The Great Industrial Relocation

As supply chains migrate away from China, dealmakers angle to aid the transition

The supply chain shocks of the COVID-19 pandemic turbocharged a trend that had begun years earlier, when companies began reconsidering where they manufacture goods and who they partner with on production.

Increasingly, that’s meant moving some production activities closer to home, which has in turn created investment opportunities in businesses that help facilitate this “reshoring” phenomenon—whether by adding North American manufacturing capacity directly, or by providing products and services intended to increase productivity.

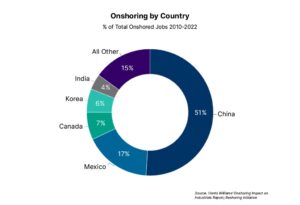

Reshoring appears to have gained broad traction. A December report from investment bank Harris Williams noted that 90% of North American manufacturers plan to bring at least part of their operations back to the continent in the next five years. The report showed that approximately 1.2 million manufacturing jobs have come back onshore since 2019.

Content continues below

“We’re witnessing a massive ‘reshoring’ trend supporting investments in North American industrial activity,” says Steve Lunau, partner at private equity firm One Equity Partners. “After the tumultuous geopolitical environment of the past four years, companies are increasingly looking to shorten their supply chains or—at a minimum—have a solid presence with sufficient access to the North American economy.”

The pandemic’s disruption to supply chains, coupled with tariffs and government policy, rising transportation and labor costs, and geopolitical tensions, has shifted the cost-benefit analysis of producing goods in China, long favored for low-cost manufacturing. Some companies had started moving some production away from China prior to COVID-19, to Mexico or Southeast Asia, for example, notes Richard Vitaro, the founder of consultancy Creo Advisors. The pandemic further underscored companies’ reliance on a single country and created greater urgency around diversifying supply chains.

Vitaro recalls a situation where a company had a single supplier in China that no one had visited for years. If something negative happened, the company could be out of business in a matter of months. “Those sorts of realizations have triggered board-level discussions and an effort to seek alternatives for portfolio companies,” he says.

Working with existing contract manufacturers to build capacity outside of China or exploring new partnerships are some of the ways that companies are addressing this concentration issue, Vitaro says. Others, meanwhile, are using M&A as a tool.

Promising Pockets

The industrial segments that stand to benefit most from onshoring are wide ranging and bear notice from industrials-focused dealmakers seeking growth opportunities, according to Harris Williams’ report.

The investment bank cites building products and materials; chemicals and specialty materials; engineered equipment, products and components; packaging; and industrial technology as critical segments that are likely to grow thanks to onshoring.

Waldo Saville, vice president of North America for Efficio, a global procurement and supply chain consultancy, names renewable energy, critical minerals, automotive, semiconductors and defense as other industrial subsectors likely to move production to North America.

He points to tech-focused private equity firm Silver Lake’s 2021 investment in GlobalFoundries, a semiconductor foundry headquartered in the United States, as a deal predicated on the push for greater supply chain resiliency. “Ultimately, nearshoring is driven by the need to have more resilient supply chains that are closer to home. You can be more responsive. There’s lower risk,” he says. GlobalFoundries completed an IPO in 2021, generating $2.86 billion; Silver Lake realized the investment in 2023, according to the PE firm’s website.

Middle-market private equity firm MiddleGround Capital cited nearshoring in its decision to partner with L.S. Starrett, a Massachusetts-based manufacturer of high-end precision tools, cutting equipment and metrology systems, in an all-cash transaction that would take the company private for $16.19 per share. (L.S. Starrett was formerly listed on the New York Stock Exchange.) John Stewart, managing partner of MiddleGround, said in a press release, “We are excited about the opportunity to further position the company for its future on the front lines of innovation, advanced manufacturing and reshoring.”

Saville notes that government programs created by the Inflation Reduction Act and the CHIPS Act, for example, provide additional incentives for companies to bring production to the U.S. Automation technology has proven a critical enabler for reshoring, too.

“With all the supply chain risks, tariffs and long lead times, the cost delta between China and the U.S. has become less attractive, and especially with automation, there is a preference to have supply closer to home,” says Saville.

Because of technology’s role in improving the efficiency of production processes, Saville sees a greater push for automation, robotics and other tech solutions. Supporting these technology services providers and other businesses whose offerings improve productivity has emerged as an alternate route for middle-market investors to profit from reshoring.

Tech Support

When relocating manufacturing processes, it’s impossible to transpose them exactly as they existed in another country, where workers might be more readily available and paid less.

“When you reshore to the U.S. you can’t bring manufacturing to the U.S. in the same structure,” says Mike Foisy, a president and partner with middle-market private equity firm HKW. “When you bring it back to the U.S., you’re going have to do the same kind of output with fewer people, which will require the design and utilization of more innovative solutions.”

The Harris Williams report estimated a shortfall of more than 2 million manufacturing jobs by 2030, “creating significant opportunities in automation, advanced manufacturing and big data, among other key Industry 4.0 trends.”

The need for automation technology has caught the attention of mid-market PE firms like HKW. “From an investment perspective, we’re focusing on companies that are coming up with novel approaches—either from an IoT perspective or a technology perspective—that will help facilitate this overall trend,” Foisy says.

Maintenance is one example of an area that can be automated to improve a factory’s efficiency and prevent shutdowns, Foisy adds. Sensors on machinery can feed information to a management team and stave off breakdowns. “If you have a productive, predictive process, you never shut down,” he says. “You never lose that productivity.”

One Equity Partners is another private equity firm that considered reshoring when investing in its worker safety business, Ballymore Safety Products. Based in Pennsylvania, the company designs, develops and manufactures safety products—like lifts, work platforms and fall protection systems—used in retail and industrial environments. A press release announcing the deal noted the role of safety products for protecting workers and, in turn, increasing productivity and reducing time lost due to injuries.

“As industrial warehouse and distribution activities move back to the U.S., they’re doing so in a manner focused on the safety and diversity of the workforce,” says Lunau. “Ballymore’s products and solutions allow its customers to scale up North American industrial activity in a safe and effective manner, while upholding the standards of today’s North American corporations.”

Reshoring has also shown up in recent fundraises. CORE Industrial Partners, a manufacturing, industrial technology and industrial services-focused private equity firm, cited reshoring as a tailwind in a February press release announcing the closing of two new funds, totaling $887 million. The firm’s newest fund strategy, Industrial Services I, aims to capitalize on the industrial services sector’s “strong growth due to reshoring and proliferation of advanced technologies with the adoption of Industry 4.0 applications in North America,” according to the release.

What’s Ahead

Despite a desire by North American manufacturers to diversify their supply chains and government incentives to bring production home, it’s not something that will happen overnight. “Whether it’s building a new facility, ramping up from non-manufacturing to manufacturing, encouraging a contract manufacturer to move to China-plus-one, or doing an RFP to work with contract manufacturers—that takes time,” says Vitaro.

It’s also unclear how long the horrors of the COVID-era supply chain bottlenecks will haunt business leaders. “Sometimes people are inclined to go for the quick win versus long-term stability,” says Foisy. “However, no business is immune to challenges like supply chain bottlenecks, and having a long-term plan is important to achieve sustainable business growth.”

There are challenges related to the skills gap, too, which will influence whether the U.S. has the manufacturing and logistics talent to support an influx of industrial activity. Whether automation and technology can fill the void remains to be seen.

At the same time, government incentives are likely to encourage investment in U.S.-based supply networks for the foreseeable future. And the financial calculus of producing in far-away countries is no longer as cut and dry. “The costs of losing access to North America are becoming greater than the benefits of cost savings overseas, especially when accounting for geopolitical uncertainties,” says One Equity’s Lunau. “We see this trend within our own portfolio as well as new platforms we’re tracking.”

The ability to operate more nimbly is another factor on the scale of pros and cons that business leaders must weigh. Vitaro summarizes the trade-offs that companies are considering: “It may cost us 5% or 10% more to (manufacture) in non-China locations, but we’re OK with that because we are actually closer to the customer and have more resilience and lower risk.”

Katie Maloney is Vice President of ACG Media.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.