Cross-Border M&A Looks Ready for Takeoff in 2024

Investment targets outside of the U.S. offer a shot at expansion—even as geopolitical and regulatory risks present challenges for buyers

As U.S. dealmakers look to transact in a tighter M&A environment, some are venturing abroad to expand their universe of deals. They are finding these opportunities by leaning into new strategies, growing their presence outside of the United States and seeking add-on acquisitions in other countries.

Higher interest rates made it more expensive to finance deals last year, prompting the slowdown in deal activity. At the same time, there’s been an uptick in interest in new avenues for growth. “Companies are more often looking at cross-border opportunities as they run out of acquisition targets in their own markets and seek growth,” says Alan Zoccolillo, chair of law firm Baker McKenzie’s North American Transactional practices.

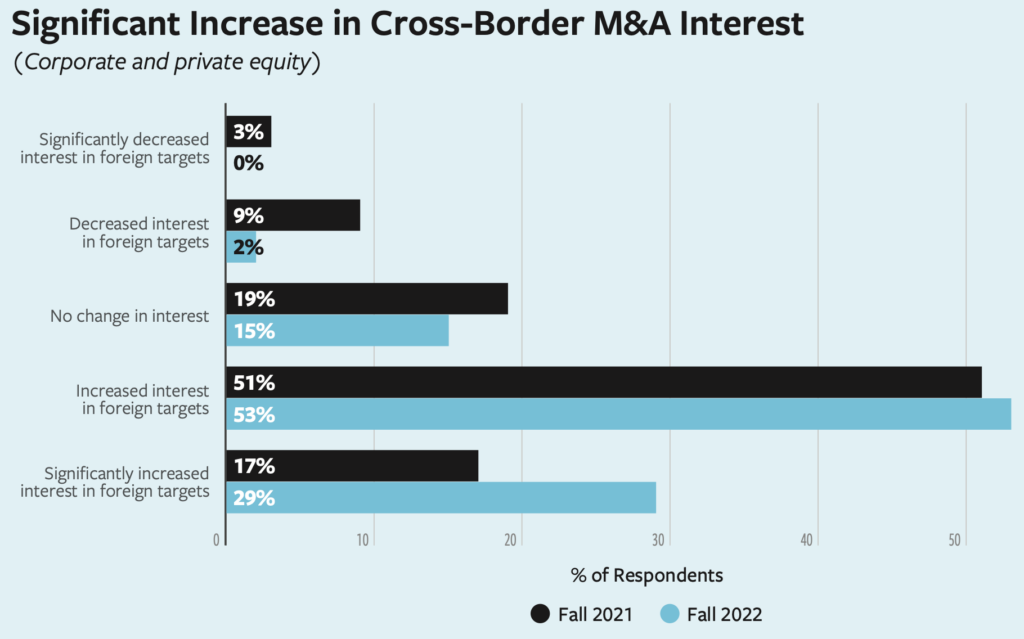

In Deloitte’s 2023 M&A Trends Survey, 29% of corporate and private equity leaders polled in fall 2022 said their organizations had “significantly increased interest” in investing in foreign targets, compared to just 17% in the prior year’s survey.

Lexington, Kentucky-based middle-market private equity firm MiddleGround Capital is among the firms eyeing international opportunities. In 2023, the firm opened its first European office in Amsterdam. Meanwhile, in April, the mega firm KKR said it had closed its largest ever European buyout fund with $8 billion.

For The Riverside Company, add-on investments have long been an effective path for entering new markets. Over its lifetime, the lower middle-market private equity firm has completed 94 cross-border deals through its portfolio companies—70 of them in the last decade. In 2018, the firm invested in U.S.-based Abracon, a specialty manufacturing and distribution business. During its ownership period, Riverside made four add-on acquisitions for Abracon, including two that were cross-border. In 2021, Abracon purchased ProAnt, a Swedish-based company, and AEL Crystals, headquartered in the U.K.

“Abracon had not completed any add-on acquisitions before our investment. Our team helped management achieve their goal of expanding into Europe,” says Cheryl Strom, a partner on the origination team at Riverside. “It’s all about the growth opportunity. When we invest in a company, they only have so much addressable market in the U.S. They have to find ways to expand.”

Story continues below

Source: Deloitte’s Navigating Uncertainty: 2023 M&A Trends Survey

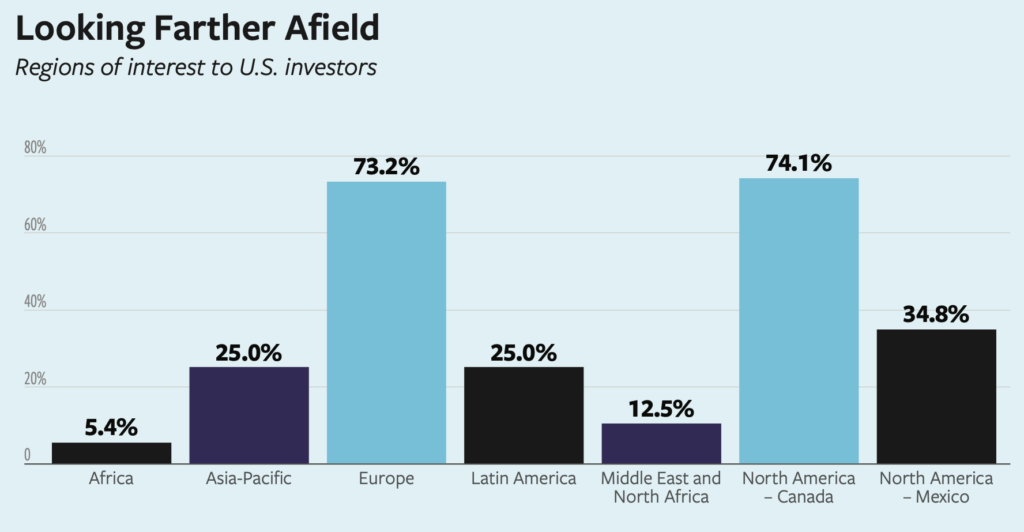

Regional preferences from 112 respondents who said their firm will consider M&A opportunities outside of the U.S. in 2024. Respondents could select more than one region.

Source: ACG’s 2024 Middle-Market Outlook Survey

Of course, there are questions to ask before pursuing international expansion, such as whether a company’s offering is relatable overseas, or whether the new market is similar enough that end users will embrace the product, Strom adds. “Everything must be thoroughly considered before a cross-border investment, but it can be a good way to find growth.”

Where Are Dealmakers Headed, and Why?

Today, many U.S. companies are focusing their deal activity on Canada, the U.K. and Europe. According to ACG’s recent 2024 outlook survey, respondents overwhelmingly said they would consider investments in Europe and Canada, with Mexico as a distant third location of interest.

Portfolio companies of firms like Blue Point Capital, Clearlake Capital and Levine Leichtman Capital Partners have all recently done deals in various parts of Europe.

In July, Law Business Research (LBR), a Levine Leichtman portfolio company, acquired MBL Seminars Ltd. Headquartered in London with offices throughout the United States and in Hong Kong, LBR provides business information, legal analysis tools and networking for global legal markets.

In May, Clearlake Capital’s BBB Industries, a sustainable manufacturer in the automotive aftermarket, acquired Poland-based Inter-Turbo, expanding BBB’s presence in Europe following its 2022 acquisition of Budweg and several other companies across the continent since 2019.

A few months prior, Blue Point Capital Partners and its portfolio company Next Level Apparel acquired Stedman, a designer, manufacturer and supplier of premium casual and blank sportswear for the printed apparel industry based in Germany.

These transactions, along with the geographic interests expressed in ACG’s survey, reflect a growing preference among investors to expand into markets where the perceived political risk is low.

“Cross-border transactions can happen in any number of geographies, but generally speaking, I think we, like many private equity firms, seek to work in markets that have a similar rule of law, and where there is less risk today,” says Strom.

Deloitte’s survey results tell a similar story about the overseas markets that are most active for U.S. buyers. Compared with earlier patterns, U.S.-based corporate and private equity executives who responded to the survey expressed increased interest in cross-border deals involving stable, established economies, often close to their headquarters, including in Canada, the U.K. and parts of Europe.

Cross-border activity between the U.S. and Europe has held on…What we are seeing less of is companies expanding in areas associated with more geopolitical risk.

Alan Zoccolillo

Baker McKenzie

Nearly half (49%) of respondents to Deloitte’s fall 2022 survey expressed interest in Canadian targets, a 15-percentage point increase from the year prior and the biggest gain for any single nation. Australia, Scandinavia and the U.K. each saw an 8-point increase in the percentage of U.S.-based survey respondents who noted acquisition interest in those locations.

The emphasis on well-established economies marks a departure from the recent past. “This stands in contrast to previous year trends focused on the potential upside in developing nations—when there was more appetite for the associated risk,” Deloitte’s report notes.

Zoccolillo similarly has observed a flight from regions perceived as high risk. “Cross-border activity between the U.S. and Europe has held on, and we are also seeing an uptick in Latin America as well,” he says. “What we are seeing less of is companies expanding in areas associated with more geopolitical risk.”

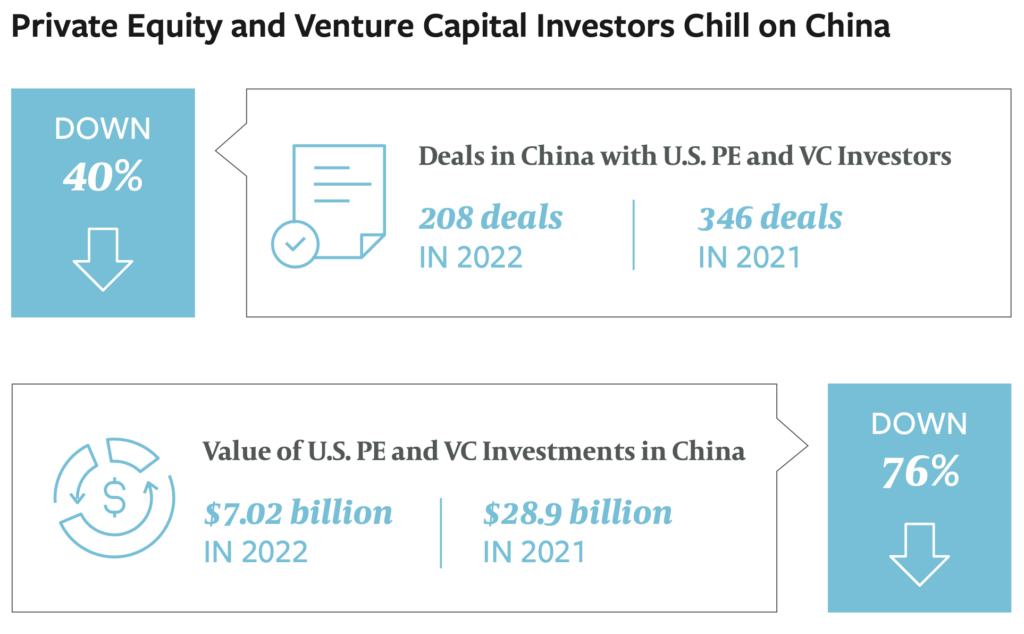

One such area is China, which has experienced a significant pullback of U.S. private equity and venture capital investments in recent years amid geopolitical tensions and strict lockdown measures. In 2022, the aggregate value of U.S. PE and VC investments in China declined roughly 76% over the prior year, to $7.02 billion from $28.92 billion. The number of deals dropped by about 40%, to 208 from 346, according to S&P Global Market Intelligence data.

Story continues below

Source: S&P Global Market Intelligence

Zoccolillo also points to Russia, from which companies continue to flee. According to a study by Yale School of Management, more than 1,000 companies have left or curtailed their operations in Russia.

The Middle East is another region likely to see reduced investor interest, following the October attack on Israel by Hamas and continuing violence. “Recent events in the Middle East will also likely have a substantial impact on the transactional activity in those markets,” says Zoccolillo.

Sector Specific

Naturally, certain types of companies lend themselves more easily to non-U.S. markets. Strom notes that cross-border opportunities in manufacturing and distribution remain popular, as do software and pharmaceutical deals.

According to PwC’s 2023 Key Themes Driving M&A Activity in Health Industries report, major pharmaceutical conglomerates are actively seeking M&A opportunities, including cross-border deals, to fill in their pipelines and achieve their growth plans, as patents for many top-selling drugs are scheduled to expire in the back half of the decade.

Zoccolillo notes that pharma is among the subsectors poised for a cross-border M&A resurgence. “We operate in a number of sectors and are seeing them all pick up a bit, but pharma and energy will continue to be a little more robust. Pharma tends to be a little easier to expand globally than healthcare services, which tend to be a bit more local or regional in nature,” he says.

Still, cross-border healthcare deals outside of pharma are happening. One notable example is the United Arab Emirates-based healthcare platform Pure Health’s investment in U.S.-based Ardent Health Services for $500 million in 2022. Pure Health acquired the minority interest in Ardent, the fourth largest privately held health system in the U.S., from its majority owner, Chicago-based Equity Group Investments.

Technology, meanwhile, has historically been a big driver of cross-border M&A, although that activity has slowed. “There has certainly been a dip in the number of tech transactions in the last year, but we are expecting that to pick up,” Zoccolillo says.

Despite the lull, there have been some big cross-border M&A tech deals. One example is Fremont, California-headquartered Concentrix’s 4.5 billion-euro acquisition of Paris-based outsourcing solutions provider Webhelp from Groupe Bruxelles Lambert. The transaction was one of the largest European deals of 2023.

The difficulty of transacting across borders today ultimately depends less on the sector of the company involved and more on the regulatory environment, something dealmakers should be prepared for.

“There is no industry that is problematic per se. Where we currently see challenges is with antitrust regulators. Regulators are talking to each other more than they did historically and are more coordinated than in previous years, which is leading to longer, more complicated and more expensive transactions,” says Zoccolillo.

Companies that are strategically positioned to complete cross-border acquisitions will continue to be competitive, while others may struggle in the increasingly global marketplace. Yet even as investors tread carefully, signs point to continued activity for dealmaking across borders. “We are always surveying our portfolio companies and thinking broadly about the best ways to expand,” says Strom. “I think we will continue to see cross-border activity in 2024. We are certainly ready to transact.”

Danielle Fugazy is a freelancer writer covering private equity for more than 20 years. She is based in Glen Cove, New York.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.