ESG Takes Center Stage

Investors are increasingly asking about a company’s environmental risk factors, how it treats its employees and the community at large, and how it is governed.

This story originally appeared in the Winter 2021 print edition of the Middle Market Growth Outlook Special Report. Read the full report in the archive.

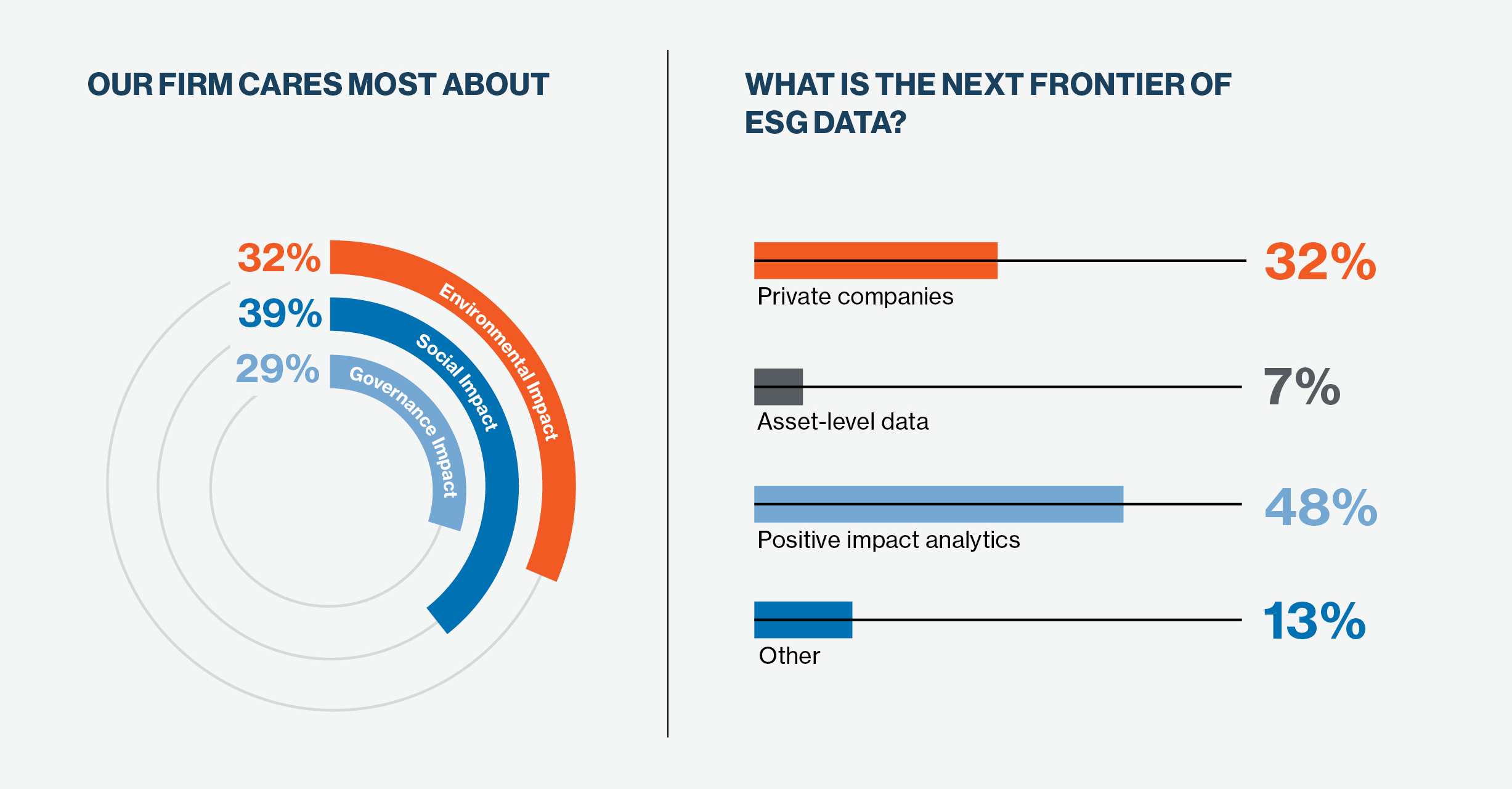

The Black Lives Matter and #MeToo movements have grown in recent years in response to a wave of stomach-churning events and tense demonstrations. These calls for greater equality and diversity, coupled with severe storms and wildfires, underscore the move by many middle-market private equity firms to look beyond the balance sheet when evaluating investment opportunities. Environmental impact, social criteria and corporate governance (ESG) are undoubtedly playing a larger role in the private equity world today, according to a recent survey conducted by the Association for Corporate Growth and sponsored by S&P Global, a provider of independent ratings, benchmarks analytics and data to the capital and commodity markets1.

Commonly known as ESG, this set of criteria for evaluating companies is regularly becoming part of the due diligence process. Investors are increasingly asking about a company’s environmental risk factors, how it treats its employees and the community at large, and how it is governed with regards to executive pay, tax audits and shareholder rights.

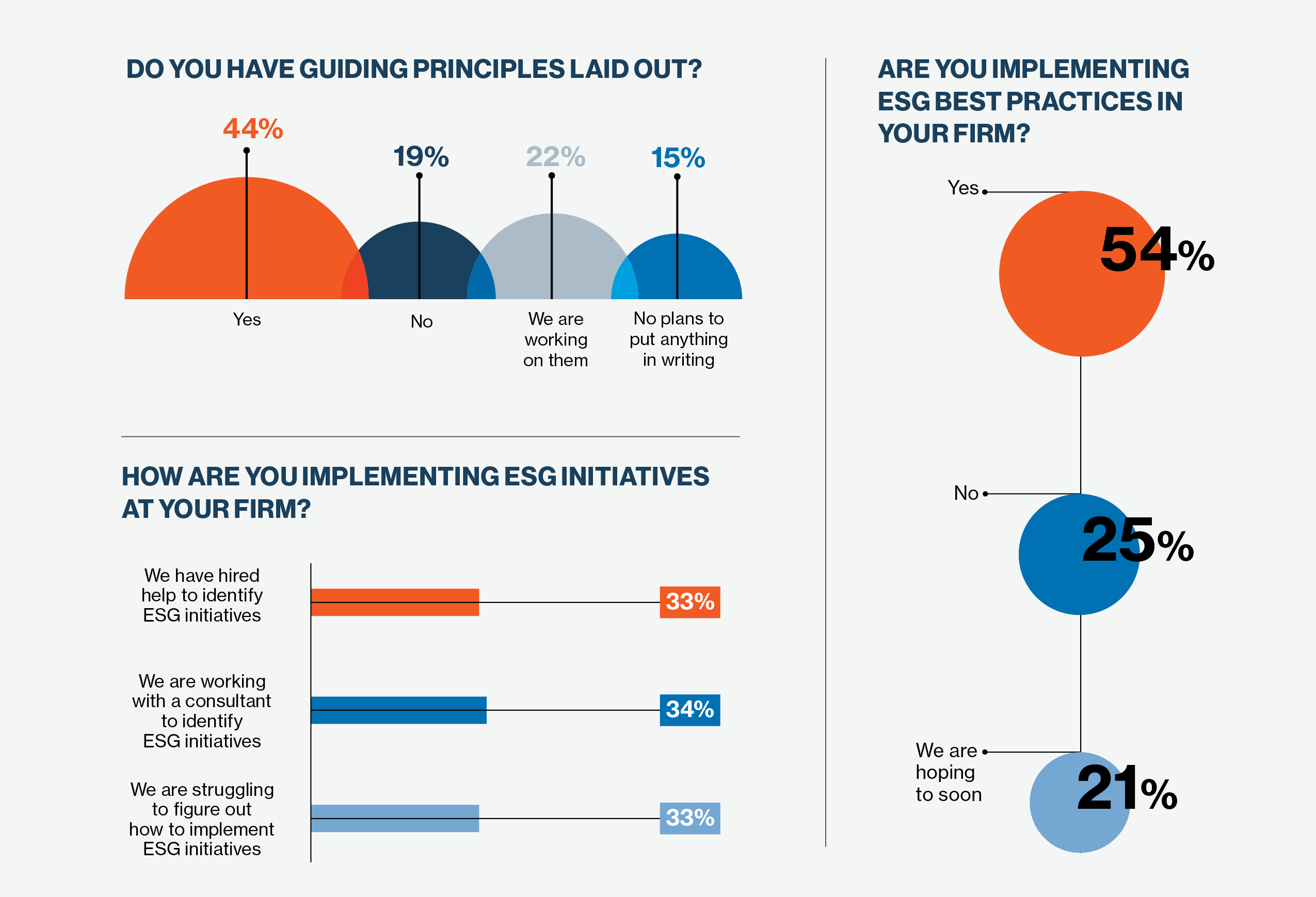

A little more than 50% of those surveyed said they are implementing ESG best practices at their firms. According to business advisory firm FTI Communications, references to terms like “sustainability,” “ESG,” “climate change,” and “human capital” more than doubled in 2020 disclosure forms compared with two years ago and more than tripled compared with five years ago.

Howard Morgan, partner and co-founder of Argand Partners, a New York-based middle-market private equity firm, is surprised that the number of firms implementing ESG best practices isn’t higher. “I think the devil’s in the details as to what is ‘best practice,’” he says. He added that while his firm is implementing ESG best practices, “the whole area is still fairly young.”

I’m not going to be investing in a company that’s making video games about violence. I just won’t do it.

Liddy Karter

Managing Director, Mizzen Capital

The extent to which private equity firms will change anything about their governance, hiring practices or their impact on the community is almost always driven by their need to improve their portfolio companies’ performance and push for stronger returns, says Liddy Karter, a managing director with Mizzen Capital, a lower middle-market private equity firm.

Mizzen only invests in socially responsible businesses. “I’m not going to be investing in a company that’s making video games about violence. I just won’t do it,” Karter says.

Although more than half the firms surveyed said they are implementing best practices at their firm, when asked if their firms have ESG guiding principles laid out, about 40% either did not have a plan or were working on putting together guiding principles.

Karter says that changes need to be fundamental and of course that takes time. “Some of my peer group funds are saying more frequently, ‘Gosh, we need to get some more minorities in our partner ranks. We need to get more women—as though suddenly that’s going to change anything. It should not be an overlay. It needs to be thought out,” she says. “If you think about something, you write it down because that’s how you clarify your thoughts. I don’t know why anyone would not write it down except that they’re not serious about it.”

While many middle-market private equity firms may not be quite at the implementation phase yet, 61% of firms said that they were planning to adopt ESG guidance because it was the right thing to do—not because they were forced to by investors. More than 20% believe adopting these principles and best practices would lead to better returns.

For example, Argand Partners implements ESG practices with its investments because the firm’s management team believes it will result in better outcomes, better earnings, higher margins and a better multiple upon exit. “There is an element of doing good, but we’re fiduciaries for our LPs. Ultimately, our responsibility is to look to deliver a good result,” says Morgan.

Karter says it’s only realistic for firms to be keeping an eye on the returns with everything they do.

“You have to maximize your returns. If you’re not, you’re probably not doing a good job running whatever you’re running,” she says. “If you don’t maximize returns, what are you doing?” Karter added that it’s not just the returns to the investors that need to be considered. They should also focus on creating a stable place for employees to work and being a good community member.

ESG in Action

Overwhelmingly, private equity firms say they want to try to work with companies that are taking ESG issues into account.

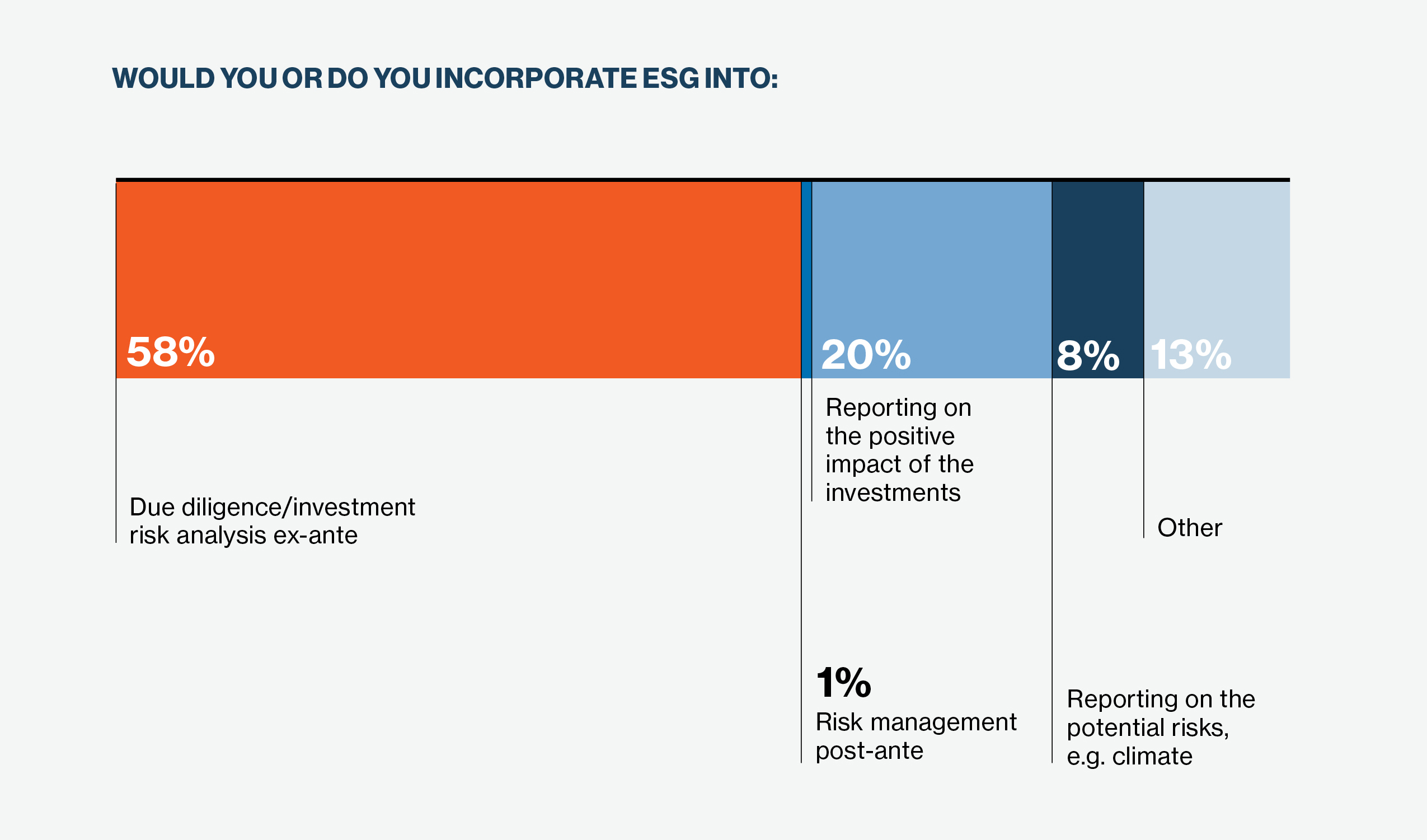

Nearly 60% of respondents said they incorporate ESG into due diligence and/or investment risk analysis.

Morgan calls ESG a “mandatory topic” in all of his portfolio company’s investment papers and has since he founded Argand five years ago.

“If there’s an environmental problem or labor and governance issues in the past, the lawyers and accountants always focused on the downside. What we’re trying to do is find the upside opportunity,” says Morgan, adding that one of his portfolio companies is one of the few competitors in its sector that recycles materials. While most believe in that particular industry that recycling is a disadvantage because of the cost, the investment has “turned out to be a fabulous business and investment for Argand,” says Morgan. “Putting an optimistic view on what can be done with the business, that’s where private equity should go.”

There is an element of doing good, but we’re fiduciaries for our LPS. Ultimately, our responsibility is to look to deliver a good result.

Howard Morgan

Partner and Co-Founder, Argand Partners

As the private equity industry continues to evolve, it’s clear from the survey results that the question is no longer whether implementing ESG practices is good for the firm and investment thesis. The question has evolved into: How can we implement best practices going forward? Survey respondents were nearly evenly divided on their implementation methods: 34% of respondents are working with a consultant to identify ESG initiatives while 33% said they are “struggling to figure out how to implement ESG initiatives.”

There’s no question that implementing ESG best practices comes with a price tag. As a result, larger firms with more resources have been leading the charge. “I’m not sure this is an outsourced silo, but nonetheless it takes resources and time to make these initiatives successful. At our firm, we want everybody personally to be driving this forward,” says Morgan.

ESG Opportunities in Thought and Action

Even after firms figure out how to move forward with guiding principles, putting ESG principles into practice will take time, patience and constant education. It can often be a challenge for people to push past their own experiences and move forward anew. There’s often defensiveness when it comes to change, Karter warns.

“I’m on the board of an oil field services company and they cannot tolerate it when I drive up in my Tesla. They just hate it because they feel like that’s just somehow missing the point of their company,” says Karter. “And I’m saying, no, your company’s done a great job for what it’s done all those years— but there’s maybe a new way to think about things.”

With all the work that needs to be done, ESG initiatives continue to evolve. Senior management never gets to announce that they have reached ESG fulfillment.

“ESG is evolving and it’s a journey,” says Morgan. “We have to continue to push forward.”

1 Between September 8 and November 3, ACG surveyed deal-makers about trends in ESG in 2021 and other topics. More than 600 people responded to the ACG surveys.

Want to learn more about how ESG is impacting the middle market?

Join ACG Los Angeles for the virtual panel discussion “Environmental, Social & Governance (ESG): Why It Matters Today in the Middle Market” on April 20. Hear from Alex Bernhardt, director at Marsh & McLennan Advantage, as he discusses environmental, social, and governance issues and how the thoughtful application of current best-practices can yield tangible benefits.

Register here today.