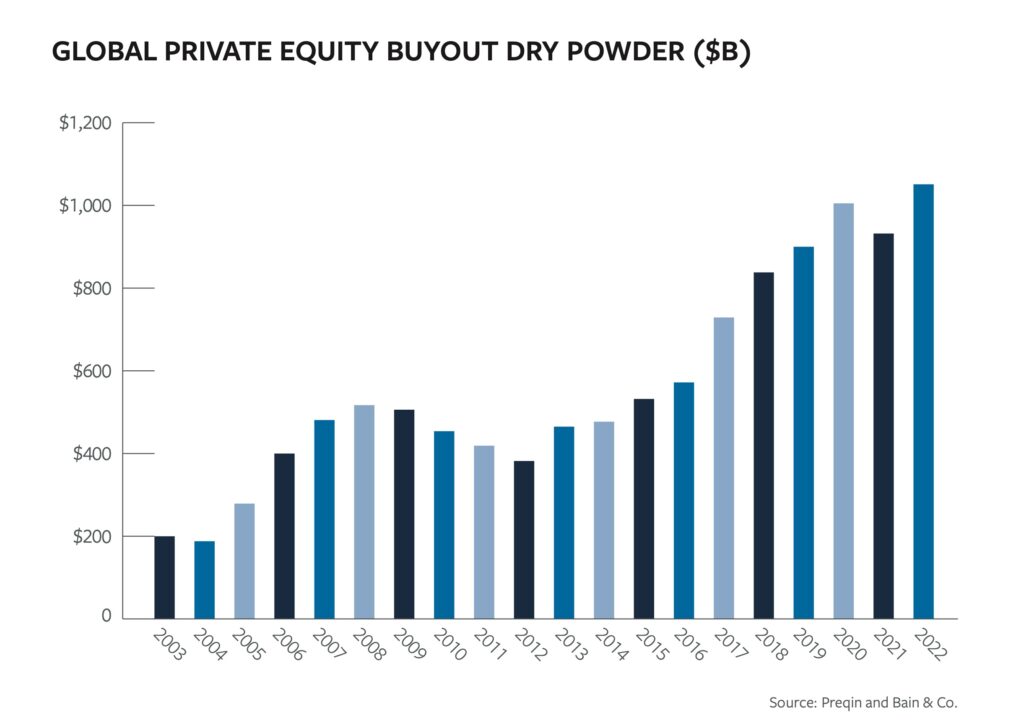

Dry Powder Reserves Point to Insatiable Buyout Demand

While uninvested assets in private markets have reached record levels, the capital is waiting to be deployed in a more favorable market environment

As the old adage goes, timing is everything. From relation- ships to career opportunities and virtually everything in between, timing is a major factor in determining whether things work out. And it is no different in private equity.

Faced with soaring interest rates, market uncertainty and ongoing fears of a recession, PE firms have largely been sitting on the sidelines as they await a more attractive investment climate. Subsequently, the global private capital sector has built up close to $4 trillion in reserves—a stockpile that has forced change in the ways private markets firms approach investing.

COVID-19 may finally be in the rearview mirror, but the fallout from the global pandemic lingers and has created a mismatch between buyers and sellers. Following paltry M&A deal volume in 2022, deal activity declined even further in the first quarter of 2023 as companies held out for a more attractive deal environment with higher valuations.

Meanwhile, the increasing cost of capital, combined with rising interest rates, macro uncertainty, the geopolitical environment and inflationary concerns, has made PE firms more cautious. As a result, the global private capital industry was sitting on $3.7 trillion of dry powder as of June 2023, $1.1 trillion of which is allocated for buyouts, according to Bain & Co.

“When you’re in an environment like this, there’s a lot of volatility and people aren’t sure what’s going to happen next. So, a lot of PE firms are sitting on their hands right now,” says Brian McGee, a managing partner at Boca Raton, Florida-based PE firm New Water Capital.

Behind the Curtain

The high levels of dry powder and declining deal volume don’t mean that the market is entirely at a standstill.

Investors are very selective about doing deals. “The environment we’re seeing is ‘barbelled.’ We see really high-quality, class A deals getting done, and we see the lower end of the market where deals need a lot more TLC. What we’re not seeing is that middle tier,” says Marc Chase, a partner and private equity leader at Baker Tilly. “The good businesses are nervous about the market, and if they don’t see a favorable multiple environment for their company, they’re just going to wait it out.”

Chris Wright, managing director and head of private markets at Crescent Capital Group, notes there are still opportunities in add-ons, too. “You have a lot of small transactions where companies are buying other companies. These are add-on acquisitions and platform investments that are held by private equity, and not all of those are getting recorded on league tables,” he says. One problem Wright thinks is keeping M&A at bay is the valuation mismatch. “Equity markets continue to be elevated at the same time that cost of capital has gone up, yet sellers expect good prices while buyers want discounts,” he says.

LP Perception

Nonetheless, LPs are not putting pressure on PE firms to deploy capital. “Many LPs deployed significantly into private markets, and the distribution in their own portfolios has dried up, given that lack of exits. … If the capital calls aren’t coming, that’s actually convenient for some LPs,” says Jared Barlow, a partner at Greenwich, Connecticut-based Kline Hill Partners, which focuses on investments in the secondary market. “The mindset of both GPs and LPs is that if there’s no rush, deploy with prudence.”

Related content: Waiting for the Next M&A Wave

And with expenditures and investments outpacing fundraising, industry professionals say that the amount of dry powder has already begun contracting. Added to that is the fact that fundraising in the current environment is extremely difficult for PE firms. Between the downturn in equities over the past couple of years, unweighted portfolios and a lack of returns from PE investments, there is a general dearth of liquidity within the LP community at the moment.

In fact, as investors are repositioning their portfolios, there has been a wave of secondary trades among LPs.

James Cassel, CEO and co-founder of Miami-based investment banking firm Cassel Salpeter & Co., agrees that most investors would be content to give PE firms another year or two to recognize the value of their investments. But he believes there are likely to be many cases where the current market conditions make that difficult or impossible for PE firms. “A lot of PE firms that did deals a few years ago stress-tested their companies for interest rates going up 100 or 200 basis points. But I’m not sure they stress-tested for a 500-point increase,” says Cassel. “The concern comes in if they still own the portfolio company and are going to continue to own it, but the debt comes due and they’re going to have to refinance at a higher price.”

A lot of PE firms that did deals a few years ago stress-tested their companies for interest rates going up 100 or 200 basis points. But I’m not sure they stress-tested for a 500-point increase.

James Cassell

Cassel Salpeter & Co.

The Private Credit Opportunity

One area where the PE community is seeing a pop in activity is private credit. As small and midsize banks have backed away from lending following the recent bank collapses, industry experts predict that direct lending will continue to pick up speed. According to Moody’s, private lending to PE-owned middle-market companies is one of the quickest growing areas, with roughly $1.3 trillion in assets under management, $350 billion of which is dry powder. “We’ve seen a lot of demand growing for junior debt in both new investments, as well as support of existing investments,” says Crescent Capital Group’s Wright. “Part of that big opportunity is the highly leveraged transactions that were put together in 2021 and 2022 that now need some help—including through the issuance of preferred equity and partial PIK securities,” he says.

Adds Baker Tilly’s Chase: “The current interest rate environment and the turmoil in the banking sector have created an opportunity for alternative debt funds, and I imagine that will continue for the remainder of this year.”

Despite the market calamity, several well-known private debt managers have recently raised large funds. They include HPS, which closed its Core Senior Lending Fund II at $10 billion in June; Oak Hill Advisors, which garnered $2.2 billion for its Credit Solutions Fund II in May; and Neuberger Berman, which collected $8.1 billion for its Private Debt Fund VI last September.

Looking Ahead

Many PE firms are bracing for an uptick of M&A activity in the third and fourth quarters of this year. Regardless of whether economic conditions improve, the expectation is that PE firms will have to finally start exiting some positions in the coming months. “Even setting aside the capital markets and the LBO and loan markets, the hold time on everyone’s portfolio companies is increasing to a point where there’s going to have to be some more selling happening,” says Jennifer Smith, a partner in Bain &. Co.’s PE practice.

Related content: U.S. Middle-Market Deals Defy Economic Uncertainties

In the meantime, she says that PE firms need to focus on where they can add value to their portfolio companies to make them more appealing when those exit opportunities finally do arise. “As dry powder comes down and deal markets pick up, you’re going to see a little bit more of a buyer’s market where it’s going to be more competitive,” says Smith.

Anthony Arnold, a partner at Barnes & Thornburg, says there has recently been a noticeable jump in activity levels. “We are seeing the beginning of a shift from a wait-and-see approach to an actual deployment of capital,” he says. “In just the last two weeks, our middle-market clients issued as many letters of intent as they did from January to the end of May.”

As PE firms begin to pick the sectors and companies they believe will present the most promising exit opportunities, industry experts say firms should be aware there could be a bit of traffic when people finally do step off the sidelines.

“Now is the time that firms should be evaluating and creating their teams in anticipation of when the market is going to turn,” says Baker Tilly’s Chase.

Britt Erica Tunick is an award-winning journalist with extensive experience writing about the financial industry and alternative investing.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.