4 Deal Sourcing Trends Shaping 2023

From the types of deals in demand to how they’re sourced, here are four themes to watch in the coming year

The coming year is unlikely to see a marked departure from the deal sourcing tactics of 2022.

Instead, private equity business development professionals and other industry participants point to trends that they expect to gain greater traction in 2023, including creative approaches to marketing, new technology applications, increased enthusiasm for smaller deals and an earlier start to relationship-building.

Taking Tech in New Directions

Technology is a must-have in dealmaking, but when it comes to deal sourcing tech, not all acquirers find themselves in the same place on the adoption curve. In a shifting M&A landscape, corporates and financial investors may have significantly different tech adoption experiences in 2023.

Nevin Raj, chief operating officer and co-founder of private company intelligence engine Grata, says a growing disparity between corporates and PE firms may lead to one of the most poignant trends in tech adoption next year.

“What we see is that (PE) investors, especially early-stage tech investors, tend to be some of the first adopters of technology,” notes Raj. As a result, those investors tend to embrace technology within their deal sourcing workflows, too. In contrast, corporates are “actually the furthest behind” in the adoption curve, he adds.

To get up to speed, (corporates) are going to make the biggest changes in their use of technology.

Nevin Raj

Grata

But 2023 could see that gap narrow, as high interest rates offer an opportunity for corporates to gain a competitive advantage over PE buyers. “To get up to speed, (corporates) are going to make the biggest changes in their use of technology,” Raj predicts. This may first begin with laying the foundations of a more digital operation, using technology to manage M&A processes and funnels. Eventually, however, corporates could leapfrog financial buyers. “You’re going to see more AI and ML (machine learning) bleed into that world, because they need to be a step ahead of the financial sponsors, who are pretty much eating their lunch now in terms of deals,” he adds.

While corporates are ready to hit the gas on deal sourcing technology adoption, for PE investors, the outlook is more about refining and bolstering existing digitization strategies to maintain the dealmaking momentum of the last few years.

Stephen Madsen, director of the Business Development and Capital Markets team at private equity firm Monomoy Capital, says this is particularly true when it comes to wielding data to support a more strategic approach to deal sourcing. Data quality, he says, “is the biggest hurdle to a lot of us,” but an often-overlooked obstacle is the quantity of information financial acquirers can use.

“Data quality, everybody complains about,” says Madsen. “But people don’t talk often enough about just how little relevant data there is for most of the problems that we, in the private markets, want to address.”

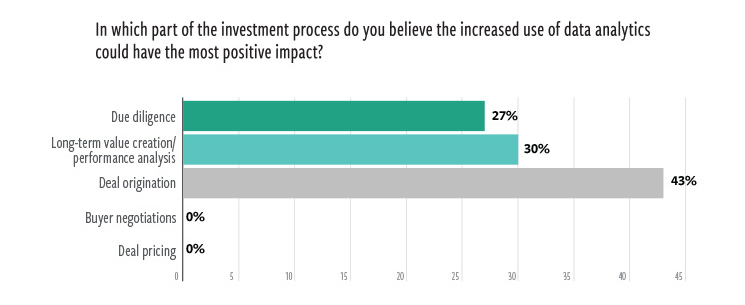

A lack of both data quality and quantity prevents acquirers from strengthening their deal sourcing workflows. Recent IHS Markit research released in October found this to be particularly true for PE investors. While 43% of survey respondents agreed that advanced analytics can benefit deal sourcing more than any other stage in the dealmaking process, only 3% say they actually leverage it.

Whether it’s enhancing existing systems with machine learning or using private market databases for the first time, corporates and financial acquirers alike will have to take a tactical approach when deploying deal sourcing technology to remain competitive in a challenging M&A market.

Building a Relationship Early

Private equity sponsors like to tout their “proprietary deal flow,” and in the current competitive environment that’s become even more important. Although deal activity is slowing down because of market headwinds, sources say quality assets will still trade in 2023 and the competition for these few deals will be more intense. As such, private equity firms want first dibs on prospective sellers—often ahead of a formal auction or bank hiring.

For some firms that means leaning more on different types of advisors, engaging with the independent sponsor community, using data tools to narrow down targets or partnering with seasoned executives in different industries to find investment opportunities.

At Trivest Partners, business development professionals will be attending more industry conferences to connect with dealmakers and advisors now that travel is back in full swing. Tony Hill, a principal in business development at Trivest, is particularly keen on independent sponsors as a source of deals.

“We spend a lot of time engaging with the independent sponsor community—they have their own networks and can find businesses that we don’t have access to,” he says, adding that Trivest has done seven deals in partnership with independent sponsors over the last four to five years. These sponsors find investment opportunities first, negotiate a purchase price and then get the funding together via private equity groups, high-net-worth individuals, family offices and other investors.

Trivest splits its business development team regionally—across its Miami headquarters, and in Chicago, Los Angeles, Charlotte, Philadelphia and Toronto. The team also engages with various advisors, service providers, data providers and external buy-side search firms to scout for opportunities. “A core pillar of our sourcing strategy is covering the ‘long tail,’ a network of thousands of smaller business brokerages, accounting and valuation providers, law firms, wealth management advisors and more,” Hill says. Often, these are trusted advisors to founders that can loop Trivest into conversations with business owners before an investment banker gets involved.

Meanwhile, Huron Capital plans to concentrate its efforts in the coming year around its ExecFactor strategy, where the Detroit-based firm partners with executives to work on an investment thesis and search for deals.

We spend a lot of time engaging with the independent sponsor community—they have their own networks and can find businesses that we don’t have access to.

Tony Hill

Trivest Partners

“We partner with a seasoned industry executive and together we develop a thesis and plan to buy and build a platform in a growing, fragmented sector,” says Heather Madland, partner in business development at Huron. “These executives have deep networks and relationships that we can leverage to make warm introductions to founders and management teams.”

Having a well-developed investment thesis, experienced industry resources and a repeatable playbook to build and professionalize scalable businesses quickly enables Huron to target smaller companies that competitive acquirers might overlook. “We can start smaller and scale more rapidly because a critical component of our thesis development is building a pipeline of actionable acquisition opportunities,” Madland says. The two platform investments that Huron made in 2022, ExperiGreen and Exigent, are part of the firm’s ExecFactor strategy.

Related content: With a Recession Looming, PE Angles for Opportunities in 2023

Starting with an executive and a thesis enables Huron to buy a smaller business to build into a platform for add-ons or to name a new business first and acquire two or more companies to create a foundation for the platform.

The firm keeps relationships with investment bankers who often make introductions to companies that are too small for the bankers to pursue from an advisory standpoint but could be a fit for Huron’s strategy.

Huron primarily invests in services companies across 10 subsectors and is currently working on a thesis around industrial automation systems integration. The firm plans to find CEOs in the space in 2023.

The Year of the Add-On

Buy-and-build strategies have long been favored by private firms, and 2023 looks to be no different, albeit with a greater emphasis on add-on acquisitions relative to platform investments, thanks to rising interest rates, slowing economic growth and eager sellers.

“I think M&A activity will continue to be soft from a platform point of view,” says Russell Greenberg, founder and managing partner of private equity firm Altus Capital Partners, which invests in U.S. middle-market manufacturing businesses. His firm has seen an uptick in the number of add-on deals and is spending more time working on those engagements relative to larger platform investments.

“In the past six months, we have a longer list of add-on opportunities for our portfolio companies than we do for new platform investments,” he says. Altus is currently devoting more than half of its time working on add-ons for its portfolio companies—significantly higher than in past years, when add-ons accounted for about 25% of the Altus team’s time, Greenberg estimates.

James Andersen, founder and managing partner at lower middle-market private investment firm Clearview Capital, attributes the relative uptick in add-on acquisitions in part to difficulty finding platforms at reasonable valuations, given the uncertain economic outlook for the coming year. Even as prices have come down for public equities, the private markets have been slower to adjust. “The valuations in our part of the market haven’t really moved much at all, so there’s kind of a disconnect,” he says.

In uncertain environments, “capital tends to flow down to the lower middle market,” to businesses with $100 million in enterprise value or less, says Phil Pizzurro, senior managing director of mergers and acquisitions at Generational Capital Markets. “They’re easier to finance. They’re easier to integrate. We’ve seen a lot of private equity groups do smaller bolt-on transactions,” he notes.

The trend toward smaller deals doesn’t stem solely from demand; the supply of lower middle-market businesses coming to market is also a contributor. Greenberg expects that there will be an increase in sellers looking to exit their businesses, including founders who want to step away, or large corporations that need to divest non-performing assets to raise cash. “I think there’ll be more seller motivation to get liquidity, and that’ll allow buyers opportunities that weren’t so available in the prior few years,” he says.

Even as their numbers dwindle in 2023, the platform investments that do close are likely to follow the traditional buy-and-build playbook, yet with greater emphasis on organic growth potential. “While we don’t expect that fundamental strategy to dissipate anytime soon, we are seeing a shift toward buyers prioritizing organic growth and placing a premium on businesses that can meet performance expectations regardless of their acquisition pipeline,” wrote Guggenheim Securities Managing Director Chris Macios in the fall edition of Middle Market DealMaker.

Greenberg agrees that a company’s ability to grow organically is paramount. “I always put a higher priority on internal growth than on trying to find add-ons,” he says. “Let’s understand that the business itself can grow and the add-ons are a nice to have, but you still have to have a business that has some inherent growth to it.”

Andersen notes that both aspects are important to Clearview’s strategy and will continue to be, irrespective of the economic environment. “We haven’t really changed the way we think about businesses,” he says. “We like companies that can grow organically but that we can supplement with add-on acquisitions.”

PE Marketing Gets Personal

Incorporating video content on your website or within your LinkedIn tends to elicit higher engagement. Both written posts and video posts can perform well, but people enjoy the imagery of videos where they can see a personality in action versus imagining who or what it is.As digital marketing continues to evolve, private equity firms must keep up with new trends that set them apart from the competition.

Farrah Holder

IMB Partners

Over the last decade, PE firms upped their marketing efforts to stand out. They’ve realized that marketing is a potent business development tool, not just a nice-to-have addition to the firm.

“The private equity industry is evolving from mainly having one-to-one business development activities to incorporating marketing, which is a one-to-many activity that supplements and enhances business development and brand building,” says Farrah Holder, managing director of business development at Bethesda, Maryland-based IMB Partners.

One of the newer frontiers in digital marketing for private equity is the use of video and podcasts to build a firm’s brand and cement its thought leadership, says Ryan Parker, chief marketing officer and head of brand at Trivest Partners. While a lot of other businesses pushed into video and audio content marketing, private equity firms would do well to consider moving in this direction, he says.

Holder agrees, saying that video, especially on social media platforms like LinkedIn, can help personalize private equity firms. It also helps with initial meetings, since people feel like they know someone a little more when they’ve seen them on video, she says.

“Incorporating video content on your website or within your LinkedIn tends to elicit higher engagement,” Holder says. “Both written posts and video posts can perform well, but people enjoy the imagery of videos where they can see a personality in action versus imagining who or what it is.”

Related content: A Data-Driven Approach to Building Better Private Equity Deals

For private equity firms, LinkedIn is the prime social media channel. While many firms have company pages, they might want to encourage employees to post about the firm on their LinkedIn profiles, Holder says, adding that people will be more inclined to interact with the company information if it’s tied to a person on the platform.

Another opportunity for private equity is to install a chat widget, Parker says. About two years ago, he began using a website pop-up window that lets people contact him, so he can reply in real time. “From June 2020, I’ve had more than 1,500 conversations on our website through the chat widget,” Parker says. “The message comes directly to me.”

Another growing trend that private equity should consider is aggressive branding, a subset of marketing that’s particularly important for the asset class. When firms define themselves, they are positioned to receive the right kind of deals instead of less-relevant inquiries, Parker says.

“What we found is that building a brand, having a personality for the firm and creating that kind of rapport with people works because you’re sharing your value proposition,” Parker says.

Many private equity firms also employ email marketing, but one of the next frontiers is the use of highly segmented email lists. Whatever private equity firms do, sending emails consistently and frequently is critical, according to Parker. Trivest sends at least two emails a week to its network, but he acknowledges that each firm is different and should find the channel and frequency that best fit its needs.

“The key is finding things you can do consistently in an effort to build the brand,” Parker says.