Strategics and PE Buyers Ready for an Industrials Dealmaking Shuffle

Amid market headwinds and antitrust concerns, industrial acquirers are having to rethink their M&A strategies

Businesses in the industrial sector have been facing significant headwinds over the last year, in the form of geopolitical uncertainties, supply chain disruptions, high interest rates, inflation and rising antitrust concerns.

The Institute of Supply Management reports manufacturing activity contracted for 17 consecutive months through April, with the brief exception of March. M&A has taken a hit as a result of these challenges: Industrial transaction volume dropped by 15.4% between 2022 and 2023, falling to 1,643 deals from 1,941.

For the industrial transactions that were completed in the first quarter of 2024, activity was mostly driven by energy, technology and healthcare, says James Frawley, managing director and head of industrials M&A at Truist Securities. “There is activity, it’s just not broad-based,” he says. “Large caps are coming back, and middle-market activity is something we expect will follow.”

According to investment bank Capstone Partners, industrial dealmaking is expected to rebound in 2024, as investors reconsider their approach to antitrust compliance and portfolio review.

Heads We Lose, Tails We Win

Despite the difficult M&A environment, industrial dealmakers say they are seeing some improvement in the market.

“We have put together more deals in the last nine to 12 months than we did in the prior 12 months,” says Tony Blanchard, a managing director in Deloitte Corporate Finance’s industrials group. “Now that there is a little more certainty around interest rates, we are more bullish than we were a year ago. While we are not at pre-COVID activity levels, we are getting there.”

One significant headwind continues to be the antitrust environment. The Federal Trade Commission and the Justice Department are focusing on what they term “excessive market consolidation,” holding firm on the Biden Administration’s antitrust enforcement approach. In 2024, increased scrutiny is expected on mergers and acquisitions, as revisions to the Hart-Scott-Rodino (HSR) Act will require organizations to provide up-front detailed disclosures of company information and revenue. This is anticipated to increase filing burdens, according to law firm Squire Patton Boggs. Additional antitrust concerns include increased regulatory scrutiny of monopolistic activity, price fixing and the ban on noncompete agreements, although lawsuits may slow that process.

In this oppositional environment, Frawley believes companies have to be mindful and have a plan. “They need to be prepared and, if appropriate, make divestitures to solve problems,” he says. Industrials and technology accounted for 14.8% and 14.5% of all divestiture transactions in Q4 2023, respectively, according to Deloitte.

High interest rates have also been a drag on M&A, but most dealmakers have accepted Federal Reserve Chairman Jerome Powell’s “sticky inflation” and “higher for longer” interest rate environment.

Michelle Ritchie, PwC’s industrial products deals leader, sees companies reconciling with continuing uncertainty in the world, which will contribute to a “choppy” market over the next six to nine months. “You’ve got the summer months, the election, and the holiday months. It’s not a smooth season to run processes, get things accomplished and get all the people to the table,” she says. “So that is going to be a creative challenge.”

Frawley sees optimistic tailwinds for M&A activity on the horizon including, possible interest rate drops, the supply chain normalizing, freight rates starting to ease from their highs, and the passage of the Inflation Reduction Act (IRA) and the CHIPS Act. The $1.4 trillion in private equity, and the $780 billion (Brookings Institution estimate) to $1.2 trillion (Goldman Sachs forecast) of IRA infrastructure money may also boost industrial dealmaking in 2024.

“If you leverage that dry powder, you have $3 trillion or more of buying power that needs to be invested in the next two to three years,” says Frawley. “Corporate balance sheets in the U.S. are very healthy, and private equity has to return capital in order to raise capital. Those are big tailwinds that we expect in the next six to 18 months.”

Strategics vs. Private Equity

Eric Andreozzi, a managing director and head of industrials with Deloitte Corporate Finance, is finding strategic deals outnumbering private equity by two-thirds. “It has been a strategic-driven market. That said, private equity is adjusting to what I call the new normal on interest rates. So now we are seeing private equity make up ground,” he said.

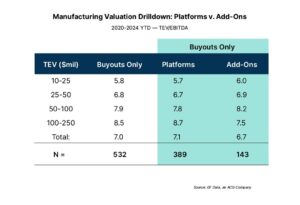

Andreozzi believes that more than half of middle-market deals in 2024 will go to strategic buyers. “When we talk about strategics, we mean both pure strategic corporations and portfolio companies of private equity groups,” he says. “Over the last two years, add-on acquisitions have dominated private equity activity, and much of the money they have put out has been for strategic acquisitions to build existing businesses.”

Content continues below

Middle-market industrial companies are likely to be more attractive than larger targets in part “because there is generally less regulatory scrutiny from the Department of Justice,” says Ritchie.

Companies are also reviewing their strategic gaps that need to be filled, while considering which assets to shed. In one example, Stockholm-headquartered Electrolux Group, a global appliance company, announced in September that it is selling its manufacturing facility in Memphis, Tennessee, to a U.S.-based investment company. The divestiture is part of Electrolux’s broader efforts to divest non-core assets, according to a press release.

“Companies that are ready to act and do so are going to have a competitive advantage in the next 18 months,” Ritchie says.

An Industrial Snapshot

Some representative deals in the industrials sector so far this year include:

- In March, The Home Depot announced that it had agreed to acquire SRS Distribution, a residential specialty trade distribution company, for $18.25 billion. Under the terms of the agreement, SRS Distribution will operate as an independent business unit within The Home Depot, focused on accelerating growth in the Pro market, according to a press release.

- In May, Monomoy Capital Partners, a private investment firm focused on the middle market, announced an investment in Southern Exteriors, a full-service installer of exterior building solutions for single family homebuilders in the southeastern U.S.

- In June, L2 Capital completed the acquisition of Robbins Sports Surfaces, a manufacturer of hardwood basketball floors for K-12 schools, colleges, the NCAA and the NBA.

The industrials category encompasses a wide range of subsectors, each of which presents distinct opportunities and challenges for business growth and M&A. Here’s a look at other prevailing trends within industrial subsectors, according to Deloitte:

Automotive

U.S. auto sales reached an estimated 15.5 million units in 2023, an 11.6% increase from 2022.

More deliveries, supply chain improvements and stronger dealer incentives fueled the new vehicle sales in Q4 2023.

Curiously, Original Equipment Manufacturers (OEMs) had profit margins averaging 7.8% in the first quarter of 2024, which was down from the average 8.5% in 2023. Automotive suppliers profit margins were 5.6% in Q1 2024, a relatively flat number, underscoring the 13th quarter that OEM margins outpaced their supplier, according to Bain & Company.

Electric vehicle sales for both volume and market share also grew in Q4 2023, with sales reaching levels 52% higher than in Q4 2022. More than 317,000 EVs were sold between October and the end of December 2023, representing 8.1% of all new cars sold.

“We are seeing some of the new EV program launches slowing down and being delayed as there might be a saturation point with demand right now,” says Blanchard. “Another vehicle segment is the commercial work truck segment, but those vehicles are really hard to electrify right now.”

Paper and Packaging

Deloitte reports 96 M&A packaging deals completed in the U.S. in 2023. The sector continues to focus on automation and robotics, advanced materials, outsourced services and smart packaging technology.

“We have consistently closed deals in this sector for the past 20 years,” says Andreozzi. “It’s a steadily growing market, and we see both strategic and private equity interest in all the companies we work with.”

Specialty Chemicals

In the ongoing evolution of the U.S. chemical sector, Deloitte reports that companies in the industry are moving toward sustainability by reducing and ending greenhouse gas emissions, investing in wastewater cleanup, increasing bio-based production efficiencies and using alternate, lower-emission pathways. Specialty chemicals represented 61% of industrials sector deals in 2023, according to Capstone Partners.

Building Materials

Housing starts fell 8.8% year-over-year, and existing home sales decreased 19.3%, stalling the housing market in 2023, according to Capstone Partners. The slow housing market weighed on building products deals, with only 124 M&A transactions closed in the U.S. and Canadian building products and construction materials industry during 2023, a 25% decline from 2022. As interest rates fall, activity in the housing market is expected to grow, however.

Stabilizing Outlook

While industrial strategics and private equity firms could see enhanced activity in the back half of 2024, Ritchie expects activity in the middle market to be very consistent and stable, with more mega deals happening in the last three to four months of the year. This should set up even greater activity next year. “I think there are a lot of tailwinds for 2025 to be a very robust deal market, both for buyers and sellers,” she says.

Cynthia Kincaid is a journalist with extensive experience writing about the financial and healthcare industries.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.