Setting the Stage for 2018 Trends

Stronger M&A activity in the middle-market arena this year is building on the positive momentum recorded in 2017.

This article is brought to you by S&P Global Market Intelligence. It originally appeared in the 2018 Middle-Market Trends Report.

Heightened private equity investing, increasing valuations and a growing number of deals involving foreign buyers are likely to drive U.S. middle-market activity higher in 2018.

Stronger M&A activity in the middle market arena this year would build on the positive momentum recorded in 2017. Middle-market companies—institutions with annual revenue ranging from $10 million to $1 billion—were targets in $100 billion in announced deals. That represents a 14 percent increase from the levels seen in 2016 and marks the highest aggregate value for middle-market deals since 2014, according to S&P Global Market Intelligence data.

Middle-market M&A activity in 2017 was bolstered by strength in the technology space, which led all sectors in both the number of deals and total deal value, generating 90 transactions with nearly $22 billion in aggregate value.

Private equity firms also helped drive middle-market M&A activity higher in 2017. Leveraged buyout activity in the middle-market space rose to $8.9 billion in 2017 from $6.7 billion a year earlier. The level of activity last year marked the highest disclosed dollar amount for middle-market leveraged buyouts since 2013, when $10.5 billion in transactions occurred.

Private equity interest in middle-market companies seems unlikely to wane in 2018, with firms holding in excess of $1 trillion of so-called dry powder, or capital raised but not yet deployed. For instance, in January 2018 alone, Compass Diversified Holdings LLC agreed to purchase Foam Fabricators Inc. for $247 million, and Francisco Partners Management LLC announced plans to acquire a controlling stake in health care technology firm Connecture Inc. for $112 million.

Traditional strategic buyers should support further M&A activity in the middle-market arena as well, as cash in corporate America stands at extraordinary levels. Calculations place total cash and investment holdings among nonfinancial and real estate S&P 500 companies at more than $2 trillion. The passage of tax reform should cause that number to increase even further as companies receive a windfall of profits from the corporate tax rate falling to 21 percent from 35 percent.

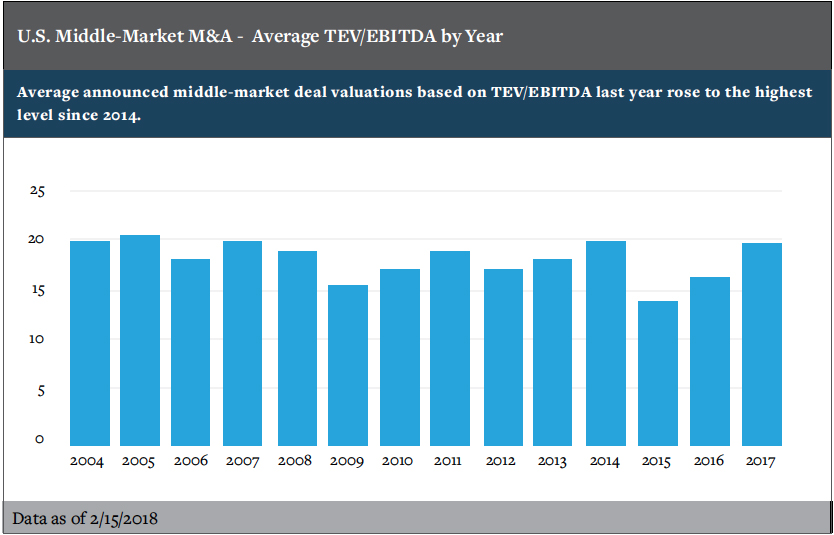

As middle-market M&A moves ahead in 2018, we anticipate valuations may edge higher. The average valuation in 2017, based on a transaction’s total enterprise value relative to a target’s 12-month trailing EBITDA, rose to 19.3x from 16.3x in 2016, marking the highest multiple since 2014.

While many economists believe the current U.S. economic cycle could be entering the late stages, U.S. corporate profits just recently reached a record level of $1.86 trillion in the third quarter of 2017, according to the Federal Reserve Bank of St. Louis. The surplus of cash and the current phase of the economic cycle could increase buyers’ willingness to bid assets higher. Borrowing costs have

begun to rise and that could potentially deter some buyers, but steady increases in interest rates last year failed to cool activity or hinder valuations.

There remains strong interest from foreign buyers in the U.S. middle-market space as well. Last year, the disclosed value of foreign purchases of middle-market U.S. companies exceeded $20 billion for the second consecutive year, while the number of deals reached the highest level since 2011.

This article originally appeared in the 2018 Middle-Market Trends Report, featuring expert insights from ACG partners and featured firms. Find it in the MMG archive.

As principal analyst at S&P Global Market Intelligence, Richard Peterson provided in-depth evaluation of capital markets activity from M&A transactions, IPO issuance, corporate cash balances and fixed-income underwriting.