PE Firms Mull Legal Spend

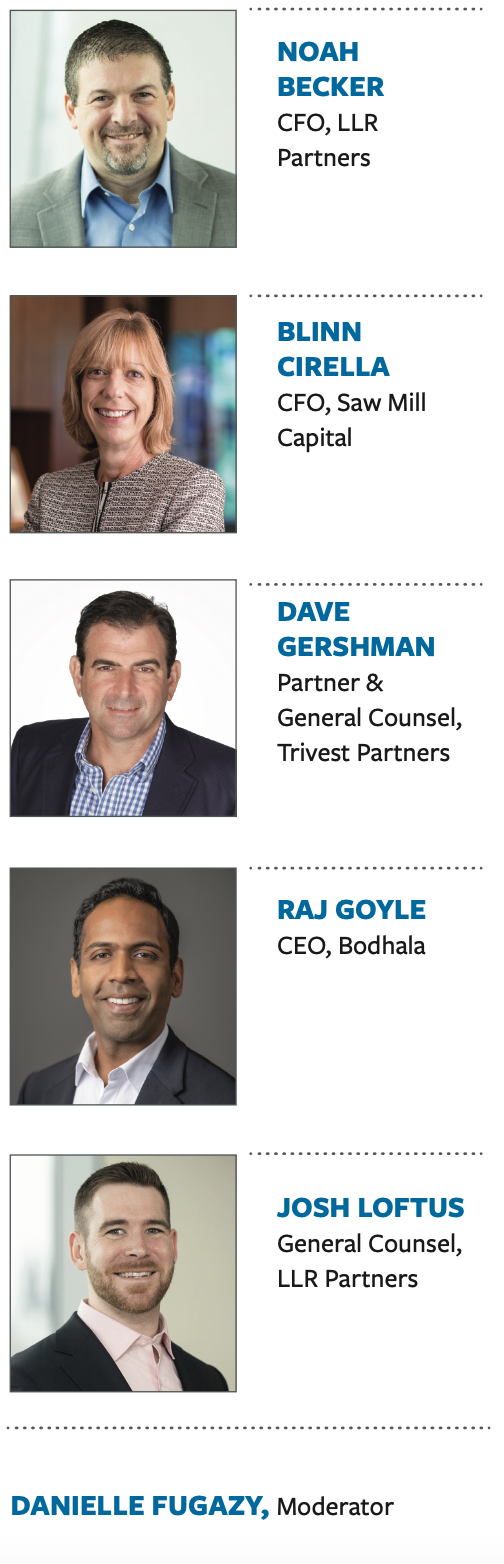

A group of private equity professionals discuss legal spend optimization in this round table sponsored by Bodhala.

Legal is one of the largest spending categories for private equity firms today.

In 2021, a group of private equity professionals came together to talk about how they manage legal spend and explore ways to save money while still getting the legal services they need to close deals and run a successful firm.

This section of the report originally appeared in Middle Market Executive’s Winter 2022 issue. Read the full story in the archive.

The roundtable was sponsored by Bodhala, a legal spend management platform. What follows is an edited and condensed version of the conversation.

DANIELLE FUGAZY: What are some of the pain points for your firm when it comes to legal spend?

DAVE GERSHMAN: When we started looking into our legal spend, it started with questions like: how much are we spending per deal, which seems like a pretty simple thing you should be able to answer.

But when you start digging into it, it requires real digging. And the deal we would agree to on hourly rates was a game of whack-a-mole. They’d do it for one month and then the next month they’d be back to the rack rate and we’d have to call them on it.

JOSH LOFTUS: We’re not focused on an individual hourly rate and getting a discount from that or what’s appropriate for mid-level associates versus a junior associate. We’re much more focused on a value-based spend for a project. If you tell me you’re charging me $200,000 an hour, and that’s what I think the project is worth, you better be able to get it done in an hour. If it takes you more than that, I want 90% off your 10-hour rate. We’re not really focused on an hourly rate, but rather on a value-based approach to the entire billing cycle and know- ing what we expect something to cost going in, even if the time spent varies.

DAVE: We want to have good data, that’s my first goal. My second goal is to know my spend. I can’t have the hard conversations with law firms if I don’t know what it’s worth. If I got those two things done, that’d be great.

We did 16 acquisitions in one portfolio, and I had to call the CFO of the portfolio company to get the data and get all the law firms’ names to triangulate the data. We have now started adding these fields through our work with Bodhala, which is allowing me to pull and sort data. It’s been getting it to where I need it to be and it has not been that painful.

DANIELLE: Would you use this data as a benchmark toward investment professional performance and how they manage spend?

DAVE: Our investment professionals view every dollar they put into portfolio companies as something we are grading them on. Our investment professionals are going to grade our portfolio management on a return to capital. Our investment professionals are our best negotiators. Having this data will arm them with better knowledge to let portfolio companies know, not in an accusatory way, what they are spending on legal.

BLINN CIRELLA: For many years we used a very large, well-known law firm to do deals, but we don’t do large deals. We found over time our closing costs just kept creeping up, so we changed to a more reasonably priced mid-sized firm.

Our new firm does a great job. Our deal guys do own the relationship, but they all use the same firm because we get at least some buying power. But the question here is, “How do you know what you’re supposed to be paying?” That’s a really good question.

RAJ GOYLE: So many professionals doing this work don’t have any information to do the analysis. They’re busy as hell, legal bills are basically ancient hieroglyphics, and they come six weeks after the work is done. By the time professionals look at these line items, they can’t really make head or tails out of it. They are looking at the bill and saying, does this feel okay? With Bodhala’s software, teams are able to see that their buddy at one law firm is three times more expensive than their new friend at a different law firm.

DANIELLE: Would most of you agree that while you never want to waste money, legal cost isn’t a front burner concern because it is considered a derivative of good dealmaking?

NOAH BECKER: You don’t want to be penny wise. We always want to get the deal right and get all the terms right because there’s a lot more dollars

at stake than saving $25,000 on a deal. However, if you have a portfolio company that’s doing lots of acquisitions and they’re paying an extra $25,000 or $100,000 every time, you will want to focus on it. But at the end of the day, you need quality, and, with that quality, you want the best cost you can get.

DAVE: Once you have some data there’s an opportunity to sit down with law firms and have a conversation about what you want from them and what you want to pay.

You don’t want to be penny wise. We always want to get the deal right and get all the terms right because there’s a lot more dollars

at stake than saving $25,000 on a deal.

DANIELLE: How do broken deal fees impact legal spend?

JOSH: We’ve been relatively successful on broken deals. It was a pain point and something we focused on over the last two years. We would tell our repeat law firms that there is the cost of doing business for them too. Some of those deals don’t make it to con- summation, and the rate we’re willing to pay without a portfolio company to show for it is significantly less.

RAJ: One of our big deliverables for our clients has been arming them with the data in negotiations to get more aggressive broken deal fees. Frankly, the law firm industry is one where if you don’t ask you don’t get. Law firm partners are trained to just charge if there isn’t a squeaky wheel.

DANIELLE: Raj, how has Bodhala tried to address some of the challenges faced by private equity firms?

RAJ: Bodhala has been around for about five years now, but in that short amount of time, we’ve established ourselves as the leading legal spend optimization solution in the market. Legal is the largest indirect spend category in private equity and it is probably the least understood in terms of the opportunities to optimize it. Given this information, it may come as no surprise that mid-market PE is our largest growing sub-vertical.

The way the legal services market is set up has certainly influenced the issues that plague private equity firms’ in-house teams. The entire buy-side, sell-side dynamics in law are inverted. Clients should be demanding transparency, competition, data innovation, price discovery and the benefits of competitive forces—but there are none of those advantages. In fact, the advantages all accrue to the sell-side vendor— the law firms control pricing. There is no industry outside of oligopolies or monopolies where the sell-side sets the price except in law. The whole industry has been set up for the benefit of those law firm economics.

But thanks to cloud computing, AI and machine learning, there’s now an incredible amount of data that the buyer of legal services can have to make sure that they are getting the best value.

At Bodhala, we’re disrupting the status quo. By leveraging sophisticated analytics and smart benchmarks, we’re driving price discovery and competition within the legal services market. We’re arming in-house teams with the transparency they need across key practice areas, timekeepers, deal types and tasks in order to make key business decisions and better understand the “should-cost” of their matters. With these insights, private equity firms can take a much more strategic approach to firm selection, performance tracking, rate negotiations and more.