Harnessing AI in Dealmaking and Corporate Tasks

While investing in pure-play AI companies might be a strategic and VC game for now, private equity firms are studying AI applications at portfolio companies and implementing new tools in their own dealmaking work

Artificial intelligence and generative AI have moved from futuristic sci-fi ideas to real-world technologies at warp speed. While private equity firms are largely taking a wait-and-see approach to AI investments, they’re keeping a close watch on developments and have begun taking advantage of the new technology in their work.

“AI is a broad subject and we are in the beginning days. … Everyone knows it is going to have a strong impact, but the question is which one and who will be the winner?” says Francois Jerphagnon, head of expansion for European private equity firm Ardian. He likens the current state of AI to the early days of the internet, when it was all but impossible to determine who the winners would be among early entrants such as Netscape, the dominant browser at the time.

This section of the report originally appeared in the Special Digital Report: Tech issue, sponsored by TresVista. Read the full report here.

“In the late 1990s, Yahoo was the name, but today who remembers Yahoo? There can be pitfalls to investing too early,” says Jerphagnon.

While there is no shortage of money heading into AI-related businesses, so far, the largest inflows have been from large technology companies like Amazon, Apple and Google. Industry participants say there is good reason for that: AI technologies are in a nascent phase where the building blocks for future applications are still being laid, and it remains unclear how many emerging AI applications will ultimately be monetized.

“Private equity likes to see proven technologies. They want to find predictable and profitable revenue production. A lot of the AI investment today is in companies that are still experiencing cash burn but have high promise,” says Travis Drouin, head of Baker Tilly’s technology industry practice.

A lot of the AI investment today is in companies that are still experiencing cash burn but have high promise.

Travis Drouin

Baker Tilly

Many PE firms are waiting for pure-play AI companies—those where AI is ultimately the end product—to mature before investing. But companies that leverage AI to help solve specific problems are already generating significant interest and are expected to represent the initial wave of PE investments.

“I think about AI not as something to invest in directly but rather an overlay that impacts how we think about our investment theses, how we think about different end markets and the durability of those markets,” says Jon Nuger, a managing director and member of the technology team at Berkshire Partners. “For us, the questions are: which sectors or companies are more or less likely to be impacted by AI, and what are the ways we can be harnessing AI in a portfolio company value creation context?”

Content continues below

“AI is evolving—across every industry and every company, from law firms to banks. … Everyone is sorting through it and trying to think how to harness it, and nobody wants to be left out,” says Tim Poydenis, co-head of the emerging companies and venture capital practice at law firm Holland & Knight.

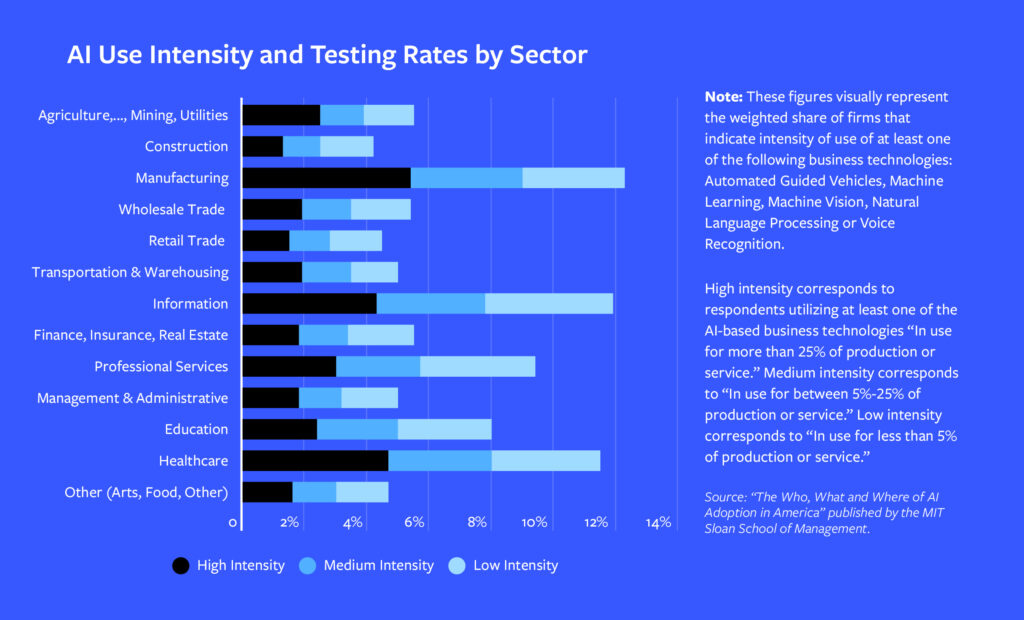

According to a February research report penned by academics from several universities and published by the MIT Sloan School, the manufacturing, healthcare and information sectors have been the biggest users of AI tools so far.

The Path to Maturation

As VCs and PE firms race to weed out the most promising players in AI, it is the “tech enablers”—infrastructure and support companies, and those with tangible products—that have been attracting initial investments. One example of the latter is Locus Robotics, which specializes in autonomous mobile robots for warehouses. The company recently landed an $8 million investment from Canadian public company Stack Capital Group. Another example industry participants point to is Nvidia, a publicly listed company that has seen its value nearly quadruple. Nvidia provides support for AI technology and the internet of things.

One factor that will determine when PE firms begin actively investing in AI is the size and maturity of companies in this space. “For AI companies, transitioning to traditional PE often involves achieving annual revenue targets of $20 million to $50 million, maintaining consistent growth rates and demonstrating profitability or a clear path to profitability,” says Kevin Baragona, founder and CEO of DeepAI, a company specializing in online text-to-image generation. “Once these milestones are reached, they become attractive candidates for PE buyouts or growth equity investments.”

Another consideration that will keep investors engaged in this space is the increasing demand for all things AI. “In our recent survey, 70% of executives said that AI is going to affect their business and it’s going to drive their business innovation over the next few years,” says Kevin Desai, a partner and private equity lead at PwC.

AI Use in M&A Work

While investing in pure-play AI companies might be premature for private equity firms, many have begun using AI to assist with dealmaking efforts. According to a recent SS&C Intralinks survey, 93% of the 300 corporate and private equity dealmakers polled said they anticipate increased use of AI tools in the M&A process.

Socratics.ai is a data and AI platform that can automate as much as 70% of deal execution, from pitch decks and financial modeling to company research and strategic positioning. As the company seeks funding from the VC and PE communities, Tim Eun, founder and CEO of Socratics.ai, has become well versed in both industries’ early usage of artificial intelligence. Though many organizations are only beginning to dip their toes into utilizing AI in-house, Eun says that “up to 90% of analysts are already using ChatGPT privately outside company policy. They’re inputting the description of a company and having it write a script that they can then put in their own voice into pitch decks.”

In cases where PE firms are actively embracing AI tools to help automate tasks such as filtering data, the technology is already having a significant impact on M&A workflow, and industry experts predict this will only increase. In many cases, it is already being used to help identify promising investment opportunities by tracking factors including hiring trends at job websites to identify companies that are expanding.

Philipp Krohn, a partner and CEO of Alantra US, says that advanced analytics are already yielding benefits in M&A processes, including identification of new revenue sources, deal sourcing, due diligence, valuation and negotiation. “As the technology continues to evolve, we anticipate broader adoption of AI in M&A processes, leading to a more efficient and effective industry,” says Krohn. “At Alantra, we have already initiated AI-driven processes to comprehensively analyze the information stored in our knowledge center.”

Last year, the tools helped Alantra track over 46,000 interactions, analyze 5,000 meeting notes, and reach over 1,000 potential buyers. Krohn adds that AI is not only transforming how deals are done, it is changing the M&A opportunities pursued by the firm’s clients.

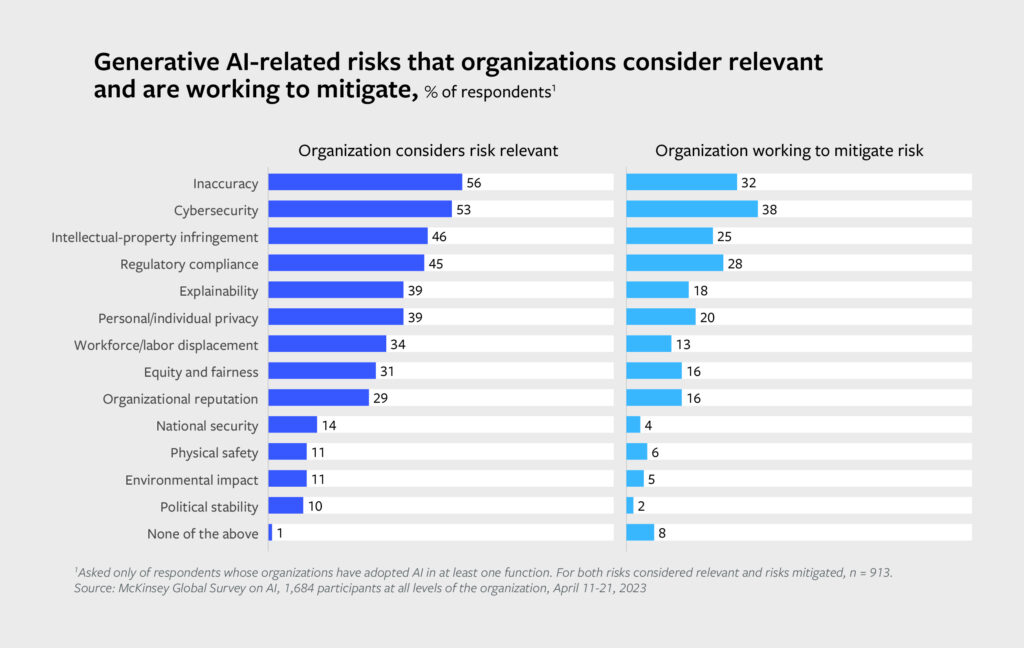

Still, while the PE industry already sees the benefits of using AI for its own workflow, industry experts are well aware of the risks of unknown biases within algorithms and hallucinations (false information generated by the large language models that power AI chatbots and algorithms). According to a 2023 McKinsey & Co. report, inaccuracy, cybersecurity and intellectual property infringement are the top risks cited in generative AI adoption.

While there is quality data flowing into AI, experts agree these engines don’t have the level of accuracy necessary to replace the role of analysts and likely never will. “There will still be the need for a human, and a very qualified human, to make the judgment at the end of the day,” says Ardian’s Jerphagnon.

Britt Erica Tunick is an award-winning journalist with extensive experience writing about the financial industry and alternative investing.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.