Challenging Market Brings Seller Opportunities

A look at how creative deal structuring can help with deals even in the toughest environments

Middle-market deal volume was down in the first half of 2023 by 23%, with GF Data reporting on 135 completed deals compared to 175 completed transactions in the first half of 2022.

We have covered the causes of the slowdown extensively in our reports—including cost of capital and an uncertain economic environment—but in this article I’ll explain how creative deal structuring can help win deals even in the toughest environments.

In the past, we have looked at deal terms for clues when we are unsure of how the market is going to proceed.

This section of the report originally appeared in the special edition Middle Market Growth 2024 Multiples Report. Read the full story in the archive.

For example, when deal flow spiked after the pandemic, the deal terms told us that 38% of companies with below-average financials garnered some sort of seller earnouts or financing in the deal. Meanwhile, just 39% of above-average companies received seller earnouts or financing. (GF Data classifies reporting companies with greater than 10% trailing 12-month (TTM) revenue growth and at least a 10% TTM EBITDA margin as “above-average financial performers.”)

Fast-forward to the first half of 2023, which witnessed a banking crisis and successive interest rate increases, and the script has flipped. We’re now seeing seller earnouts or financing in 42% of deals involving companies with below-average financials. The percentage of deals involving above-average businesses that received seller earnouts or financing also rose significantly, to 47%.

The challenging market environment clearly is driving more use of seller earnouts and financing, but it also appears to have fostered an environment that favors rollover equity as a bridge to getting deals done. In the first half of 2023, we saw more instances and higher amounts of seller rollover equity (12% of deals in the first half of 2023 compared to 9% over the last five years). While these deals require a greater financial commitment for the seller, they can often turn out to be lucrative for them—especially when the deal involves an above-average financial performer.

Source: GF Data

Source: GF Data

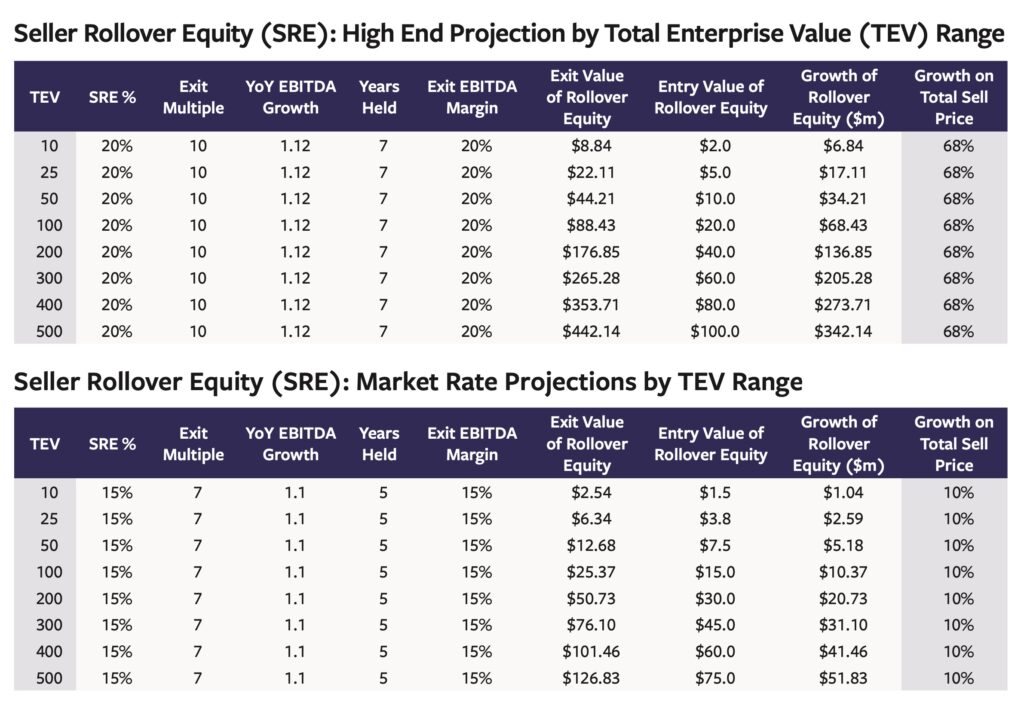

When we look at the total value of a deal along with the typical return on investment at exit, a 15%-20% offering of seller rollover equity can lead to incredible value for the seller. The two charts detail examples of return on rollover equity upon exit at both a high and low end.

At the high end, I assume a 10x exit multiple, with EBITDA growing year over year at 12%, a seven-year holding period and an EBITDA margin of 20% at exit. With these assumptions, the seller’s rollover equity upon exit has grown by 68%, with a multiple on invested capital (MOIC) of 4.42x and a 23.65% internal rate of return.

At market rate, I assume a 7x exit multiple (approximately the current average multiple for all industries tracked by GF Data), with EBITDA growing year over year at 10%, a five-year holding period and an EBITDA margin of 15% at exit. With these assumptions, the seller’s rollover equity upon exit has still grown by 10%, with an MOIC of 1.69x and an 11.11% IRR.

While these deal structures ramp up in the transactions that are being completed in a difficult buyer’s market, they have allowed TEV/Adjusted EBITDA multiples to remain relatively stable while not completely bringing deal flow to a halt.

Austin Madronic is the research manager of GF Data, an ACG company. GF Data collects and reports on platform and add-on acquisitions completed by private equity funds and other deal sponsors in the $10 million to $500 million enterprise value range. For information on subscribing, or on contributing data as a private equity participant, contact us at info@gfdata.com.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.

GF Data and FORVIS Team Up For Roundtable Discussion Series

GF Data, an ACG company, and FORVIS are pleased to announce they are partnering in the coming year to host two roundtable discussions covering trends in the middle market for technology and business services companies, and their impact on valuations and operational issues.

These invitation-only sessions will bring together senior personnel in finance from portfolio companies as well as investment banking and private equity professionals working with these businesses. The roundtable discussions will begin with a review of GF Data’s quarterly data and will bring unique perspectives to the market analysis as well as FORVIS’ market-leading insights and forward vision in accounting, tax and consulting.

The first GF Data/FORVIS roundtable will take place at ACG Atlanta’s M&A South 2024 conference in Alpharetta, Georgia, on Feb. 5 and will focus on technology and business services companies with a deep dive into valuations and operational issues.

A second roundtable is planned for New York City in the summer. While attendance is by invitation only, please email Bob Dunn, GF Data’s managing director, at bdunn@acg.org for more information if you are interested in participating.

GF Data offers the most accurate valuations on private equity-backed middle-market businesses valued between $10 million and $500 million. Through its network of more than 300 contributing private equity firms, independent sponsors, family offices and mezzanine investors, GF Data helps deliver clarity to the middle market through its quarterly reports and online searchable database. Visit gfdata.com to learn more.

FORVIS, LLP is an integrated professional services firm with a global reach and a passion to drive businesses forward. The firm’s 6,000 dedicated team members provide an Unmatched Client Experience® through the delivery of assurance, tax and consulting services for clients in all 50 states and internationally.

FORVIS’ dedicated private equity professionals cross multiple service lines to support middle-market firms, investment funds and their portfolio companies in several industries, including technology and business services. The firm tailors its approach based on client needs and routinely uses its deep global resources to develop strategies and services for clients’ success, now and in the future. Visit forvis.com to learn more.

GF Data and FORVIS will also be at DealMAX 2024 in April in Las Vegas. We hope to see you there!