November Retail Sales Not Full of Holiday Cheer

Traditional holiday sales did not get off to a robust start in November, likely due to a late Thanksgiving holiday that pushed some spending into December.

This article is sponsored by RSM US LLP. It was originally published on RSM’s The Real Economy Blog on Dec. 13.

The traditional holiday sales did not get off to a robust start in November, which was most likely because of a late Thanksgiving holiday that pushed some spending into December. After peaking in mid-2019, overall retail sales will need to pick up in December to support growth anywhere near 2% in the current quarter.

Given the noise around the data series — Cyber Monday, for example, fell in Decemer this year — we expect a modest rebound to spending in December that will be in line with the stronger underlying trend in the data over the past six months. For this reason, we will wait until we get that data to come to any conclusions about the condition of the consumer heading into 2020.

For the third straight month, retail sales arrived well below expectations with the top line advancing by 0.2% month over month, while the all-important control group used to estimate consumption inside the GDP rising by 0.1% in November. Outlays excluding autos and gasoline, or core retail sales, were flat on the month.

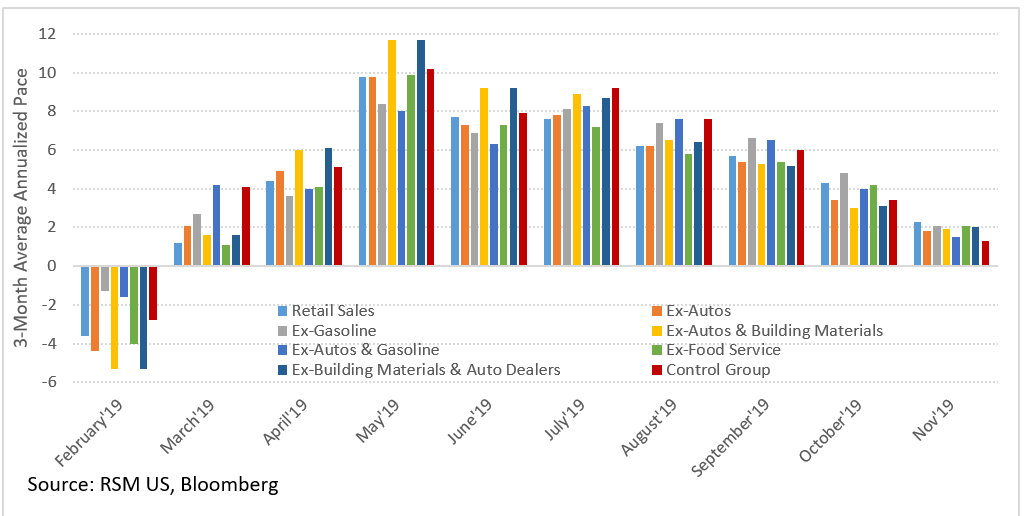

Over the past three months, overall retail sales have slowed to the point where one needs to differentiate between noise and signal. In our estimation, there is simply too much noise around the time series to come to any major conclusions about the condition of the consumer or the health of the economy. Our preferred look at this time series is the three-month average annualized pace of sales. This implies that top line retail sales have slowed to a 2.3% pace, with the control group that feeds into the calculation of GDP easing to 1.3%. Outlays excluding autos and gasoline sales increased at a 1.5% pace, while ex-good service increased by 2.1% and ex-building materials and auto dealers advanced by 2%.

Spending by category was quite volatile. Outlays on health and personal items declined by 1.1%, clothing by -0.6%, eating and drinking establishments by 0.3%, while miscellaneous spending declined by 0.4%. Spending on motor vehicles and parts increased by 0.5%, electronics by 0.7%, food and beverages by 0.3% and the proxy for e-commerce advanced by 0.8%.

Subscribe to The Real Economy blog to receive email updates.

Joseph Brusuelas is chief economist for RSM US LLP. He provides macroeconomic perspective to help RSM clients anticipate and address the unique issues and challenges facing their businesses and the industries in which they operate. In 2015, he helped launch The Real Economy, the only monthly economic report focused on the middle market, and helps lead the firm’s cutting-edge Industry Eminence Program. Prior to joining RSM as chief economist, Joe was a senior economist at Bloomberg, LP and the Bloomberg Briefs newsletter group.