Update on the Future of Corporate Interest Deductibility

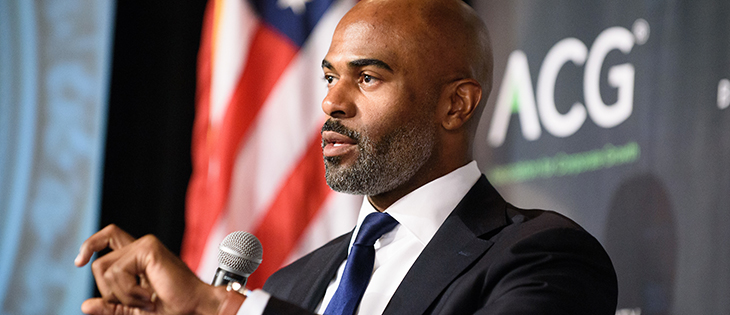

Langston Emerson, managing director of The Cypress Group, which works on ACG's advocacy initiatives, gives an update on the future of interest deductibility on corporate debt.

Langston Emerson is managing director of The Cypress Group, a Washington, D.C.-based advocacy firm that lobbies on behalf of ACG and other clients on public policy issues. MMG caught up with him during ACG’s Public Policy Summit on Wednesday, the day the Republican-led Congress offered its “Big Six” framework for tax reform. Emerson provided an update on the future of interest deductibility on corporate debt, an important provision in the existing tax code that ACG is working to uphold.

Q. Can you contextualize the issue of corporate interest deductibility and its importance to ACG?

Langston Emerson: It’s a big issue and it’s very timely as of today. It’s a tax issue and it falls within the rubric of the tax reform package that the administration and the House and Senate Republican leadership have been working on. It’s one of the key priorities for ACG.

Q. Why is maintaining this provision important for private equity and midsize companies?

LE: The ability to deduct 100 percent of interest on corporate debt or debt taken on to grow and operate businesses is key. For private equity, in large part, it’s how they finance transactions.

PE firms put up capital they get from their investors and they also place debt on the portfolio company in order to consummate the transaction. It’s an important component, and it’s what allows them to use the remainder of their capital to invest in other companies and to ultimately grow companies for the benefit of their pensioners, their beneficiaries.

It’s also important for private equity-owned companies and non-private equity-owned companies that take on debt already written in their books to be able to write that interest off at the end of the year.

Hear MMG‘s full interview with Langston Emerson.

Q. Some in Congress have categorized this provision as a tax loophole. Why is this not the case?

LE: It’s ordinary, it’s not a loophole or anything of that matter, as some policymakers view it. This is a normal cost of doing business, such as you would deduct for advertising costs. It’s been in the modern-day tax code since its inception. A lot of these businesses take on debt so they can grow—they take on debt so they can acquire a tractor or a sewing machine, or whatever it is.

Q. Congress has been toying with a provision that would swap interest deductibility for expensing. Is that a fair trade-off?

LE: It seems what Congress has been looking to do is swap 100 percent deductibility of interest or business debt for 100 percent expensing. What they’re saying is, we’re going to get rid of 100 percent deductibility of interest; we’re not going to let you write off the interest on your debt, but if you buy something, we’re going to allow you to expense 100 percent of it in year one.

A lot of these businesses take on debt so they can grow—they take on debt so they can acquire a tractor or a sewing machine, or whatever it is.

In essence, it sounds like it’s a good swap. But for smaller businesses, they already have a lot of incentives and credits that allow them to write off a substantial amount—over 50 percent—of what they purchase in the first year. And so with 100 percent expensing, they’re getting an extra 50 percent, and for some, maybe 25 percent.

Also, it’s hard to expense something you can’t afford to buy. It’s not a good trade-off. Debt is important to the transaction and it’s also important to the growth of the business.

Q. Can you talk about the BUILD (Businesses United for Interest and Loan Deductibility) Coalition, a group of businesses and trade associations across multiple sectors that has been lobbying on behalf of this issue?

LE: ACG was a founding member. We’ve had over 200 meetings in this past year—with both the House and Senate, as well as the administration, the Treasury Department and the president’s National Economic Council. We’ve met with NEC Director Gary Cohn and Treasury Secretary Steven Mnuchin as well, and discussed these issues. And we’ve gotten a good reception.

Q: How does this issue stand in the newly proposed Republican tax framework?

LE: There was a proposed limitation of sorts. We don’t know what that limitation may be, whether it’s 30 percent, 25 percent or 40 percent. What’ we’re very happy about on this issue is that we’ve been able to take off of the table, through advocacy, 100 percent elimination. That’s not within the framework. Now it’s up to the House and the Senate to come up with real language, mark that language up, debate it in committee, and then come to an agreement and send it to the president.

Q: How soon do you think we’ll have a bill?

LE: If it’s a very large bill and I was to speculate—I think the first or second quarter of 2018 is what we’re looking at. If it’s something small, more like a tax cut that we saw in the Bush era, I think that it could be done a little sooner, maybe early Q1. I think it’s up in the air.

This Q&A was extracted from a podcast that explored a range of advocacy issues important to ACG. It has been edited and condensed.

Deborah L. Cohen is editor-in-chief of Middle Market Growth.