor filed proposed comments for the joint-employer standard.

In Congress, Democrats continued their decade-old attempts to kill the carried interest tax rate for managers of private equity and hedge funds—something previous congressional sessions failed to do.

Meanwhile, there has been a flurry of activity on the labor front this week. The Department of Labor filed proposed comments on the joint-employer standard as it relates to overtime and wages, and it announced it would propose an increase to the long-debated “overtime rule,” which determines when a company is required to pay salaried employees for work outside of regular hours.

Carried Interest Fairness Act of 2019 Introduced

On March 13, Sen. Tammy Baldwin, D-Wis., and Rep. Bill Pascrell, D-N.J., introduced legislation in both chambers of Congress that would raise the tax rate for carried interest, the compensation private equity fund managers receive for their work providing a return on investment for a fund’s investors.

Currently, carried interest is classified as capital gains, and thus taxed at a maximum of 23.8 percent, rather than as regular income, whose tax rate may be as high as 37 percent. Rep. Max Rose, D-N.Y., and Rep. Andy Levin, D-Mich., are co-sponsors of the House bill.

The issue of how carried interest is taxed was raised during the 2016 presidential campaign. As candidates, Donald Trump and Hillary Clinton both vowed to engage in carried interest reform. In the 2017 Tax Cuts and Jobs Act, Congress addressed carried interest by extending the holding period required for an investment to qualify for favorable tax treatment upon its sale. It increased that holding period to three years, up from one.

Rep. Sander Levin, D-Mich., now retired, introduced this legislation during every congressional session since 2007, and Sen. Baldwin introduced accompanying bills in the Senate. Last Congress, both versions of the legislation died in their respective Republican-controlled committees.

DOL to Propose Changes to Joint-Employer Overtime and Wage Pay

The Department of Labor has sent the Office of Management and Budget a proposed rule to clarify the joint-employer standard under the Fair Labor Standards Act. Joint employment refers to a business’s legal responsibility for another company’s employees.

The DOL proposal is separate from the National Labor Relations Board’s recent proposed rule on joint-employer status. That proposed rule attempts to clarify the meaning of joint employment under the National Labor Relations Act, which addresses issues such as collective bargaining and private sector labor management.

Conversely, the DOL rule looks at joint employment with respect to minimum wages and overtime pay, as established by the Fair Labor Standards Act (FLSA).

Although questions have been raised about whether the DOL actually has the statutory authority to make a legally binding joint-employer rule, some in the legal community have pointed to the agency’s ability to clarify ambiguous terms in the FLSA.

A notice-and-comment period is expected once the Office of Management and Budget reviews the proposed regulations.

Forthcoming Overtime Rule Change Proposals

The Department of Labor’s “overtime rule,” which establishes when salaried workers are legally required to receive time-and-a-half pay for work in excess of 40 hours per week, may be modified per a recent notice of proposed rulemaking. The DOL proposal would raise the salary under which an employee qualifies for overtime pay to $35,308 per year.

Previously, the Obama-era DOL attempted to more than double the salary threshold to be exempted from overtime pay to $47,476, up from $23,660. This faced challenges from a variety of business groups and was eventually put on hold due to a legal dispute spearheaded by 21 Republican-controlled states. In 2017, a federal judge in Texas ruled that the DOL exceeded its authority in attempting to increase the threshold so drastically.

Additionally, the new proposal would raise the total annual compensation requirement for “highly compensated employees” to $147,414, up from $100,000. The IRS uses such employees when determining whether 401(k) plans are fair and equitable, and not disproportionally tilted toward high-income earners. If highly compensated employees are, on average, contributing more than 2 percent when compared with all other employees, the employer is required to correct the discrepancy or face severe tax consequences.

Are you an ACG member who enjoys reading the public policy roundup? Join our Public Policy Interest Group to receive even more in-depth coverage of federal policy activity impacting the middle market, as well as opportunities to help shape ACG’s advocacy efforts.

Maria Wolvin is ACG Global’s vice president and senior counsel, public policy.

Ben Marsico is ACG Global’s manager of legislative and regulatory affairs.