PE Weekly: Manufacturing, Software Fuel M&A Deals This Week

Platform investments, carve-outs and take-privates drive healthy week in dealmaking

Platform Investments

Trivest Backs Applied Value. Trivest Partners has provided a growth investment in Applied Value Group, a management consulting firm. Applied Value specializes in advising on cost and capital efficiency improvements for Fortune 500 clients as well as private equity firms.

Thoma Bravo Takes Verint Private. Thoma Bravo, an investment firm focused on software, has acquired Verint Systems for $2 billion. The transition delists Verint from the Nasdaq. The firm expects the deal to close in early 2026.

Peak Rock Acquires Aegis Software. Middle-market private investment firm Peak Rock Capital has acquired Aegis Industrial Software. The company provides manufacturing execution system (MES) software for electronic components and discrete manufacturing, targeting the aerospace and defense, medical device, consumer electronics, and other industrial end-markets.

Partners Group Acquires Minority Stake in restor3d. Partners Group has acquired a minority stake in orthopedic solutions provider restor3d, according to a recent press release. The transaction raised $104 million for the company, including $65 million of new equity.

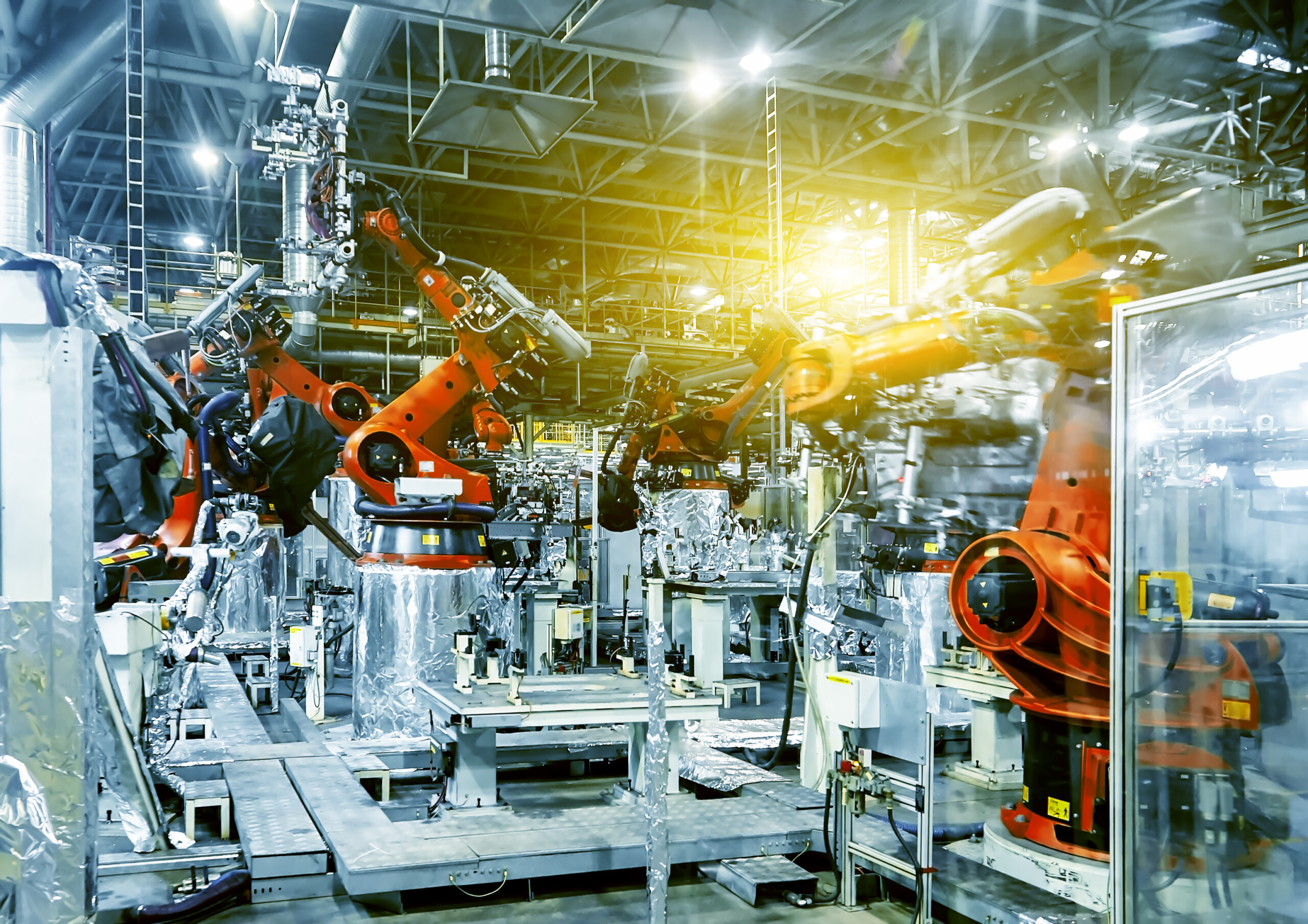

CORE Industrial Acquires Edwards Moving & Rigging. CORE Industrial Partners, a private equity firm focused on manufacturing, industrial technology, and industrial services, has acquired Edwards Moving & Rigging. The business is a provider of heavy hauling and rigging services to the power generation, manufacturing, infrastructure, and construction markets.

FalconPoint Acquires SMS. FalconPoint Partners, a middle-market private equity firm targeting the business services and industrials sectors, has acquired SMS, an industrial services business. FalconPoint provided $500 million to support the company’s growth and invest in new equipment. SMS provides site environmental services, as well as scrap and slag management.

Bow River Carves Out ABL Business of Park Cities. Bow River Capital has acquired the asset-based financing business of Park Cities Asset Management, according to a recent announcement. Park Cities is an asset manager servicing the lower-middle market. The investment expands Bow River’s private credit offering.

Pacific Avenue Carves Out Pick Your Part from LKQ. Pacific Avenue Capital Partners, a private equity firm focused on carve-outs and complex transactions in the middle market, announced it is acquiring Pick Your Part from publicly listed LKQ Corporation. PYP is an auto salvage business.

NexPhase Acquires Magic Science. NexPhase Capital has acquired Magic Science Corporation, a health sciences company that manufactures hypochlorous acid for skincare products. Backing from NexPhase will support expansion across product, retail distribution and household consumer goods.

Fruition Acquires The Memory Company. Fruition Partners announced this week its acquisition of The Memory Company, a licensee of sports and consumer-branded merchandise. The company specializes in drinkware and home décor, a press release noted.

GTCR Acquires Innovative Systems. Private equity firm GTCR has acquired Innovative Systems, an enterprise software provider servicing broadband providers. GTCR acquired the business from Alpine Investors, according to a press release.

Vector Capital Acquires Showpad. Vector Capital Management, a technology-focused private equity firm, announced an agreement to acquire Showpad this week. Showpad provides AI revenue enablement technology for marketing and revenue teams.

Add-Ons

Shore Capital’s ONDEX Acquires Vision and Control Systems. ONDEX Automation, a process automation systems integrator servicing manufacturers, has acquired Vision and Control Systems, a factory automation systems integrator with a specialization in machine vision. ONDEX is a portfolio company of Shore Capital Partners.

Transom Capital’s Artivo Carves Out Brands from Mosaic Companies. Transom Capital-backed Artivo Surfaces has acquired two brands from Mosaic Companies. Artivo, the parent company to several flooring solutions brands, acquired Walker Zanger and Anthology, expanding its flooring and service solutions offering for commercial and residential customers.

Arcline Investment’s MMT Acquires Innova Design. Arcline Investment Management-backed Medical Manufacturing Technologies (MMT), a medical device manufacturer, has acquired Innova Design. The investment expands MMT’s suite of bonding technologies, a press release said.

Strategics

TrustFlight Acquires Aviation Businesses from Wheels Up. TrustFlight, an aviation training and security solutions provider, announced this week its acquisition of Baines Simmons, Kenyon Emergency Services and Redline Assured Security from Wheels Up. The acquired businesses will retain their teams and brands, TrustFlight noted.

Exits

Blackstone Exits Irth Solutions to TPG. Blackstone Energy Transition Partners is selling Irth Solutions, a provider of enterprise software for the critical energy and infrastructure industries. Alternative asset management firm TPG will acquire Irth through its middle-market and growth equity platform TPG Growth, a press release said.

Fundraising

Curewell Capital Raises $535 Million. Curewell Capital, a healthcare-focused middle-market private equity firm, announced the close of its inaugural fund at $535 million in capital commitments. Curewell Capital I will focus on healthcare services, pharmaceutical services, medical devices, and healthcare technology.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.