What is Private Equity’s Role in Higher Education?

Private equity has had a fraught history in higher ed, but tech-enabled learning creates new investment opportunities.

This article was written in partnership with Grata.

Few topics cause the kind of consternation that profit-seeking in education does. This is especially true in higher education where government funding accounts for a significant portion of schools’ budgets.

However, experts like Trace Urdan argue there’s an important complementary role for the private sector: “As important as it is to have non-profit and public education, I’m a big believer in the idea that risk capital drives innovation in education.”

Urdan is a managing director at Tyton Partners, a consulting firm and investment bank specializing in all aspects of knowledge services. He has 24 years of experience in the investible education space, and in speaking with Next Target, he describes a higher education landscape that’s rife with controversy, re-regulation and uncertainty. But for industry stalwarts, this kind of challenging environment is rich with possibility.

In this second edition of the Next Target education series, we’ll explore the green shoots of opportunity emerging from the fracturing and evolving higher education landscape.

Helping Universities Adapt to Hybrid Learning

Compared to its heyday in the late 2000s, PE participation in for-profit higher education has narrowed dramatically to a handful of players, like Sterling partners, who have specialized in the space for years. Experts predict a spike in enrollment in the wake of the pandemic, but uncertainty and stricter regulation are spooking investors.

One of the closest verticals that will benefit from the increased demand is the online program management, or OPM, market. These are companies that help universities provide online learning. Some business models may only provide the learning platform, while full-service models do everything including content development, marketing, enrollment, and support. In these full-service arrangements, partner universities lend the legitimacy of their name brand as well as instructors to teach the courses.

“In some ways, [an OPM] is the private equity workaround to say, ‘how can I benefit from this incredible growth and demand for online but not subject myself to the regulatory uncertainty,’” explains Urdan.

The OPM market is not entirely free of problems. It’s still under the umbrella of Title IV funding (federal pell grants, federal student loans, etc) and therefore exposed to regulatory scrutiny. For instance, lawmakers have called into question profit-sharing agreements between OPMs and universities. Despite this controversy, OPMs are still appealing to investors because of the strong market forces at play.

“In terms of the level of perceived risk, it’s not nothing but it’s seen as much lower and the reason for that comes back to the pandemic,” says Urdan. “So many schools are reliant on this new [hybrid online] model and looking to enter into new agreements with these companies because the schools are financially strapped. There’s a general sense that yes, regulators don’t love the profit-sharing but it’s probably not a priority considering the long list of things they have to go after.”

For private equity investors that have no appetite for this type of regulatory risk, Urdan recommends companies that deliver a straightforward product or service directly to institutions without the complication of profit sharing. We used this as guidance in this edition’s Grata search analysis to find companies that can capitalize on increasing online learning demand while minimizing the Title IV regulatory risk.

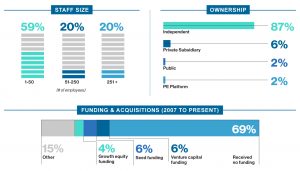

We found 54 companies in the U.S. and Canada that provide tools and services to help institutions deliver online learning. These include eLearning platforms, learning management system providers, online learning consultancies, and learning design companies.

Meeting the Demand for ROI in Higher Ed

For years, a simmering question among college students and their families has been whether traditional four-year education is worth the time and cost. The question reached new fervor during the pandemic when many campus amenities were stripped away.

Coding bootcamps have been the private market’s definitive response to this question. According to Course Report, “79% of bootcamp graduates landed a job where they use the skills learned at bootcamp—and saw a 56% salary lift…”

Investment in the space has been—and continues to be—very active. However, the market is going through changes that spell uncertainty for incoming investors:

- Traditional universities are becoming increasingly active in the space; the number of university bootcamps jumped from 19 in 2019 to 47 in 2020.

- The industry is already consolidating, including acquisitions from for-profit universities and staffing firms.

- Regulators are taking a closer look at the industry and implementing rules around licensing and accountability.

Alongside the rise in bootcamps come new funding models that aim to further address concerns about the ROI of higher education. Deferred tuition and income share agreements (ISAs) allow students to attend a program without having to pay for it until after they are gainfully employed. Generally, ISAs are offered by individual skills training programs to their students.

Like many aspects of higher education, ISAs have been controversial. Some critics label the practice as deceptive and predatory, while advocates point to it as the solution to the student debt crisis. There’s even a bipartisan bill in Congress that aims to codify the legal framework of ISAs.

The theme of controversy and uncertainty continues with ISAs, but between the focus on ROI in education, as well as the meteoric rise of bootcamps, this niche market is one to keep an eye on. To illustrate this point, a search in Grata shows new ISA-based business models are cropping up outside of individual bootcamp offerings.

The search found 27 companies with a few different business models including offering ISAs directly to students, offering ISA programs as a service to institutions, or offering investors a vehicle to invest in ISA funds.

Candace Adorka is a content editor for Next Target and Middle Market Growth.