With a Recession Looming, PE Angles for Opportunities in 2023

After several years of frenzied M&A, increased economic headwinds leave dealmakers wary about the 2023 outlook

Uncertainty is the name of the game when it comes to M&A expectations for 2023. Coming off a massive peak in 2021, deal activity in 2022 slowed considerably, driven by geopolitical issues, inflation, rising interest rates, supply chain instability and other factors.

GF Data, which provides data on deals from more than 250 active private equity contributors reported 129 PE-sponsored M&A deals in the first half of 2022, compared with 464 in all of 2021. (GF Data covers transactions with enterprise values of $10 million to $500 million.)

Depending on who you talk to, the market outlook for the coming year varies from slightly pessimistic to exceedingly so.

This section of the report is sponsored by S&P Global Market Intelligence and originally appeared in the special edition Middle Market Growth 2023 Multiples Report. Read the full story in the archive.

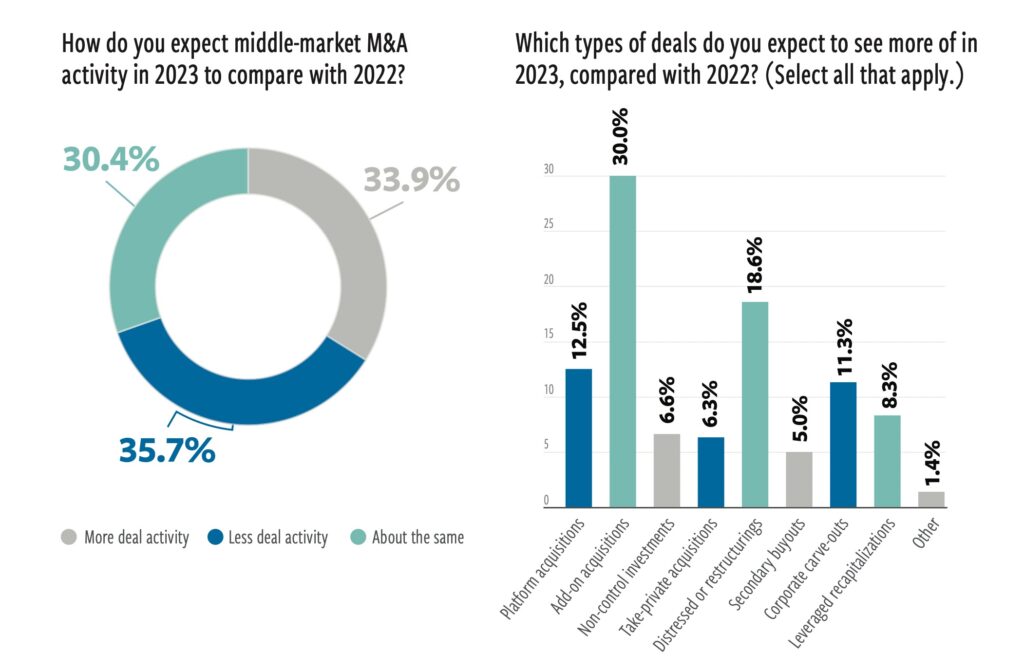

According to a survey* of ACG members conducted in late summer, 66% of respondents believe deal activity will either slow or stay about the same in 2023.

“Public markets are down, IPOs are down, interest rates are up, leverage levels are down. Banks are incredibly conservative right now. It’s more costly to do deals,” says Brian Crosby, managing partner at private equity firm Traub Capital Partners, which invests in consumer businesses. “All these factors are weighing on private equity buyers and making us much more selective in terms of what we’ll look at.”

Jeffrey Stevenson, managing partner at private equity firm VSS Capital Partners, adds that the anticipation of a recession is weighing on the market. “We’re beginning to hear about valuations being dropped and some processes being pulled. Banks being more conservative will of course have a knock-on effect on M&A and valuations,” he says. “I expect we’ll start to see a lot more cracks in the system in terms of M&A slowing down— buyers will have more apprehension about the future, and sellers may decide to put off going to market.”

However, the effect may be less pronounced for well-established companies with above-average financial characteristics that serve targeted niche markets, according to GF Data’s August M&A Report. These deals account for 68% of total deals tracked by GF and completed in the first half of 2022, up from 66% in 2021 and a historic norm of 57%.

“Top-tier assets with recurring revenues, high margins and limited cyclicality are still getting robust interest from private equity buyers, along with support from private lenders and sellers, and are receiving mid-teens to higher EBITDA multiples similar to 2021,” says Sash Rentala, partner and head of financial sponsors at investment bank Solomon Partners.

Valuations on the Downslope

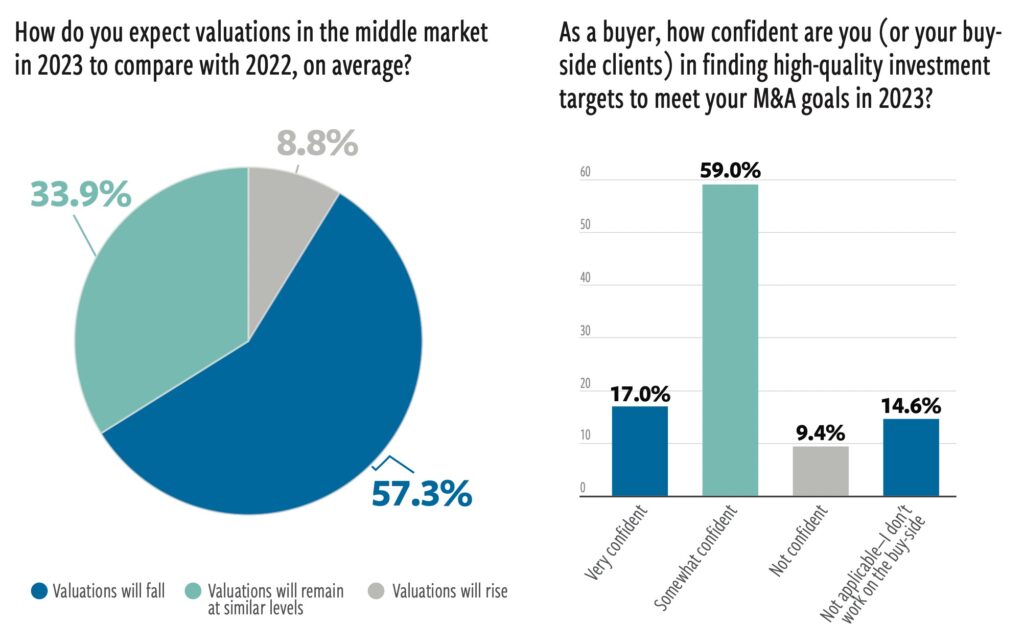

While top-tier businesses may be an exception, valuation expectations are trending downward across the board. Fifty-seven percent of ACG members surveyed said they expect valuations to fall, while 34% expect them to stay about the same. Only 9% said that they expect them to rise.

The reality of lower valuations is taking some time for sellers to get used to, after several years of sky-high multiples. Many dealmakers agree that in the summer of 2022, the market flipped from a seller’s to a buyer’s market. Now, “sellers are mostly looking for last year’s multiple while buyers are more typically looking to pay a multiple that reflects the current economic outlook,” says Doug Korn, managing partner at Victor Capital Partners.

As a result, deals are taking longer, and it can be hard for both sides to reach mutually agreeable terms. However, many expect that in the coming months, seller expectations will start to shift, creating an equilibrium and leading those who need to transact to accept lower valuations and those who are able to wait to do so.

Eroding Buyer Confidence

Meanwhile, buyers’ confidence in their M&A prospects in 2023 is lukewarm at best. The volatility of the public equity markets, driven by macroeconomic factors like the pandemic, the Ukraine war and increasing interest rates, “has created a host of liquidity problems for GPs and LPs who need a return of capital to enable future M&A activity,” says Rentala. “I suspect these macro issues will take a good part of 2023 to resolve and there will be a significant backlog of portfolio companies waiting for liquidity events.”

Fifty-nine percent of buyers are “somewhat confident” in their ability to find high-quality investment targets to meet their M&A goals in 2023, according to the ACG survey.

At the same time, buyers do want to get deals done—and there is plenty of capital in the private equity space to back up that desire. As of August 2022, private equity still had $1.2 trillion of dry powder (down from $1.5 trillion in 2020), according to PitchBook.

“Buyers and investors want to be active. There are still massive amounts of capital in the market, and they want to put that capital to work. They want to be able to show that they can do transactions in whatever market environment prevails,” says Dan Connolly, managing director and co-head of M&A at William Blair.

Whether they’re able to make that happen remains to be seen.

Creative Dealmaking

One thing is certain: Faced with a tight financing market, buyers need to get creative with deal structure in order to complete transactions in 2023.

Previously, “sellers just wanted cash and they were by and large able to get what they asked for,” says Meahgan O’Grady Martin, director of business development at private equity firm Palladium Equity Partners.

Moving forward, many transactions will be bridged through structure, as was more common prior to the pandemic, in order to meet expectations on both sides. This may include cash up front, as well as contingencies around the continued performance of the business, such as earnouts. “This helps address concerns about ‘COVID bumps’ and how businesses will be able to fare in the pending recession,” notes O’Grady Martin.

Borrowing has also grown more costly these days. “Debt is more expensive, less plentiful and less tax-advantaged than it was a year ago,” says Victor Capital’s Korn.

The cost of debt is already impacting processes, a trend that is likely to continue in 2023. “We’ve had deals where leverage multiples have come down a full multiple of leverage or more from when we put in the IOI,” says Traub Capital Partners’ Crosby. This necessitates further communication with advisors and sellers and can put a snag in deal discussions. However, while the state of the debt markets makes pure financial engineering a much less viable strategy, it creates opportunities for PE firms that put greater emphasis on value creation through operational improvements.

In addition to complicating negotiations, the debt markets are leading some business owners to rethink sale plans. “We’re seeing owners evaluate a broader set of alternatives than simply an outright sale or buyout,” says William Blair’s Connolly. This includes minority investments and secondary sales.

Intimate Processes Become the Norm

There are also changes underway to the sale process itself.

“Given the volatility right now, regular sell-side auctioneering is by and large not happening,” says Connolly, with the exception of companies that are forced into a position where they need to transact immediately. This is a marked change from 2021 and the first part of 2022, when auction processes were large, frequent, competitive and rapid-fire.

In 2023, the expectation is that many companies that can wait to go to market will. However, dealmakers expect that deals will get done—just in a different way. “There are far fewer broad processes being launched. Creative origination—getting to know founders and CEOs at a more intimate level—is at the core of deals being done now more than ever,” says O’Grady Martin.

Bankers would rather engage a targeted buyer in a lengthier proprietary process than risk a hung deal by attempting a broader process. This helps everyone save face. “If bankers have conversations with the most logical buyers and things don’t work out, they can say they were just testing the market and will circle back again,” says O’Grady Martin.

Though borne of necessity, these more intimate processes can be a boon for both sides. Of Traub Capital Partners’ five active deals as of the time of writing, three of them have been a long courtship emerging from targeted matchmaking. “We’re big believers in a culture-led approach, in finding a true partnership with owners and the management team. It’s nice to be able to ‘date’ each other for much longer durations rather than have a 45-day shotgun marriage,” says Crosby.

Doubling Down on Due Diligence

In a volatile market, due diligence takes on increased importance as well.

M&A processes are slowing down, driven in part by buyers taking more time to do their due diligence. “Last year, people were buying companies off projected year-end numbers and taking the sellers’ word for it. This year people are much more skeptical. They want to see the results come in,” says O’Grady Martin.

There are numerous factors to consider. For example, with inflation on the rise, “if you have a business that can’t pass along its price increases to consumers, that’s difficult to navigate,” says Victor Capital Partners’ Korn.

Labor costs, which have been increasing, are another big factor. “If you look at EBITDA over a 12-month period, as is typical, it’s not going to capture the run rate increase of those costs,” notes VSS’ Stevenson. It requires a lot more work that needs to be done during due diligence to understand where the business is headed, he adds.

Ultimately, after three years of a pandemic, there’s an inherent challenge in predicting how businesses will perform in a “normal” environment. Ideally, buyers would find companies where performance has been steady, but that can be difficult. Whether looking at a company that was hurt by or benefited from the pandemic, buyers need to put in the work to understand how changing dynamics may affect future earnings.

Add-Ons Abound

In an uncertain landscape, add-on acquisitions offer opportunities for private equity firms, their platform companies and smaller businesses looking to transact. In the first half of 2022, add-on acquisitions made up nearly 80% of total deal activity by buyout funds, according to PitchBook. When ACG members were surveyed about which deal types they expected to see more of in 2023 vs. 2022, the most popular answer was add-ons (30% of respondents), followed by distressed/ restructurings (19%) and platform acquisitions (13%).

“Add-ons can be less of a bet on the economic cycle and may be poised to accelerate in a challenging economic environment. A current owner may find that their business is more competitive when part of a private equity platform than to the current owner of the business, because of cost synergies, cross-selling opportunities or the multiple expansion ascribed to being part of a larger company,” says Korn, who adds that Victor Capital Partners is stepping up add-on activity across its portfolio.

In addition, owners of smaller, family-owned businesses may find it hard to weather economic downturns and may be ready for a transaction.

For private equity firms eager to deploy capital, add-ons can be a less risky way to do so. “Add-ons make a lot of sense in uncertain times. You have an existing investment in the space, you know the industry, you have a management team that you know and trust,” says Traub Capital Partners’ Crosby, who notes his firm is also increasingly seeking out add-ons for its existing portfolio.

Opportunities for PE

A down market also creates opportunities for those firms looking to provide growth capital to help build businesses.

“Firms that look to buy companies at a bargain price and drive returns while otherwise leaving it alone will struggle. Firms with sector expertise and those that can offer real value to their portfolio companies will be well-positioned to navigate this environment,” says Korn.

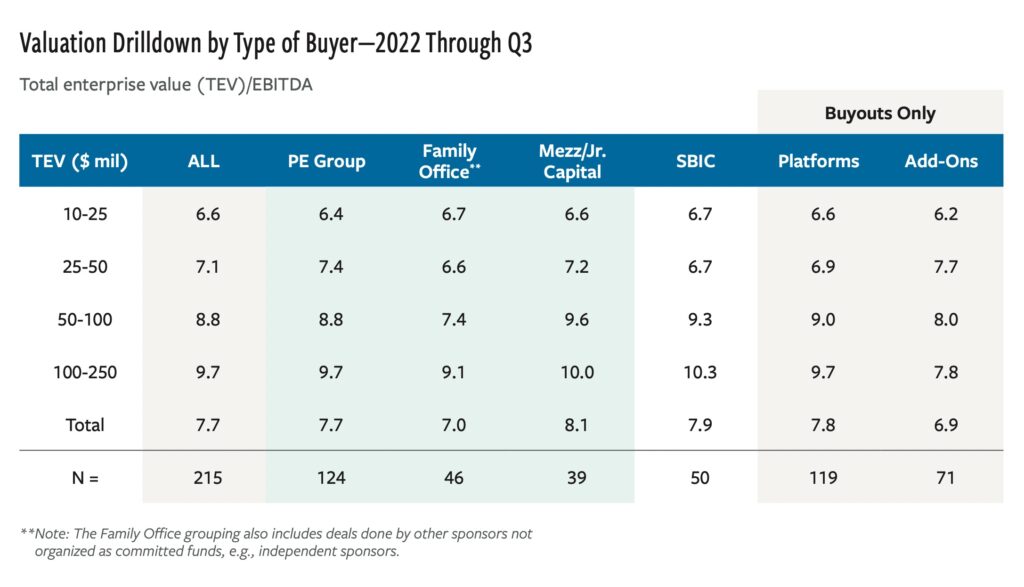

While fewer business owners may be willing to consider an all-out sale, “in a market environment where valuations are lower, we’ll find more entrepreneurs wanting to hold and raise capital,” says VSS’ Stevenson. GF Data found that in the first six months of 2022, “more high-performing companies are choosing to ‘take chips off the table’ rather than substantially exit,” a trend that is likely to continue. In an atypical development, mezzanine funds/junior capital providers completed transactions at an average of 8.1x in 2022 as of Q3, while the average for PE funds was 7.7x, according to GF Data.

While there may be fewer high-quality targets to consider, the new market environment does have some advantages for buyers. “It’s nice in the sense that these auction processes have moderated a bit 50 in terms of pace, frenzy, speed to close, and certainly the valuation multiples and expectations,” says Crosby.

Ultimately, most agree that a recession is on the horizon in 2023. But there remain opportunities for buyers, if they only know where to look. “Right now, we’re seeing more and more deals being put on ice, with seller expectations still at 2021 levels,” says O’Grady Martin. “But once those expectations converge, that will provide a very nice buying opportunity for those that still have a significant amount of dry powder left.”

Meghan Daniels is a freelance writer and editor based in Brooklyn, New York.

*ACG conducted a survey between Aug. 16 and Sept. 21 in which 171 respondents from the middle-market dealmaking and corporate growth community answered questions about their outlook for 2023.