GLE Precision Puts a Face on Middle-Market Business

The Michigan manufacturer makes products that fit in your palm, but its reach goes much farther.

Tucked behind the main street of Frankenmuth, Michigan, where Bavarian architecture, world-famous chicken dinners and horse-drawn carriages are town trademarks, stands the grinding facility of GLE Precision.

Behind its unassuming facade on a road dotted by farm fields in a building where a horse barn once stood, GLE manufactures high-precision products on an impressive global scale. It produces parts machined from materials such as tungsten carbide and ceramic for use in almost every industry imaginable, from medical devices to aerospace and defense.

“Even if you’ve never heard of GLE before, we’re involved in the products that you use,” says Clint Bucholz, the company’s general manager. The “precision” in GLE Precision isn’t just a moniker; the company’s components are so precise that they require accuracy of 10 millionths of an inch. Most of the products that GLE produces are small enough to fit in the palm of a hand.

But that precision comes with a price. GLE, along with 820 other companies in Michigan, relies on private investor backing to run its business. Private equity funding made a key difference in GLE’s growth and expansion: After private equity firms Colfax Creek and Victory Park Capital acquired the business in 2015, GLE increased its capital and technology investment by 71 percent.

A Crucial Component

Michigan businesses alone received $57 billion from private capital investors between 2003 and 2014. According to data from GrowthEconomy.org, private equity-backed jobs in the United States grew by 70 percent between 1998 and 2015, with three-quarters of that growth coming from middle-market businesses like GLE.

“Private capital investment is crucial for many middle-market companies, which use it to make improvements to their operations, acquire additional businesses, add staff and expand facilities,” says Christine Melendes, vice president of public policy, strategic events and partnerships at the Association for Corporate Growth. “With private equity investments, companies not only get working capital, they also get expertise and leadership from experts that can assist them in their growth.”

Despite the promise that middle-market companies have shown over the last decade, Melendes says they now face what could be a major blow to their financial infrastructure under the proposed House Republican Federal Tax Plan, which aims to eliminate business interest deduction practices. The current tax rules allow companies to write off the interest they pay on borrowing costs as a business expense, reducing the taxable net profit.

The new tax reform plan, however, could prevent companies from writing off that interest, forcing them to pay taxes on the cost of borrowing through an inflated reflection in their overall profit.

GLE contends that for it and many other middle-market companies, especially in the manufacturing industry, a change like that could be crippling.

If the proposed replacement for interest deduction were to go into effect, it would raise the tax rate for GLE to a staggering 58.8 percent, from 35.9 percent. This would be one of the most significant moves in tax reform: The United States has allowed the deduction of business expenses since the creation of the modern tax code more than 100 years ago. Increasing the cost of investments in machinery, tools and other capital expenditures runs the risk of restricting economic expansion and growth, and favoring foreign markets over domestic industry.

Proponents of the tax plan expect the move will encourage companies to avoid taking on too much debt and potentially avoid contributing to another recession. The hope is that, although the change may slow growth initially, it will balance out over a period of time. For middle-market companies, however, the move would significantly impact how they do business and may put them out of business altogether.

Investing in Policies

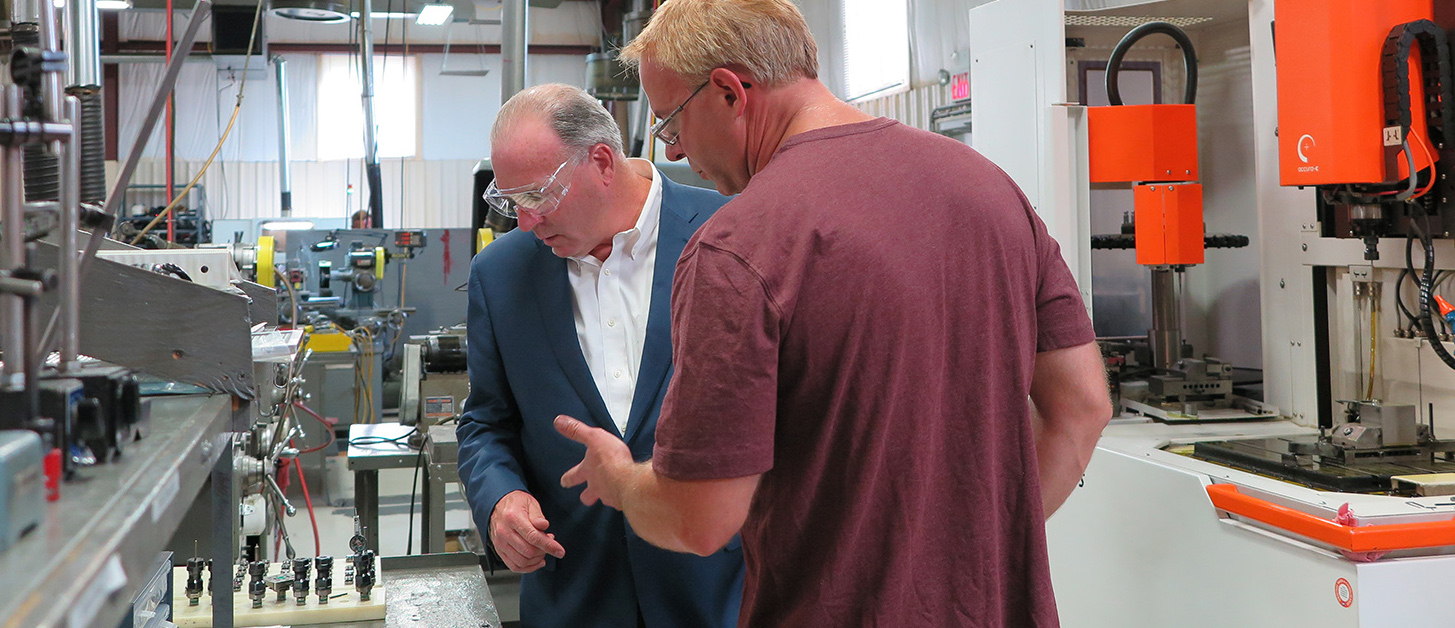

U.S. Rep. Dan Kildee, a Democrat representing Michigan’s 5th District, recently toured GLE and met with staff, engineers and machinists, many of whom have spent their entire careers at the company. Kildee noted that throwing out numbers on a tax proposal doesn’t necessarily translate into understanding how deeply those changes could affect a company like GLE—and the workers it employs.

Wearing safety glasses on the factory floor, Kildee met with employees who produce everything from catheter components to the fiber optic dies of 5G network systems. They shared with the congressman personal stories of how their work drives the American economy.

“It’s not just pushing a button,” says Dave Ecker, 48, who began his 30-year career with GLE as part of a co-op through local Bridgeport High School. “It’s an art. You have to know what [the machine] is doing without seeing what it’s doing.”

Kildee notes that companies like GLE need the support of policies that take into account the needs of middle-market businesses and recognize the talent, skill and dedication of the men and women they employ.

“Federal policy impacts businesses of every type, and this is one of those businesses that really adds a lot of value in our region—good jobs, people who obviously have a lot of skill and also, because of the nature of the work, it supports other industries by providing really high-quality products,” Kildee says.

Investing in policies that support middle-market companies and their high-quality products means investing in the future.

Bucholz puts it simply: “This is what we need to grow.” //

Watch a video filmed during Rep. Kildee’s visit to GLE, and learn more about the company in a May 2017 MMG profile.

Chaunie Brusie is a writer and author from southeastern Michigan.