Dealmakers Look Forward to an Active but Slightly Cooler Market in 2022

A recent ACG survey shows that dealmakers anticipate an active but slightly cooler market after last year's M&A frenzy.

This story originally appeared in Middle Market Growth’s 2022 Guide to Dealmaking. This section of the report is sponsored by S&P Global Market Intelligence and was illustrated by Eva Vazquez. Read the full report in the archive.

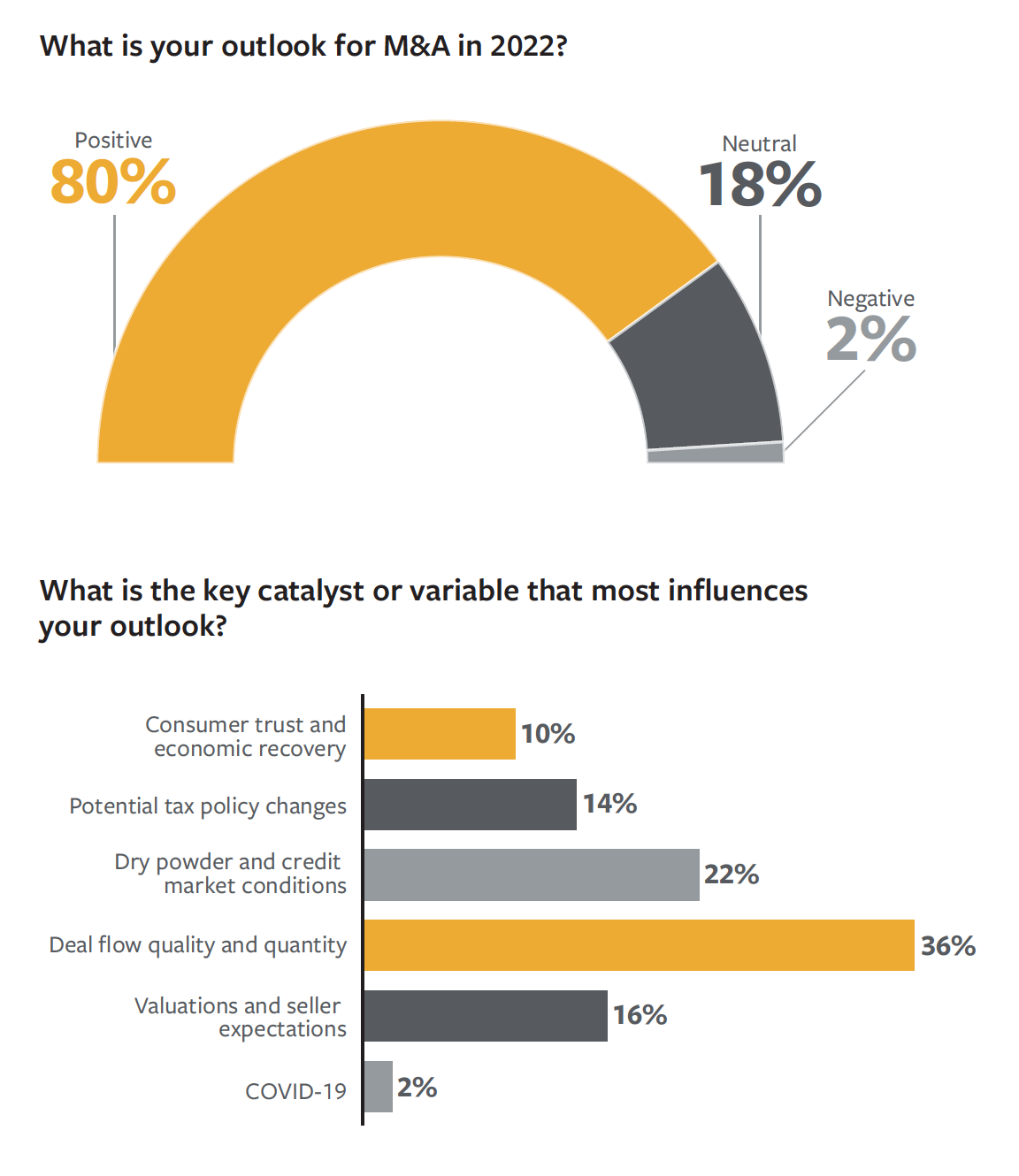

Winding down from a frantically busy year of M&A transactions, investment professionals are looking ahead to another active market, even if it’s not expected to be quite as busy. According to a recent survey of ACG members sponsored by S&P Global, 80% of respondents said their outlook on M&A activity for 2022 remains positive.[1]

“I’m positive on dealmaking, but I don’t think it’ll be gangbusters like it was in 2021,” says Art Penn, founder of direct lending firm PennantPark. The backlog of deals that didn’t launch in 2020, coupled with expected changes to tax rates and attractive valuations, were some of the factors for unprecedented activity in 2021.

The volume of U.S. middle-market buyouts from January through November 2021 came to $714.8 billion, eclipsing 2020’s year-end total of $613 billion, according to Pitchbook. Pre-pandemic total deal volume amounted to $699 billion in 2019.

“It will be busy in 2022, but not as busy as it was this year, which is good, because everyone is exhausted,” Penn adds, explaining that private equity firms and lenders, as well as their lawyers, accountants and other service providers, have been stretched thin.

“2021 was fueled by the fact that the world shut down for a long time. The market didn’t start picking back up until August or September of 2020, so there was a lot of pent-up demand,” says Lauren Boglivi, partner and co-chair of Proskauer’s M&A and Private Equity Group. “2022 will still be busy but probably less so. I don’t think you can keep up that level of demand.”

2022 will still be busy but probably less so. I don’t think you can keep up that level of demand.

Lauren Boglivi

Partner and Co-Chair of M&A and Private Equity Group, Proskauer

Some of the elements that drove a particularly busy year in 2021 will still be around in 2022, but will be less pronounced. For example, a record amount of dry powder will still be present, but the fear of changes to the capital gains tax rate is dissipating, which will likely lead to a less frenzied dealmaking pace.

Thirty-six percent of survey respondents said that deal flow quality and quantity was the primary variable that influenced their positive outlook on M&A. Dry powder and credit market conditions came in second at 22%, while valuations and seller expectations were in third place at nearly 17%.

Dealmakers and advisors say that the number of auctions and new deals hitting the market peaked in late summer 2021 and industry practitioners spent the rest of the year working on closing them. David Clark, head of financial sponsors at Raymond James, was telling most of his clients to prepare for exits in 2022 rather than try to fit them in during the fall or winter. There was too much of a backlog of work that needed to be done to close existing deals.

“Our recommendation to sellers was: Don’t try to bring something to market now, people are busy trying to get deals closed by the end of the year,” Clark says. He’s recommending that his sponsor clients prep marketing materials and quality of earnings and plan to launch processes in the first or second quarter of 2022.

Sash Rentala, head of the financial sponsors group at Solomon Partners, agrees: “Deal volume peaked in August. Post-Labor Day, we’ve focused on closings.”

Some market participants expect a busy dealmaking environment to be the new norm, even if it slows a bit from 2021. “We’re in an environment where activity will remain busy on a near-perpetual level,” says Andrew Olinick, co-head of North America Private Equity at London-headquartered 3i.

Excess dry powder, more companies in line to be sold and sellers looking at high valuations garnered by competitors all continue to be motivating factors for a strong pipeline.

“There was a lot of pent-up demand in 2021, both for buyers and for sellers. The expectation of the capital gains tax changes might have artificially inflated volume in 2021,” says Michael Ewald, global head of private credit at Bain Capital Credit.

Despite the fear of changes to the capital gains tax, which drove some dealmakers to hurry toward exits, the rate now looks less likely to change at all. If it does, the hike is expected to be minimal.

Market players are now watching another potential change: the likely rise of interest rates that will impact the cost of debt for leveraged buyouts. Federal Reserve officials said in November that interest rates will likely rise before the end of 2022. A rate hike will mean that lenders won’t be able to offer as much leverage on deals, which could directionally impact valuations. Private equity sponsors will then have to lower their purchase prices or put up more equity.

“Our expectation is that next year, demand for M&A will remain high, growth will slow down a bit, rates will go up a little and that will solve the inflation problem to an extent,” says Olinick.

VALUATION TRAJECTORY

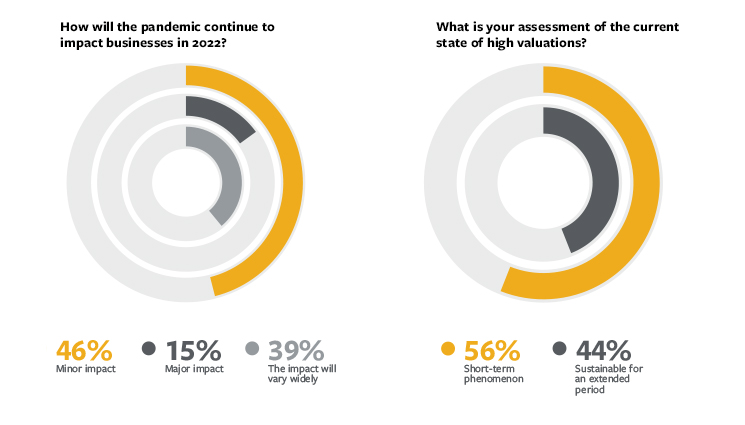

Despite the busy dealmaking pace, high valuations have continued to make it difficult to compete. However, 56% of survey respondents think high valuations are a short-term phenomenon, while 44% said that high valuations will remain for an extended period. Beyond the potential for rising interest rates, market players say that valuations are expected to at least level off in 2022. Many of the top tier businesses coming out of the pandemic have already been sold.

“Some of the better companies have transacted already. I think the market will cool off a little bit and valuations will come down,” says Clark.

Sectors also impact valuations. Sectors such as technology will continue to garner high multiples, while others like manufacturing, industrials and consumer tend to fetch lower valuations. More of the latter type of businesses are expected to come to market next year.

“There are a lot of high-quality companies that had minimal impact from COVID that came out in late 2020 and early 2021 and were able to attract very high multiples,” Clark says. “Midway through 2021, more COVID-impacted companies came out, and there were more EBITDA adjustments. It’s harder for buyers to get comfortable around those.”

Still, sellers will remain aggressive. “The way businesses are being sold is changing,” Olinick says. “There are a lot of preemptive approaches and narrow processes. The market has gotten much more focused but hasn’t compromised valuations.” He also expects valuations to level out a bit when interest rates rise.

The good news is lenders have been disciplined through the frenzy and are prepared for a busy but more subdued 2022. “Some lenders have gotten fast and loose with pricing and terms but not necessarily on leverage multiples. While purchase prices have gone up, the leverage hasn’t followed as much, which is encouraging to see,” says Ewald.

SECTOR TRENDS

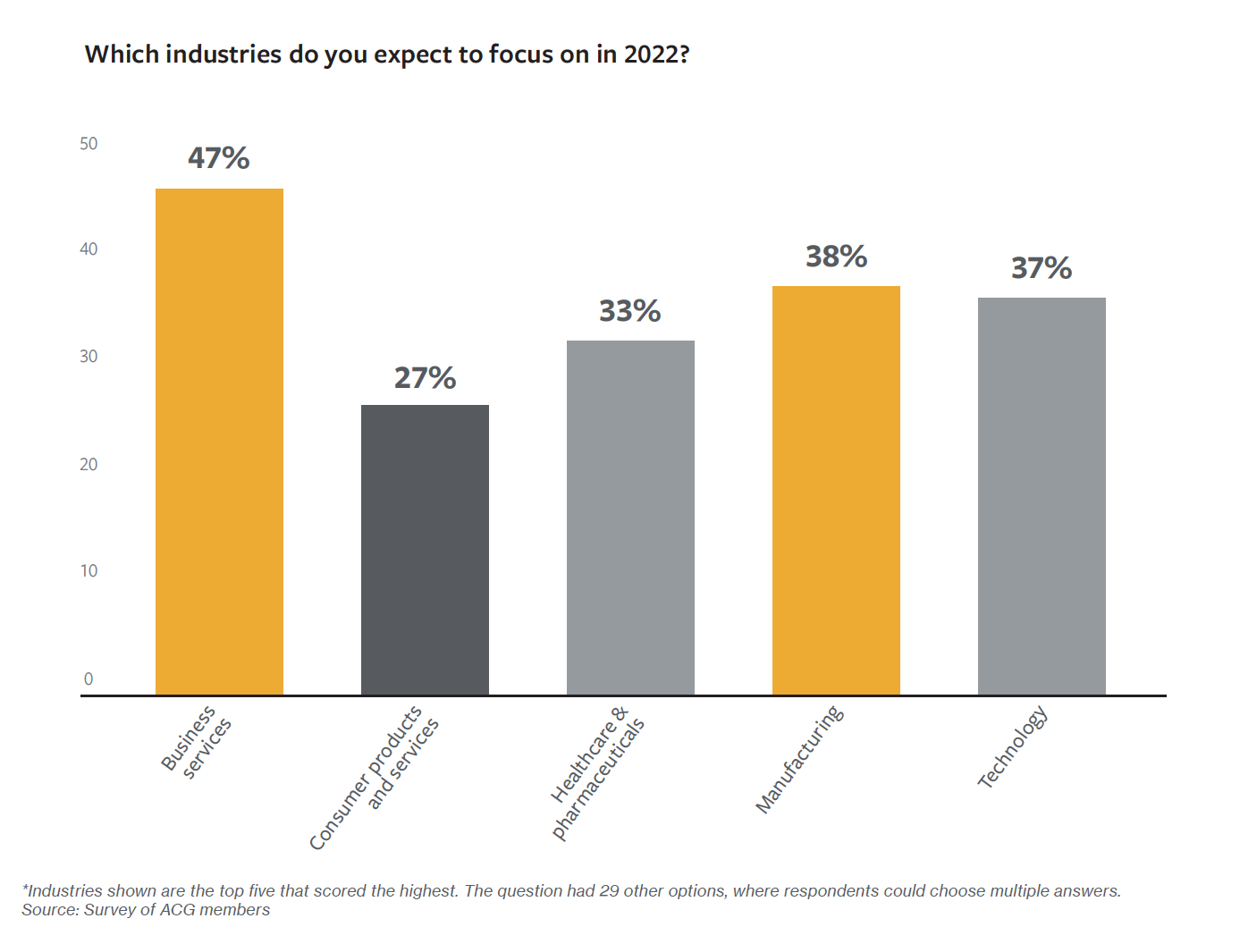

Some of the industries that were hot in 2021, like technology, healthcare and services, will continue to be attractive next year. Some note that pockets of consumer and industrials will also start to come back online. When asked which industries investors expect to focus on in 2022, survey respondents selected business services, technology, healthcare and pharma, manufacturing, and consumer products and services as some of their top picks.

As we get further into the economic recovery, it tends to be a bit more ‘risk on’ with more interest in consumer products and services.

Michael Ewald

Global Head of Private Credit, Bain Capital Credit

Jeff Jacobs, head of M&A execution at Solomon Partners, agrees that technology has been attractive in 2021 and will continue in 2022. His firm has focused on areas like B2B and CRM software, cloud, business intelligence analytics and digital transformation. Within financial services, a lot of focus has been on fintech, banks and insurance companies, according to Jacobs.

He also sees potential consolidation through M&A as companies seek to protect their supply chains from future disruptions. “Companies are using M&A to solve bottlenecks and shortages driven by supply chain issues,” he adds.

Healthcare and technology drove a lot of investment activity this year and pockets in these sectors will continue to be attractive as investors begin to shift their focus. “As we get further into the economic recovery, it tends to be a bit more ‘risk on’ with more interest in consumer products and services,” says Bain Capital’s Ewald. These could be household goods and services, as a lot of people are “nesting and sprucing up at home,” he adds. As more people go out to restaurants, investment activity in that space could pick up too, Ewald notes, though many restaurants still have a labor shortage problem.

“The hope was that, [the] consumer would be out in full force, but then the Delta variant hit and there wasn’t as much of a comeback in vacations and international travel,” says Ewald, noting that this area could still pick back up in the new year.

Several M&A experts agree that they are watching the consumer space for a comeback. “As we get further away from COVID, there will be less noise around some of these industries that could lead to more of a play for consumer companies,” Clark says. This could include areas like home furnishings, retail, travel and leisure.

PANDEMIC AFTERSHOCKS

Most of those surveyed said that the pandemic is expected to have a minor impact on dealmaking next year, with 39% saying that the impact will vary widely and another 15% answering that it will have a major impact.

“In 2021 you still had some impact. Now that we’ll have a full year of results that are more distanced from the pandemic, there is more of an acceptance of what the new normal will look like,” says Clark.

Some investors are watching companies that experienced a “COVID bump” and weighing whether that performance is sustainable. Companies like Peloton and other direct-to-consumer products experienced an uptick in 2021. “They had a huge increase in top-line cash flow. Next year, the numbers will be more normalized,” Solomon’s Rentala says.

Investors and advisors tell Middle Market Growth that the pandemic itself isn’t expected to weigh as much on activity in 2022. But knock-on effects like supply chain disruption, rising inflation, labor shortages and the increasing cost of labor will be more pressing issues.

These are likely to squeeze companies’ EBITDA margins and will affect the potential valuation of businesses going to market as they grapple with these factors.

“Obviously, labor is a big challenge, reducing capacity in many industries,” says Bob Baltimore, co-head of M&A at investment bank Harris Williams.

“That’s continuing to ripple through the economy and the cargo ships stuck at sea because there aren’t enough dock workers, as well as many other disruptions. So, until we have COVID truly under control, those and other related issues will likely continue,” he adds.

I’m positive on dealmaking, but I don’t think it’ll be gangbusters like it was in 2021.

Art Penn

Founder, PennantPark

“Supply chain issues will continue into next year and will weigh on different companies’ performance,” says Bain’s Ewald. The availability of components and the cost of getting them to make consumer products that are affected by both supply chain bottlenecks and inflation could negatively impact some companies, he explains.

When it comes to entertainment, travel and leisure, it’s still unclear when and whether consumers will go back to it. Even if the risk of the COVID-19 pandemic dissipates, people might be more fearful of something like it happening again. “The question is: Next time you see something that was affected badly by COVID, will you be more cautious about investing in it?” says Penn, highlighting businesses such as trade shows, theater and cruise lines.

With the pandemic and some of its effects weighing on pockets of dealmaking, it’s increasingly hard to predict how COVID will impact the market. “COVID-19 is going to continue to be around, but as more people get vaccinated, it’ll become easier to live with,” says Ewald. “It’s uniquely difficult to forecast with so many factors impacting dealmaking. Our crystal ball is cloudier than usual.”

[1] From September through the beginning of November 2021, ACG surveyed dealmakers about their outlook for 2022 and other topics. 250 people were surveyed.

Anastasia Donde is the senior editor of Middle Market Dealmaker.