Sale-Leaseback Transactions Poised to Play a Larger Role in M&A

While more private equity firms are employing a sale-leaseback strategy, there are still many that aren't taking advantage of this opportunity and could be leaving money on the table.

This story originally appeared in the Winter 2021 print edition of the Middle Market Growth Outlook Special Report. Read the full report in the archive.

Three years ago, J.C. Penney Co. was in dire straits. To raise cash, the 118-year-old department store chain opted to sell its three-story headquarters in Plano, Texas, spanning 1.8 million square feet.

Silos Opportunity Partners LP paid $353 million for the campus and subsequently rented it back to J.C. Penney as part of a sale-leaseback agreement.

Fast forward to 2020, and J.C. Penney is again in need of liquidity, citing the coronavirus pandemic for exacerbating its financial woes. The retailer is shopping its real estate and hoping to cut more sale-leaseback deals like the one it made in Texas in 2017.

J.C. Penney’s situation is a familiar one today. Thousands of companies with retail space have been hit hard by the pandemic. As a result, shareholders are hustling to unlock whatever value they can.

Now could be an opportune time to consider a sale-leaseback transaction, according to Branford Castle Partners Managing Director Erik Korsten. With low interest rates, capitalization rates are trending down.

“For middle-market private equity, there is usually an accretive opportunity to sell real estate,” says Korsten. “Current cap rates remain favorable — at least for more stable industries.”

Branford Castle was in the midst of closing a sale-leaseback deal in the manufacturing space in the fourth quarter—one of many the New York-based private equity firm has successfully completed over the years.

Here’s how a typical sale-leaseback transaction plays out: A facility gets sold, and the seller becomes a tenant under the new owner. Proceeds from the sale may then go toward bolstering the seller-tenant’s operations or strengthening shareholder value.

“The frequency of sale-leaseback transactions are increasing,” Korsten says. “It’s now a mainstream strategy for generating equity value.”

For Middle-Market private equity, there is usually an accretive opportunity to sell real estate.

Erik Korsten

Managing Director, Branford Castle Partners

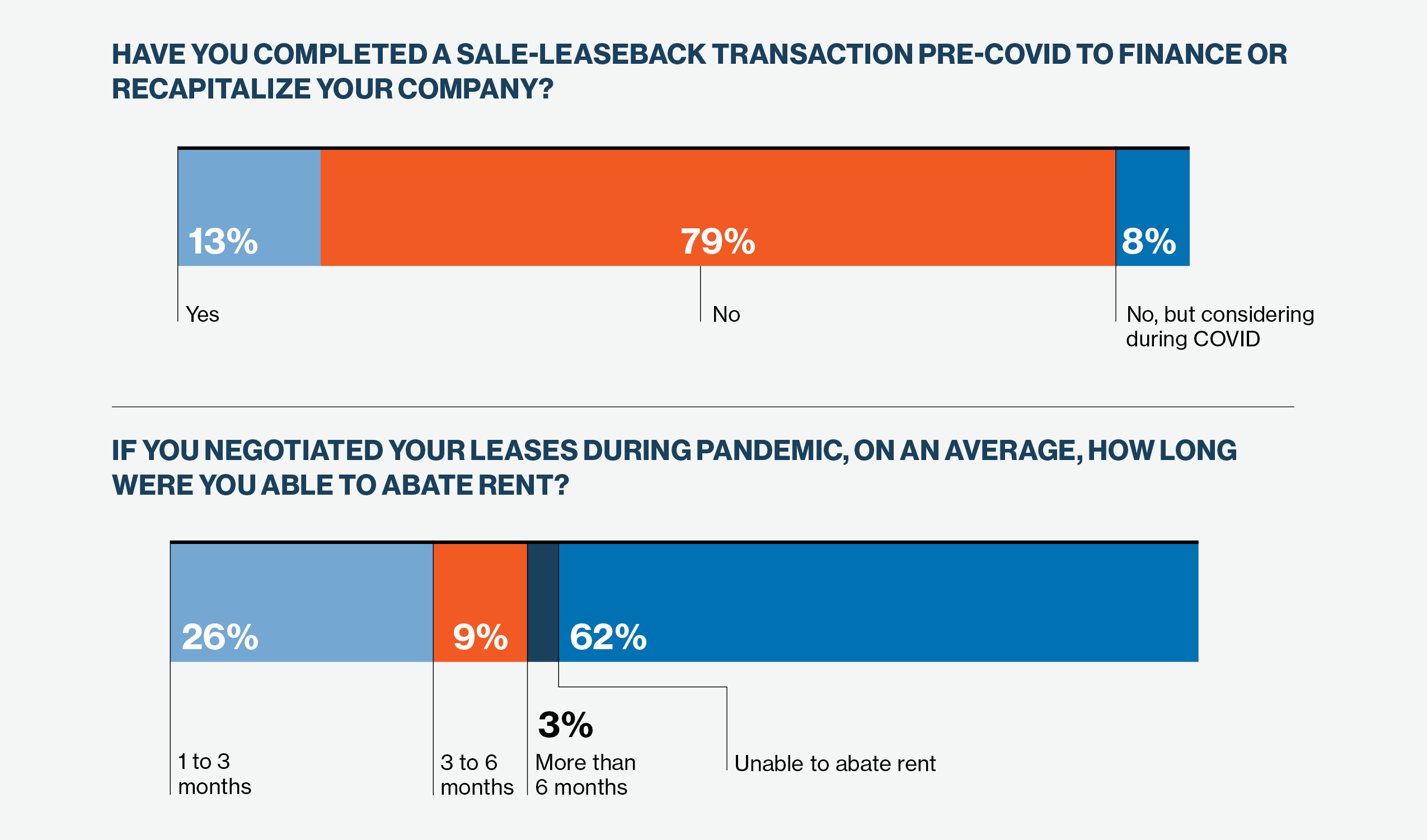

Although more private equity firms seem to be employing a sale-leaseback strategy, there are still many that are not taking advantage of this opportunity and could be leaving money on the table. Per a recent survey1, conducted by the Association for Corporate Growth and sponsored by STNL Advisors, a real estate consulting group, 80% of respondents said they had never done a sale-leaseback transaction. Yet, more than 40% have mortgaged debt on their real estate. Additionally, more than 50% of respondents have done nothing to negotiate their leases since the pandemic—leaving room for better financing options.

There are plenty of case studies besides J.C. Penney to reference for successful sale-leaseback transactions. Bed Bath & Beyond Inc. and Big Lots Inc. each completed sale-leasebacks this year.

In January, Bed Bath & Beyond sold approximately 2.1 million square feet of commercial real estate space to Chicago-based Oak Street for $250 million. The assets included retail stores, a distribution facility and Bed Bath’s headquarters in Union, New Jersey.

The company is now renting the properties back under a long-term lease agreement.

Oak Street also inked a $725 million sale-leaseback deal with Big Lots. The deal allowed the retailer to pay down debt, while Oak Street gained control of four distribution centers.

The market is ripe for sale-leasebacks. “I truly believe this is the best environment since the [financial crisis] for the execution of sale-leasebacks, both from a buy-side and sell-side perspective,” says Oak Street CEO Marc Zahr. “Broadly speaking, investors are moving into higher quality assets as a result of the pandemic. There is a flight to safety.”

On a risk-adjusted basis, Zahr says long-duration, triple-net leased, investment-grade rated properties are the best place to allocate capital today for firms like his.

And from a seller’s perspective, corporate prioritization has largely shifted due to COVID-19. Twelve months ago, most investment-grade companies were primarily focused on shareholder return initiatives such as buybacks, dividend growth and M&A.

“However, COVID has afforded the strongest of companies an opportunity to further fortress their balance sheets,” Zahr says. “In fact, shareholders throughout this period have rewarded companies for being able to raise capital and increase their liquidity.”

Big Lots, for example, saw its stock price increase nearly 30% on the heels of Oak Tree’s sale-leaseback announcement.

“Many investment-grade companies are using this time to rationalize their real estate footprints and execute sale-leasebacks to optimize their balance sheets,” Zahr says.

Columbia Care Inc., a pharmaceutical company specializing in cannabis products, completed a sale-leaseback this year. In July, New York-based Columbia Care sold its entire plant in Vineland, New Jersey, totaling some 54,000 square feet, to Innovative Industrial Properties Inc. (IIP) for about $14 million. It agreed to manage the property as part of a long-term, triple-net lease agreement.

This was Columbia Care’s second sale-leaseback deal with IIP. Another deal occurred in Massachusetts. And in both states, it was able to get a significant amount of investment “in the form of tenant improvement money” to put toward expanding manufacturing facilities, Columbia Care VP Joshua Snyder says.

IIP completed a similar deal with Holistic Industries.

In September, Monson, Massachusetts-based Holistic sold a complex in New Castle, Pennsylvania, to IIP for $8.9 million. The deal included 7.4 acres, with 108,000 square feet of industrial space. IIP agreed to provide up to $6.4 million in reimbursements should Holistic make any improvements or renovations.

“They underwrite the transaction as though they’re making a loan to the company, so the underlying credit is as important as the real estate,” says Holistic CEO Josh Genderson.

Holistic opts to buy real estate and hold on to the asset until it needs the capital. Or, it will find a friendly landlord up front who will buy their property and then lease it back.

“It doesn’t make sense for us to keep real estate on our balance sheet long-term,” says Genderson. “So even if we do buy a property initially, we will usually monetize it eventually in order to provide more capital for the operating business.”

I truly believe this is the best environment since the [financial crisis] for the execution of sale-leasebacks, both from a buy-side and sell-side perspective.

Marc Zahir

CEO, Oak Street

Chicago-based Green Thumb Industries also sold a chunk of its real estate to IIP over the course of three sale-leasebacks.

“Given the constraint in the capital markets today, sale-leasebacks are a beneficial way to get additional capital to build out some of our operations,” says Andy Grossman, EVP of capital markets at Green Thumb.

The most recent deal was based in Illinois and earned Green Thumb $50 million.

Although many companies see the benefit of sale-leasebacks, some have opted to do nothing. According to the survey results, more than 56% of respondents haven’t even tried to have their leases changed, 36% have worked to negotiate leases directly with their landlords, while 14% have hired a real estate advisor to negotiate their leases. Additionally, some said too many sale-leasebacks can put the seller at a disadvantage.

“You don’t want to just do unlimited amounts of deals. You don’t want to tip over,” says Grossman.

Also, in a sale-leaseback, the seller-tenant no longer has an ownership interest. They essentially forfeit the right to receive any appreciation on the property’s value. And if they can’t make payments, they would have to renegotiate the lease or risk getting evicted.

Also, in a sale-leaseback, the seller-tenant no longer has an ownership interest. They essentially forfeit the right to receive any appreciation on the property’s value. And if they can’t make payments, they would have to renegotiate the lease or risk getting evicted.

“It’s essentially debt,” Korsten says. “Each month the [seller-tenant] has to come up with cash flow to make rent. The more burden you put on the company, the less flexibility they have in the future. It’s a careful balance.”

A long-term lease can also be problematic. If it goes for, say, 15 to 20 years, companies have less flexibility during tough times—such as the current economic downturn.

“The biggest downside to a sale-leaseback is that you can get locked into a long-term lease at a rate that will someday be above market,” Genderson says. “[But] by the time that happens, we expect our real estate cost to be a pretty small component of our overall profit and loss.”

For others, real estate costs are a major component and these hefty leases end up getting renegotiated.

According to the ACG survey, during the coronavirus pandemic, 36% of respondents said they negotiated leases with landlords directly. Some 56% of respondents have not done anything, while roughly 14% hired real estate advisors to negotiate leases on their behalf.

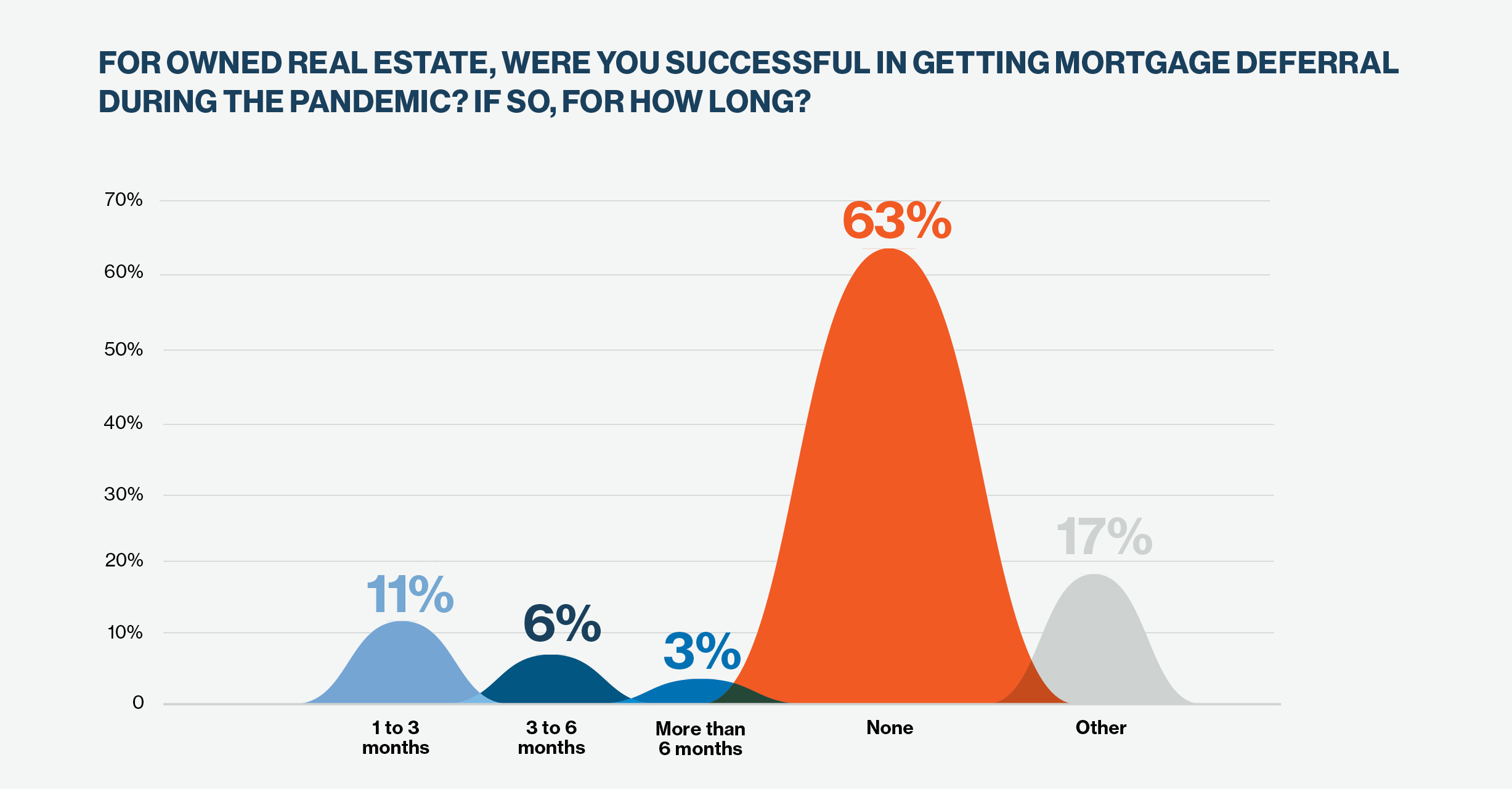

Over 60% of survey respondents said they weren’t able to get any months deferred when they tried to negotiate the rent. More than 25% said they were able to get one to three months deferred, and 9% managed to get a three to six months deferral. In addition to trying to negotiate deferments, businesses also try to renegotiate lease terms. For example, some successfully negotiated prepaid leases for the next two years and the ability to leave the lease terms in place for one year after stabilization.

Some landlords were open to rent abatement agreements, where they worked out a contract granting a period of free rent.

Despite some of the challenges that may come with sale-leasebacks, more deal-makers may find it to be a worthwhile strategy.

“There are still a few real estate assets on our books and when we can monetize them at a good rate, we will,” Snyder says. “I wouldn’t be surprised if there are more sale-leasebacks as a component of M&A.”

1 Between September 8 and November 3, ACG surveyed deal-makers about real estate financing trends in 2021 and other topics. More than 600 people responded to the ACG surveys.