Reps and Warranties Insurance Evolves with the Deal Market

While RWI pricing and underwriting have adapted to M&A trends, claims processing has proven less flexible and could affect the product’s future use

The slowdown in mergers and acquisitions in 2023 has impacted the representations and warranties insurance (RWI) market by driving down prices. Although rates are expected to rebound when dealmaking picks up, changes to the types of transactions that use RWI, and how insurers approach underwriting and settling claims, are likely to outlast the chill in M&A activity.

Representations and warranties insurance was first introduced more than 20 years ago to transfer risk from the parties of the deal to an insurance company and has since grown in popularity. Insurance brokerage and consultancy Woodruff Sawyer estimates that RWI is used in 64% of deals involving large strategic acquirers and 75% of private equity transactions.

This section of the report originally appeared in the special edition Middle Market Growth 2024 Multiples Report. Read the full issue in the archive.

Illustration by Afry Harvy.

“For PE funds, RWI is a lifesaver,” says Craig McCrohon, partner at law firm Burke, Warren, MacKay & Serritella. “Before, funds were loath to bring a claim against the very managers who sold the company and now oversee the portfolio crown jewel. Now, PE buyers bypass the drama with the seller- manager and simply seek compensation from a third party—the RWI insurer.”

When M&A activity soared in 2021, demand for reps and warranties insurance rose with it. Two years later, the market looked much different. Global M&A value fell by 44% in the first five months of 2023 compared with the same period in 2022, according to Bain & Co. Deal volume dropped by 16%, reflecting a shift toward smaller transactions. Lower deal activity translated into less demand for RWI, and insurance prices dipped.

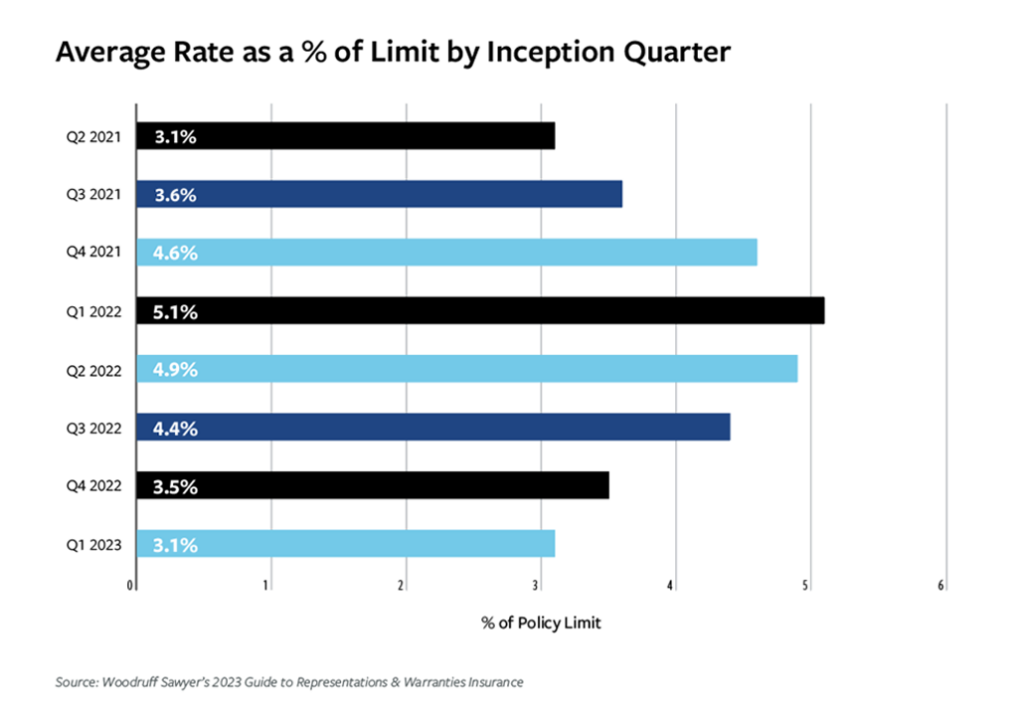

Woodruff Sawyer noted in its 2023 Guide to Representations & Warranties Insurance that, as of June 2023, standard premium rates were running at about 2% to 3% of the policy limit. (The mean policy limit amounts to about 10% of the transaction size.) That pricing for premiums is down from a recent high of 5.1% of the policy limit on average in Q1 2022, and closer to the Q2 2021 average of 3.1%.

Other brokers have observed the drop in premium pricing, too. “We have seen a decline in premium rates on line for all transactions and across all industries,” says Celeste Owens, director of operations for private equity and M&A at Gallagher, a global insurance brokerage and risk management firm. “Pricing is nearing or just below what we saw pre-pandemic.”

The dip in prices has prompted some RWI policy-seekers to increase their coverage amount. Eric Jesse, a partner at law firm Lowenstein Sandler, notes that he’s seen clients involved in smaller or midsize deals raise their liability limit to 15%.

Story continues below.

Self-insured retention (SIR) levels—the amount of loss that the policyholder must incur before RWI insurance coverage kicks in—have also fallen. Traditionally, the SIR amounted to 1% of a deal’s enterprise value (EV), but a report from Lowenstein Sandler noted SIRs as low as 0.5% of EV for deals above $500 million. A 1% SIR remains typical for deals below that threshold, although “retentions of 0.75%-0.9% of EV were also achievable while deal flow remained high,” Lowenstein’s R&W Insurance Claims Report 2023 noted.

Widening the RWI Tent

As the RWI market matures, underwriters have grown comfortable with a broader swath of deals.

Stephen Davidson, global co-head of litigation risk and head of claims at Aon, notes that RWI use has expanded to a broader set of deal types, including secondaries, minority investments and take-private deals.

Meanwhile, use of the insurance has extended to smaller transactions. Small and middle-market M&A deals were a significant part of the RWI landscape in 2023, Davidson notes, and as a result, insurers became much more willing to underwrite smaller transactions.

Insurers today are able to extend RWI coverage to some deals worth as low as several million dollars of enterprise value and to craft policies with coverage commensurate with transactions of such sizes, Davidson says. That’s a marked change from the recent past. “Previously, you wouldn’t have seen deals with an EV below $10 million to $20 million,” he says. “If you go back even further—five, six years ago—you probably wouldn’t have seen a policy that was less than $3 million to $5 million.”

Related content: Under the Radar: Cutting-Edge Insurance Offerings

McCrohon, too, is seeing RWI used in some smaller deals. “For most traditional PE-backed industries, $100 million was a common break point. For stronger deals, however, this number is coming down,” he says. At the same time, he notes that the economics have to make sense, and RWI might not be a fit for all transaction sizes. “Deals with enterprise values below $50 million are still a challenge to make RWI cost-effective,” McCrohon says.

For most traditional PE-backed industries, $100 million was a common break point. For stronger deals, however, this number is coming down.

Craig McCrohon

Burke, Warren, MacKay & Serritella

A Commodified Product

Although today’s insurers are willing to underwrite a wider range of deals, claims processing has headed in a less nimble direction.

Lowenstein’s 2023 report showed that in cases where claims exceeded the amount of the self-insured retention, only 60% of respondents said that a claim payment was negotiated, down from 87% of respondents three years ago.

Although RWI was developed to facilitate dealmaking transactions, a lengthier and more difficult claims process suggests RWI is losing

some of the features that make it attractive. “This insurance product is different than other types of insurance because it was born out of the M&A community, where people are business focused and they want to get a deal done,” says Jesse. “I think that mentality had carried over on the claims side a few years ago, but now you see the product may be becoming a little bit more like other commoditized insurance policies.”

Claims filed against the RWI policy still tend to be resolved swiftly compared with alternatives, McCrohon notes, even if the process is not always seamless. “RWI is faster and often as successful as traditional indemnification protection,” he says. “However, policyholders should not confuse better, faster and cheaper with perfect, immediate and free.”

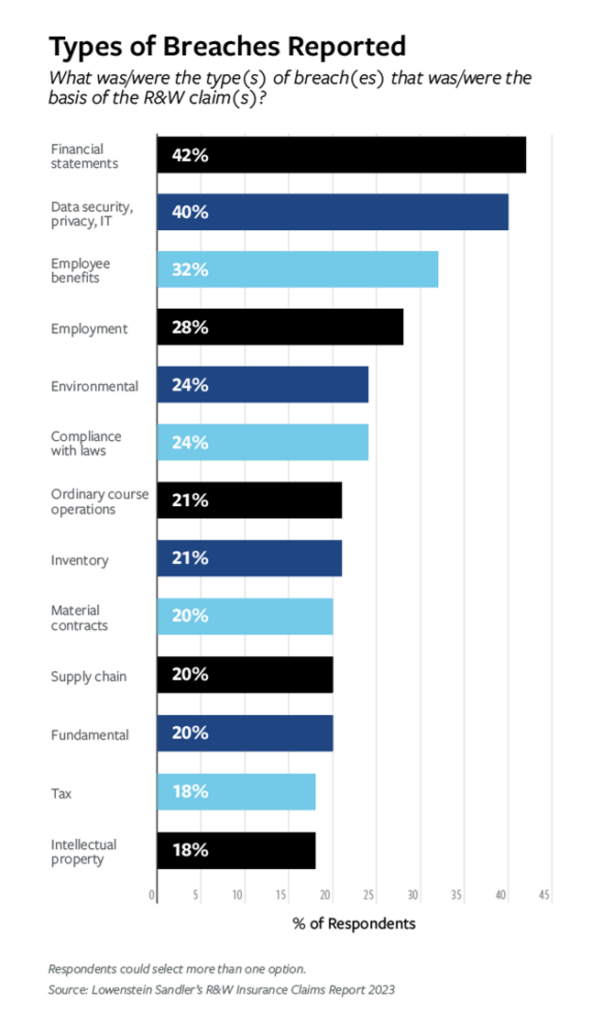

As for events that trigger claims, financial statement breaches continue to be the most reported type of breach observed by Aon, but an uptick in third-party claims has driven up the number tied to compliance with laws and undisclosed liabilities, Davidson notes. Unlike first-party claims, which are brought by the insured party listed on the policy, a third-party claim originates with a party outside of the M&A transaction, such as a vendor seeking to enforce a contract, or the IRS as part of an audit.

Lowenstein’s report similarly showed financial statements as the leading breach type, followed in the Top 5 by data security, privacy and IT; employee benefits; employment; and environmental-related breaches.

What’s Next

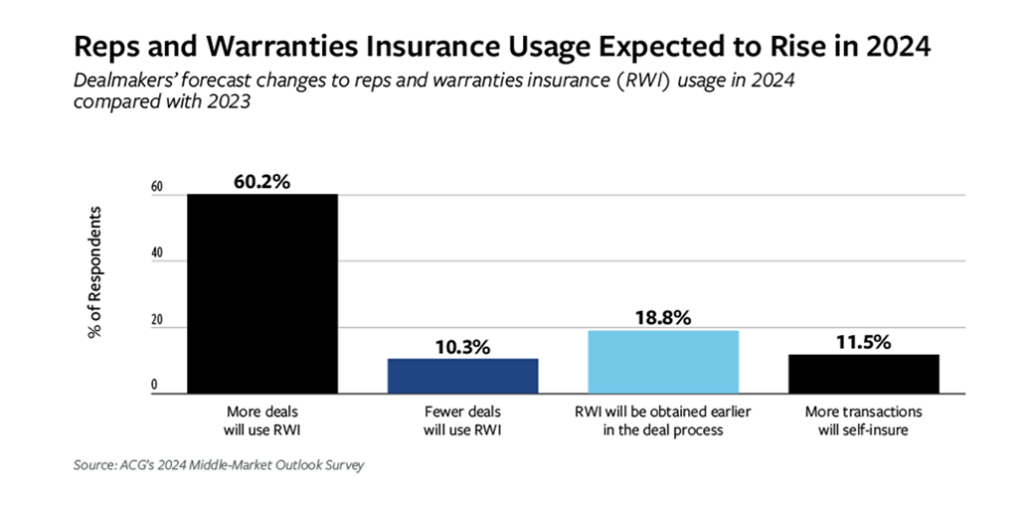

Industry participants expect reps and warranties insurance will continue to be in high demand as M&A activity accelerates. An Association for Corporate Growth survey in the fall showed that 60% of middle-market respondents foresee more deals using RWI in 2024 compared with 2023.

Related content: No Uncertain Terms: Shifts in Key Deal Terms Ahead

RWI pricing is also expected to increase. “The transactional risk insurance arm of a well-regarded managing general agent recently shared that they anticipate raising rates to sustain an uptick in high-severity claims which they have paid,” says Gallagher’s Owens. “We often hear this from our market leaders following an extended softening of the market. While rate hikes are not always immediate, it remains to be seen when or even if this will impact the market.”

A pickup in deal flow is expected to contribute to higher RWI prices, too, but Jesse hopes carriers will keep retentions low—something that will benefit not only dealmakers but insurers themselves. “When the retention is a little bit lower, it means that the policyholder—the buyer—has quicker access to the policy limits,” he says. “I know insurers don’t want to hear this, but that’s actually a good thing for them because it means that this is a product that is actually utilized and is needed.”

As for the decline in negotiated claims that Lowenstein’s report showed, Jesse describes it as a “call to action” for carriers to become more reasonable in resolving claims, in part to ensure that RWI continues to be seen as an effective tool for risk transfer.

“They (policyholders) expect that when there’s a claim that comes in, that they should be paid and they shouldn’t have to be run through the ringer,” Jesse says. “The last thing you want clients to do is question why they even need R&W insurance.”

Katie Maloney is ACG’s content director, based in Chicago.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.