Investors Weigh Financing Options as M&A Improves

With many new private credit funds, BDCs and bank direct lending arms in the market, private equity sponsors debate the merits of different capital providers

Rising interest rates, last spring’s regional banking crisis and other headwinds sent dealmakers and lenders to the sidelines for much of 2023, a year that saw a 44% drop in deal value and a 36% decline in transaction count in its first nine months compared with the same period in 2022, according to S&P Market Intelligence Data.

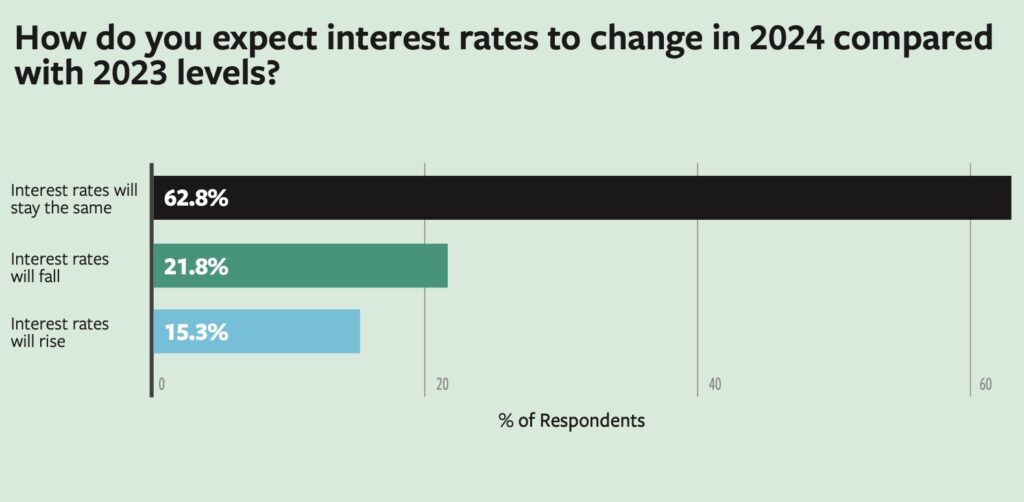

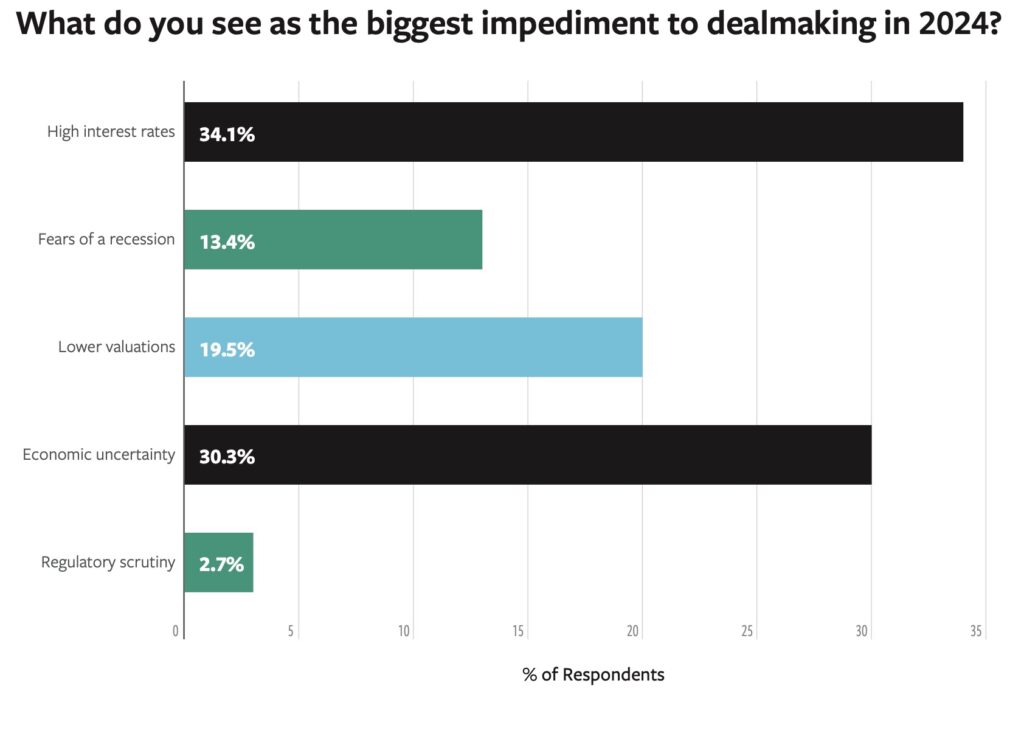

The coming year looks brighter on the deal front. A majority of respondents to ACG’s 2024 outlook survey expect M&A activity to increase, although high interest rates and economic uncertainty remain top concerns. Lenders say capital is available for high-quality deals, thanks to a bustling private credit market—but riskier transactions are likely to face a harder path.

This section of the report originally appeared in the special edition Middle Market Growth 2024 Multiples Report. Read the full issue in the archive.

“The bottom line is that rates are way higher,” says Ben Radinsky, a principal at alternative asset manager HighVista Strategies who focuses on opportunistic credit and special situations investing. “Spreads have been pretty consistent if you look at the past four years. But the net result is that the real cost of capital has increased dramatically, and it’s making some of the financings that were done over the past few years just impossible to maintain.”

When it comes to accessing capital for M&A, most sponsors prefer working with private credit funds and business development companies (BDCs). “Sponsors generally are more inclined to go with these options because they need flexible capital and providers that are willing to offer leverage,” says Christine Tiseo, managing director on the debt capital advisory team at Lincoln International. “The additional 100-200 basis points of cost is outweighed by the certainty that they can get around closing in the private markets.”

According to GF Data, bank lenders charged an average interest rate of 10.2% on senior loans for platform investments in the $50 million to $500 million enterprise value range in 2023 through Q3. By comparison, non-bank lenders charged 10.9% for similar deals.

‘A Dream Scenario’ for Private Credit, BDCs

The ascendance of private credit and BDCs is being fueled by investors eagerly seeking new opportunities. The size of the private credit market at the start of 2023 was approximately $1.4 trillion, up from $875 billion in 2020. The market is projected to grow to $2.3 trillion by 2027, according to data from Morgan Stanley.

Story continues below.

Source: ACG’s 2024 Middle-Market Outlook Survey

“We’re in kind of a dream scenario for private lenders,” says Troy Gayeski, chief market strategist for alternative asset manager FS Investments. “We have to pinch ourselves a little bit because not only is the Fed going with ‘higher for longer,’ but the probability of a recession has dropped significantly. We also have a positive feedback loop from stable government spending, more business and more construction driven by the Inflation Reduction Act.” This creates an ideal environment for direct lenders, Gayeski adds, which stand to earn more income for longer at wider spreads and lower leverage levels.

We think this is going to be a very good vintage year for private credit.

Steven Ruby

Audax Private Debt

Steven Ruby, co-head of originated debt at investment firm Audax Private Debt, agrees. “We think this is going to be a very good vintage year for private credit,” he says. “When you zoom out and look at the asset class, it’s very easy to get 11%-12% coupons at a lower leverage ratio and a loan-to-value of 35%-40%. That’s a net positive for investors and lenders.”

BDCs are also drawing investor interest. These closed-end investment companies, which lend to small and medium-size privately held businesses, are available to retail investors and can trade like stocks. “All types of investors are interested in having exposure to private credit almost as a core holding or a permanent holding, and for ultra-high-net-worth investors and retail investors, BDCs provide that avenue,” Ruby explains.

BDCs typically have a significant amount of floating-rate debt in their portfolios; in an environment where rates are high, that debt should provide investors with solid returns if it performs well. So far, it has. The S&P BDC Index was up 4.91% through Oct. 30, putting the performance of BDCs ahead of the S&P High Yield Corporate Bond Index, which was up 4% over the same period.

That floating-rate debt can cut the other way, too, and historically, BDC performance has been somewhat volatile. A lack of discipline with credit selection can result in loans that default or underperform due to late payments, which in turn can negatively impact performance. “We saw some BDCs falter during the pandemic because they were under pressure and needed to make changes in their portfolio,” says Patrick Linnemann, managing director at Blue Owl Capital’s credit platform. “That’s a scenario you want to avoid, and we could see it again if there’s a recession. It’s going to be important for teams to make sure they are managing risk.”

Related content: A Decade on, Private Credit Matures and Evolves

The pullback of traditional banks has created a need for alternative financing sources, and BDCs are positioning themselves to fill the gap. Large firms have come to market with new BDC offerings in recent months, including Ares Management, Jefferies Financial Group, T. Rowe/Oak Hill Advisors and Vista Equity Partners.

“The issue is that financing is going to get more competitive, and there is limited balance sheet (capacity) available from traditional lenders,” says Linnemann. “I think private credit and BDCs are going to be an increasingly important piece of the puzzle as the market continues to grow.”

Story continues below.

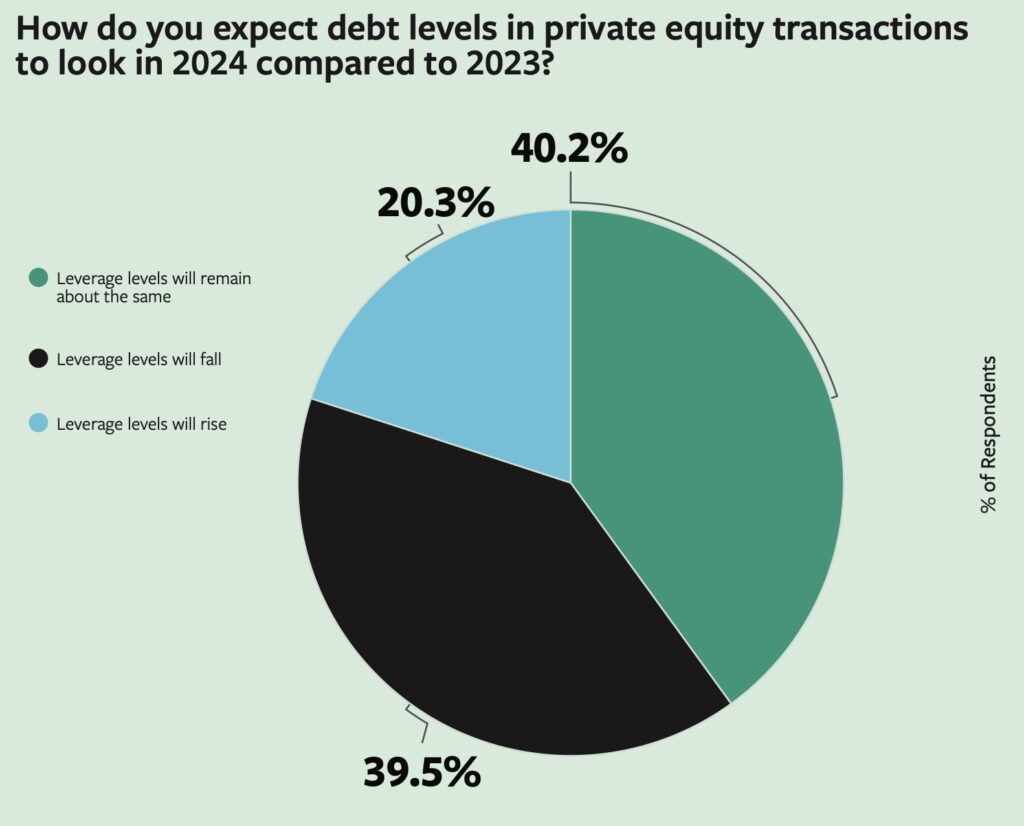

Source: ACG’s 2024 Middle-Market Outlook Survey

BDCs and private credit vehicles are participating in ever-larger deals.

According to a Bloomberg report, private lenders including Oak Hill Advisors, Blue Owl Capital and HPS Investment Partners teamed up in August to provide a $5.3 billion financing package to Finastra Group Holdings, a London-based financial software company. Finastra’s loan refinances existing debt that the company raised in the U.S. and European leveraged loan market.

Tiseo is seeing more of these arrangements and says that Lincoln, too, is receiving calls about recapitalization. “Because the market has slowed on the M&A front, this trend is likely to persist,” she says. “There are fewer exits, and parties have to think through their capital needs and what is going to make the most sense.”

I think private credit and BDCs are going to be an increasingly important piece of the puzzle as the market continues to grow.

Patrick Linnemann

Blue Owl Capital Corp.

The Banking Option

The high-profile bank collapses last spring have made traditional lenders more cautious, and private credit firms have stepped in to do deals. But the banks haven’t walked away entirely.

“We are absolutely willing to support well-managed companies. Many of them have good balance sheets and are trying to be opportunistic right now,” says Steve Woods, executive vice president and head of corporate banking at Citizens. “We have to be strategic. There are still limitations on what it makes sense to do, but we are committed to working with these companies to understand and support their strategic long-term vision.”

Several large commercial banks have announced new ventures in direct lending to middle-market companies. At the beginning of 2023, JP Morgan set aside $10 billion to enter the world of direct lending. In September, Reuters reported that Wells Fargo was teaming up with Centerbridge for a $5 billion fund focused on direct lending to middle-market companies.

According to a September Bloomberg report, Barclays, Société Générale and Deutsche Bank have also made concerted efforts to start direct lending ventures via dedicated departments or new funds. According to the report, banks don’t want to miss out on the private credit opportunity while their broadly syndicated loans business is in a lull.

Big banks got burned in the leveraged lending market in 2022, and while there are incentives for them to consider smaller, mid-market loans, Gayeski says it will take time for them to reenter that market. “The too-big-to-fail banks just haven’t been in the middle market for years,” he says. “It’s going to take some time for them to build up the relationships and meaningfully compete against lenders that have been doing business in this part of the market for a number of years.”

David Miller, Americas co-head of private credit within Goldman Sachs Asset Management, agrees. “We have not been competing with banks for a while now,” he says. “It seems clear that people are still pulling back following what happened with Silicon Valley Bank and others at the beginning of the year, and from a risk and regulatory perspective, it’s hard for banks to provide the leverage profile sponsors are looking for.”

A Look Ahead

A big story in 2024 is likely to be refinancing. Many loans are nearing maturity and borrowers are facing tough math. Some lenders are poised to take advantage of these trends.

According to data from KKR, traditional leveraged loan issuance is down through Sept. 30 at $178 billion—the lowest level since 2009. Within that issuance, KKR is seeing that the largest portion falls into the “amend and extend” category. Amend and extend arrangements typically offer companies and sponsors an additional two years before a loan matures.

“The challenge for legacy portfolios is structure; this is why underwriting discipline is so critical throughout the credit cycle,” says Ruby. “Lenders are going to have to look at their exposures and determine who can cover the cost or what needs to be done via restructuring or refinancing to address the issues. In some cases, company owners or management teams will be able to demonstrate that they are taking steps to fix problems. Other cases will be less straightforward.”

Related content: Private Credit’s Rise Continues—But Not Because of SVB

A recent research note from Bank of America suggests the default rate could tick up to 5% in 2024 if financing challenges prove to be widespread.

Miller adds that debt service could mean some companies have to put off acquisitions or other growth strategies, at least in the short term. “It’s just math,” he says. “Companies that were levered at 6.5x-7x two years ago are spending significantly more on debt service than what they were. And while top lines continue to grow, the operating margin hasn’t grown sufficiently to generate significant free cash flow to make acquisitions or invest in the business given higher debt costs.”

For new M&A transactions, the outlook is more positive. Stuart Aronson, executive managing director and CEO of lender WhiteHorse Capital, says he’s seeing the number of deals in his inbox begin to normalize. “We normally see 160-200 deals in our pipeline on a typical Monday, and what we had on Monday was 185 deals,” he said in an interview in October. “Some of these are deals that were in market earlier in the year, and processes stalled out because of valuation or credit issues. And they’re returning to market now that those challenges have been addressed.”

Story continues below.

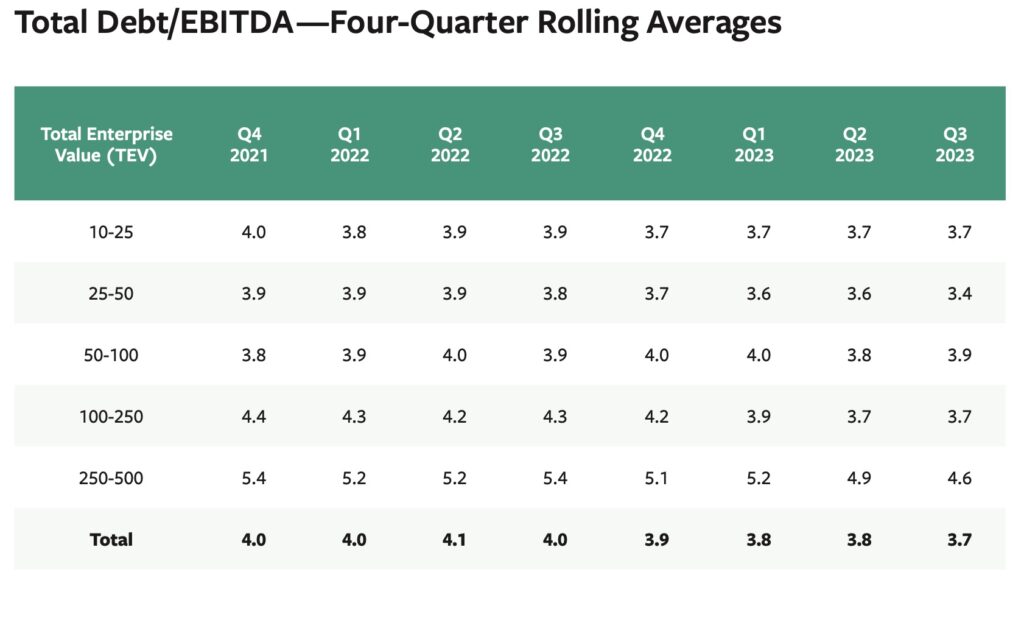

Source: GF Data’s Q3 2023 Leverage Report

Aronson notes that he’s seeing leverage levels of 3x-6x, depending on the size of the company—a range that supports dealmaking, he says.

According to ACG’s survey data, most lenders who responded anticipate that leverage levels will remain steady or fall in the year ahead.

“Debt markets are getting more aggressive than they were at the beginning of (2023),” Aronson says. “But I think we’re in a range that is likely to hold because lenders will want to ensure that companies have adequate cash flow coverage. If rates come down, that may change, but it seems unlikely that will happen in the near term.”

This tracks with what Hunter Davis, Aon’s co-head of M&A and Transaction Solutions for North America, is seeing from clients. “We think the bid/ask is getting more realistic, and that’s going to support activity going forward,” he says. “We’re also seeing some of our larger private equity clients engage with us on more complicated carve-out platform deals that they haven’t been doing a lot of. I think people are getting more comfortable with rates and other issues, and so we’re seeing more firms coming to the table.”

Miller anticipates that private credit will continue to lead on new deals coming to market. “The deals in private credit continue to get larger. We’re seeing $1 billion to $3 billion unitranche deals, and that just didn’t exist before,” he says. “That’s a function of how much money has been raised but also maturation in the market. These are high quality deals from a credit perspective.”

Bailey McCann is a business writer and author based in New York.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.