M&A Outlook: 2021 Deal Trends

During the ACG Winter Summit panel session “M&A Outlook: 2021 Deal Trends,” sponsored by Datasite, panelists from middle-market investment banks said 2021 could be a record year.

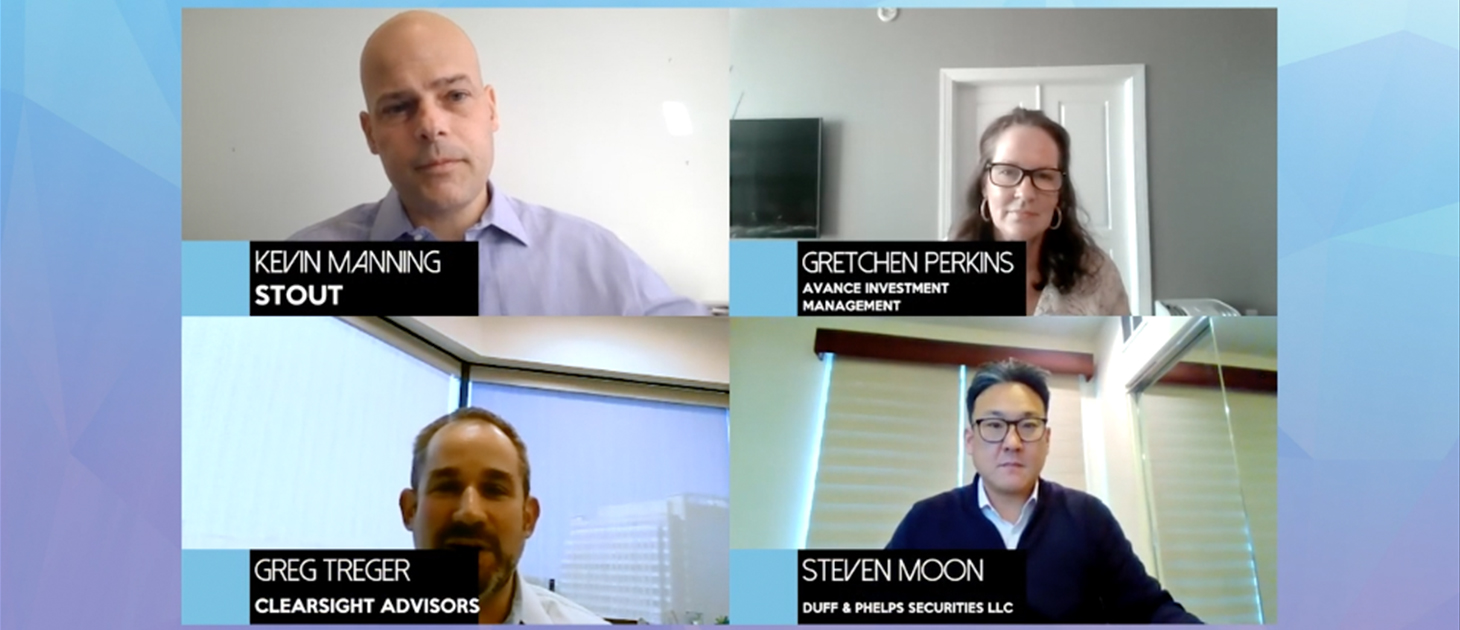

Deal-makers think that 2021 will be a banner year as the vaccine rollout for COVID-19 hits full swing in the springtime and business picks up. During the ACG Winter Summit panel session “M&A Outlook: 2021 Deal Trends,” sponsored by Datasite and moderated by Gretchen Perkins, a partner with Avance Investment Management, panelists from middle-market investment banks said 2021 could be a record year.

For starters, business travel and in-person meetings will return, but if a business owner wishes to conduct meetings over Zoom, then virtual visits will continue, said Greg Treger, co-founder and managing director at Clearsight Advisors.

“If our prospective client wants us there, we’re going to be there. Most of our clients we’ve signed up over the last six months, we’ve never met face to face,” said Treger. “A year ago, I never would have thought that was possible, but we’ve all figured out a way to make this work.”

Once a successful vaccine is deployed, pitch meetings will revert back to more in-person activity, said Kevin Manning, managing director and head of industrials at Stout. But he has seen some positive results with a new technology: remote-controlled drones, used for factory and facility tours.

“I would not be surprised if we see more of these drone-oriented facility tours. It actually works really, really well because there’s less noise. You can pause, you can ask questions and it’s something that I found to be actually better than an in-person tour,” said Manning.

Manning added that while he thinks the year started out light in terms of deals, he sees that changing quickly. “With the tax dynamic that we all believe is being discussed amongst every advisor that touches a corporation, we could also see a mad dash in the spring all the way through the winter to get as many transactions done as possible,” he said. “We think it’s going to be a very active year and a good year for a lot of us.”

Steven Moon, managing director and deputy head of M&A for Duff & Phelps Securities, predicted that some companies looking to sell or merge have discovered a benefit of meeting over Zoom: confidentiality that does not cause concern and speculation among employees.

“You don’t have leadership teams gone for a week and [workers asking] what’s going on with the CEO and CFO?” said Moon. He adds that while Zoom can reduce the time and energy otherwise spent on in-person meetings, the virtual alternative might require more reference checks and conversations with portfolio company CEOs to understand their potential partner.

“You’re not getting that kind of interaction when we’re doing things over Zoom,” said Moon.

Phil Albinus is Middle Market Growth’s managing editor.