LPs’ Payback Purgatory

Limited partners hungry for distributions adjust to a challenging exit environment

Broader economic uncertainty is weighing on the private equity market—and forcing the industry to get creative when it comes to liquidity solutions.

“We ended 2023 with a hopeful view, and we’ve seen some growth although it’s been slower than anticipated,” says Jessica Mead, regional executive of North America at fund administrator Alter Domus. “The middle market has been directly impacted by the wider slowdown in the PE fundraising market generally.”

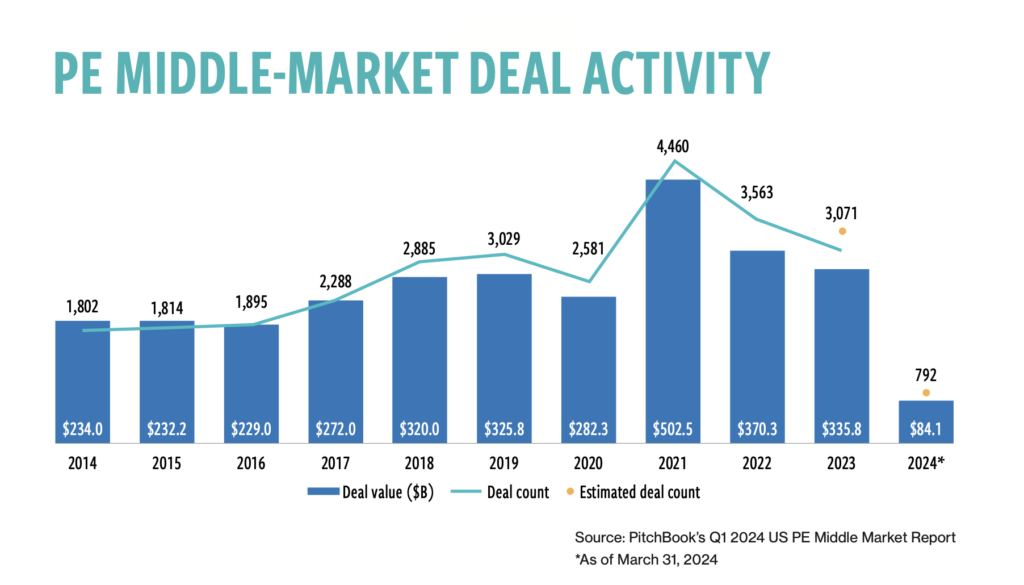

LPs are feeling the effects of a slowdown in distributions. Deal and exit activity have fallen significantly since the dealmaking rush of 2021, with distribution rates for private equity at just 15% in 2023, compared to 33.9% in 2021, and capital calls outpacing distributions to LPs by more than two to one, according to PitchBook.

“Deal activity and distributions are now moving in the right direction, but it’s been gradual,” says Bart Molloy, partner at placement agent Monument Group. “Dealmakers are always saying that the next quarter is going to be huge. We do foresee a busier Q4, as Q3 tends to be partly a wash with summer,”

The macro factors weighing on the market are familiar ones. Following the Federal Reserve’s aggressive tightening cycle in 2022 and 2023, interest rates remain high, though many predict a cut at the Federal Reserve’s next meeting in September. Geopolitical tensions and uncertainty around tax and regulatory policy leading up to the U.S. presidential election in November is only exacerbating the “wait and see” nature of the current market.

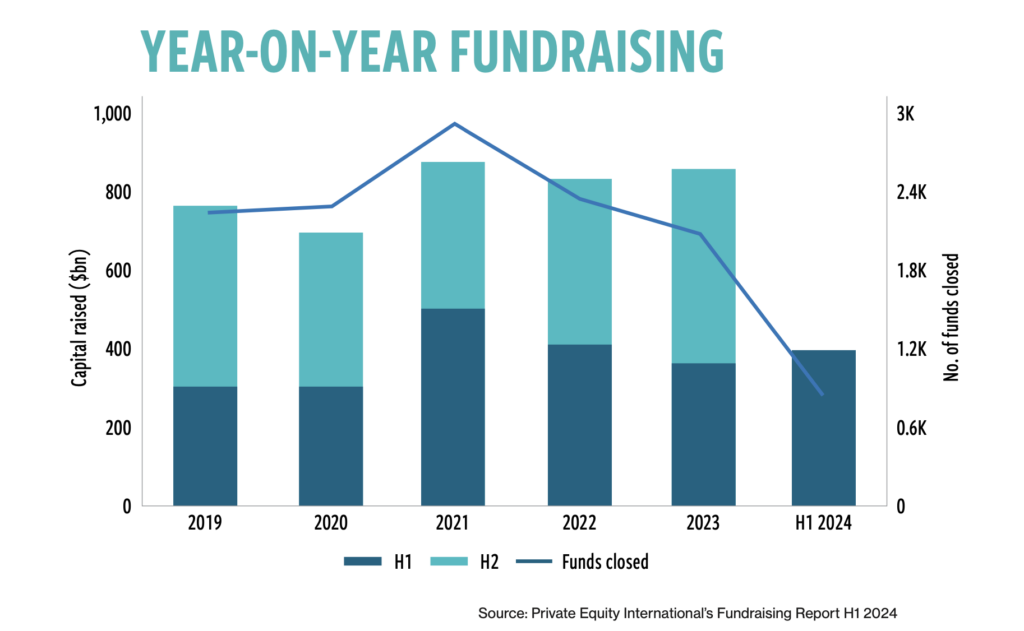

Private equity funds globally collected $408.6 billion with 861 funds closing in the first half of this year, compared to $374.6 billion in the first half of 2023, according to Private Equity International (PEI).

In an environment with record amounts of dry powder—$2.62 trillion globally as of July, according to S&P Global Market Intelligence—and lagging distributions, some LPs are being highly selective with their capital outlay, choosing to focus on larger, well-established GPs with proven track records. In the first half of 2024, the top 10 funds globally raised nearly $150 billion, according to PEI. “Even when the number of closings is down, the amount of aggregate capital has been more or less stable due to higher-than-average fund sizes being closed,” says Steve Hartt, managing principal at institutional investment consulting group Meketa Investment Group.

The high level of dry powder—26% of which is 4 years old or older, according to Bain & Co.—is also increasing pressure on GPs to exit. “LPs are paying meaningful management fees on that capital and want to see it put to work. I’m hopeful we’ll see a bigger pickup in M&A and thus liquidity in the second half of the year, but there are always wild cards,” says Marc Lederman, co-founder and general partner at middle-market private equity firm NewSpring Capital, which in July raised $390 million in its fifth mezzanine fund.

In the U.S. middle market, private equity dealmaking was down 36.8% at the end of 2023 from its peak in 2021, according to PitchBook. Though no one expects a return to 2021 levels, signs of stability have been apparent in recent quarters, with the first quarter of 2024 measuring slightly ahead of the first quarter of 2023 in terms of deal value and flat by deal count, PitchBook data shows.

According to GF Data, an ACG company that tracks deals between $10 million and $500 million in enterprise value, deal volume in the first half of the year was up 23% on an annualized basis compared to 2023. Despite recent challenges, the middle market remains an attractive sector for LPs. “There tend to be lower prices, more opportunities for GPs to apply an operating value-creation playbook and more exit options,” says Hartt.

Alternative Strategies Become Mainstream

Buyouts have suffered in the current environment. Last year saw the overall buyout market decrease by 32.7% in deal value, though this number was somewhat less dramatic for middle-market buyouts between $25 million and $1 billion, which decreased 18.9% in value, according to PitchBook. Deal volume in the middle market was down 12% in 2023 compared to 2022 for deals valued between $10 million and $500 million, according to GF Data, while average valuations dropped just 4%.

Many PE firms are still holding out on selling all but their most attractive assets. With traditional exit activity lagging, firms are looking for other ways to create liquidity. Secondaries—once a niche strategy—have continued to gain traction in the last few years. “Any stigma around using the secondaries market was removed five or even 10 years ago, but it took time for many institutions to get comfortable with the mechanics of these transactions. We’ve seen increasing comfort with using secondaries as a portfolio management tool to create fresh capital to deploy in the primary market,” says Molloy.

Secondaries and continuation fund strategies provide an alternative to buyouts in an uncertain market. In a traditional secondary transaction—sometimes referred to as an LP-led secondary transaction—an LP sells its interest in a partnership to another buyer, who then takes on the LP role. In recent years, GP-led secondary transactions have also been on the rise, with GPs restructuring the ownership of one or multiple assets to create liquidity for their existing LPs. These transactions often come in the form of continuation funds, in which GPs sell one or more of their portfolio companies from their primary fund to a new investment vehicle, which they continue to manage.

Relative to the overall market, secondaries are still a small player, but many see room for continued growth. “It’s becoming a bona fide exit alternative for GPs in a way that it hasn’t been historically. You’ve got very sophisticated capital that is focused on continuation vehicles. It’s something that every GP has to consider as an alternative,” says John May, founder and managing partner of private equity firm CORE Industrial Partners.

The overall secondary volume in 2023 was $112 billion, up 4% from 2022, according to Jefferies. In particular, the volume of GP-led transactions has increased as these deals become a key source of liquidity for LPs. Continuation funds made up 12% of sponsor-backed exit volume in 2023, vs. 7% in 2022, and GP-led secondaries transactions increased 88% from the first half of 2023 to the second half of that year, according to Jefferies. In June, Hamilton Lane closed a $5.6 billion secondary fund, its largest fund to date.

LPs have mixed feelings about these transactions. “Continuation vehicles help LPs generate liquidity, but that liquidity comes at a price. You thought something was worth $100, but now you’ll only get $90—but you can get it today. Ultimately, it’s always a little disappointing to get something for less,” says Meketa’s Hartt.

Net asset value (NAV) lending, in which GPs borrow against their entire underlying portfolio, is also on the rise. According to the Fund Finance Association, the market for NAV credit facilities is currently around $100 billion but is projected to grow to around $600 billion by 2030.

Among LPs, this strategy is even less preferred than continuation funds. “It’s LPs’ least favorite way to get capital back. It’s additional leverage on your assets without getting realization, and there are ongoing issues around alignment,” says Hartt. LPs cite a lack of transparency from GPs, with some not disclosing their use of NAV loans. Many also have reservations about the risks involved with GPs taking on leverage at both the portfolio company level and the fund level.

In July, the Institutional Limited Partners Association released a set of guidelines for LPs and GPs focused on the use of NAV-based financing facilities. The ultimate goal is transparency, with ILPA recommending that GPs seek approval from LPs before taking on a NAV loan and for the use of NAV-based facilities for distributions.

What LPs Want

In the current environment, predictability and a proven track record are a key focus for mid-market LPs.

CORE Industrial Partners closed two new funds totaling $887 million in February, including its third flagship fund focused on manufacturing and industrial technology businesses and a new offering specific to the industrial services sector. Other recently closed middle market funds include Kingswood Capital’s $1.5 billion third fund, CCMP Growth Advisors’ $500 million fourth fund, Monomoy Capital’s $2.25 billion fifth fund, Partners Group’s $15 billion fifth direct private equity fund and InTandem Capital’s $715 million third fund.

“What we saw resonate most with LPs in this fundraise was the fact that we have an established platform. LPs know what we’ve been able to do with regards to investments and exits. Our team brings operational expertise while our thematic sourcing approach allows us to continue to invest regardless of the market environment,” says CORE’s May.

While many LPs are prioritizing existing relationships, those looking to invest with new managers have to make sure to vet firms carefully. “For most institutional LPs to add a new GP to their roster, they want to know that they can invest in at least two or three of your funds. It takes a lot of work to underwrite a new relationship, so they want to know the firm is going to be around for not just the next fund but the fund after that and after that,” says Lederman. Recent middle-market debut funds include StoneTree Investment Partners at $155 million, Agellus Capital at $400 million, Trulink Capital Management at $875 million, and MFG Partners at $299 million.

Cash-strapped LPs also expect an increasing level of professionalization from all GPs in today’s competitive environment. “The firms out-raising others are strategically mapping out who their LPs should be. … They are building the kind of commercial organizations the best B2B sellers rely on daily,” notes Bain & Co. in its 2024 Private Equity Outlook.

This includes maintaining off-cycle communication with limited partners. LPs are looking for firms to keep them in the loop on all aspects of fund management, rather than just getting in touch when they’re being asked to sign a limited partnership agreement. “In the middle market, there isn’t a true off-cycle anymore. Continuous updates help build a case and set up a successful fundraise,” says Monument Group’s Molloy.

In addition, LPs want to be able to see how fund managers plan to handle uncertainty or potential difficulties down the road. “It’s a very different market than it was two or three years ago,” says May. “Investors are very keen on exactly what they’re looking for and how a given manager slots into their respective strategy.”

Meghan Daniels is a freelance writer and editor based in Dutchess County, New York.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.