Midmarket Dealmakers’ Confidence Remains Steady: ACG Survey

ACG’s Q1 Market Pulse Survey finds unwavering, though tepid, confidence in M&A volume over the coming months

The phrase “cautious optimism” has emerged as a consistent descriptor for how middle-market dealmakers have felt about the market over the last few years, and the first quarter of 2026 is no different, according to ACG’s Q1 2026 Market Pulse Survey.

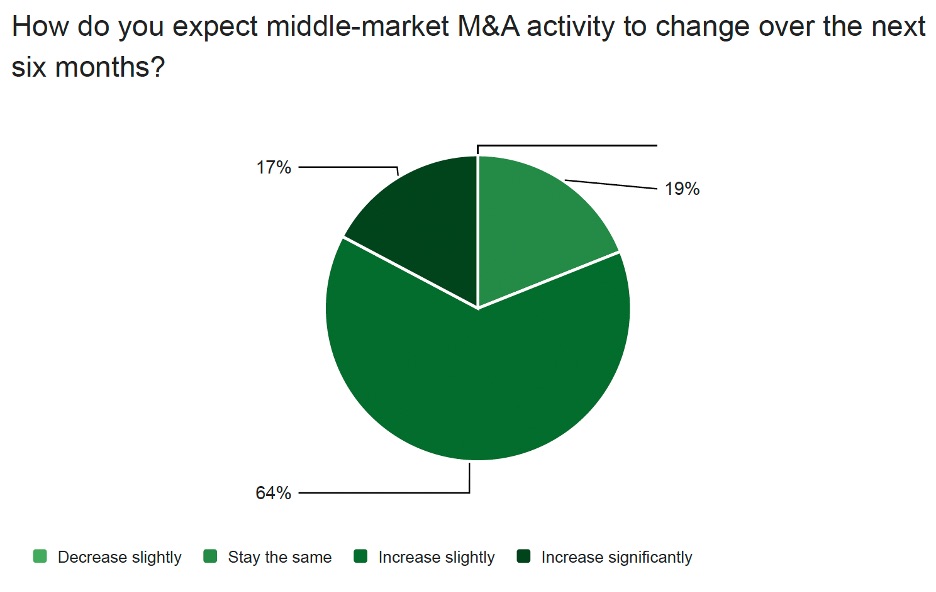

At the start of Q1, 64% of middle-market M&A professionals said they anticipate a slight increase in dealmaking activity in the next six months. That’s on par with the 62% who said the same in ACG’s Q3 2025 Market Pulse Survey, and an increase from the 54% who agreed in ACG’s Middle-Market Outlook Survey, which was released at the start of 2026.

That modest confidence extends to the debt markets, with the same portion of survey respondents (64%) describing a somewhat favorable financing environment for middle-market dealmakers today. None described the current environment as either “very favorable” or “very unfavorable.”

Timing the Market

Over the last year, dealmakers’ cautious optimism could largely be attributed to economic policy and geopolitical events with both favorable and unfavorable implications for M&A activity. In this year’s first quarter, “timing and market conditions” was named the top driver of M&A decision-making for the next six months, followed by “pressure to return capital to investors” and “valuation levels” (survey respondents could choose up to three items).

Indeed, while geopolitical and economic uncertainties have forced many dealmakers to wait on the sidelines, building pressure among LPs for returns and a narrowing gap in valuation expectations between buyers and sellers could be the factors that tip the scales in dealmakers’ favor as 2026 progresses.

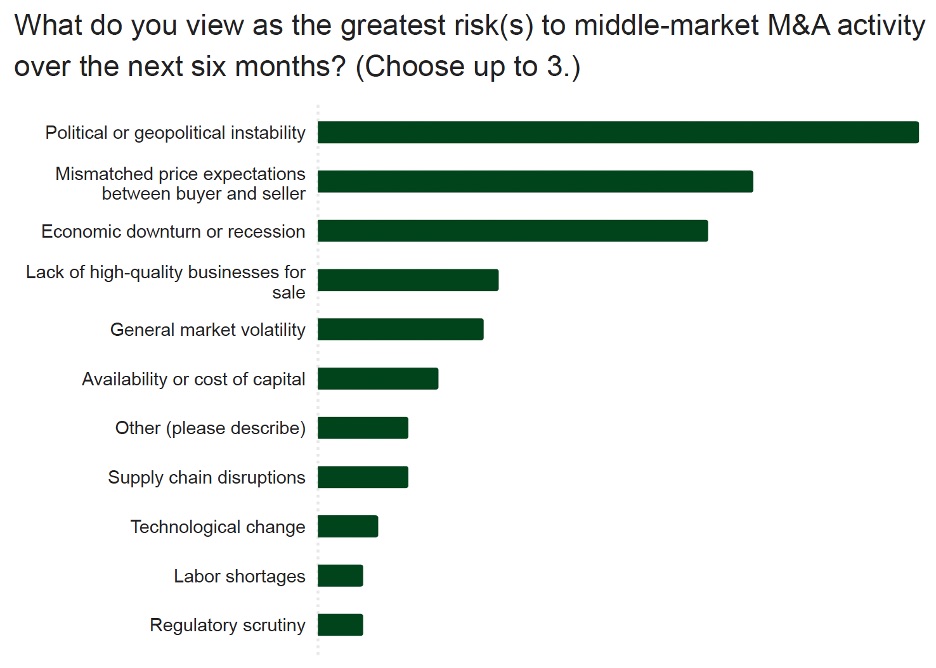

Still, political and geopolitical instability weigh heavy on dealmakers’ minds, and indeed emerged as the largest risk to middle-market M&A survey respondents identified in the next six months. That was followed by the narrow—but persistent—valuation gap, with the risk of an economic downturn or recession coming in third.

Industry Attraction

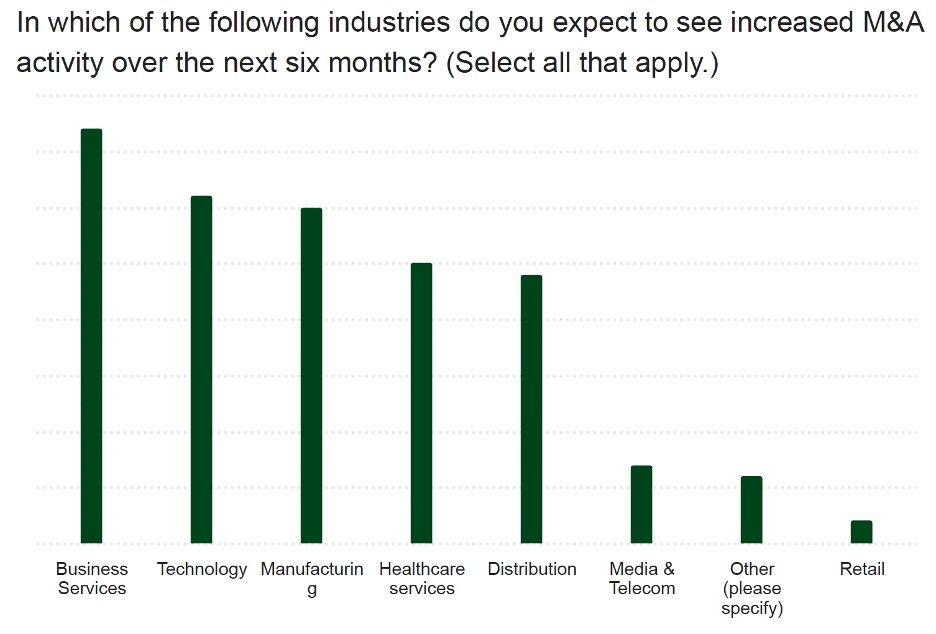

Manufacturing saw a challenging end to 2025 amid downward pressure on the industry from tariff policy. Even so, the Q1 Market Pulse Survey finds manufacturing as a strong driver of expected M&A activity in the coming months: the industry came in third place, with technology in second, and business services in first.

On the other end of the spectrum, retail and media & telecom emerged at the bottom of the pack as the industries least expected to boost dealmaking volume.

The Q2 Market Pulse Survey will open in mid-April.

Carolyn Vallejo is ACG’s Senior Editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.