Dealmaker Q&A: MidOcean Partners on Cloyes Gear Acquiring Automotive Tensioners, Inc.

Steven Loeffler of MidOcean Partners discusses the plans that portco Cloyes has for its latest acquisition

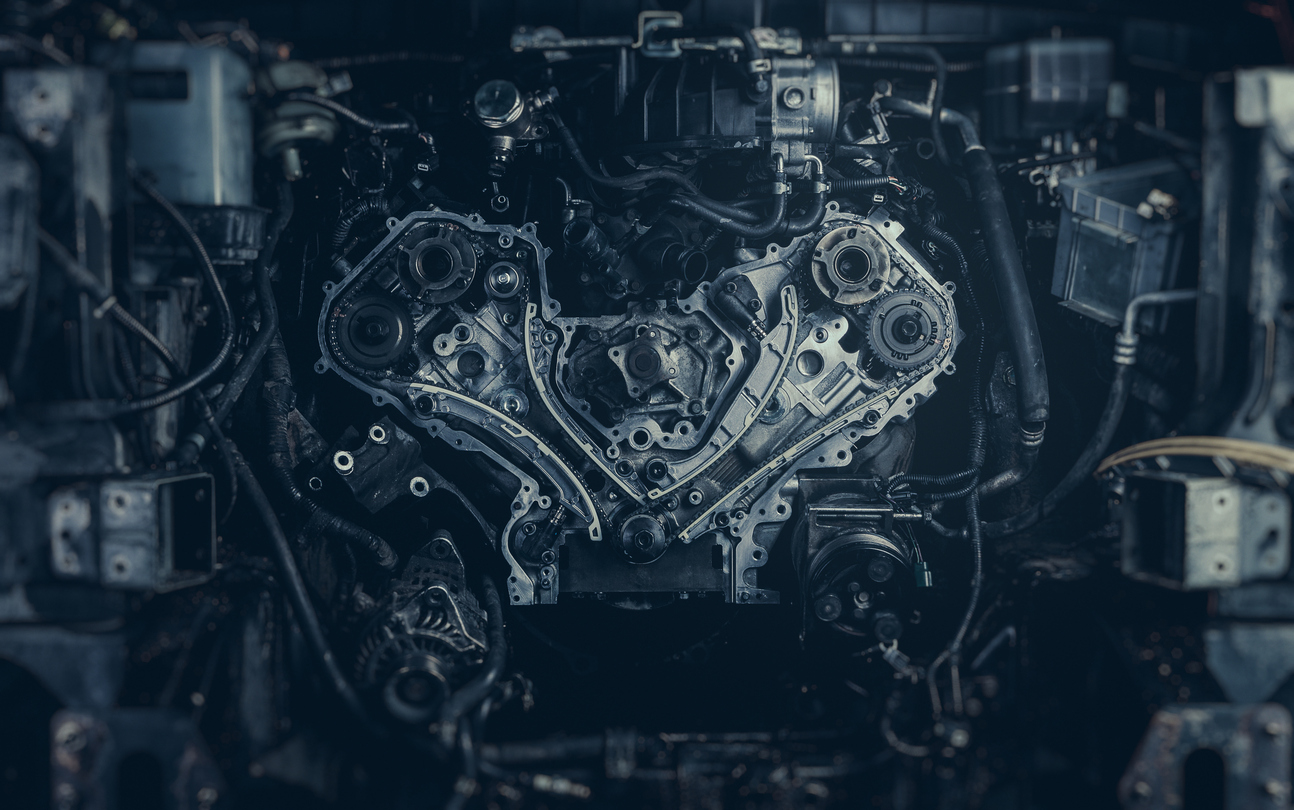

When Cloyes Gear & Products, a portfolio company of MidOcean Partners, acquired Automotive Tensioners, Inc. (ATI) earlier this year, the deal marked its second recent acquisition and another step forward in the firm’s strategy to build value for automotive repair shops. Steven Loeffler, managing director at MidOcean Partners, shared his thoughts on what made ATI a great investment, why the automotive aftermarket is thriving and how it plans to expand the Cloyes business.

Middle Market Growth: When sourcing the deal, what were you looking for in an investment target and how did ATI fill those requirements?

Steven Loeffler: Cloyes is an automotive parts platform for the aftermarket and we’ve had an acquisition strategy there since we’ve invested in the business. What we look for is businesses that can come under the Cloyes platform, and we can use our differentiating factors and abilities at Cloyes to help drive these businesses even further than they’re able to do on their own and ATI really fit the bill. We sourced it through relationships being driven by the CEO John Hanighen and by getting to know the ATI people over the past two years. I think the collective view was, what ATI recognized and what we obviously recognized, is that with Cloyes’ help we could make ATI’s business and products today a lot larger under our umbrella. In that sense it checked a lot of those boxes, because the kind of customer relationships and brand loyalty that we have at Cloyes could benefit ATI.

MMG: What attracted MidOcean Partners to the automotive supplier space initially, and how does this deal fit into your broader investment thesis?

SL: What we like about the automotive supply spaces—and first of all, it’s the aftermarket, so this is not OEM—is when your car breaks down, you’ve got to fix that part. It’s mission critical and it’s really important for the consumers to be able to get the right part quickly with their equipment tech at whatever place they get their car repaired. And the overall car market is getting larger; there are more cars on the road, but they’re also getting older, so there’s more break-fix requirements. That has benefited the aftermarket for a long period of time, and it stands to benefit even more going forward. We like that dynamic a lot and it’s one where quality is really important, customer service is extremely important and brand matters, especially to the to the techs who are installing the products. And Cloyes is going to check all those boxes so it’s a great fit for us.

MMG: What are some headwinds you’re watching in the automotive industry, and how will that impact your approach to value creation?

SL: So, the OEM market is much different than the aftermarket. The OEM market has a lot more volatility, especially as rates go up, new car purchases go down. You avoid a lot of that in the aftermarket, but the outset or at the top part of the supply chain is still volatile. There’s a lot of tariffs still in place that remain a challenge. Inflation has been a challenge, but I think it’s not as rampant in this sector as it is in others like the food space, so that’s been somewhat of a challenge but I think it’s one we’ve been able to work around pretty effectively. At the level where we sell our parts, labor is still a challenge, getting qualified technicians and getting more of them. I think there’s not enough techs out there and we’re just generally short-staffed in this country. I think those are some of the challenges and Cloyes is a good example of how we’re addressing these challenges. We put out a lot of content that helps explain how to install our products and makes it really easy for new techs to learn. We give them how-to videos, give them constant marketing collateral and information and really try to develop direct relationships with them. In our market efforts, we’ve got over 20,000 techs that we talk to on a regular basis. And so it’s really just knowing your consumers, your customers, and making sure you’re holding everyone’s hand on the journey and articulating what we’re offering and also investing a lot in in the supply chain and people systems to make sure you can be agile in this kind of dynamic market. We invested significantly in our operational teams and our facilities in the United States and abroad, and we’ll continue to do so.

MMG: Another challenge for the automotive industry that’s gotten a lot of attention in recent years has been the supply chain—can you talk a little bit about the developments you’ve noticed there and how you’re helping your portcos navigate that?

SL: Yeah, it’s definitely gotten better. The most hectic time was right after Covid during the whipsaw of the supply chain. We just had huge delays and the container prices were through the roof. Container prices have come down dramatically, which is great for everyone. But then, you know, they’ve come up recently—the disturbances in the Red Sea have definitely impacted container prices and the drought in Panama, which is not as covered as much. The Panama Canal can only get so many ships through these days. So what we’ve done is try to be super agile where we can take shipments in from the west coast, east coast, by rail, by sea, by plane. But it just requires a lot more focus and attention than it did prior to Covid, where you took a lot of things frankly for granted on the supply side. What’s much better now is that demand is steady and consistent. It’s not as chaotic as it was with Covid. So that part has definitely helped resolve a lot of the hiccups in the supply chain.

MMG: Cloyes’ president and CEO John Hanighen was quoted in the press release as seeing the acquisition as an expansion opportunity. What kind of expansion are you pursuing for Cloyes?

SL: They’ve got a couple of new product categories—they’re in tensioners, belts and pulleys today. There are extensions of those that we want to roll out and we also want to increase what we call the VIO coverage, meaning vehicles in operation. Basically, what percentage of vehicles do you cover with your products? Best in class VIO is above 80%, so when we’re in the 90% at Cloyes, we want to drive that percentage higher for ATI. Also, their customer base is not nearly as diversified as ours, so there are a lot of new customers that we can bring to the table and we’re doing that as we speak to really diversify and expand the distribution of the existing products and then the new products that will come out on top of that.

This interview has been lightly edited and condensed for clarity.

Hilary Collins is ACG’s Associate Editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.