What Kennedy’s Confirmation as Health Secretary Could Mean for Food M&A

As criticism against ultra-processed foods grows, strategic and PE food investors could be impacted differently, says Balmoral Advisors’ Bob Dekker

Ultra-processed foods have found themselves in the headlines lately as health-conscious consumers, regulators and policymakers shed light on the potential implications of consuming products that are extensively processed and contain multiple food additives, including preservatives, artificial flavors and food dyes.

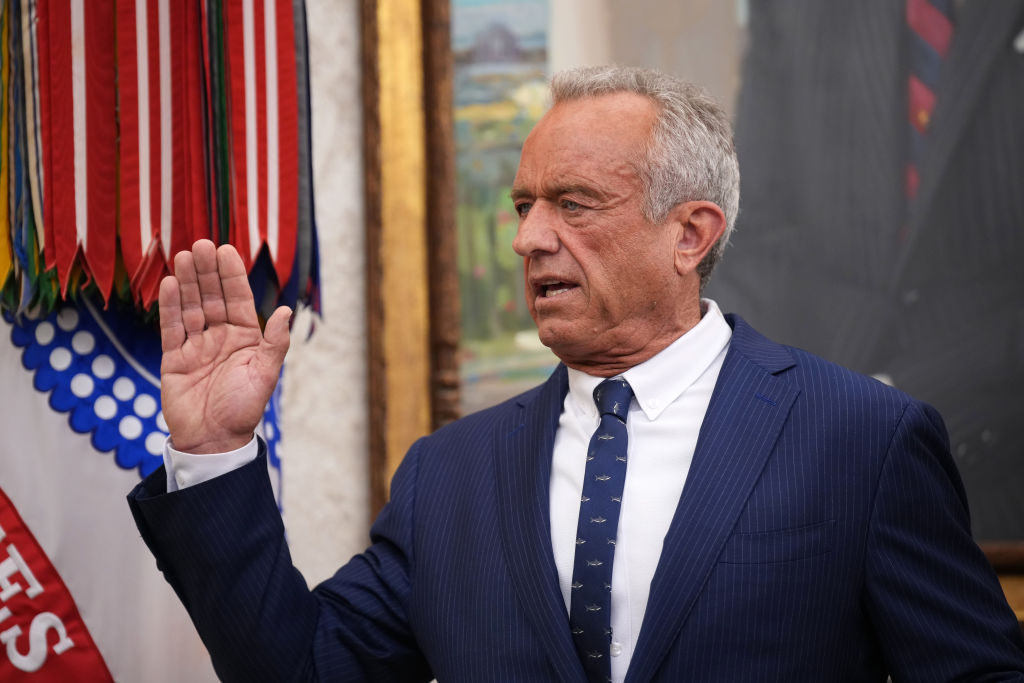

From the Food and Drug Administration’s ban of synthetic food dye Red No. 3 in January, to the confirmation of Robert F. Kennedy Jr.—a vocal opponent to ultra-processed foods—as health secretary last week, the spotlight on food manufacturing procedures and ingredients is likely to continue.

According to Bob Dekker, managing director of Balmoral Advisors’ Food & Beverage practice and co-chair of ACG Chicago’s Food & Beverage Committee, M&A dealmakers in the food and beverage space—spanning consumer packaged goods (CPG), food manufacturing and ingredients suppliers—are paying attention to the criticism of ultra-processed foods.

But how they’ll respond depends on where you look, he says.

Strategics on the high end of the market are active in the space, and recent criticism of ultra-processed foods “is not going to have a significant impact on overall dealmaking with large industrial food companies in the short-term,” Dekker tells Middle Market Growth. He points to several recent high-profile deals among corporate acquirers involving brands with products that fall within the ultra-processed category, including Mars’ $36 billion acquisition of Kellanova, the maker of snack foods like Pringles, in August, as well as PepsiCo’s acquisition of Siete Foods, a brand that makes a variety of snacks, for $1.2 billion in October.

“It almost seems like there is a land grab going on now, particularly in the snacking business, among the big food players,” adds Dekker.

In the middle market, private equity firms are more focused on health and wellness investments, a trend that began before this recent wave of ultra-processed food skepticism. In his own line of work, Dekker says PE investors are largely focused on ingredients and beverages businesses in the natural, organic and healthy snacking niches, and less interested in the CPG space, a category into which ultra-processed food items typically fall.

Kennedy’s confirmation as health secretary is “going to bring a lot more attention to the space,” and is likely to reinforce PE firms’ existing investment thesis on healthier, “clean-label” products, says Dekker. Kennedy is a vocal advocate for additional bans of food additives similar to Red No. 3, as well as for eliminating ultra-processed foods in student lunches. Such initiatives could see PE backers dig their heels even deeper into the health-focused food and beverage spaces, and potentially weigh down on valuations of CPG, food manufacturing and ingredients business that operate in the ultra-processed foods arena.

Strategics may, at some point, begin to consider whether potential lawsuits related to health impacts from ultra-processed foods could further erode the value of their investments, notes Dekker, who adds that surging popularity of weight loss drugs like Ozempic could place even more downward pressure in this corner of the food and beverage market.

According to Dekker, more research is needed on ultra-processed foods’ impact on health, and that developing a more broadly-accepted definition of what an ultra-processed food even is will be important going forward. For now, investors will continue to watch how policy around ultra-processed foods evolves, and how growing attention on these products influences consumer behavior.

Carolyn Vallejo is ACG Media’s Digital Editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.