Middle-Market Public Policy Roundup

Policymakers discuss post-recession financial regulation, a Senate committee reviews Trump’s nominee for the SEC, and other policy news of the week.

In this week’s roundup, prominent lawmakers and regulators discuss the value of regulation following the Great Recession, a Senate committee reviews President Trump’s nominee for SEC commissioner, and the Treasury Department appears closer to clarifying new pass-through provisions.

We will not be publishing the weekly roundup next month due to the August recess on Capitol Hill. We will keep you updated should any highly pertinent news occur and look forward to resuming in September when we hope to see you in Washington, D.C., for the ACG Middle-Market Advocacy Summit!

‘Regulating Wall Street’ Panel at Americans for Financial Reform Event

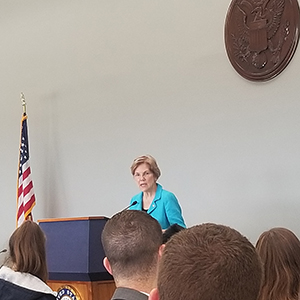

On Tuesday, members of ACG’s policy team attended an event that examined the U.S. economy 10 years after the financial crisis of 2007-2008. Prominent lawmakers and regulators spoke during the event, hosted by the nonprofit organization Americans for Financial Reform.

Speakers included Sen. Sherrod Brown, D-Ohio, Ranking Member of the Senate Banking, Housing and Urban Affairs Committee; Sen. Elizabeth Warren, D-Mass., a prominent member of the Senate Banking Committee; SEC Commissioner Robert Jackson; and Former FDIC and Treasury Dept. officials.

The event focused on the importance of maintaining and furthering the safeguards put in place after the financial crisis through the Dodd-Frank Act, such as the Consumer Financial Protection Bureau and the Volcker Rule.

Of note were SEC Commissioner Jackson’s comments surrounding private funds, industry regulation and the middle market. Jackson underscored his concern that that the systemic risk throughout the public markets that ultimately led to the financial crisis has shifted to the “shadows of private funds.”

He noted his concern that there is a “ticking time bomb” due to a lack of transparency surrounding private fund risk. As such, Jackson believes robust oversight and disclosure requirements need to be maintained and strengthened.

In addition, Jackson said broker-dealers were “ground-zero” for the financial crisis due to their selling of collateralized debt obligations and derivatives consisting of the lowest-rated mortgage-backed securities. Using this example, he extrapolated that it is important for regulators not to have blind faith in the industries they are regulating. Instead, they should be proactive in developing a fundamental understanding of how those industries work.

Jackson’s comments surrounding what he has coined the “middle-market initial public offering (IPO) tax,” echoed ones he has made previously. He has said that one of the barriers for firms looking to go public is the 7 percent fee. According to Jackson, previous efforts to increase IPOs by small and midsize businesses have failed because firms must take 7 percent of what they make “off the table.” He expressed his concern that such companies are being deprived of the option to go public because of this. As a result, they are forced to rely on private funds, which “lack competitiveness” because they do not have to compete with public markets. According to Jackson, the “fourth forgotten pillar” of the SEC is cost-benefit analysis of what proposed regulatory changes do to competition in markets.

Confirmation Hearing for Elad Roisman, SEC Commissioner Nominee

The Senate Committee on Banking, Housing, and Urban Affairs held a nomination hearing on Tuesday for four of President Trump’s nominees, including Elad Roisman, the president’s nominee to replace Michael Piwowar as one of the five SEC commissioners. When asked about his priorities, Roisman spoke about the need for a strong enforcement program and the importance of restoring investor confidence, improving capital formation and continuing to improve cybersecurity measures at the SEC and within American companies.

Topics discussed included the decline in the number of SEC enforcement cases; Roisman’s support for SEC policy that limits the subpoena power of enforcement attorneys; the need for greater transparency and accountability in the Municipal Securities Rulemaking Board (overseen by the SEC); and the fiduciary rule. Roisman said he is a strong proponent of cost-benefit analysis with respect to rulemaking, to ensure that small and midsize firms have access to the capital they need.

Treasury Submits Pass-Through Deduction Implementation Proposal to OMB

Under the Tax Cuts and Jobs Act, passed in December of last year, individuals received a 20 percent deduction for “income derived from pass-through businesses.” The law was written to prevent that deduction from applying to income over a certain threshold ($415,000 if filing jointly) from a “specified service or trade,” meaning any business involved in the fields of law, accounting, consulting, financial services, health, brokerage services, or any such business where the “reputation or skill” of one or more of its employees is its principle asset. Architectural and engineering businesses do not count as a specified services or trade, but a business involved in securities trading or investment management does.

Due to the immense complexity of regulating this issue, no one is quite sure how regulations will be written that prevent gaming of the system. Yet Treasury, the department charged with writing the new tax code, appears to have gotten one step closer. The Office of Management and Budget has received the regulation for review, according to its website. The website states that it is only “computational,” however, meaning that it may not cover all facets of the deduction. Rather, it may only cover issues such as how to calculate losses.

Check back each Friday for the weekly Public Policy Roundup. Is there a policy issue you’d like us to cover? Send your suggestions to MMG Editor Kathryn Mulligan at kmulligan@acg.org.

Maria Wolvin is ACG Global’s vice president and senior counsel, public policy.

Ben Marsico is ACG Global’s manager of legislative and regulatory affairs.