The Search for Talent Continues Even Amid the Pandemic

Many investors and their portfolio companies had already incorporated technology in hiring decisions before COVID-19, but those capabilities have since become indispensable.

This story originally appeared in the Winter 2021 print edition of the Middle Market Growth Outlook Special Report. Read the full report in the archive.

Pandemic or not, private equity firms and their portfolio companies have to keep moving forward, and sometimes that requires hiring new talent. Prior to the COVID-19 outbreak, many investors and their portfolio companies had already incorporated the use of technology to help them make hiring decisions. Those tech-enabled capabilities have since become key in a world where meeting candidates face-to-face is no longer a viable option.

“Like everyone else, we had no idea in March what was going to happen. No one has lived through anything like this before,” says Lisa Knapp, talent manager for NewSpring Capital, a middle-market private equity firm. “We put the brakes on to see how busy we were and what our portfolio companies needed. By the summer, it became apparent that this wasn’t going away and we needed to do what we needed to do.”

NewSpring has continued to add to its staff this year, although the hiring and onboarding process looks a bit different than it has in the past. “We are hiring as planned for 2020 to replenish our analyst program, and adding additional senior team members as necessary,” Knapp says. “The biggest change is that we are hiring all virtual, so while hiring needs haven’t changed, how we hire, onboard and maintain our culture while the office is closed has.”

The biggest change is that we are hiring all virtual, so while hiring needs haven’t changed, how we hire, onboard and maintain our culture while the office is closed has.

Lisa Knapp

Talent Manager, NewSpring Capital

NewSpring is not alone in moving ahead with its hiring plans. Almost 50% of deal-makers say that the pandemic hasn’t affected their appetite to hire, according to a recent survey conducted by ACG and sponsored by Globalization Partners1, a company that helps businesses hire globally. Additionally, the majority of respondents said they expect to hire in 2021 at the portfolio level, because their portfolio companies will be expanding or replacing talent.

“We’ve been fortunate that the pandemic has not negatively impacted our hiring. We are doing more virtually, and not meeting candidates live before offers, so it means more reference calls, but we have to keep our recruiting and hiring levels the same,” says Melissa Guttman, a principal and head of talent at JMI Equity, a middle-market private equity firm.

In addition to leaning on technology like Zoom to help with new hires, many firms are turning to their own networks and headhunters to find new talent, according to the survey. More than 40% of respondents said they rely on an existing network of advisors to help them identify candidates, with 24% saying they use a headhunter. Using personal networks isn’t necessarily a new practice, but it’s perhaps more comforting today when you’re less likely to meet someone in person.

Adam Miller, a managing director and head of global talent management with The Riverside Company, says his firm relies on both methods. “We have a strong network of individuals who are well-networked and referrals tend to work in our favor. There are no recruiting fees and the candidates are usually very strong—everyone wants to refer someone that is a good reflection on themselves,” he says. “The senior-level positions with sector specificity are harder and fewer to come by, so sometimes recruiters can pull the levers and are good to lean on in these instances.”

Guttman adds that using recruiters can help diversify the candidate pool, which is an important initiative for the Baltimore-based firm. “We use a search firm quite regularly. It doesn’t mean we will not reach out to our network, but the search firms have broader reach and it helps us gain diversity at the firm, which we are focused on. They go beyond our network,” she says.

Overwhelmingly, private equity firms look to hire when they expect to expand into new markets and need teams on the ground, according to the survey. Additionally, most firms start searches for new hires prior to closing on a deal; however, they tend not to make a final decision on hiring until after the transaction closes and there has been an assessment period to evaluate the company’s needs.

Miller agrees with survey respondents and says Riverside’s deal teams target a blended approach as well. “Pre-acquisition, the transactors are meeting with management and understanding the operation and where the synergies lie,” he says. “Generally, the search for talent in our portfolio companies is done post-acquisition, when boots are on the ground, and our operating partners can truly see how the company operates and can onboard the right talent. They can start the search prior to a deal closing, but not pull the trigger until after you get a feel for the operation in action.”

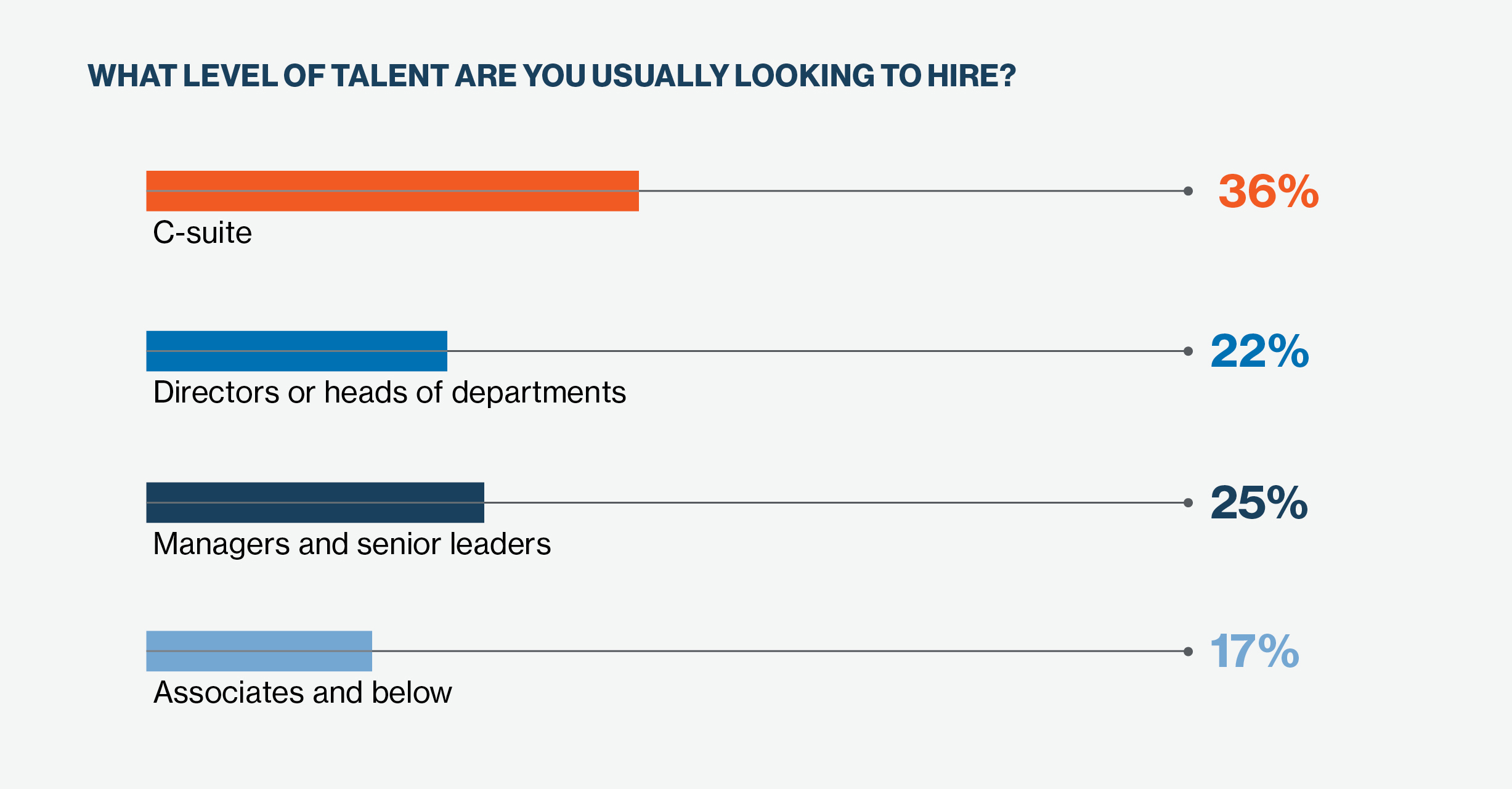

C-suite-level individuals are the most sought-after talent for portfolio companies, according to the survey, with 36% of respondents saying that these senior-level positions are the ones they’re looking to hire most frequently. The importance of having the right C-suite talent cannot be overlooked. Private equity firms want to replace top positions soon after the transaction is complete because effective management teams often lead to strong returns. “The C-suites of the portfolio companies drive the vision. If you have the wrong people in these roles, it can eat away at growth,” Miller says. “If it takes too long to identify the right person, the company will be that much further along in the holding period and it will impact the company’s growth and performance.”

He stresses that time is of the essence, creating urgency for private equity firms to hire new leaders quickly. “Our private equity funds typically have a three- to seven-year window to help grow a portfolio company. The more efficiently you can hire or replace executives, the better the company performance will be long-term. These individuals play an important role when making decisions at your company. Their importance can’t be underestimated,” Miller says.

When it comes to acquiring a carveout, buyers want to be sure that they will be able to retain key talent. To do that, most respondents said that they offer performance and retention bonuses as well as incentive plans.

“First, assess talent to determine if you want to retain, then offer retention bonuses payable in six to 12 months. You can also offer incentive plans as well,” offered one survey respondent.

Others try to forge strong relationships with talent, reinforce the executives’ value in the organization, and assure them of their future within the business—and perhaps even offer promotions.

We use a search firm quite regularly. It doesn’t mean we will not reach out to our network, but the search firms have broader reach and it helps us gain diversity at the firm, which we are focused on.

Melissa Guttman

Principal and Head of Talent, JMI Equity

“We talk to each key person individually to discuss the long-term strategy for the business, solicit their ideas on how to add value, and determine their aspirations on how they see themselves fitting in. If their only motivation is getting a better compensation package, we write them out of the go-forward plan,” one respondent wrote. “If they see the vision, we look to get them deeper involved.”

Another respondent offered, “Ensure a clear understanding of the strategy along with well-defined expectations of the role, provide an incentive-based approach, and involve senior leaders in the interview process to ensure a good cultural fit of the candidate.”

Many respondents stressed that retention of key employees is critical in a carve-out situation.

Respondents’ outlook for hiring talent in 2021 was evenly split between hiring to expand and hiring to replace talent that has moved on. Riverside’s Miller admits he will be approaching the new year cautiously when it comes to hiring. “Without a vaccine or herd immunity, we are not running into 2021. We will see where the winter months take us and where we are with the needs of our companies,” he says. “At the private equity level, there is usually some organic attrition as a result of bonus payouts at the end of the year or in the first quarter. I don’t think we will see as much of that with all the uncertainty. We will do what we need to do to keep our businesses profitable.”

Additionally, some expect changes to the ranks of job seekers in the future as a result of COVID. “It is too early to tell, but my guess is that the candidate pool for associate classes will look different,” says JMI’s Guttman. “There might be less investment banking analysts than in prior years, so a smaller pool there, but as a result we may have access to more candidates for our analyst class, which we hire straight from undergrad. There could be a shift in the number of candidates available, which could give hiring firms an advantage, depending on what position you are hiring for.”

Few things about the market are certain as firms make plans for the new year, and many are doing their best to forge ahead amid the continuing pandemic. “We are just going to have to wait and see how things play out,” says NewSpring’s Knapp. “We are moving forward with the reality that this will drag on longer than we thought, so we’ve focused on how we can stay efficient through hiring and training new talent and keeping a positive culture.”

1 Between September 8 and November 3, ACG surveyed deal-makers about their outlook for hiring talent in 2021 and other topics. More than 600 deal-makers completed the surveys.