Uptown Grid: A New Model Says 2026 Deal Volume Will Be Flat

Andrew T. Greenberg of Greenberg Variations Capital examines the key takeaways from a multi-variable regression model to forecast 2026 M&A activity

One end-of-the-year ritual in the M&A business, as in other industries, is assessing what the next year will look like. In our world, there’s a pronounced bent toward optimism—dealmakers looking for the next opportunity act like sailors trying to sniff a breeze.

This year, I decided to try to do better, and to do it by wrapping together three themes of widespread interest: what will drive deal volume next year, how is this affected by elevated levels of political risk and how is artificial intelligence expanding our abilities to do financial analysis and serve business owners?

With an assist from OpenAI’s ChatGPT Business, we built a multi-variable regression model.

Here are the takeaways:

- In 2025, total U.S. M&A volume is on track to rise 13% year-over-year, a notable pickup from the doldrums of 2023-24. Our model predicts a 3.2% drop in 2026—essentially in-line with 2025’s solid, but not spectacular, performance.

- A deep dive into the manufacturing sector confirms that heightened political uncertainty is having a dampening effect on completed deal activity.

- A deeper dive suggests that selling businesses valued at $25 million-to-$50 million have been finding their buyers. Larger middle-market companies, along with those at the lowest end of the middle market, should benefit most if and when visibility improves.

The GVC Model

We know the factors that drive deal volume: public equity values; availability and cost of debt; amount and vintage of private equity “dry powder;” and qualities of predictability, visibility, and confidence in capital and consumer markets. The challenge is in finding metrics that have explanatory value, co-exist well with one another, and are properly timed.

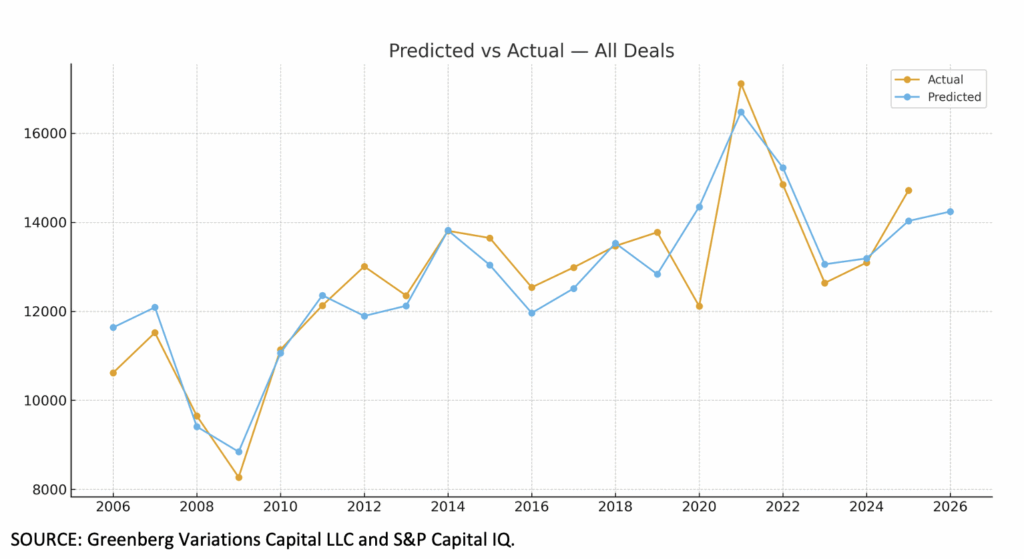

For statistics geeks, the Greenberg Variations Capital (GVC) model has an adjusted R-squared measure of .78, meaning the selected variables explain about 80 percent of annual volume:

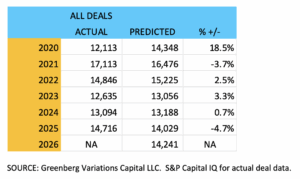

Actual and predicted deal counts for this decade are:

The huge miss in the pandemic year of 2020 is no surprise. After that, the model has turned in five solid years. The largest recent deviation is in 2025, where it looks like the predicted count will fall short of actual by 4.7%. (S&P Capital IQ’s data for 2025 is the total through November annualized.)

Expected 2026 volume is 14,241 deals—3.2% off of 2025. As noted above, we consider this essentially a continuation of the solid, but not spectacular, performance recorded this year.

What is holding the market back?

Throughout this year, I’ve been advising clients on the unprecedented levels of uncertainty and/or volatility in such areas as borrowing costs, tariffs, domestic regulatory policy, multinational trade policy, and supply chain management.

These elements of political risk fall hardest—not exclusively, but hardest—on industrial businesses.

For a better understanding of how these risk factors are dampening deal volume, we dive into the manufacturing sector.

Manufacturing Malaise

For the 15-year period 2009-2023, manufacturing accounted for about 5.5% of S&P Capital IQ’s annual deal volume.

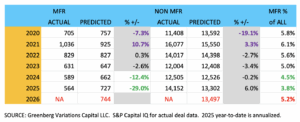

When we pull manufacturing apart from the rest of the data set, we see remarkable flux in the deep-COVID years of 2020-2021, but then an even more dramatic departure from convention in 2024 through 2025.

The pandemic iced over the M&A business along with much other economic activity in 2020, but manufacturing declined far less against expectations than other sectors—7.3% vs. 19.1% (shown in purple). Then, the comeback in 2021 proved even stronger for manufacturing—a 10.7% gain versus 3.3% for the rest of the universe.

Meanwhile, in U.S. politics, 2024 was defined by the prospect of two widely different sets of policies depending on an election outcome. Then, the Trump agenda defined 2025. With respect to the non-manufacturing cohort, the GVC model performed about as well as in prior years. In manufacturing, though, the actual numbers fell off the table—12.4% short of the prediction for 2024 and 29% off in 2025 (shown in green).

As a result, manufacturing cascaded downward as a share of the overall universe—to 4.5% in 2024 and then to 3.8% in 2025.

If manufacturing had performed in-line with recent convention—at 5.5% share this year rather than 3.8%—we would be on track for about 15,000 completed deals in 2025, 2,000 more than in 2024.

Looking forward, manufacturing accounts for 5.2% (shown in red) of the predicted count for next year—a classic good news/bad news proposition.

The good news: A return to the historic 5-6% range suggests that the political noise is now “priced in.”

The bad news: This may well be a case of lowering the ceiling rather than raising the floor. The disparity between manufacturing and the rest of the pack may have narrowed because political effects have settled in the deal market more broadly. Labor shortages induced by immigration policy, for example, impact service categories more than manufacturing.

The Deeper Dive

S&P Capital IQ provides a useful benchmark for volume trends in the broader market, but as the numbers suggest, its reach goes beyond traditional private equity or corporate targets. Furthermore, using this data set to assess valuation and deal size trends proves tricky because many of the deals get reported without those metrics.

For more detailed analysis, let’s turn to GF Data, the private deal tracking database Graeme Frazier and I co-founded in 2005 and ran until the Association for Corporate Growth acquired it in 2022.

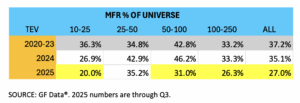

From 2020-2023, the manufacturing business category accounted for 37% of the GF Data pool—in line with historic averages. This more focused data set shows a more modest decline in 2024 deal volume than in the S&P Capital IQ numbers. But, as with Cap IQ, GF Data’s manufacturing deal share drops dramatically in 2025 to date:

Manufacturing accounted for 27% of total reported deals in the first nine months of this year—10 percentage points below the recent average.

Companies in every size bracket experienced the downdraft, except for those in the $25 million-to-$50 million TEV group. This is in line with experience. Aggregate valuations in this swath of the market are “never too high, never too low.” Commercial bank financing, earnouts, and seller financing help get deals done amid otherwise challenging conditions.

Deals in the $10 million-to-$25 million range and those at $50-million-to-$250 million experience quite different dynamics, but they do share a tendency for sellers who know they are not going to get their price to retreat to the sidelines. Thus, these are the cohorts positioned to benefit most in 2026 from clarity on tariffs, interest rate cuts and the shared aspiration of politicians in an election year to “do no harm.”

Andrew T. Greenberg is CEO of Greenberg Variations Capital, an M&A advisory firm based in suburban Philadelphia, and Co-Founder of GF Data. For more information, please contact: atg@greenbergvariations.com

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit acg.org.