The Staying Power of Technological Transformation

Investors and advisors say SaaS and tech-enabled services businesses are helping companies upgrade antiquated processes or solve new problems

The concept of digital transformation might sound like a tale as old as time, especially after the COVID-19 pandemic made companies rush to do business virtually.

But sector advisors say this work is not done. There are many industries that still operate with antiquated processes, as well as sectors whose inefficiencies were revealed during the pandemic, that can benefit from digital upgrades.

Tech-enabled services companies and SaaS (software-as-a-service) businesses have jumped into that fray, helping upgrade old-fashioned ways of doing business or solve emerging problems.

This section of the report originally appeared in the Special Digital Report: Tech issue, sponsored by TresVista. Read the full report here.

Sector advisors point to healthcare, government services and human resources management as some areas where technology services—either as a software product or an outsourced service provider—can help upgrade old systems. Supply chain, transportation and logistics, meanwhile, are areas that were weakened by the pandemic and lockdowns, and now benefit from technology upgrades and digital processes.

“There are certain end markets that are realizing using old software or none at all doesn’t cut it anymore,” says Jeremy Fiser, managing director in Baird’s Technology & Services Investment Banking Group. “There are a lot of different opportunities in underserved or underrepresented markets like schools and municipalities that are working with outdated software.”

There are certain end markets that are realizing using old software or none at all doesn’t cut it anymore.

Jeremy Fiser

Baird

Adrian Guerra, partner at Houston-based lower middle-market firm Capstreet, agrees that some industries are behind in adopting technology solutions. “We see opportunities in various areas that were previously laggards in adopting technology,” Guerra says. “Software and other technologies are becoming more accessible to smaller companies as costs come down as a result of cloud computing and other advancements.”

Government Software and Other Pockets of Activity

Multiple sources say that government entities, particularly state and local governments, have historically been behind on adopting technology-driven processes. That’s starting to change.

Content continues below

“Legal and government services solutions businesses have historically operated with heavy reliance on people and paper,” says Josh Koplewicz, managing partner at Thayer Street Partners, a New York-based lower middle-market private equity firm. “As they transition to the cloud and more software systems, it creates opportunities that we’re monitoring.”

One of Capstreet’s recent acquisitions was the purchase of PlanetBids, a provider of e-procurement SaaS solutions. Headquartered in Studio City, California, the company aims to streamline the procurement process for government agencies, nonprofit organizations and educational institutions.

The bid management process is often cumbersome for government entities, Guerra explains. They must run public processes that are subject to strict regulations and periodic audits when seeking service providers. PlanetBids helps its clients organize their processes, communicate with all stakeholders and keep them compliant.

Baird’s Fiser says local government entities in particular stand to benefit significantly from digital transformation, an area that has seen some recent deal activity. Multiple companies in this space have seen deals so far this year, including OpenGov, SmartGov, JJR Solutions and Finvi.

Elsewhere, business challenges that arose during the COVID-19 pandemic and its aftermath are additional targets for modernization efforts, says Fiser. Addressing labor shortages, managing global or remote workforces and making supply chains more resilient are just a few spots benefiting from technology improvements.

Legacy solutions in supply chain management aren’t as effective anymore. “An increasingly interconnected global supply chain necessitates modern solutions that can digest and provide actionable, real-time insights,” says Andy Livadariu, managing director in Baird’s Technology Group. “Supply chain visibility solutions that allow organizations to respond proactively and with agility will see tremendous investment interest.” In October, UPS announced plans to buy Happy Returns, a software and reverse logistics company that offers frictionless returns for merchants and customers without needing boxes or labels. Other strategic investors like Blue Yonder and Optilogic have been active in the area, too.

The Services Focus

Bona fide technology investors are often looking to parse what’s a “true tech company” and what’s just masquerading as such. For some, that distinction doesn’t matter. “Everything is becoming tech-enabled,” says Thayer Street’s Koplewicz.

Thayer Street targets B2B business services, financial services and real estate services companies where technology is being used to upgrade old processes. The firm’s portfolio company Grove Point Marinas, a holding company that acquires and operates marinas around the country, has acquired assets in 10 states since coming under the Thayer Street umbrella in 2021. Koplewicz says the company is now using digital tools to improve the experience of its customers and employees. In February, Thayer Street was on track to invest in a hybrid software and services business in the real estate space.

While SaaS investors usually focus on software as the main product, firms that target “tech-enabled services” are often talking about companies that offer an outsourced service where technology and digital upgrades are part of the equation. Trent Hickman, managing director at VSS Capital Partners, thinks of them as businesses that use “people, process and technology to outsource a business function and do it faster and cheaper than in-house.” This could mean outsourcing HR, finance and accounting, or IT services to a third party.

New York-based VSS, which invests in lower middle-market companies via equity and credit, targets founder-owned tech-enabled services companies that have 60%-80% recurring revenue streams.

Last year, the firm reinvested a minority stake in GreenSlate, a tech-enabled provider of payroll and accounting services for the entertainment industry. VSS’ portfolio company Quattro Business Support Services, which offers cloud-based accounting and payroll services and other business outsourcing functions, bought Robust Network Solutions, an outsourced managed IT provider, early last year.

Evaluation and Valuation

Valuation multiples in technology have historically been high, and several sources say they haven’t come down much in the last year. That’s because it’s mostly high-quality assets that are trading. “The best SaaS companies are still trading in the high single-digit or low double-digit revenue multiple area,” Baird’s Livadariu says.

VSS’ Hickman agrees that only top-quality assets have been trading lately, which makes valuations look high. In the tech-enabled services space, he’s seen some come down to the 10x-12x EBITDA range, while it would have been 14x-15x two years ago.

Capstreet’s Guerra says he’s seen no or very low discounts on the top-quality SaaS companies that are selling. Sources say it’s when the B or C assets start trading that valuations will likely come down.

Capstreet’s Guerra says he’s seen no or very low discounts on the top-quality SaaS companies that are selling. Sources say it’s when the B or C assets start trading that valuations will likely come down.

While buyers are increasingly scrutinizing tech companies more for being able to deliver profit, not just high growth, Livadariu says acquirers will still look at break-even companies as long as they’re capital efficient. Fiser adds that the focus on profit is the knock-on effect of high interest rates and companies having to service more expensive debt loads.

“Investors used to reward companies for high growth and no profitability,” says Capstreet’s Guerra. Now they are looking for profitability or at least a path to get there, so they have it at exit. “It used to be that companies could have lots of growth and no visibility to positive EBITDA, but that’s changing.” He notes that the Rule of 40, a common principle in SaaS investing that says a company’s combined revenue growth rate and profit margin should equal or exceed 40%, “is becoming the Rule of 50 or 50+.”

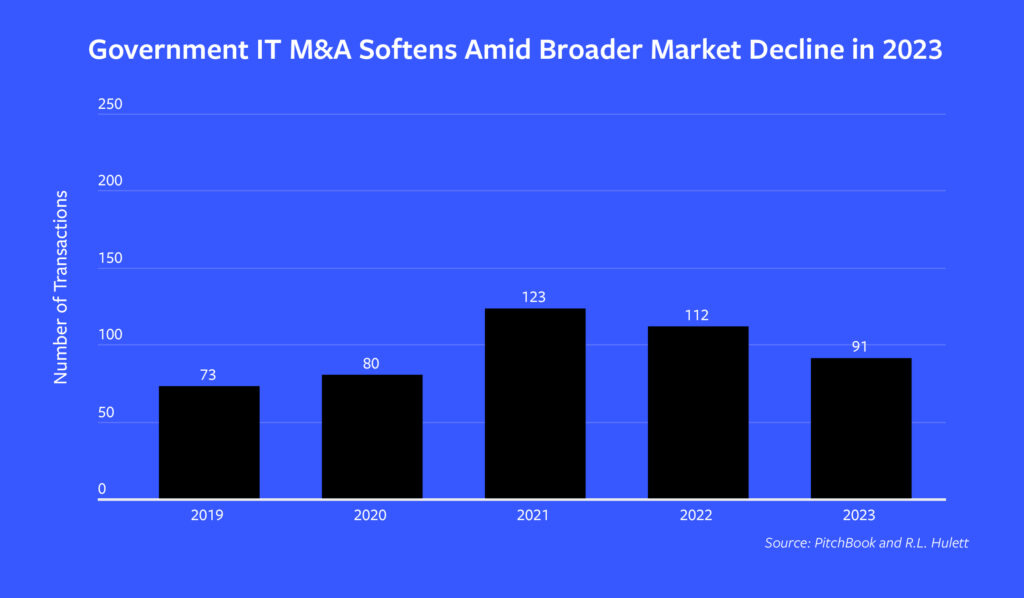

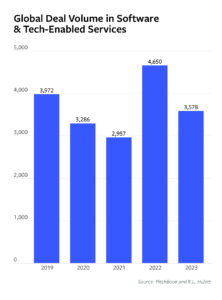

Despite a lot of the themes underpinning activity in the technology services space, deal volume was down across the board last year. The number of government IT services transactions fell to 91 in 2023 from 112 in 2022, according to Capstone Partners research, for example. Deals for software and tech-enabled services overall declined to 3,578 in 2023 from 4,650 in 2022, according to PitchBook data compiled by St. Louis investment bank R.L. Hulett.

Investors say they are seeing signs of improvement so far this year. “Generally, there are a number of signs that the market is firming up a little bit and we might get some interest rate cuts,” says Hickman. “More companies are coming to market and there is a gradual improvement in conditions. But it won’t be like we flip a switch and go back to 2021.”

Anastasia Donde is Middle Market Growth‘s Senior Editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.