Tech Dealmakers Tread Lightly as M&A Stabilizes

It’s been a brutal year for the technology sector. Now, dealmakers are eager to get to work, but headwinds remain

Technology M&A has had a volatile few years. After record-high deal volume in 2020 and 2021, the second half of 2022 and 2023 served up substantial challenges. Tech deals decreased in value by 63.5% and in volume by 22.4% from 2022 to 2023, according to data from a KPMG survey. Cost of capital was the biggest factor steamrolling deals, according to the survey. Overall macroeconomic uncertainty, an aggressive regulatory environment and geopolitical unrest also contributed.

However, industry experts are cautiously optimistic about the outlook for technology M&A this year.

In late February, the Nasdaq closed at a record high for the first time since 2021, bolstering confidence in the public sector that is beginning to trickle down into the private sector.

This section of the report originally appeared in the Special Digital Report: Tech issue, sponsored by TresVista. Read the full report here.

“The economy is barreling forward. We’ve been sitting in an ambiguous world for 18 months. At some point, everyone has to go to work,” says Adam Haller, partner at Bain & Co.

This is true for sell-side and buy-side players across the industry. Many aging founders of family businesses, who are already struggling with growth in the current landscape, may not have anyone from the next generation to take over and will need a liquidity event to retire. Private equity investors have commitments to LPs that they can’t put off any longer. Strategics are eager to restart their M&A strategy as equity markets rebound.

Story continues below.

Many hope pent-up demand will help fuel a better year for deals in 2024. “We’re already seeing deals getting done. We’ve signed and/or closed more than 12 technology M&A transactions as of the end of February 2024 and are seeing much better close rates,” says Greg South, managing director at William Blair. “A lot of funds and investors are in a good spot and recognize there’s an opportunity to deploy capital to make the math work.”

Sector Trends

Deals focused on stable markets are seeing continued attention as 2024 kicks off. “We’re seeing good interest in software deals across the board, but particularly in end markets with very safe budget backgrounds, such as K-12 education, state and local government, and healthcare,” says Jeremy Fiser, managing director at Baird. “Furthermore, we are seeing very good interest for software deals with great fundamentals (growth, profitability, retention) regardless of end market.” This focus on stability is also reflected in several of William Blair’s recent tech deals. In January, the firm represented Warburg Pincus and TA Associates in their sale of Procare Solutions, a provider of childcare management software and payments processing, to Roper Technologies for a total enterprise value of $1.9 billion. “Childcare is a durable end market—people will always have kids,” says South. In August 2023, William Blair represented Fintech, a company in the beverage alcohol payments and compliance software space, in a partnership recap with General Atlantic. “It’s another durable end market,” South says. “People will consume alcohol, though the way that they buy it and where they buy it from may change.”

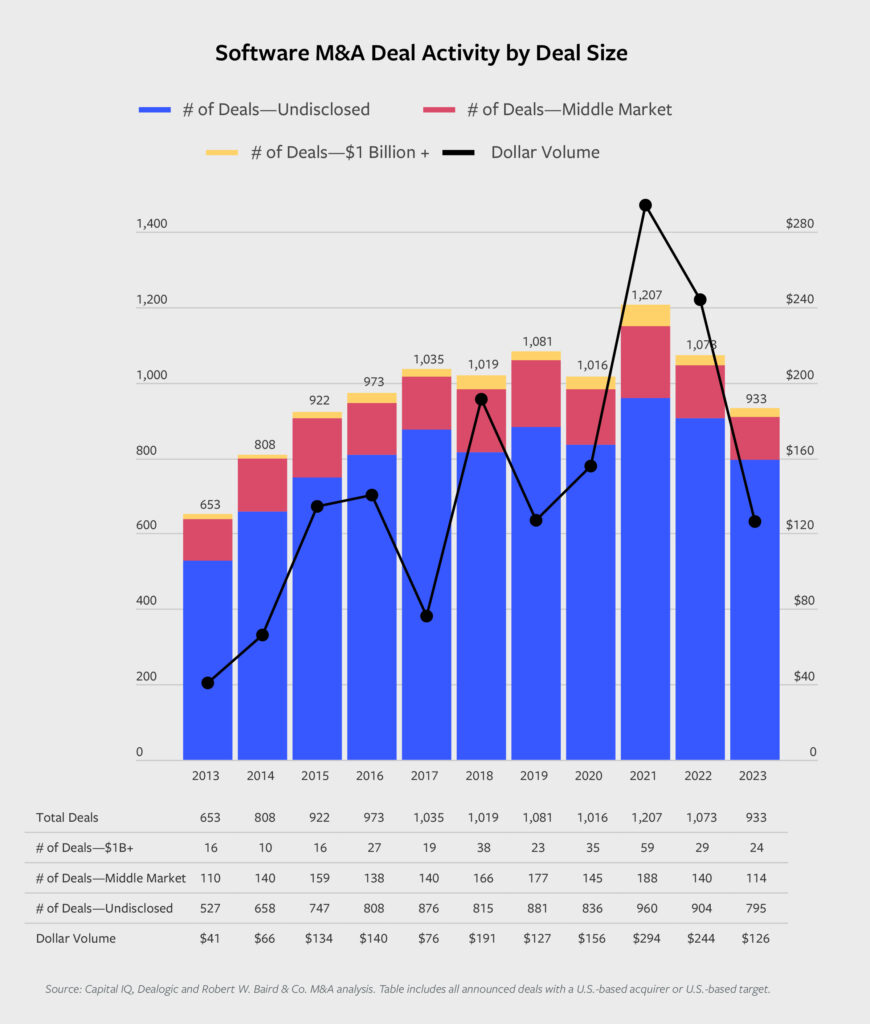

Still, the software industry overall saw a decrease in both deal volume and value in 2023. According to data from Baird’s 2024 Software Outlook report, 2023 deal volume was around 22% lower than the 2021 high-water mark and 13% lower than 2022 levels, while dollar volume was 57% lower than 2021 and 48% lower than 2022. For middle-market deals, 2023 deal volume was 39% lower than 2021 levels and 19% lower than 2022 levels, according to the Baird report.

Still, the software industry overall saw a decrease in both deal volume and value in 2023. According to data from Baird’s 2024 Software Outlook report, 2023 deal volume was around 22% lower than the 2021 high-water mark and 13% lower than 2022 levels, while dollar volume was 57% lower than 2021 and 48% lower than 2022. For middle-market deals, 2023 deal volume was 39% lower than 2021 levels and 19% lower than 2022 levels, according to the Baird report.

However, “both in terms of activity and anecdotally, we’re in a better setup for software now. There’s better support in the lending environment, which is providing support for M&A activity,” says Fiser. Baird’s latest software report, released in April, showed an M&A deal count of 290 in Q1 2024, the highest quarterly figure since Q3 2022.

On the other hand, some experts predict the cybersecurity space, which has been very hot, may be headed for a decline. “Cybersecurity, especially technology around cloud security and protecting large sensitive data sets related to the emergence of gen AI, has been very active. However, as a sector overall it may be headed for a deceleration as buyers become fatigued with their cyber-spend,” notes James Brundage, Americas Strategy & Transactions TMT leader at EY.

Buyer and Seller Expectations Converge

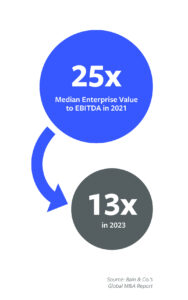

Following sky-high valuations in 2020 and 2021, it has taken many sellers time to wrap their heads around the new normal. But 2024 may be the year that buyers and seller expectations finally come together. According to Bain & Co., strategic tech deal values have decreased by approximately 45% from 2021 to 2023—from their peak at a median 25x enterprise value-to-EBITDA values in 2021, to 13x in 2023.

“Sellers are slow to adjust their mindset in terms of what their businesses are worth, and buyers are very quick to adjust theirs,” says William Blair’s South. “But we’re seeing a return to dealmaking as the Nasdaq has recovered; the feds have signaled there will be no more rate hikes; and public market valuations are strong and healthy. Buyers are willing to pay premium prices for premium assets, while sellers, many of whom need liquidity, are recognizing that certain assets aren’t going to trade for the prices they did in 2021.”

One area where the gap may take longer to bridge, however, is with private unicorns. These companies raised a large amount of capital in prior years, and many are holding out in hopes of securing larger valuations when they do transact. “There’s a lot of pent-up activity for these private unicorns. The IPO window is open but not many people are taking it. But these companies will have to have a liquidity event at some point, so we’re bullish on the M&A outlook for the back half of 2024,” says Brundage.

Strategics Gain Confidence

As 2024 progresses, strategics are becoming more aggressive with their M&A plans. “These acquirers are feeling better about their ability to pay for businesses and make bets on sectors that are compelling to them,” says South.

For strategics in the technology space, the need for innovation is a natural impetus for M&A. Large companies feel immense pressure to incorporate generative AI capabilities into their product lines and operations. “Companies across industries have awoken to the potential for disruption that gen AI is presenting in their core business, and they know that leading-edge innovation in gen AI is going to require a set of talents and capabilities that is probably far distant from their success in the past,” says Bain & Co.’s Haller. “When you look at companies that have made a splash, they are independent VC-funded startups and smaller businesses where the risk tolerance is greater,” he adds. Savvy strategic acquirers have also adjusted their due diligence processes to maximize their chances of M&A success, in many cases taking notes from private equity playbooks. Traditional processes focused primarily on evaluating financials, products and capabilities, quality of earnings and management. Many acquirers then evolved to consider customer feedback to inform their perspective on the future of the business. “Now, the 3.0 version of due diligence is focused not just on how this business is going to perform in the future, but also on what the potential synergies are with the new business and what the strategy is for how they’ll unlock those after close,” says Haller.

Now, the 3.0 version of due diligence is focused not just on how this business is going to perform in the future, but also on what the potential synergies are with the new business and what the strategy is for how they’ll unlock those after close.

Adam Haller

Bain & Co.

Higher interest rates make it crucial to do this planning early in order to make the deal work financially. According to a recent Bain & Co. report, the top two challenges to capturing revenue synergies in M&A deals were failure to integrate product portfolio and failure to achieve go-to-market integration and transformation. “There’s a huge premium to planning in advance so that after close you can start to put the actions in place that unlock that lever,” says Haller.

This increasingly measured and in-depth approach to due diligence applies to financial acquirers as well. “Diligence processes have extended. With less of a sellers’ market comes less of a constrained period that sellers can demand,” says EY’s Brundage.

Headwinds Remain

Although dealmakers appear eager to get back to work, fundamentals at some tech companies may not leave them in an optimal place to transact. According to a BDO survey of mid-market technology company CFOs, “41% of survey respondents say economic volatility poses a greater risk to their business in 2024, whereas only 26% say it poses less risk—a clear indication that CFOs expect these conditions to persist.”

Plans to raise capital or make acquisitions are on hold for many CFOs, according to the survey. Sixty-six percent of respondents say that they’ve stopped or slowed capital raise plans, while 54% report the same about acquisition strategies.

According to Baird’s 2024 Software Outlook, buyers are focusing more on profit than growth and scrutinizing target companies’ financials. “Buyer scrutiny on cash flow and profitability has substantially increased in light of the need to meet debt service requirements,” the report said. “In the recent past, growth had a higher correlation to value versus profitability. In the current markets, growth plus profitability now has a higher correlation to value versus growth alone.”

What’s more, a presidential election looms at the end of this year. While advisors agree there is a backlog of pent-up demand for tech IPOs that couldn’t go public last year, the opportunity for listing this year might be short-lived. “The window for IPOs will be narrow due to upcoming elections in the U.S., the U.K. and certain other countries,” according to PwC’s 2024 Outlook for TMT.

“It’s always unclear how election cycles affect the M&A market. We’re focused on company-specific dynamics instead. We can’t control the macro environment, but we can focus on company-specific trend lines to determine the right timing for deals,” says South.

Meghan Daniels is a freelance writer and editor based in Dutchess County, New York.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.