Water Utilities Investors Take On Climate Change

Investors bet on water companies to solve for multiple issues, including water scarcity, global warming and aging infrastructure

Water shortages in cities across the U.S., shrinking lakes and rivers, and unpredictable weather patterns have shined a spotlight on water scarcity and preservation. In response to these challenges, deals in the water utilities sector have been increasing.

Although activity is light this year—in line with the rest of the M&A market—water specialists say the opportunity set is vast and will continue to pick up because of long-term trends affecting the sector that include water scarcity, climate change, aging infrastructure, increasing regulation and population growth.

“There are long-term, attractive secular trends around water management and treatment,” says Michael Oleshansky, managing director at investment firm PSP Capital Partners, which owns a company focused on stormwater management.

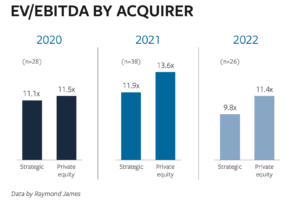

The deals moving forward today usually involve high-quality companies that offer a unique product or service, smaller businesses that don’t require much debt financing, or strategic deals funded with cash and stock. In fact, strategics have been especially competitive in the water utilities arena for some time, representing about 80% of M&A activity in the sector for the past three years, according to investment bank Raymond James.

For their part, private equity firms are primarily seeking high-quality, premium assets when acquiring new platforms. “A company that is a market leader, has a proprietary technology or product, operates in a fragmented industry ripe for consolidation or has demonstrated strong revenue/margin growth is more likely to trade at frothier multiples,” says Brendan Tierney, managing director and head of Global Water at Raymond James.

Water-focused bankers at Baird say that the market is being selective, but interest remains strong for high quality companies. “Amidst a softer, more uncertain market, buyers are picking their spots, while some see a window to do something transformational,” says John Kinsella, director in Baird’s Water & Filtration group.

There are long-term, attractive secular trends around water management and treatment.

Michael Oleshansky

PSP Capital Partners

The Strategic Advantage

Advisors say strategics are in an advantaged position for deals in the water utilities sector, given healthy balance sheets and the ability to buy companies with stock and cash. They are also paying top dollar for quality assets. “When a premium water asset becomes available, we’ve seen strong competition, and companies will step up and pay a compelling price,” says Steve Guy, managing director and global head of Water & Filtration at Baird.

In a strategic deal in May, Xylem, a publicly traded water technology company, acquired Evoqua, a provider of water and wastewater treatment systems, for $7.5 billion and a high valuation of 25x EBITDA. In an announcement about the deal, Xylem President and CEO Patrick Decker noted, “Global awareness of water as a systemic risk to society has never been greater. Investment in water solutions continues to accelerate as communities and businesses around the world address intensifying challenges like water scarcity, quality and resilience to climate change.”

Several other strategic water deals, including Whirlpool buying InSinkErator, Pentair acquiring Manitowoc and Zurn Water Solutions purchasing Elkay, came in at multiples in the mid to high teens in 2022.

Related content: Climate Change Alters the Real Estate Renovation M&A Landscape

Still, M&A volume in water has cooled off lately because sellers are unable to get the same transaction multiples that they saw just 12 months ago, largely due to macroeconomic headwinds.

“Part of the reason for lower transaction volume is fewer exits from financial sponsors who don’t think they will get a strong multiple in the current market, but for strategics with great balance sheets, there is room to make acquisitions,” says Guy. “But the business has to be perform- ing well to withstand the scrutiny of the market,” he says, adding that the lesser quality companies or companies with lower quality earnings aren’t being marketed right now.

Adding On

Although debt financing is hard to come by, private equity firms are still competitive in smaller deals and add-ons, with many having acquired

platforms in the water utilities sector that they’ve been using to tack on smaller businesses.

Valuation multiples in the water industry tend to vary greatly depending on the type of business, but platforms can expect to trade for 10x-15x EBITDA, while small add-ons can go for 4x-8x EBITDA, according to Raymond James’ Tierney. “Like most industries, multiples are largely driven by the size and uniqueness of the asset, as well as its financial characteristics,” Tierney adds.

In May 2021, New Mountain Capital bought Aegion Corp. in a take-private deal valued at $1.1 billion, or $30 per share, and has since completed several add-ons. New Mountain had been looking at the St. Louis-based company for years and saw an opportunity to focus it on water and shed some of its unrelated assets.

Some of the old infrastructure in water pipes will continue to need upgrades, so New Mountain saw a long-dated opportunity in Aegion, which provides infrastructure maintenance, rehabilitation and protection solutions. “There are estimates that it could take up to 100 years to fix leaks in pipes,” says Joe Delgado, managing director at New Mountain. Currently, it is estimated that about 30% of water is lost in the pipes. “It’s incredibly economic to get things right,” he says.

Following New Mountain’s acquisition, Aegion divested an energy services division and completed five add-on acquisitions, including underground excavation company Next Level Environmental and trenchless rehabilitation provider Infraspec Services.

Another company actively pursuing add-ons is Komline-Sanderson, a designer and manufacturer of equipment and aftermarket solutions for water treatment, liquids filtration, and separation and air pollution control, backed by private investment firm Sunny River Management. Komline has made six purchases since Sunny River acquired a majority stake in the New Jersey-based company in 2021. Most recently, Komline acquired Wyssmont Co., a designer and manufacturer of equipment for product filtration, thermal processing, wastewater management and other industrial applications in June 2022.

Fausto Lucero, principal at Sunny River, says the firm generally employs a buy-and-build strategy. Komline’s management was looking to grow through acquisitions, so the shared goals made sense for the deal. The company was already growing and has quadrupled in size since its acquisition by Sunny River.

Fausto Lucero, principal at Sunny River, says the firm generally employs a buy-and-build strategy. Komline’s management was looking to grow through acquisitions, so the shared goals made sense for the deal. The company was already growing and has quadrupled in size since its acquisition by Sunny River.

Related content: What the Future Holds for Energy M&A

Federal laws have been a further boon to growth in the water utilities sector. The America’s Water Infrastructure Act of 2018, for example, provides for water infrastructure improvements throughout the U.S., while the $1.2 trillion Infrastructure Investment and Jobs Act of 2021 earmarked funds to expand access to clean drinking water for households, businesses and schools. The latter includes provisions for replacing lead pipes and addressing contaminants like the so-called forever chemicals known as PFAS in drinking water, among other priorities. Ultimately, the 2021 bill “creates an estimated $60 billion opportunity for upgrading water infrastructure,” says Lucero.

New Solutions

The modern challenges to water management require innovative solutions, which increasingly are drawing the interest of investors.

When PSP Capital acquired StormTrap, a Romeoville, Illinois-based provider of solutions for managing water runoff during storms, in 2022, the firm’s executives felt the business model was attractive and offered opportunities for expansion. The company’s solutions allow property owners to manage and treat stormwater themselves, says PSP Capital’s Oleshansky. “The rising frequency of extreme weather events and legacy stormwater infrastructure deficiencies mean new solutions are needed,” he adds.

With rising population density in some areas and a growing need for water treatment, StormTrap’s services become more attractive. The company’s executives are working with government associations and water-management nonprofits to target progressive and practical regulation for stormwater management in an environmentally friendly way, notes Don Traubert, director at PSP Capital.

PSP Capital found StormTrap in collaboration with its real estate arm, Pritzker Realty Group, which owned a property that was a StormTrap customer. (PSP runs buyout, venture capital, real estate and asset management strategies.) Thanks to perspectives provided by its real estate affiliate, PSP can see trends in population growth and density in urban areas that require new water solutions. One of the things they noticed is “antiquated infrastructure in many areas of the country that creates a great burden” on water supply, says Oleshansky.

Over at Aegion, the business backed by New Mountain Capital, the team is developing new technology solutions to make its work easier, such as using artificial intelligence and robotics to find and fix leaks and predict when the infrastructure will need upgrades.

“There is an opportunity to become a technology leader and provide sensing capabilities,” Delgado says. “We’ve made a significant investment in robotics, sensing technology and analytics in the field.”

The company’s technological expansion had been largely organic, while add-ons are still a pursuit for other purposes. “We’re looking for several things: First is a great team with the right winning culture, a leadership position in a category, a product or capability that we don’t have, or geographical expansion,” Delgado says.

Anastasia Donde is Middle Market Growth’s senior editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.