The BD Teams Acting Like Sales Teams Are Closing More Deals

How a personalized approach can lead to more engagement with prospects

Only 9% of mass sales emails get opened, according to Gartner. Despite this fact, PE business development teams still send mass emails, customized with nothing more than an executive’s name.

There’s a better way to do cold outreach: segmenting lists and leading with unique insights. Sales teams have been experimenting with these strategies for years and found that open rates dramatically increase when an email educates the reader about their industry or addresses a challenge they face (a 14% increase globally, according to a Mailchimp report).

“Company owners have told us on many occasions that they receive numerous calls on behalf of private equity firms,” says William G. Freels III, managing director at M&A consulting firm Andra Partners. “And the fact is that many do not want to sell their life’s business to any firm that does not understand and know their sector well.”

From the onset, BD teams face the same challenges as sales teams—encouraging a recipient to not only open and read their email but to respond to it. Executives are busy.

BD professionals have approximately 11.15 seconds to answer why an executive should read their email and also respond and begin a conversation with their firm.

Hedging their bets, many firms take an easier, less personalized approach, but there’s value in engaging with targets differently.

There’s a better way to do cold outreach: segmenting lists and leading with unique insights.

Thematic Sourcing Fuels Segmentation

A thematic, strategic approach to M&A breaks down an investment thesis in the industrials sector into specific categories, like “manufacturers of cryogenic equipment.”

With more specific categories, BD professionals can craft emails to those business owners that highlight a firm’s expertise in their specific subsector. And that kind of value proposition can increase open rates, meetings taken and deals closed.

Related content: Why Your Business Development Needs a Tech Stack

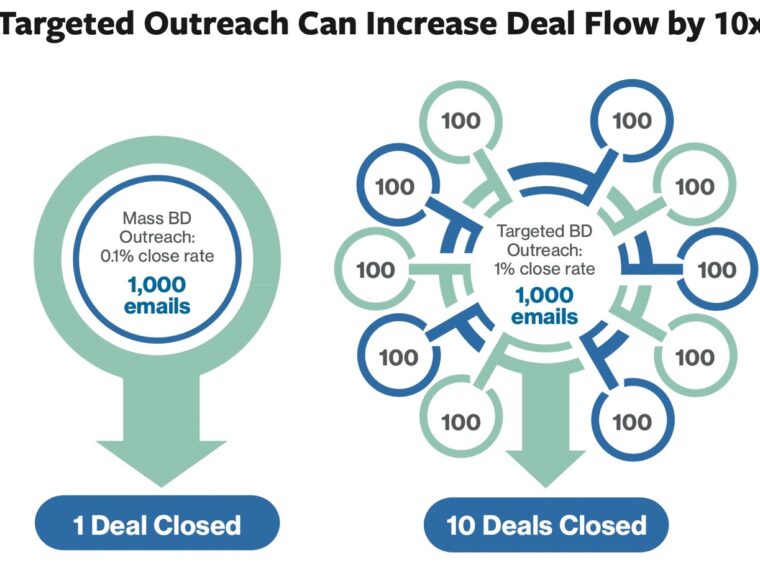

With a broad investment thesis like industrials, you may see 1% of 1,000 email blasts respond. With segmented outreach, you will see your close rate improve.

Thematic sourcing does not mean sacrificing the number of opportunities in your deal pipeline. In fact, the opposite is true. If you have a more effective sourcing method, you can cover more companies at the top of your funnel.

Thematic Outreach Requires a Deal Sourcing Platform

If the results are so dramatic, why aren’t more dealmakers looking to thematic sourcing to boost deal flow? Many firms have not invested in the right tools to accomplish this kind of customized outreach.

Without the ability to search by industry (“Industrials”), by business model (“Manufacturing”) and by keyword (“Cryogenic equipment”) all in one place, BD teams cannot map campaigns effectively. You need to find these companies before you can reach out to their executives, and you cannot find these companies without a deal sourcing platform like Grata.

There’s a new way of sourcing called deep search that incorporates industry and keyword search in the Grata platform. This deep search capability has driven a new form of BD outreach that incorporates sales teams’ secrets about how to pitch.

Leaders in investment banking are already approaching outreach this way. “By utilizing marketing and deal outreach email campaigns with targeted contacts and highly tailored messaging, we experience open rates in the 40%-50% range and click rates in the 10%-20% range,” says Patrick Nolan, president at investment bank Nolan & Associates. “We have shifted away from a mass marketing approach to our communications by coupling Grata’s data with industry-specific messaging that provides value to our network of business owners.”

Nevin Raj is the chief operating officer and co-founder of Grata, a private company intelligence engine for middle-market dealmakers.