Fundraising Trends and Value-Creation Focus Weigh on Private Equity Hiring

Firms are seeking staff to deploy newly raised funds and fill functional roles while fine-tuning strategies for employee retention

Following a period of strong dealmaking activity, market conditions are shifting and middle-market private equity firms, as well as their portfolio companies, are preparing for a slowing economy. The question is, how will the looming recession and rocky market conditions impact hiring and compensation in 2023?

Turns out, the impact varies greatly depending on firm size and role. Some firms and employees will experience disruption, while others are likely to remain unscathed.

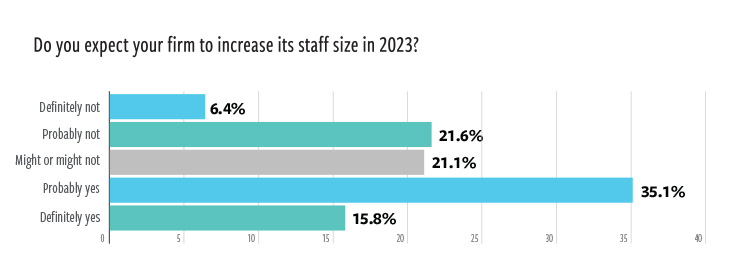

In fact, according to a recent survey* of middle-market financial services executives conducted by ACG, respondents were divided on whether staff size would increase or decrease in 2023.

Fifty-one percent of respondents said their headcount will most likely increase in 2023, while 28% said their staff size will either definitely not or probably not increase. The balance of the respondents remains unsure about staffing in 2023.

“I do not think we are looking at massive layoffs in the private equity industry, but I do think some firms will have a more difficult time getting to target fundraises, which will lead to indirect layoffs and less hiring,” says Bill Matthews, co-founder of BraddockMatthews, an executive search firm that focuses on the private equity industry.

According to PitchBook, during the first three quarters of 2022, U.S. PE firms collectively raised $258.8 billion across 296 funds. However, the year is expected to end on a low note, with fundraising slowing considerably in the fourth quarter.

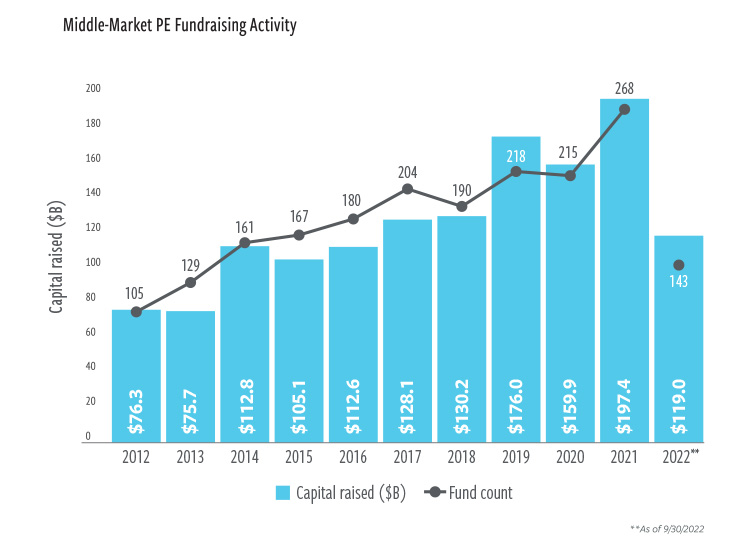

For middle-market vehicles, fundraising has slowed in each quarter of 2022. Through the first three quarters, middle-market funds raised $119 billion across 143 funds, according to PitchBook’s Q3 2022 US PE Breakdown report. “With one quarter to go,” the report’s authors noted, “we expect that the middle-market space will fall short of the 200+ closed funds seen in each of the previous three years. The fundraising market continues to tighten, and the middle market is feeling the pinch as LPs allocate to larger funds and capital is rationed.”

The sentiment at this year’s Super Return conference was similar. According to PitchBook, the consensus at Super Return was that two of every three funds in the market today will need to push their closings into 2023. Even with the longer lead time, given the overcrowding in the fundraising space, large limited partners are prioritizing certain private equity firms over others and often putting their most trusted relationships first. Due to the extensive track records of these long-standing relationships, larger and more-established managers are likely to fare better with their fundraising efforts than emerging and middle-market managers.

“If a firm’s new fund isn’t going to be as big as originally anticipated, managers may look at the headcount and say, based on the size of the fund we are able to raise in this environment, we don’t need as many people,” says Matthews. “Reduction of staff will happen at firms that struggle to raise their next fund. Fundraising is expected to be difficult next year.”

This, however, is a very different story from the firms that raised new funds over the past couple of years and are planning on actively deploying capital in 2023. According to PitchBook, 2021 saw a record amount of capital raised from a record number of funds, with 699 private equity firms raising $366.1 billion. The prior two years—2019 and 2020—were also record-breaking. In the first half of 2022, the private equity industry recorded $1.81 trillion of dry powder, according to S&P Global.

“Hiring for us is driven by our fund size,” says Nathan Schray, director of talent and organizational development with Clayton, Dubilier & Rice, a New York-based private equity firm, which has raised about $10 billion for the first close of its 12th buyout fund. “If you extrapolate from that, it’s fair to say many firms have been growing their fund sizes and many firms have raised new funds. If you have a bigger fund and you are deploying your fund, you need a bigger team to deploy those funds.”

Functional Roles Matter

In addition to hiring traditional investment professionals to deploy funds, many private equity firms have created nontraditional positions over the last few years to strengthen firm resources. “We have seen an overall increase in hiring over the past couple of years. Private equity firms have always recruited traditional investment or deal professionals, but they are now also hiring in other functional areas,” says Dan Ellis, a managing director at Townsend Search Group, an executive search firm that caters to the private equity industry. “They are recruiting in-house operating partners, finance, accounting, business development and marketing professionals,” adds Ellis. “As firms grew their funds, they were able to expand their resources and functional expertise, which ultimately creates value and saves on outside consultants.”

The outlook for these roles will likely remain steady, as a downturn could create a greater need for different skill sets. “Hiring may slow on the dealmaking side if the market declines, but then firms may need more turnaround-type people or operating partners to make sure portfolio companies are performing under more stressful conditions. These functional people come with a different skill set that is useful in a down market,” says Ellis.

Related content: Hiring Talent Where Talent Lives

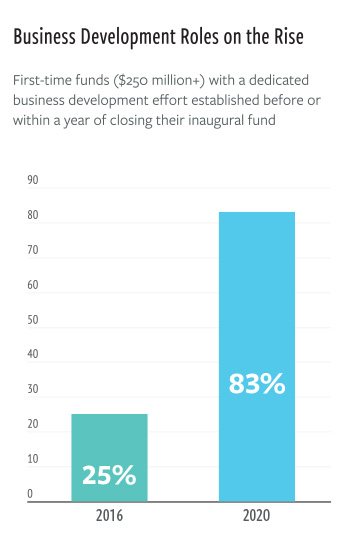

All functional roles have been growing. For example, in 2016, approximately 25% of first-time funds with $250 million or more established a dedicated business development effort within the first year of, or before, closing their inaugural fund, according to research from PitchBook and BraddockMatthews. That number steadily increased in the following years. In 2020, approximately 83% of first-time funds with upward of $250 million established a dedicated business development effort within the first year of, or before, closing their inaugural fund.

Other titles, such as operating partner, chief financial officer, chief compliance officer and chief diversity officer, to name a few, have seen growth as well. “The number of non-investment professionals working in the larger, more established private equity firms has grown significantly. It’s the luxury of getting larger—you have the capital to add these roles and they have the potential to bring tremendous value to the firm,” says Schray.

The number of non-investment professionals working in the larger, more established private equity firms has grown significantly. It’s the luxury of getting larger—you have the capital to add these roles and they have the potential to bring tremendous value to the firm.

Nathan Schray

Clayton, Dubilier & Rice

Retaining Talent

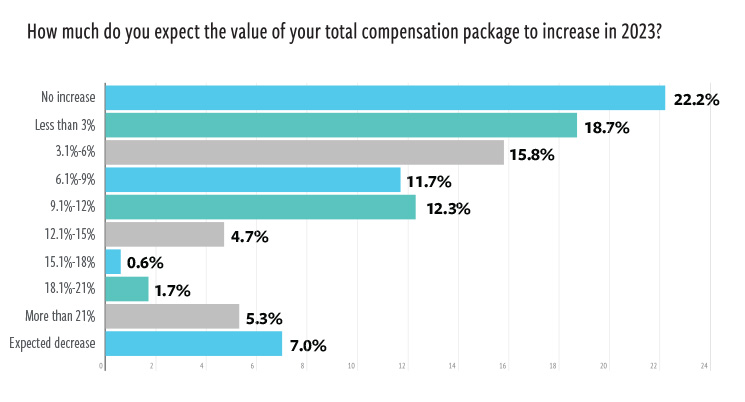

Cash compensation has grown significantly at private equity firms over the past few years; however, most respondents to the ACG survey do not expect that to continue in a significant way. According to the survey, more than 40% of respondents—who represent private equity as well as other financial services firms—expect no increase or a less than 3% increase to employee compensation in 2023. That said, only 7% of respondents believe that total compensation will decrease.

According to Ellis, not only has cash compensation increased over the years but so have offers of equity participation to junior employees at firms. “We are now seeing firms attract talent at a lower level by offering them equity and letting them grow with the firm. It’s harder and more complex to leave a firm when you have that equity,” he says. “Also, by giving equity earlier on, you are telling employees they are a part of the value-creation process, which matters to employees today.”

These factors have made positions at private equity firms more attractive to prospective employees, compared with family offices or private companies that cannot offer carry, Ellis adds.

Additionally, employers are being more thoughtful about work-life balance, and giving employees thoughtful benefits is leading to better retention. For example, Clayton, Dubilier & Rice introduced fertility benefits for its employees. “It’s fair to say, the employee value proposition has evolved. Cash will always matter, but there is growing recognition that other important intangibles need to be considered as well,” says Schray. “Flexible work arrangements are one way to strengthen the value proposition, but there are so many more.”

Working From Home

During the past couple of years, working remotely became synonymous with work-life balance, but this is changing and likely will continue to evolve throughout 2023. Many private equity firms have asked their employees to come back to the office at least four days per week. AEA Investors, New Heritage Capital and The Blackstone Group all have employees coming into the office, and other firms are starting to follow suit.

“If you want to be developed and mentored, you have to be there for the impromptu water-cooler moments. Remote work is a deterrent because you have to be so deliberate about every conversation that it sometimes means you simply don’t have the conversation because it requires scheduling a meeting,” says Ellis. “The pendulum is swinging back, and employers want people back in the office at least a couple of days a week. You have to be present or else you will plateau.”

Matthews agrees and says he is seeing less work from home options being offered. “Firms were trying to be flexible, but now we are out of COVID, and they are setting policies; it’s less fluid. I wouldn’t be surprised if it gets back to a more normal four or five days in the office,” he says.

“The more we talk with people, the more we hear that employers are preferring more in-office time,” Matthews continues, adding that softer market conditions could lead to employees having less power to make demands of employers in general. “This dynamic of working anywhere will change in the next couple of years and employees will have less leverage,” he says.

“The more we talk with people, the more we hear that employers are preferring more in-office time,” Matthews continues, adding that softer market conditions could lead to employees having less power to make demands of employers in general. “This dynamic of working anywhere will change in the next couple of years and employees will have less leverage,” he says.

At the Portfolio Level

Compensation and hiring at the portfolio company level vary greatly depending on industry and role. However, C-suite talent is expected to remain in high demand. A lot of companies that private equity firms buy are owned or led by founders. Private equity firms are tasked with professionalizing these organizations. “These companies are putting in their first CFOs and operational leaders. I do not see that slowing down as private equity firms continue to make acquisitions,” says Ellis.

Employees below the C-suite level may have a different experience in 2023 if the market softens. Still, private equity firms and portfolio company managers must be very thoughtful about how they engage with and develop employees either way.

Related content: Hiring Talent Gets Easier with a Larger Pool of Candidates

“If we go into a full recession, the employers will gain the upper hand, but that’s not where we are right now in the market. Right now, every employer must be in tune with employees’ aspirations, otherwise they will leave to find an employer who is,” says Ellis. “For the private equity firm, to be in tune with employees creates a good transformation story for them to share. People want to feel included and part of something.”

Even if the economy enters a recession and employers gain some leverage, they’ll still need to tread carefully to protect their reputation. “If the market turns and employers do gain the upper hand, they will have more flexibility, but either way employees will share their experiences with the world,” Ellis says. “Positive and negative actions will have an impact on a company’s brand.”

DANIELLE FUGAZY is a freelancer writer covering private equity for more than 20 years. She is based in Glen Cove, New York.

*ACG conducted a survey between Aug. 16 and Sept. 21 in which 171 respondents from the middle-market dealmaking and corporate growth community answered questions about their outlook for 2023.