Betting on Commercial and Residential Services

Why businesses that offer HVAC, landscaping and other commercial and residential services are seeing an uptick in investment activity.

Demand for companies that provide residential and commercial services has seen steady growth in recent years. The stability of the sector and its numerous small players have especially made it a safe harbor and a source for growth amid the COVID-19 pandemic. Those same features are likely to power the market segment in the future, experts say.

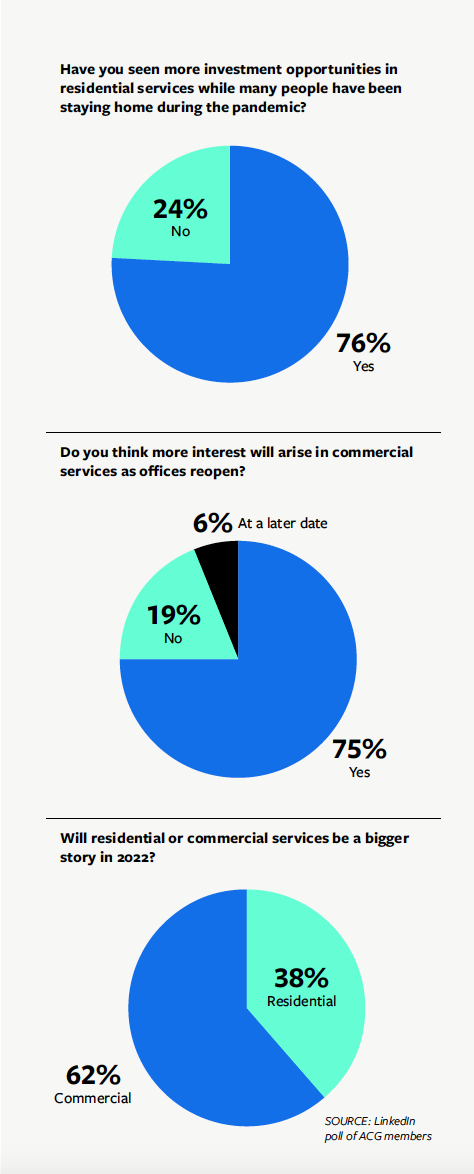

While activity in the sector has been steady for some time already, the pandemic underscored its value. As workers spent more time at home, they invested more in heating, cooling, remodeling and landscaping.

“We spend all of our time at home, so every service provided to homes is being amplified,” says Glen Kruger, a managing director at GCA Global, an investment bank recently acquired by Houlihan Lokey. “It’s just a much higher demand that trickles down from the homeowner to the home service provider.”

When workers began returning to the office, demand started to accelerate for commercial services as well.

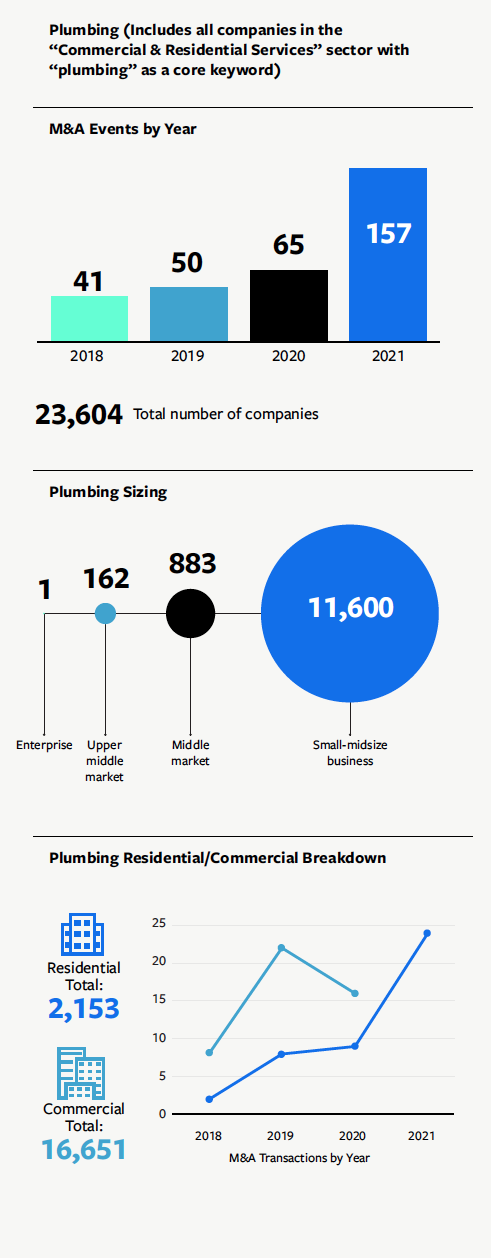

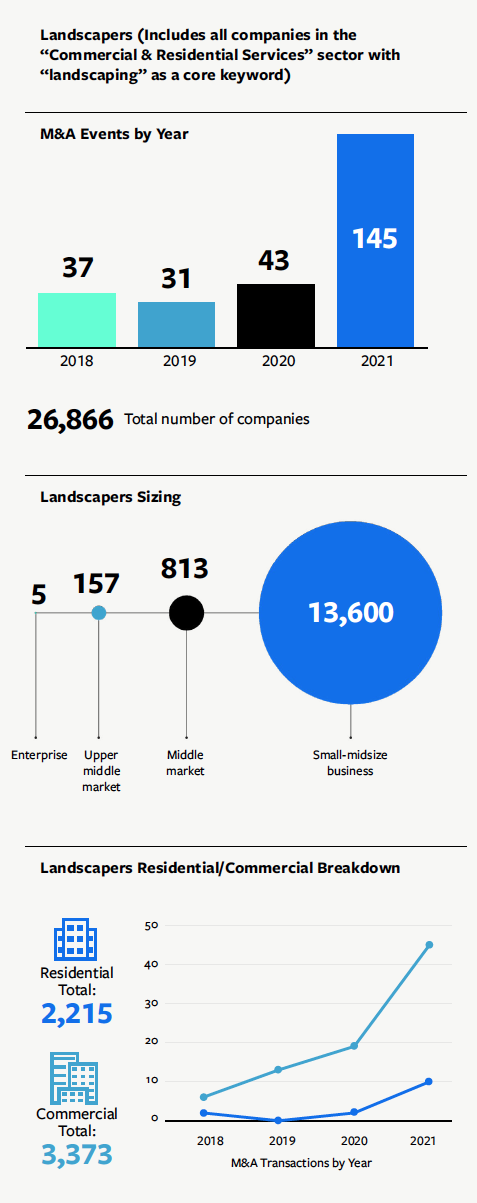

The number of annual M&A events completed by dealmakers for companies in the commercial and residential services space, which includes businesses that provide HVAC, electrical, plumbing, cleaning, landscaping and other services, saw consistent growth between 2018 and 2020, increasing from 366 to 489 transactions, according to Grata, a company intelligence engine.

That activity nearly quadrupled this year. There have been over 2,000 M&A events tracked by Grata so far this year involving industrial services.

Tim Shea, a managing director and head of business services at Solomon Partners, has also seen increasing interest over the last decade in facility services catering to residential and commercial clients.

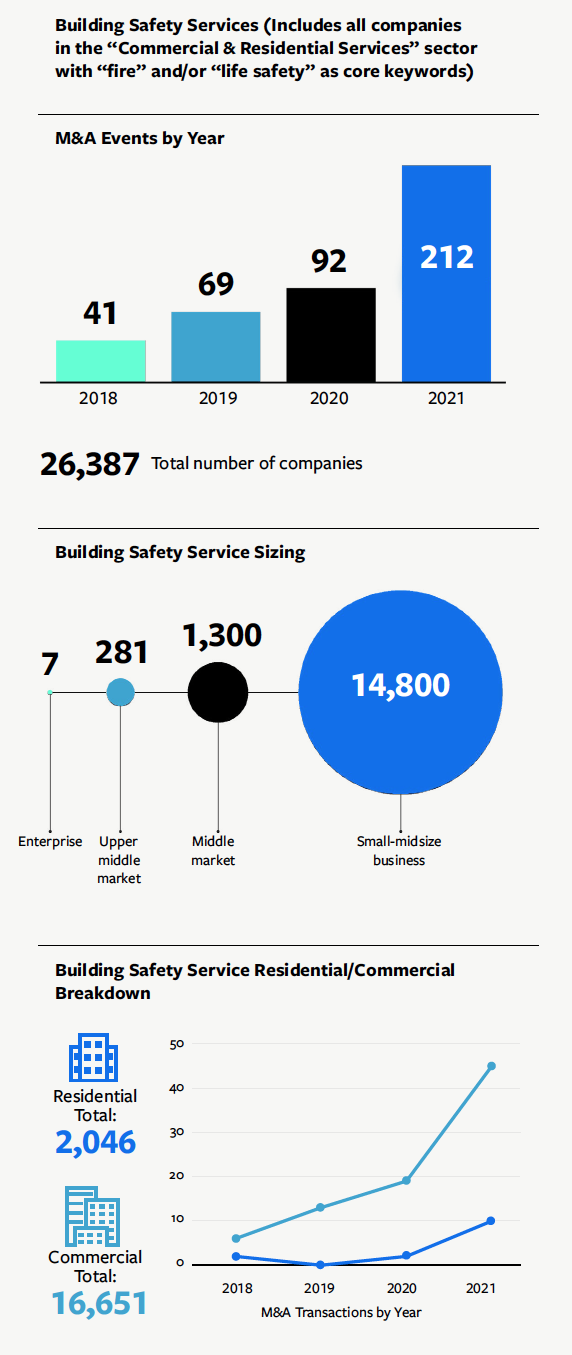

His recent transaction experience in the space includes the sale of CI Capital Partners’ portfolio company Summit Companies to BlackRock Long Term Private Capital in September. The Minnesota-based company is a provider of fire and life safety services for offices and other buildings.

There has been an incredible flood of deals in the services space in recent months, according to sector specialists. They’ve included the sale of Encore Fire, a fire protection service firm, to Levine Leichtman in September; the sale of landscaping company SavATree to Apax Funds in August; and KKR’s purchase of home service company Neighborly in July.

Attractive Features

Shea and other market experts agree that the key drivers of that interest—particularly from private equity—include the breadth of the market, as well as the businesses’ small size and stable revenues. Most commercial service revenues are highly recurring and predictable, while the companies’ services are essential.

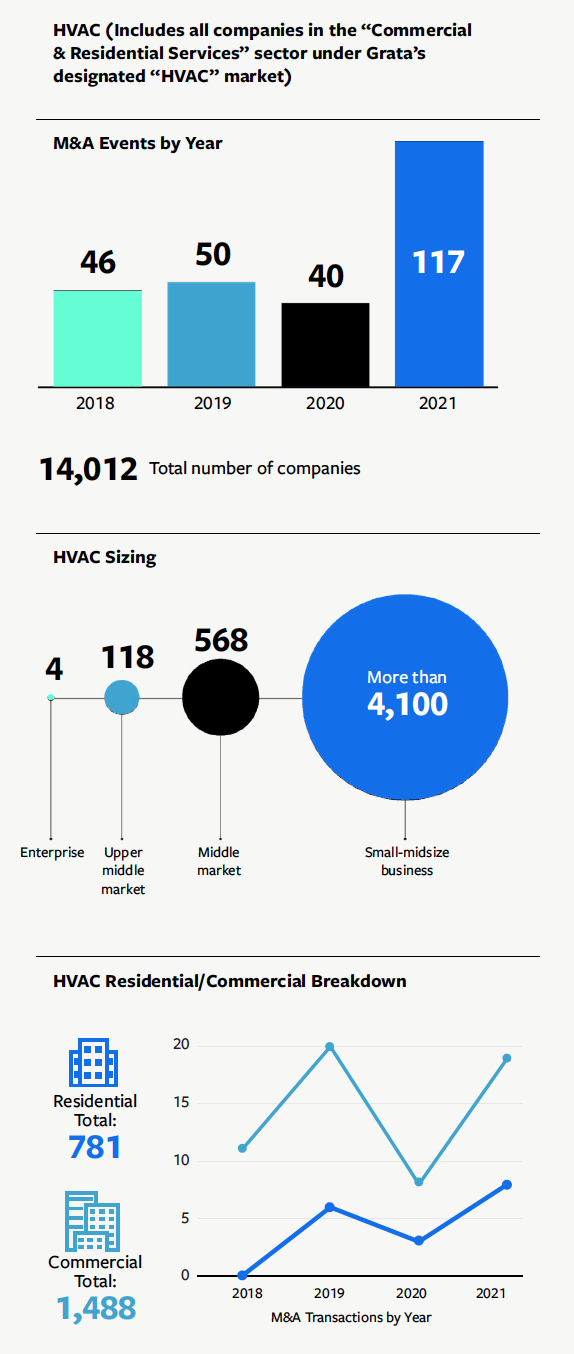

“If you think about fire and life safety, you have regulations and code requiring regular inspections. Then, when something needs repair or replacement, code requires it. It simply cannot be postponed,” Shea says. “If you think about HVAC, if your furnace goes out, or your air conditioner goes out, that’s not something you can ignore.”

That demand is stable across business cycles, according to Shea, and the pandemic was no exception. “The sector was in focus prior to COVID-19,” he says. “COVID was just an accelerant given the proven stability in the markets and relatively strong performance.”

Many investors find the non-discretionary nature of commercial services attractive, experts say. Additionally, the maintenance and repair cycles are predictable, making it easy to underwrite what future demand will look like, according to Brian Lucas, a managing director at Harris Williams who focuses on commercial services.

“Repairs are generally non-deferrable, even in an economic downturn,” he says.

Private equity is the predominant investor type, but family offices and other long-term investors are starting to show interest in the space as well, according to Brent Spiller, a managing director at Harris Williams who focuses on the residential side of the sector. “They’re all interested in the sector for the same reasons—there’s low downside and good return.”

While residential services have already seen a considerable uptick in demand over the last year, sector bankers agree some subsectors will continue to be attractive based on current activity and growth potential.

Building safety services have seen a considerable increase in demand in recent months. Grata figures show M&A has more than doubled since last year, from 92 to 212 transactions.

Pest control services saw a nearly five-fold increase in M&A activity over the last year—the spike resulting from a near-inactive market segment that’s seen a sudden rise from 6 to 33.

Demand for heating and air conditioning services was also remarkable. The number of HVAC M&A events has nearly tripled since 2020, from 40 to 117, according to Grata.

A Fractured Market

Perhaps more than any other factor, the primary driver for the recent surge in M&A activity for commercial and residential services has stemmed from the fractured nature of the sector.

There are more than 283,000 active companies across the U.S. and Canada, according to Grata, and the market is also highly fragmented, with 94% of these types of companies weighted in the small-to-midsize end of the market, which Grata defines as businesses with 50 or fewer employees.

These companies can be leaders in their segment but have only 10% of the market share because the space is so large and fragmented, Shea explains. “There’s a lot of white space.”

As a result, residential or commercial service companies experiencing investment activity at the moment may be seeing their first injection of institutional capital. “That creates a lot of opportunity for private equity firms to build M&A platforms where they buy a business and they use that as a platform to do a bunch of acquisitions,” Shea says. Unsurprisingly, the rally on the sector by investors is causing prices for target companies to rise.

While it depends on the transaction type, market experts agree that they’ve seen a steady progression upward on both the commercial and residential side of the industry.

“The range used to be high-single-digits to low-teens [as a multiple of EBITDA]. Now, it’s generally low-teens to high-teens, and even higher,” says Brian Lucas, a managing director at Harris Williams.

According to Solomon’s Shea, transaction size in the space remains scattered. Due to the fractured state of the market with many small players and few large ones, he says he’s worked on deals ranging from $30 million to $1 billion. Many small businesses are valued at 7-8x EBITDA, and valuations are rising—with some now going to market as high as 20x EBITDA.

On the residential side, HVAC is standing out. According to Shea, private equity firms are seeing prices for HVAC companies 50% higher than they have been historically.

Prices are edging up, but funds are comfortable with deploying increasing sums in the space because of the growth potential, Shea says.

Other market trends include larger investors moving down-market to build their platforms. This also presents an opportunity for small funds to make exits. “Smaller funds are feeding the medium-sized funds and the medium-sized funds are feeding into the larger funds,” Shea notes.

As a result, Shea is noticing that hold times for building services companies are shortening from five years to 2-3 years in many cases. “The velocity has gone up,” he says.

Watch a panel of experts discuss the commercial and residential services sector. Moderator Nevin Raj, COO and co-founder of Grata, is joined by Brian Rassel, a partner at Huron Capital, and Brent Kulman, head of business development at Five Points Capital.

Minding the Commercial & Residential Gap

While the building services space has seen remarkable growth in recent months, nuances remain between commercial and residential subsectors.

According to some experts, commercial was historically more dynamic than the residential side of the market. That trend reversed over the last five years. The residential side became even more active during the COVID-19 pandemic.

In general, the commercial-facing wing of services was hit harder than its residential counterpart, as businesses that service hotels and airports were negatively impacted.

M&A activity for service companies that solely served commercial clients stagnated between 2019 and 2020—remaining at around 200 deals— at the same time transactions for residential-focused companies increased from 120 to 160, according to Grata figures.

Companies providing services to homes and private residences increased from 160 to nearly 500 over the last year.

There has always been very consistent, strong, resilient demand for home-based services, according to Harris Williams’ Spiller. With more people spending time at home, that has only increased, but the market is leveling out. “We’ve seen more demand across all different types of services throughout the entire building services sector,” he says.

Company Spotlight: Pueblo Mechanical & Controls

Learn how private equity firm Huron Capital Partners is helping a commercial HVAC repair and replacement services provider expand its footprint. Read the story here.

The market for commercial services recovered, and even accelerated, in 2021. M&A activity for commercial-focused services tracked by Grata increased from 200 to over 550 transactions since over the last year.

Despite opportunity, the sector faces some challenges. Across the commercial-residential divide, the labor shortage is becoming more pronounced.

“Labor shortages are a problem throughout these industries, and that problem is magnified as the skill of the technician increases,” GCA’s Glen Kruger says.

Kruger is concerned that demand for building service companies is tied very closely to the pace of construction. “The problem, of course, is when the construction boom starts to wane, or the home services boom starts to wane, we may see a reversal of fortune.”

Opportunities in Tech

The service market is also undergoing a technological revolution. The segment is shifting toward digital sophistication that traditional mom-and-pop shops are often ill equipped to implement, which creates opportunities for investment and value creation.

“Whether in painting, plumbing, landscaping or any other home service, consumers desire a frictionless customer experience,” Harris Williams’ Spiller says. “They want brands they recognize and trust, and those that make it easy to do business with.”

By leveraging software like customer relationship management, enterprise resource planning, human capital management and dispatch management, service companies can easily distinguish themselves from their competition.

Examples of such software include well-known companies like Shopify and Toast, but there are emerging platforms built specifically for residential and commercial services. Software company FieldRoutes developed Pest Routes, business management software for pest control services. In June, WorkWave acquired Real Green, a payment processor for lawn care and landscaping companies.

The lack of technological sophistication for service companies is becoming a problem, especially as they grow, sector specialists say. Without business management software, these companies may not be able to handle as much work or run business operations as effectively as they could.

“Many small businesses are still using spreadsheets or the calendar on their PC to manage their business,” says Kruger.

Fintech trends like integrated payments, where payment processing is built into other business software like scheduling and accounting, is shaping the residential services market as more companies are able to process credit cards and other forms of payment they couldn’t under previous ownership.

But investment targets in the form of these software companies are few and far between— and they’re getting more expensive, Kruger says. The value of software vendors to building service companies is reaching double-digit multiples, with valuations ranging in size from $3 million to $600 million.

Long-term Outlook

While many factors contributed to the rapid growth in home and business services in recent months, headwinds for the segment are looming. But experts are still confident that the space will continue to grow.

Commercial properties—from offices to hotels to hospitals—will need to adapt to new demands for air quality, environmental compliance, efficient use of energy and worker safety, resulting in exciting growth opportunities for the companies that provide these services, sector specialists say.

“We’re seeing more focus on employee health and the physical safety of workspaces,” says Harris Williams’ Lucas. “And while there are questions around occupancy, and how people are going to use office buildings as more people continue to work from home, there will always be a focus on the systems that manage a building.”

Lucas says there will be a continued need for commercial services that manage infrastructure, HVAC, fire safety and all of the other systems that a building needs to operate.

“If the building is occupied at 100% or 50%, the systems still have to function properly and comply with regulations. And because commercial services were deemed essential in the early stages of the COVID-19 pandemic, it has been a very resilient sector,” Lucas adds.

As the market becomes more sophisticated by adopting new software and processes, experts expect the sector will attract new customers.

“Trusted brand names continue to gain momentum, and each generation tends to be more likely to want someone to ‘do it for me’ versus fixing or improving their homes on their own. I don’t see any of that changing in the short or medium terms,” Harris Williams’ Spiller says.

Finally, as the COVID-19 pandemic further recedes, future growth is expected on both sides of the residential-commercial divide.

“There’s plenty of dry powder to go around, and we think both sectors will continue to attract their respective investors,” Lucas says.

Benjamin Glick is a former associate editor for Middle Market Growth.