Manufacturing Stems Its Slide in Q3 2023

GF Data analysis examines manufacturing M&A trends

Signs are pointing to a recovery in purchase price multiples for manufacturing investments in the middle market. Average valuations for manufacturing deals rebounded in the first quarter of 2023, according to recently published research from GF Data, in the midst of significantly low deal volume.

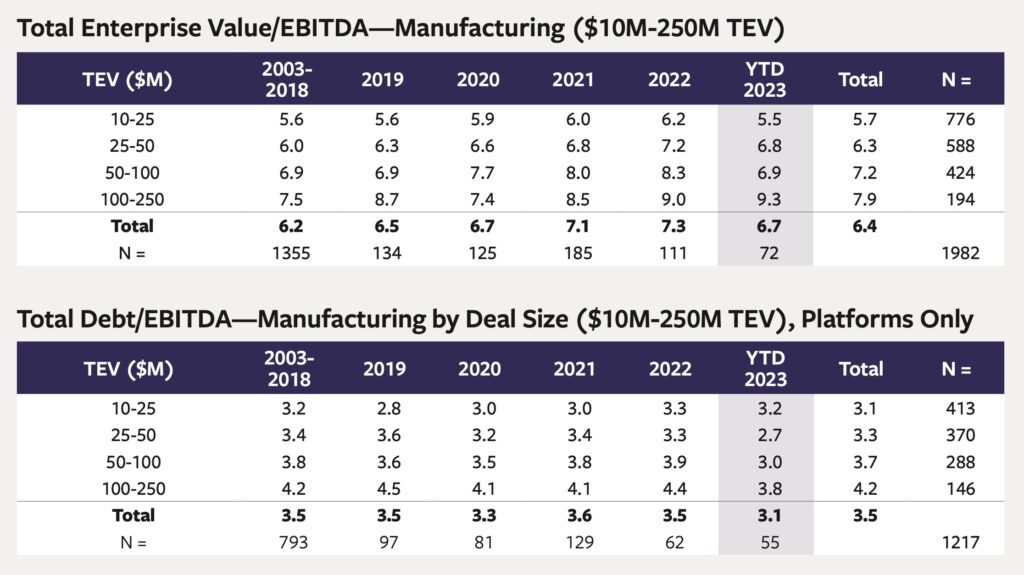

At the end of the third quarter (at the time this article was written), valuation multiples for private equity-backed manufacturing deals with enterprise values between $10 million and $250 million averaged 6.7x trailing 12 months (TTM) adjusted EBITDA. This compares to 6.4x—the average through the first two quarters of 2023 and also the historical average since 2003.

The multiple increases were seen across all deal sizes, save for transactions valued between $25 million and $50 million, which were flat at 6.8x. All other size cohorts were up approximately 2.5x year to date through the third quarter of 2023, versus the first half of last year.

However, deal volume for manufacturing transactions through the third quarter of 2023 was down a little more than 33% from the total for full year 2022, and 61% off the tally for 2021—which recorded the highest volume in more than five years.

Debt coverage for manufacturing platform deals remained stuck at an average of 3.1x TTM EBITDA through 2023’s third quarter, the same mark achieved in the first half of 2023. Again, the $25 million to $50 million size tier saw erosion in coverage, dropping to an average of 2.7x through the third quarter compared to 2.8x, while debt coverage multiples for larger transactions rose slightly. All other size tiers improved slightly.

It was a similar case for senior debt coverage for manufacturing deals, which held steady at 2.3x through the third quarter of last year with a small decline in deals valued between $10 million and $25 million, and modest improvements in coverage for transactions above that mark.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.