Looking to 2020: Consumer Is King Amid Slowing Growth

RSM's chief economist looks at household spending, trade policy and fiscal conditions, and how they bode for the U.S. economy in 2020.

This article is sponsored by RSM US LLP. It was originally published on RSM’s The Real Economy Blog on Nov. 18.

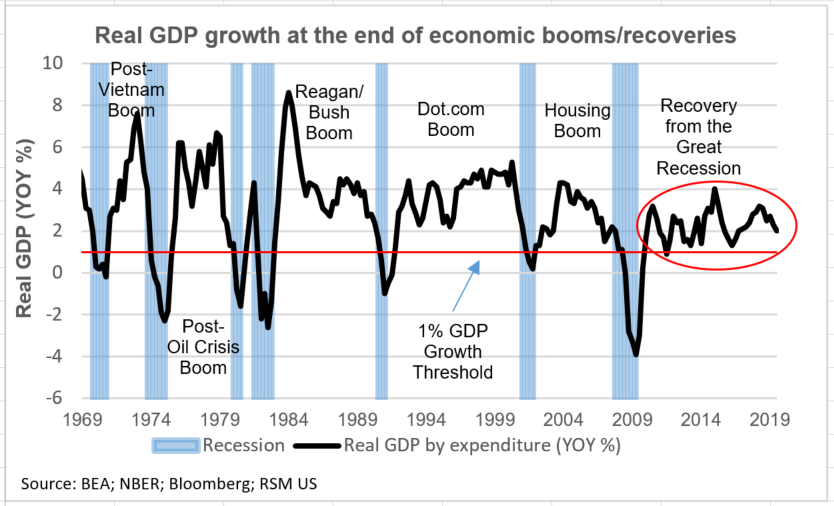

The American economy will continue to slow toward a growth rate of 1.5% in 2020, below its long-term average of 1.8%, as sturdy consumer spending compensates for financial volatility and erratic trade policy. That consumption, though, increasingly depends on rising asset prices that help boost confidence, and solid job growth. As long as consumers, particularly those with higher incomes, stay confident, the domestic economy should continue to show modest, if unspectacular, growth in 2020.

Behind this slowing growth is a somewhat imbalanced domestic economy. The service sector is experiencing brisk growth, while manufacturing and agriculture continue to contract. So while 75% of the economy is doing just fine amid low unemployment and solid spending, one quarter is experiencing outright contraction and rising job losses. Still, overall wage growth near 3% and relatively low unemployment across the board should continue to foster enough economic activity to avoid a recession in 2020 as long as cooler heads prevail in the trade war and financial markets.

The primary drivers for our call for below-trend GDP growth are the risks around the trade war and the uncertainty around the 2020 presidential election. We do not expect a trade deal that boosts overall economic activity. The potential use of presidential power to label European automotive imports as a domestic security risk remains the largest threat to the outlook, one that could even spell a premature end to the business cycle. While we expect no announcement on European auto tariffs in 2019, we do expect movement by spring of next year.

Cars, Planes and Elections

In addition, challenges in the domestic auto and aerospace sectors continue to damp overall manufacturing activity. In particular, once Boeing restarts production of its problematic 737 Max, some pent-up demand will provide a boost to overall business investment. But we do not anticipate an increase in production until mid-2020.

We also remain skeptical about a significant economic boost from a “phase one” trade deal with China that has been capturing headlines. Rather, we view this as reaffirmation of the status quo, which includes no new tariffs placed on Chinese imports, as Beijing promises to purchase agricultural products from the United States. To obtain a significant economic boost from a trade deal, a much more substantial agreement involving the rollback of taxes on imported goods would be required; we do not anticipate this before the election. If a substantial rollback of tariffs does occur, then we would revise our growth forecast higher.

Then there is the presidential election. The two quarters leading up to the vote during the past three election cycles have seen flat capital expenditures as businesses await the election outcome. And already this year, fixed business investment has fallen by 6.3% and 1.5%, respectively, during the second and third quarters. Add to this the deep polarization around the direction of policy, we think that overall investment will continue a downward trend during the first three quarters of 2020. This is the primary rationale for our call of growth near 1% during the first half of the year before returning to just above trend in the second half of the year as pent-up demand for capital expenditures is released.

By the second half of 2020, the lagged impact of global monetary and fiscal accommodation, as well as an improved domestic manufacturing outlook linked to strong aerospace activity in the United States, should boost overall activity slightly above the 1.8% long-term trend. A rebalancing in the composition of growth would put the economy on a much better footing, as slowing in overall hiring drops below 100,000 jobs per month and the unemployment rate begins to rise ahead of the election.

“As long as consumers, particularly those with higher incomes, stay confident, the domestic economy should continue to show modest, if unspectacular, growth in 2020.”

Household Consumption

Low unemployment, modest wage growth and an elevated savings rate near 8% all reinforce our confidence that the condition of the U.S. consumer will more than offset the drag from trade and investment in 2020. Annual bonus payments to workers and the move toward a $15-per-hour minimum wage in the 20 largest metropolitan statistical areas in early 2020 will continue to place a foundation underneath the economy. But the risks to the outlook are increasingly linked to volatility in asset prices and rising economic inequality.

For some time, we have noted that the evolution of economic inequality has reframed the way in which we look at household consumption. In our estimation, 40% of households — the two upper-income quintiles — are now responsible for 60% of overall spending. For this reason, consumption will remain strong as long as a minority of upper-income households remain confident in the growth of their liquid portfolios and illiquid assets. If the equities and housing markets remain strong, overall household consumption will drive growth at or near the economy’s long-term potential. But should these asset prices drop — much like the 20% drop in equity prices during the final three months of 2018 that resulted in a sharp decline in spending — then the risk of a slower pace of growth would increase.

Financial Conditions

Given the upcoming presidential election, we anticipate that the Federal Reserve will remain on hold for the duration of 2020. We expect the policy rate will remain in a range between 1.75% and 2%, despite a slower pace of growth in the economy. The term spectrum will be defined by a modest steepening of the fixed income curve in which the American 10-year yield tends to float between 1.75% and 2% during the year. We expect the dollar to grow modestly stronger on the back of more accommodative monetary policy from the European Central Bank, the Bank of England and the Bank of Japan.

As global central banks and fiscal authorities act to offset slower global growth, we would expect that capital flows will gravitate back to dollar-denominated assets, dampening rate increases along the long end of the curve and bolstering the value of the dollar.

We also expect that lagged impact of the Fed’s easing of interest rates will bolster residential investment during the first half of 2020, which, coupled with a strong labor market and modest wage growth, should provide solid support for overall growth. It will most likely be a bright spot in an otherwise dour fixed business investment outlook. If rates follow along our path of lower rates, this should boost sales and broker commissions, which will also support overall growth.

Overall financial conditions determined by a combination of money markets (U.S. Ted Spread, LIBOR/OIS spread, the Commercial Paper/T-Bill Spread), U.S. Bond Market (Baa/10-year treasury spread, US high-yield/10-year treasury spread, U.S. Muni/10-year treasury spread, swaption volatility index), U.S. Equity Markets (S&P 500, VIX Index of S&P 500 Volatility) stand at .41 standard deviations above neutral, which implies that conditions for modest growth remain solid. If housing and technology financial conditions are included, that improves to 1.6 standard deviations above neutral, which points to some upside risk on household consumption given the imbalance and inequality inside the economy.

Recession Risks

While our baseline forecast is predicated on slower overall economic activity, we do not anticipate a recession next year. Our model implies a 34% probability of a recession over the next 12 months, which is not consistent with an economic contraction in 2020. Household consumption at or near 2.5% is sufficient to compensate for the 20% to 25% of the economy – manufacturing, agriculture and transport – that is in recession. Those sectors are simply not large enough to drag down the broader service sector, whose growth is linked to low unemployment and modest wage growth. But if the trade ward intensifies, or there is a large shock to the economy over, say, energy, the risk of recession would grow.

Fiscal Matters

Over the past two years, growth has been bolstered by large increase in fiscal outlays on defense and social spending. During the first three quarters alone, government spending increased, by 2.9%, 4.8% and 2%, respectively, representing an important and overlooked driver of domestic growth. But given the rising acrimony in Washington, we do not foresee another large increase in the annual operating budget for the 2020-2021 fiscal year and expect a growth rate in government expenditures of closer to 1.5% next year.

Subscribe to The Real Economy blog to receive email updates.

Joseph Brusuelas is chief economist for RSM US LLP. He provides macroeconomic perspective to help RSM clients anticipate and address the unique issues and challenges facing their businesses and the industries in which they operate. In 2015, he helped launch The Real Economy, the only monthly economic report focused on the middle market, and helps lead the firm’s cutting-edge Industry Eminence Program. Prior to joining RSM as chief economist, Joe was a senior economist at Bloomberg, LP and the Bloomberg Briefs newsletter group.