Navigating the Turbulent Waters of Healthcare Mergers and Acquisitions

While labor shortages and rising bankruptcies are weighing on the healthcare sector, investors still see M&A opportunities in select niches

This past year was another challenging one for hospitals and health systems across the U.S. Staff shortages, relentless inflation, falling reimbursements, the continuing interruption of COVID-19 and the escalating costs of essential supplies continue to plague the healthcare industry.

However, there are “green shoots” of hope amid these headwinds: Patient volumes are returning, staffing and contract labor costs are normalizing, and the slower-than-expected M&A environment is starting to rebound. These positive shifts are breathing new life into the healthcare sector.

This section of the report originally appeared in the Special Digital Report: Healthcare issue, sponsored by Sourcescrub. Read the full report here.

The industry’s resilience in the face of unprecedented adversity has been partially sustained by the federal government’s allocation of more than $700 billion in spending related to the COVID pandemic, according to the Committee for a Responsible Federal Budget. While this fiscal lifeline helped to shore up the beleaguered healthcare sector, more will need to be done. Many financial experts expect mergers and acquisitions to play a pivotal role in reshaping the battered healthcare landscape. Healthcare organizations, biotechnology companies and hospitals are well-positioned for increased M&A activity in 2024 and 2025.

“The larger companies have stronger balance sheets and have been able to weather the storm quite well,” says Ross Nelson, principal and national healthcare strategy leader at KPMG. “There are several smaller companies that need capital. If they are publicly traded, they don’t have a constructive enough stock price to raise equity. So, we are expecting a lot of M&A activity to happen in the middle market.”

A Changing M&A Landscape

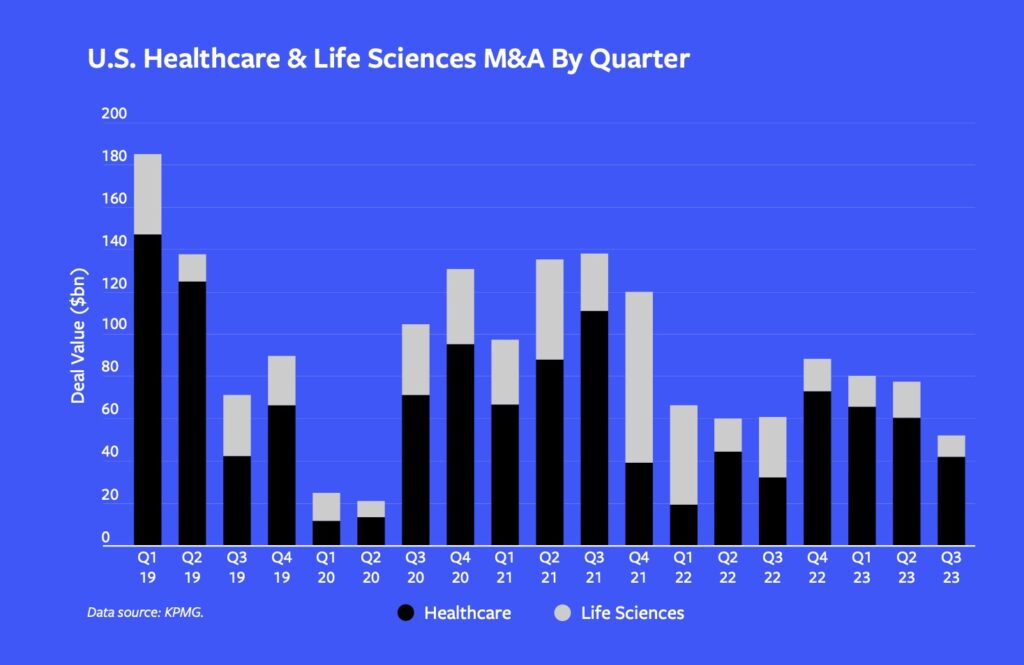

According to an analysis from KPMG, the number of healthcare deals continued to decline in the second quarter of 2023, the lowest level in three years, but things are starting to tick up. Becker’s Hospital Review has reported that the 245 M&A deals completed by Q2 of this year was only 7% lower than in Q2 2022 but still 41% lower than Q2 2021.

“We are seeing a lot more acquisitions and divestitures for entities that have multiple lines of business and are thinking about the portfolio areas where they want to either double down or exit,” says Nelson.

We think deal flow is going to pick up in the next six to 12 months. There’s only so long you can be on the sidelines.

Karen Winterhof

FFL Partners

A coalition of 31 life sciences, pharma and biotech organizations announced a partnership on Oct. 4 to advocate for M&A in these sectors. Their coalition was formed in response to the Federal Trade Commission’s recent efforts to crack down on mergers and acquisitions on antitrust grounds.

High-quality, growth-focused healthcare businesses are attracting robust interest from both financial and strategic buyers, according to Cheairs Porter, Harris Williams’ managing director of healthcare and life sciences. Competitive valuations, multiple bids and

aggressive closing behavior are becoming increasingly common for top-tier companies in the healthcare sector, he says.

“Compared to the first half of this year, it feels like there is a little more momentum in deal flow in the second half of this year,” says Karen Winterhof, partner at FFL Partners. “We think deal flow is going to pick up in the next six to 12 months. There’s only so long you can be on the sidelines.”

There also has been notable variability in deal volume from one subsector to another, according to Porter. There is specific interest and activity in provider subsegments, such as physical therapy, vision, dental and orthopedics. With strong consumer demand for healthcare services, M&A in the provider segment is expected to gain momentum in 2024.

Content continues below.

M&A buyers also are diversifying their interest beyond providers into healthcare information technology, medical products, product services and pharmaceutical services. “We’ve spent more time around pharmaceutical services,” says Winterhof. “That’s been a more attractive space for us, and we completed an investment recently partnering with a few founders.”

Urgent care, once a darling for private equity owners, has cooled a bit over the past decade because of oversaturation in some metropolitan areas. Still, urgent care clinics remain popular in some areas because of the shortage of primary care physicians. More than 100 million Americans don’t have easy access to a primary care physician, according to the National Association of Community Health Centers. In response, a variety of alternatives have cropped up, such as One Medical (owned by Amazon), and retail clinics in stores like CVS, Walmart and Target, and even in some neighborhood grocery stores.

“Payers want you to go to urgent care because they’re quick and efficient and therefore should be cost-effective,” says Greg Belinfanti, senior managing director at private equity firm One Equity Partners, which invests in healthcare, among other industries. “I think big questions will be around the consumerization of healthcare and whether we can maintain or even improve quality while reducing cost of care. Time will tell.”

Winterhof finds these alternative care choices to be a positive. “I think those businesses push the whole industry to make a more convenient patient experience,” she says. “That means more people will have access to good healthcare.”

Labor Shortages: A Looming Crisis

While some healthcare subsctors are in demand, labor shortages continue to weigh heavily on the industry. According to industry market analytics firm Mercer, by 2025, the U.S. is projected to have a shortage of 446,000 home health aides, 95,000 nursing assistants, 98,700 medical and lab technicians and 29,000 nurse practitioners. Adding to the crisis, an estimated 334,000 healthcare providers left their jobs in 2021, including 117,000 physicians, 53,000 nurse practitioners and 22,700 physician assistants, according to a report by Definitive Healthcare, an industry-focused software provider.

Related content: Digital Healthcare Report 2023

A study conducted by the National Council of State Boards of Nursing and the National Forum of State Nursing Workforce Centers estimates that more than 800,000 nurses intend to leave the workforce by 2027. This equates to one-fifth of the current 4.5 million nurses in the workforce today.

A study conducted by the National Council of State Boards of Nursing and the National Forum of State Nursing Workforce Centers estimates that more than 800,000 nurses intend to leave the workforce by 2027. This equates to one-fifth of the current 4.5 million nurses in the workforce today.

“The U.S. is suffering from a significant healthcare worker shortage, and early data shows that this is going to have near-term and long-term effects on both patient care and hospital and physician performance,” the study says.

Not surprisingly, wage inflation has directly contributed to the soaring costs that hospitals, health systems and other healthcare organizations are facing. These costs have taken a tremendous toll on expenses and revenue.

“In most other businesses, when costs increase, one of the first things you do is try to implement price increases,” says Belinfanti. “But with most healthcare services, you don’t have that luxury because price is typically set by the government as payer, or managed care plans that are indexed to government prices. Thus, healthcare companies frequently have to wait a year or two to lobby for reimbursement rate increases.”

He adds that healthcare organizations are struggling with determining what a normalized financial picture looks like, especially around staffing, where traveling contract nurses were commanding rates during the pandemic as high as $180 to $200 an hour. Those rates, he says, have now fallen back closer to $100 to $110 an hour. “What does the ‘new normal’ look like, and how does one price assets that have seen such large fluctuations in price and financial performance? This has created some stagnation in the M&A market,” Belinfanti says.

Healthcare Bankruptcies: An Industry in Flux

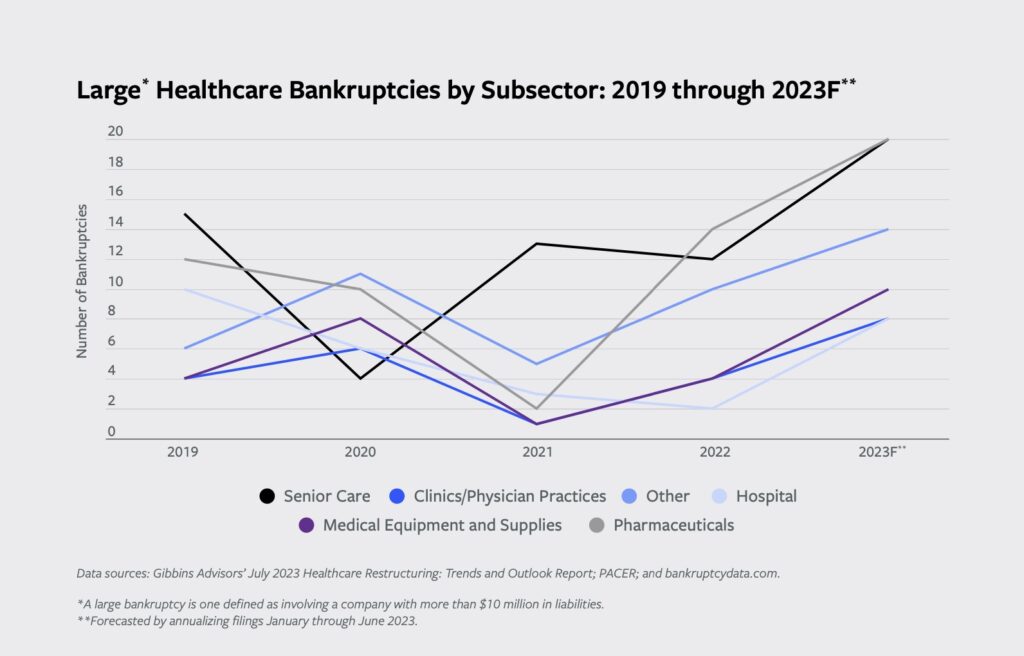

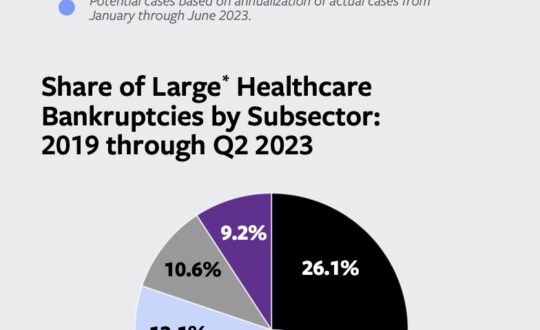

Some of the clouds in pockets of healthcare have pushed companies into distress. Healthcare bankruptcy filings in 2023 are trending three times the level seen in 2021, according to Gibbins Advisors, a healthcare advisory firm. Senior care and pharmaceutical subsectors continue to make up approximately half of the total healthcare bankruptcy filings.

“There was a level of distress in the healthcare sector before COVID, caused by macro trends, such as population demographics, how care is changing with technology, and care models in the outpatient and community-based environment,” says Clare Moylan, principal at Gibbins Advisors. “With COVID-related government funding, the hospitals in particular were able to work through challenges with a healthier balance sheet.”

Now that the government funding is gone, Moylan says the systemic issues facing health systems are still present, with costs rising and margins squeezed. “Bankruptcies are tracking to be higher this year than pre-COVID,” she says.

Senior care has been heavily impacted by financial challenges over the past few years, representing 26.1% of large healthcare bankruptcies from 2019 through Q2 2023, according to Gibbins Advisors. “We are seeing a lot of pressure by states to reduce the number of licensed nursing home beds and facilities,” says Ronald Winters, principal at Gibbins Advisors. “We are going to have to see if that is a long-sighted approach.”

Related content: AI Creates a Flurry of M&A Activity in Healthcare RCM and HCIT

Alternatively, home-based care appears to be relatively immune to current bankruptcy trends and continues to attract investor interest. In 2022, 37 of the 628 healthcare private equity transactions were home health and hospice deals, as reported by Home Health Care News.

A Shifting Paradigm: Value-Based Care and Technology

Seismic shifts are taking place in healthcare, with an increasing emphasis on value-based care, which ties what providers earn for their services to the results delivered to patients. These results can include quality of care, more effective and efficient delivery of care, and cost savings to both the patient and the healthcare organization. Investment in companies focused on quality over volume has surged, with growth exceeding 4x between 2019 and 2021, according to a McKinsey & Co. analysis. McKinsey projects that if the value-based care market continues to grow at its current rate, it could eventually reach a valuation of $1 trillion.

Technology will emerge as a crucial component in financially transforming the healthcare sector and attracting M&A interest. A May 2023 study conducted by Eagle Telemedicine revealed 94.6% of hospitals across the country now use telemedicine. Healthcare organizations also are increasingly turning to digital technology and artificial intelligence to analyze data, improve revenue cycle management and reduce readmissions.

Gibbins Advisors’ Winters points out that change comes with a caveat: “It will mean disruption to the old way in favor of the new way, and providers that don’t transform with the market will be left behind,” he says. “Healthcare will continue to transform, but some organizations won’t survive because they won’t successfully evolve to the new model.”

Perhaps the mergers and acquisitions of the future will help usher in a new paradigm in healthcare. Time will tell.

Cynthia Kincaid is a journalist with extensive experience writing about the financial and healthcare industries.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.