Pandemic Still a Major Threat to Midmarket Companies

Dealmakers said the pandemic is the single biggest risk factor in 2021, and expect it to seep into all facets of business—including M&A.

This story originally appeared in the Winter 2021 print edition of the Middle Market Growth Outlook Special Report. Read the full report in the archive.

The coronavirus outbreak has disrupted virtually every type of business—especially those within the middle market, according to a recent survey conducted by HawkPartners on behalf of ACG and sponsored by QBE Insurance Group Limited. Middle-market business professionals were asked about their biggest perceived risks going into 20211. “Pandemic” was mentioned more often than any other concern. For Simplura Health Group CFO James Caruso, the frequent mention of COVID-19 in the survey is very telling of the times.

“If you took this [survey] a year ago, pandemic wouldn’t be there,” Caruso says. “What that shows you is it’s the unknown risks that are potentially the most disruptive.”

The risks that the coronavirus pandemic posed seeped into all facets of business, including M&A. Orchestrating a transaction in a normal year is challenging in its own right, but the pandemic certainly makes matters worse, Caruso says, citing travel restrictions and how the typical meet-and-greets all went virtual, making M&A transactions harder to complete.

Despite these obstacles, Simplura’s private equity owner, One Equity Partners, was able to successfully sell the home health care agency to Providence Service Corp. (Nasdaq: PRSC) for $575 million in September.

Simplura’s sale was part of a surge of deals in the second half of the year. Although M&A activity was down significantly in the first two quarters of 2020, the market rebounded in Q3, when deal count in the U.S. rose to 2,714 with a total value of $361.1 billion, according to Pitchbook Data. Still, the third-quarter spike failed to make up for the slow year where global M&A deals, overall, slipped 21% to $2.2 trillion throughout the first nine months of 2020, according to Reuters.

This trend was illustrated in the survey. A majority of companies said M&A strategies were negatively impacted in 2020. About 21% of respondents reported having “general concern about risk” related to deal-making. Some 17% said financing would likely dry up, 13% said deals would likely be delayed, and 10% said deals would disappear altogether.

“When a transaction makes fundamental sense strategically, the coronavirus pandemic can be kept in perspective as a short-term anomaly, rather than a reason not to do a deal,” Caruso says. “When both the acquirer and the acquiree share a vision and have the desire to proceed, where there’s a will there’s a way, as the saying goes. Technology—and, more importantly, trust that builds on reputation and relationships—enables the parties to navigate the obstacles posed by COVID-19 and run a successful process.”

If you took this survey a year ago, pandemic wouldn’t be there. What that shows you is it’s the unknown risks that are potentially the most disruptive.

James Caruso

CFO, Simplura Health Group

The pandemic’s effects were not exclusive to any one sector. Survey respondents worked in a diverse group of industries, including construction; electronics; finance/ banking; food and beverage; health care; hospitality; insurance; manufacturing; professional services; real estate; retail and consumer goods; technology/computer services; and wholesale/distribution.

The pandemic will likely continue to disrupt these industries as the number of new coronavirus cases reported in the U.S. climbs.

Remote Work

Going forward, 33% of survey respondents said that cash flow was a top concern, followed by employee safety, the ability to interact with employees, customer safety and travel restrictions.

Jeffrey Kadlic, co-founder of Evolution Capital Partners, took each of these risks into consideration at the start of 2020 and continues to evaluate the threat they pose going forward.

His Cleveland-based private equity firm had become aware of how devastating COVID-19 was in China as cases spiked in Wuhan and across surrounding regions at an alarming rate.

“We are invested in some companies that source product in China and they were experiencing disruptions in their supply,” says Kadlic. “By early March we began to recognize that the virus was undoubtedly going to impact the United States, but were uncertain as to the extent and how Evolution or the rest of the country was going to respond.”

For Evolution Partners, traveling to China was no longer an option. The firm’s top priority became employee safety. And so it responded like everyone else and adapted to the new work-from-home culture.

This was a major challenge, Kadlic says. From a technology perspective, the small-business PE fund moved quickly to get its portfolio companies the necessary tools to be as effective at home as they were at the office.

“Every company subscribed to Zoom, Microsoft Teams or Google Meet to facilitate communication,” Kadlic says. “The usage of video conferencing as the standard way to communicate was greatly accelerated due to the pandemic and will likely be a permanent change.”

Kadlic and his colleagues had to adjust how they interact, and they’re preparing for more of the same in 2021.

“Communicating in person, particularly around sensitive topics, is still the preferred method to communicating, but that simply is not possible at this point,” Kadlic says. “It is important to put more emphasis not only in what you say, but how it’s communicated, so it is received the way it was intended.”

Cybersecurity

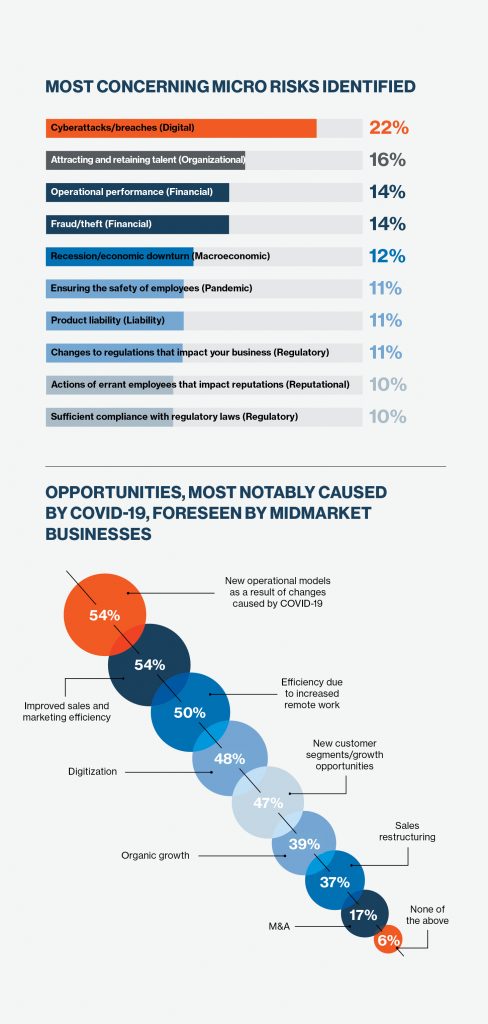

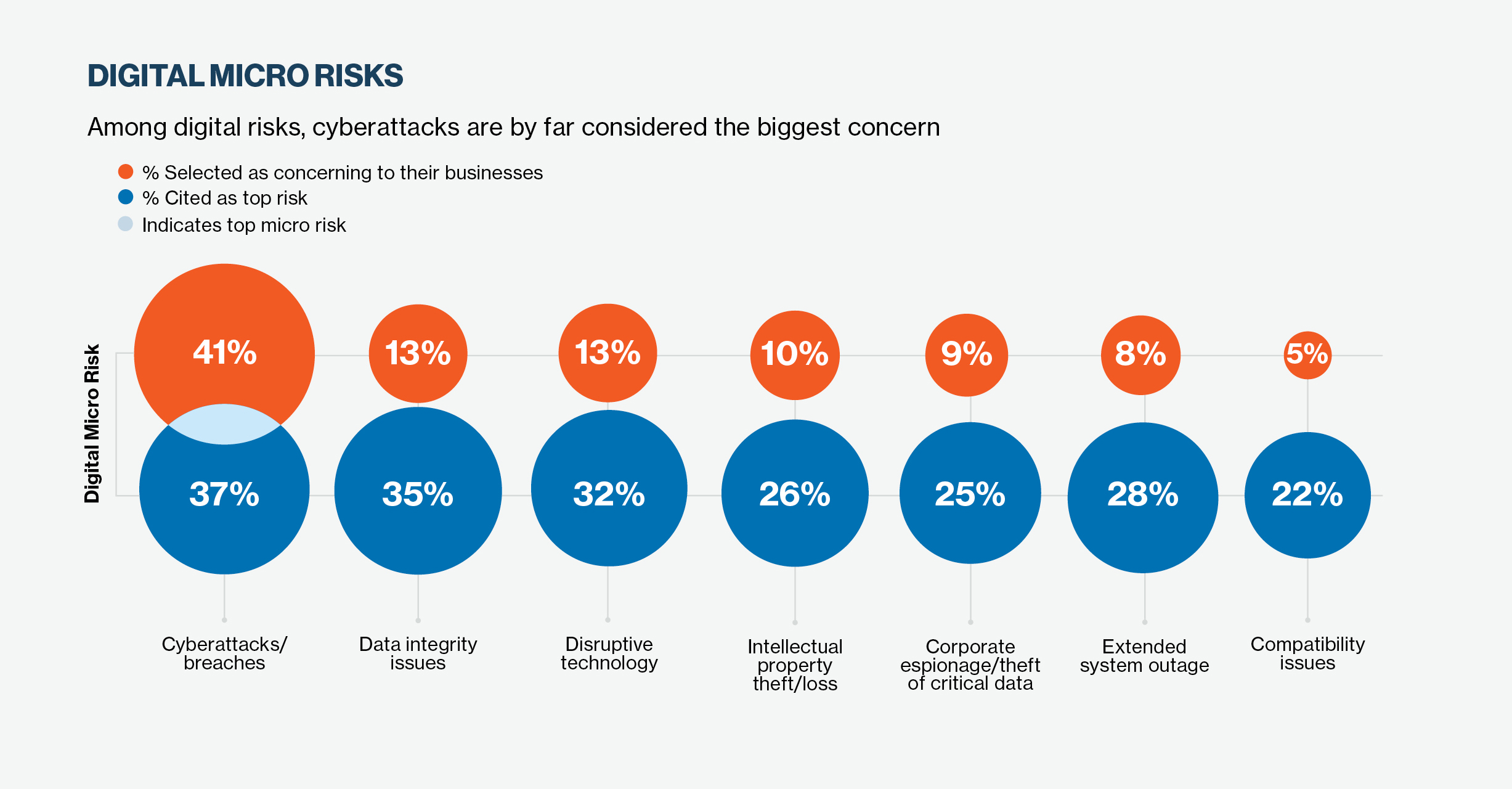

Midmarket business professionals in the survey also expressed concern about their cybersecurity preparedness. Digital risks are dire for all industries. Most respondents find cyberattacks and breaches to be a significant risk factor, one compounded by companies’ reliance on virtual communication.

About 37% of respondents said that cyberattacks and digital breaches were the most concerning digital risk, while 35% said data integrity issues were a top issue.

Considering how many high-profile beaches there were over the past several years, it’s not surprising that cybersecurity is so prominent. In 2019, major companies like Zynga, the tech firm behind mobile games such as “Words With Friends,” and Capital One Bank reported breaches that affected 218 million accounts and 100 million accounts, respectively.

The breach at Quest Diagnostics and its billing and collections vendor, the American Medical Collection Agency, was especially devastating. The security breach exposed private medical information, as well as financial and personal information of about 11.9 million customers.

For those like Caruso who work within the health care sector, cybersecurity is always top of mind.

“Any data breach that would happen to us is more significant because we’re in health care—it’s protected health information,” Caruso says. “I feel like we’re adequately protected and we’re insured for potential breaches, but it’s still always a concern. The people that commit these types of crimes are looking for ways around the current defenses. It’s like your house. You put the alarm on, but if someone wants to get in, they can find another way.”

Hiring New Talent

Hiring New Talent

In addition to cybersecurity, some 27% of respondents said the ability to attract and retain talent was a concern, with 47% calling it the “top risk,” according to the survey.

Indeed, the pandemic complicated matters, namely in the way employers onboard and exit workers.

“We are big believers in healthy communication and positive culture. Maintaining these during the pandemic requires more effort,” Kadlic says. “Think of situations like onboarding a new employee who knows no one at the company. If culture is important, then how will the new employee be exposed to that culture when they work remotely for most, if not all, of the time? Conversely, how do you exit individuals from a business without it feeling undignified or unprofessional?”

In addition to those challenges, facility shutdowns occurred more frequently despite the financial rescue efforts of Congress. Roughly 25% of survey participants said this was a top concern, along with critical infrastructure breakdowns.

Closures inevitably led to furloughs and mass layoffs. The U.S. unemployment rate hovered at 3.5% in February. It spiked to over 14.7% in April, and came down to 10.2% in July.

Future Business Opportunities

Middle-market companies also foresee upcoming opportunities, stemming from changes that were brought about because of COVID-19, including improved business efficiency and digitization.

About 54% of the survey’s respondents said there will be new operational models as a result of COVID-19. The same percentage of respondents anticipate improved sales and marketing efficiency, while 50% expect remote work to be more efficient going forward.

For 2021, pandemic risk will be something midmarket pros take into consideration as companies expand their definition of disaster recovery.

“This year has been a lesson in crisis management,” Caruso says. Cloud-based systems, data storage applications and other high-tech infrastructures were already in place to allow employees to work from home. To reduce risk, it would be wise to test those systems periodically.

“In general, people always thought of disaster recovery as primarily IT systems going down or a physical business interruption, such as a hurricane or flood—something like that,” Caruso adds. “The 2020 lesson really has been to expect the unexpected.”

1 HawkPartners surveyed 303 midmarket decision-makers at companies with revenue ranging from $200 million to $3 billion. QBE Insurance Group Limited, Australia’s second largest global insurer, sponsored the survey.