Patents as an Alternative Asset Class: A Financial Sponsor Perspective

Financial sponsors seeking investment diversification strategies can maximize returns by investing in high-quality patent portfolios.

In recent years, the patent monetization market has grown to almost $10 billion annually1, attracting interest from several major financial sponsors, such as hedge funds, private equity firms, and fund of funds managers. A confluence of technological, legislative, and macroeconomic factors, such as disruption, convergence, low interest rates, and increased merger and acquisition (M&A) activity, have significantly increased the availability and attractiveness of patents as an alternative asset class for investors looking to diversify and generate meaningful non-correlated returns.

To date, the investment landscape has been dominated by funds, such as Centerbridge Partners, Fortress, Magnetar Capital, StarBoard, and Vector Capital, which have successfully invested in licensing programs to generate outsized returns. Fortress is considered to have the largest, active patent-focused fund in the industry with $900 million under management and another $400 million being raised for its IP Fund II. In addition, several litigation funders such as Burford, GLS Capital, Omni Bridgeway, Longford, and Parabellum Capital have also turned their attention to patents by investing directly in enforcement programs or striking portfolio-funding deals with law firms that specialize in intellectual property (IP). Just last year, Parabellum Capital and GLS raised $450 million and $345 million respectively for litigation funding, a subset of which will be deployed toward patent cases.

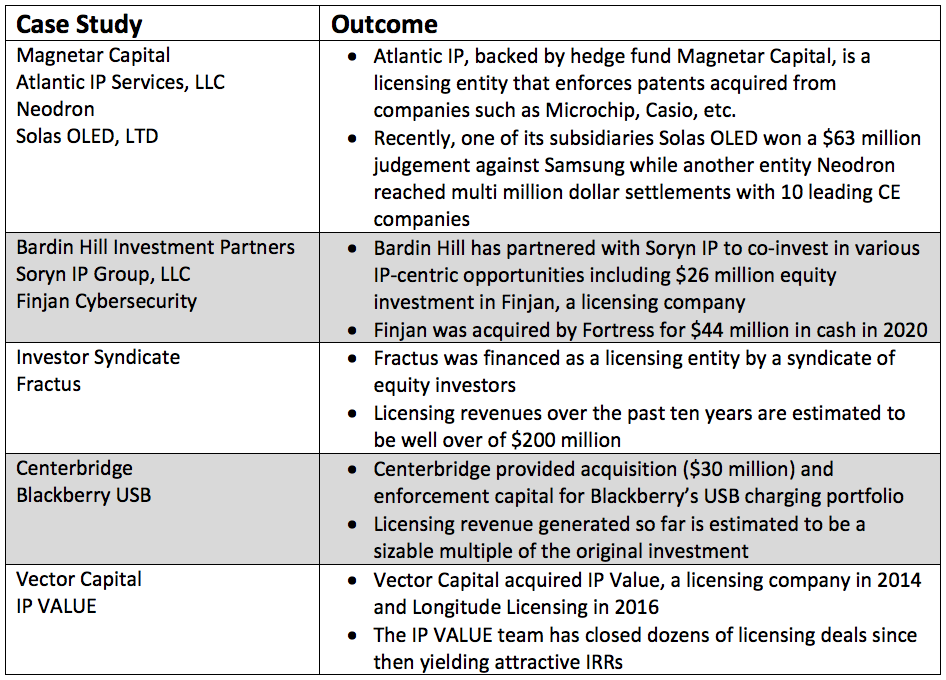

A few exemplary investments in patent monetization by financial sponsors include:

Although this space has seen an influx of new entrants, opportunities remain to take advantage of price arbitrage. By doing so, financial sponsors can source premium assets or fund licensing programs backed by such assets for investments with attributes such as:

- Non-correlated internal rate of return (IRR) potential well above 20%

- Average investment period of generally 3-5 years

- High settlement rates for entities with high-quality portfolios and a successful licensing track record

- Senior rights to high-margin royalty cash flow secured by patents as collateral

- Opportunity to tranche investments and reassess risk/reward as the program progresses

- Favorable settlement dynamics created by substantial deployed capital to lower the risk profile

Despite the above attributes, most financial sponsors have largely been reluctant to invest in this alternative asset class despite their vast reserves of available capital. Unfamiliarity, perceived complexity, risk appetite, and the need to partner with multiple parties are some of the major inhibiting factors. However, by partnering with industry experts, financial sponsors can overcome these challenges and unlock value from patent assets by investing in enforcement campaigns for third-party patent assets and then monetizing patent assets of portfolio companies

Investing in Enforcement Campaigns for Third-Party Patent Assets

At a high level, these investment opportunities involve funding deals to execute enforcement campaigns to license and litigate high-quality patents from well-regarded innovators, thus generating royalty cash flows.

Given the complexity of patents, such campaigns need multiple experts aligned as stakeholders to generate positive outcomes. Many financial sponsors lack the necessary background and resources to structure such deals. Therefore, partnering with industry experts with a successful monetization track record is critical to effectively invest in such campaigns. Examples of such partnerships, provided in Figure 1, offer an instructive template to structure win-win deals between experienced patent operators and savvy investors. In addition, financial sponsors have the option to invest in litigation funders that fund multiple lawsuits across different campaigns to add another layer for diversifying risk.

Experienced IP advisors can provide turnkey solutions to financial sponsors interested in exploring patent-centric investments. They can help to set up all aspects of new monetization programs or to identify opportunities to invest in existing programs that are raising capital to expand their enforcement campaigns. The IP advisors utilize trusted relationships with IP-rich corporations to source, access, and price portfolios, as well as to recruit highly experienced and sophisticated operators with a successful track record in generating investor returns. Investment deals can be structured flexibly to accommodate investment criteria. Such deals may involve debt, equity, or a combination to ensure preferred returns to financial sponsors as a multiple on invested capital or target IRRs with cash flow sweeps. These arrangements ensure first money out in the form of what are effectively preferred dividends.

Monetizing Patent Assets of Portfolio Companies

In high-tech industries, especially semiconductors and wireless, patents are critical to a company’s success but are often neglected as drivers of value by financial sponsors due to unfamiliarity and perceived complexity. By taking a more informed and proactive approach, financial sponsors can partner with IP advisors to unlock the “hidden” value of the patents held by their target or portfolio companies.

For example, financial sponsors can encourage their IP-rich portfolio companies to strategically review and optimize their portfolio to save maintenance costs and generate high-margin income. This analysis involves segmenting the portfolio to better align it with the company’s strategy. It also concurrently identifies assets that are no longer core to the business but monetizable via an outright sale or a licensing partnership to generate funds that can be reinvested in the company’s core business.

In sum, financial sponsors looking for new diversification strategies through alternative asset investments can maximize returns in the present environment by leveraging high-quality patent portfolios. The existing capital market for patent monetization is mostly restricted to a handful of providers with limitations in their investment mandates. These limitations restrict providers from making direct investments in licensing companies or portfolio acquisitions suitable for lengthy licensing campaigns. Financial sponsors have an opportunity to proactively take advantage of these market conditions and increase their exposure to the patent asset class that offers high, uncorrelated IRRs. In pursuing such strategies, sponsors have at their disposal specialized advisors. Such advisors can demystify what is often perceived as a complex asset by providing access to deal flow, assessing the risk-benefit profile, and introducing the right partners to help unlock value.

1This estimate is based on an estimate that aggregates the patent licensing revenues of Qualcomm, InterDigital, Xperi, Acacia, Quarterhill, Immersion, Nokia, and Ericsson. It also factors in an estimate of the aggregate litigation finance capital deployed in patent litigation. For additional information on patent licensing revenues of the above companies, see corresponding Form-10K disclosures. For more information on estimates of litigation finance deployed for patent litigation, see The Westfleet Insider: 2020 Litigation Finance Market Report.

2This range includes upfront cost to acquire the portfolio, and working capital needs to execute broad multi-jurisdictional enforcement campaigns that may be required to ensure successful outcomes. To limit exposure, working capital can be deployed in milestone-based tranches over time.

Supreet Saini is senior vice president of Stout, a global investment bank and advisory firm.

Lyubomir Uzunov is a vice president at Stout.

Mitch Rosenfeld is a managing director at Stout.