Middle-Market Dealmakers Prepare for a Rebound

M&A experts are hopeful that 2024 will be a more fruitful dealmaking year, as seller valuation expectations begin to come down

When New York City’s famed crystal ball dropped in Times Square on New Year’s Eve, millions of people watched as it heralded the start of 2024 and the blank slate of a new year. But long before the ball fell, experts within the M&A industry were looking into their own proverbial crystal balls to predict what the mergers and acquisitions landscape will look like in the year ahead.

There are some significant differences in what dealmakers anticipate for 2024, yet a common expectation shared by all is that it will be a year of change—and largely for the better.

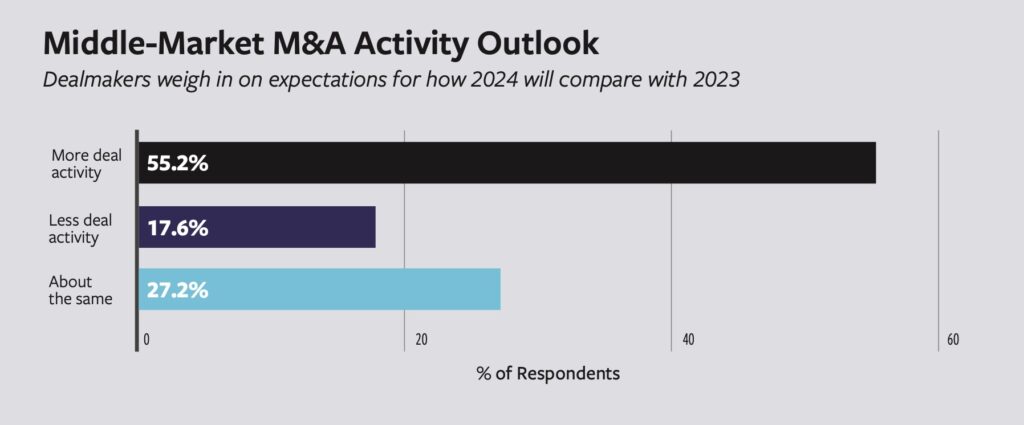

According to the results of a survey of the ACG community, 55% of respondents expect an increase in deal activity in 2024, 27% expect activity will remain much the same as 2023, and only 18% anticipate a decline.

This section of the report is sponsored by S&P Global Market Intelligence and originally appeared in the special edition Middle Market Growth 2024 Multiples Report. Read the full issue in the archive.

Following a year and a half of paltry M&A activity, due primarily to high interest rates, inflation, fears of a recession and a major disconnect between buyers and sellers regarding portfolio company valuations, there are widespread expectations that the floodgates will finally begin to open in 2024.

“We’re not in the business of sitting on the sidelines. We’ve remained extremely active over the past two years, having closed on three platforms and multiple add-ons. We’re in the business of buying and selling companies and doing deals, and I expect 2024 will be a good year,” says Tad Nedeau, a co-managing partner at PE firm Lincolnshire Management and head of the firm’s origination team. In fact, he says it would not be surprising to see a similar deal trajectory to what occurred after the 2008 credit crisis. “We saw this in ’08-’09, where in the following years, deal volume picked up. And I think we’re going to see that here again,” says Nedeau.

His sentiment is shared by Trent Hickman, a managing director at structured credit firm VSS Capital Partners: “The last year or so, particularly the last six months since the fall of SVB (Silicon Valley Bank), has been rough from an M&A perspective. Things have been really slow and the lending markets were largely shut for several months during the spring and summer. … But I think we’re starting to come out of this, and 2024, 2025 and 2026 should see an increasing amount of exit volumes.”

Story continues below

Getting Off the Sidelines

Such prognostication is more than just wishful thinking and is backed up by positive signals in the market. “An increasing number of privately held companies, family-owned businesses, strategic sellers and private equity sellers are getting quality of earnings reports done in advance of a sale process,” says Michael Milani, an executive managing director and principal with Baker Tilly, an advisory, tax and assurance firm. “The number of opportunities, pitches, proposals and engagements that our transactions teams are working on have meaningfully increased since roughly the second week of August. … Many of those deals will be going to market in 2024.”

The number of opportunities, pitches, proposals and engagements that our transactions teams are working on have meaningfully increased since roughly the second week of August. … Many of those deals will be going to market in 2024.

Michael Milani

Baker Tilly

While the onset of the COVID-19 pandemic ground M&A activity to a halt for a large part of 2020, the following year saw a record number of deals completed after the Federal Reserve reduced interest rates to record lows. Countless PE firms rushed to execute M&A deals of varying levels of quality.

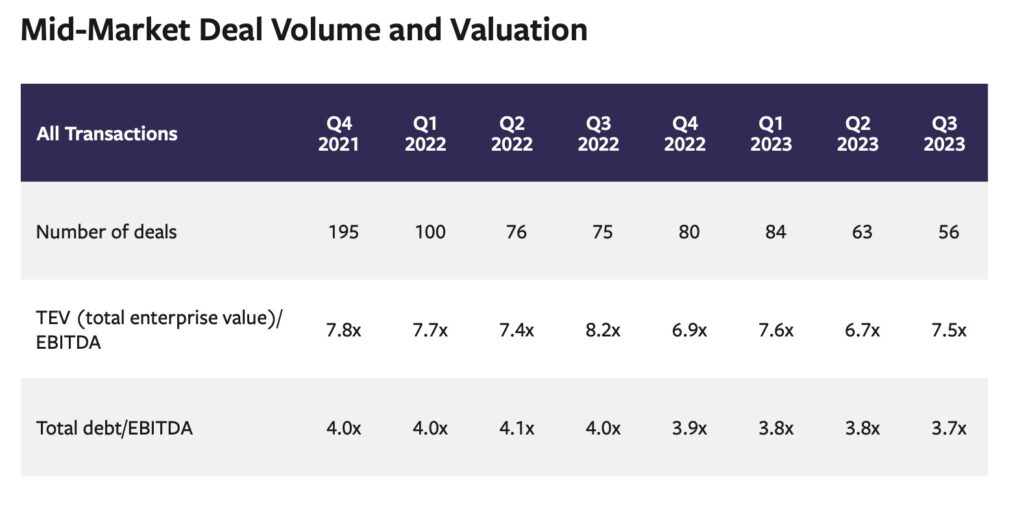

Once the pendulum swung in the other direction, however, as the Fed sought to control inflation through repeated interest rate hikes, deal activity plummeted. M&A activity has steadily declined since the start of 2022, due to higher debt costs, fears of recession and a sudden halt in fundraising as limited partners grappled with private equity-heavy portfolio allocations.

In 2021, a total of 1,839 M&A deals were completed in the middle market with a combined value of $878.3 billion, according to data from PitchBook. Comparatively, 1,307 PE exits valued at a combined $321.5 billion took place in 2022. Activity and deal values have continued to drop, with only 378 middle-market M&A transactions completed in the first half of 2023 with a combined value of $139.6 billion.

But following the lengthy lull in M&A activity, a lessening of the denominator effect and PE firms’ collective need to begin returning money to LPs, industry experts are optimistic that change is beginning. Not only is deal flow expected to pick up in 2024, so too is the overall quality of companies brought to market.

Exits largely dried up since the start of 2022, and PE firms have found themselves holding portfolio companies much longer than anticipated. Absent opportunities to cash out of these companies, firms have taken a more hands-on operational approach with their holdings than they are typically able to do. “As long as you’re holding companies, you’re trying to create value in them. So, there’s been a lot of focus on improving the operations of businesses,” says Justin Green, a partner and co-head of flagship funds for PE firm Palladium Equity Partners. The result has been an overall improvement in the quality of many of the portfolio companies that firms will soon be bringing to market.

Coming to Terms on Valuations

The quality of targets coming to market, combined with lower prices, bodes well for future investment returns. “I honestly believe that the vintage fund years over the next three years in private equity are going to be some of the best returns over the next decade,” says Sash Rentala, partner and head of financial sponsors at investment bank Solomon Partners.

Story continues below

Prices are expected to come down as sellers accept that the valuations of 2021 are a thing of the past. Until recently, there has been a major disconnect between the value that sellers and buyers ascribe to companies positioned for sale, which has stymied transactions. Rentala says he has heard from clients that roughly 75% of deals launched in 2022 never got done. That disconnect is not completely gone, but Rentala says that by the third and fourth quarters of 2023, many PE firms had turned their attention to selling off their “B” assets— mature holdings they’ve held on to for up to five years—with more flexible pricing, in an effort to return some capital to LPs. Some firms reintroduced hung deals in hopes that buyers would recognize the value from the additional time and attention PE firms have given to these companies.

I honestly believe that the vintage fund years over the next three years in private equity are going to be some of the best returns over the next decade.

Sash Rentala

Solomon Partners

“There’s been a lot of holding out, to a certain extent, because sellers are looking at valuations and models that probably made sense at 2021 levels. … But those expectations are unrealistic,” says Chris Sheaffer, a partner at law firm Reed Smith and global vice chair of the firm’s private equity group. Many sellers continue to believe their companies are worth more than buyers are willing to pay, but Palladium’s Green says the valuation gap is finally beginning to narrow.

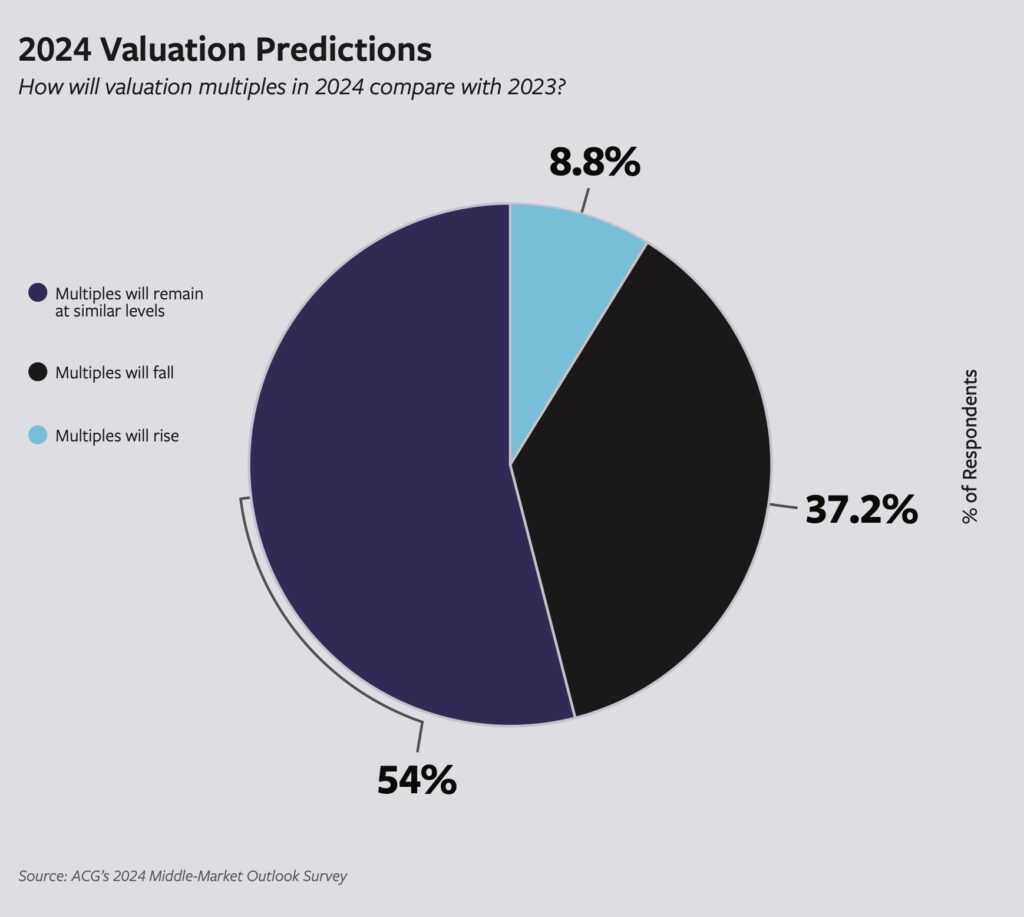

When looking at the lower end of the middle market, though, valuations have actually held steady or risen. In the third quarter of 2023, average multiples on EBITDA rose to 7.5x from 6.7x in Q2, according to GF Data, which tracks transactions with $10 million to $500 million in enterprise value.

Once activity finally begins to pick up and PE firms can start cashing out of their second-tier holdings, industry experts believe firms will unload some of their weaker holdings at bargain prices to get them off their books.

Keeping On with the Add-on

Of the deals that made it to market in 2023, a sizable share were add-ons and platform deals financed largely with equity. Credit deals remained few and far between, and those that did come to market attracted significant competition.

“Add-ons are a way for us to continue to transact and deploy capital despite the uncertain times and the low M&A activity,” says Brian Crosby, a managing partner at PE firm Traub Capital. He says firms can use portfolio companies to buy add-on acquisitions at attractive prices and lower multiples using existing debt facilities.

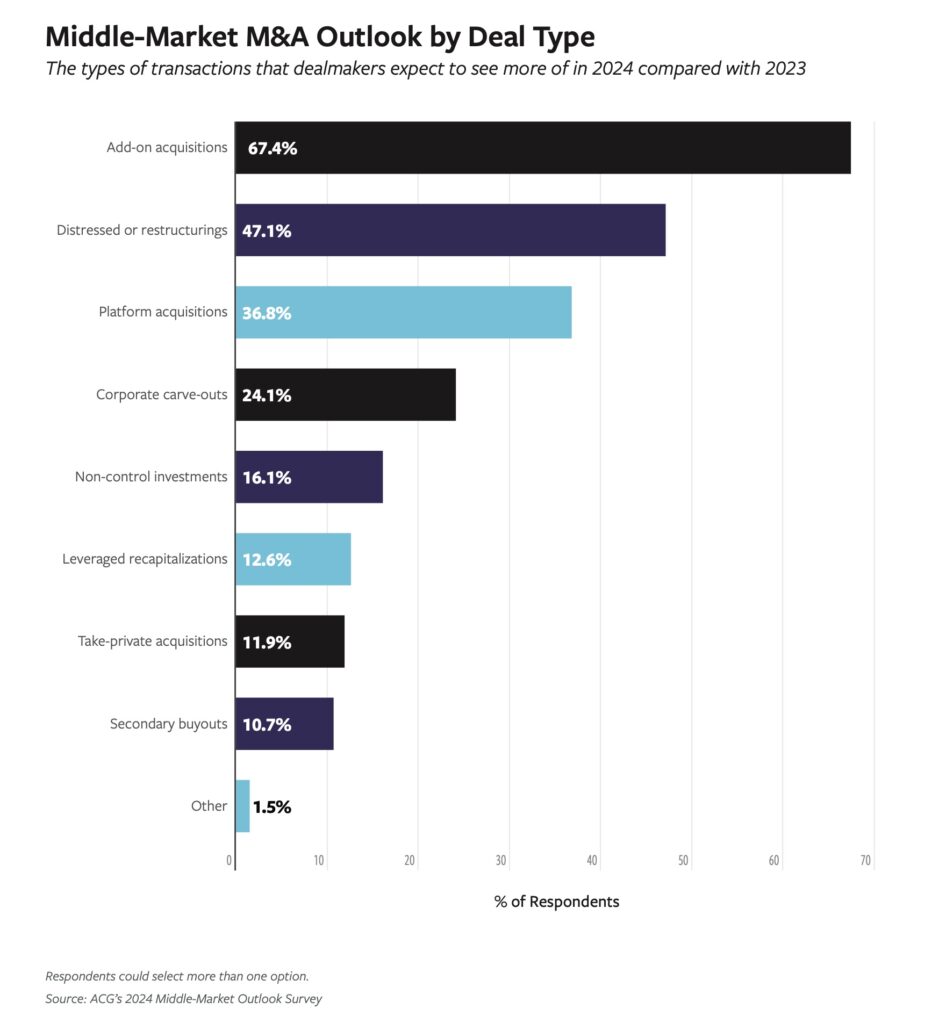

Those sentiments are largely echoed in ACG’s survey findings. Asked what types of deals they expect to see in 2024 (with the ability to select multiple options), respondents ranked add-on acquisitions at the top of the list (67%), followed by distressed or restructurings (47%), platform acquisitions (37%) and corporate carve-outs (24%). When it comes to expected debt levels for PE transactions in 2024, 40.2% of respondents expect leverage will remain about the same as 2023, 39.5% expect that leverage levels will fall from 2023, and 20.3% anticipate higher leverage levels.

Related content: This Year, Expect LPs to Dial up the Pressure for Capital Returns

The private equity industry has begun bracing for deal activity to ramp up again in 2024, yet there is less certainty about how quickly M&A activity will surge. “Once there is a signal that there is a little bit of clarity and stability in the markets, I think there’s going to be a massive resurgence of not only deal volume but deal quality. And everyone’s going to be trying to push through the exit door at the same time,” says Crosby. “But even if there is a surge and a return to quality, I don’t think that multiples are going to revert immediately. There will be such a supply of these companies coming at once that it will help temper rising valuation multiples.”

Story continues below

The private equity industry has begun bracing for deal activity to ramp up again in 2024, yet there is less certainty about how quickly M&A activity will surge. “Once there is a signal that there is a little bit of clarity and stability in the markets, I think there’s going to be a massive resurgence of not only deal volume but deal quality. And everyone’s going to be trying to push through the exit door at the same time,” says Crosby. “But even if there is a surge and a return to quality, I don’t think that multiples are going to revert immediately. There will be such a supply of these companies coming at once that it will help temper rising valuation multiples.”

In-Demand Industries

When it comes to the outlook by sector, less cyclical areas such as healthcare services and information technology—particularly healthcare IT companies—top the list of those that industry experts expect to garner more attention from dealmakers.

Pharmaceuticals is expected to remain a strong sector, as are artificial intelligence applications, particularly businesses that have real-world utilities for AI. Certain niche areas are also expected to do well. Palladium’s Green notes that his firm has been actively investing in businesses that serve the Hispanic community, which he says is growing faster than the overall U.S. population and has become an increasingly important part of the macro landscape. “If you were to look at the U.S. Hispanic market as if it was its own country, it would actually be the fifth-largest county in the world in terms of GDP, behind only the U.S., China, Japan and Germany,” says Green. “It’s a huge market that’s becoming increasingly important, and that’s a big focus area for us.”

Conversely, businesses that have fallen out of favor include those in the consumer and retail sectors, specifically discretionary goods and services.

The outlook is less clear for businesses that were directly impacted by the pandemic-era lockdowns and supply chain issues. Though remote communications, home improvement and decorating businesses got a major boost during COVID, and the travel and hospitality industries struggled, things have changed as the pandemic has receded.

“In a lot of cases, many businesses that were really frothy 18 months ago are having a hard time now, and valuations are coming down,” says Randi Mason, a partner at law firm Morrison Cohen and co-chair of the firm’s corporate department. “It’s still hard to price those businesses because it’s hard to project how they are going to do in the long term in a post-COVID environment.” She adds that fragmented industries, such as the medical and dental sectors, are particularly attractive to investors, who see the potential of consolidation and roll-ups.

Persistent Clouds

Despite the many opportunities that dealmakers see ahead, the industry is cognizant of myriad factors that could dampen the expected surge of deal activity. Macro issues such as the ongoing wars in Ukraine and the Middle East, along with any unexpected move by the Fed to raise interest rates further and, of course, the 2024 presidential election, are high on firms’ radar.

Related content: The 2024 ACG Outlook from CEO Brent Baxter

“When you look at what happened in the last election—and there’s no reason to assume this one will be any different— everyone lost their minds and we had a two- to three-month period of uncertainty,” says Chris Sugden, a managing partner at growth equity firm Edison Partners and chairman of the firm’s investment committee, noting that uncertainty and the damper it put on deal activity could be even worse this time around, depending on which candidates ultimately end up on the ballot. He expects firms will try to complete as many deals as possible in the first half of 2024.

Regardless of when deal activity finally picks up, there is a contingent that believes the struggles the M&A community has faced over the past couple of years haven’t been all bad. “Indigestion is actually healthy, because everyone’s sort of got religion now,” says Sugden. “Buyers and sellers know that the price is the price and nobody’s going to lean way over their skis. And, in general, people still feel like the highest quality assets will still get a higher valuation and are not being punished for other people’s bad outcomes or bad management.”

Reed Smith’s Sheaffer adds: “Even though this last year was on the slower end, we think it was probably needed to reset some of the market expectations, and we’re confident that we’re going to end up in a very healthy M&A market in the next several years.”

Britt Erica Tunick is an award-winning journalist with extensive experience writing about the financial industry and alternative investing.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.