What You Need to Know About Amazon’s Largest Deal To Date

The online retailer's purchase of Whole Foods reflects an overall uptick in activity for grocery store M&A.

This article is brought to you by S&P Global Market Intelligence. It was adapted from a blog post originally published on the company’s website.

Today’s announcement that Amazon.com will begin selling merchandise from Sears’ Kenmore brand is the latest in a spate of new deals and partnerships for the online retailer. This follows on the heels of news last month that it would acquire Whole Foods Market Inc., a $14.6 billion deal and Amazon’s largest-ever acquisition. The amount it paid for the grocery chain represents approximately 2.6 times the aggregate disclosed value of $5.59 billion for all of Amazon’s previous acquisitions.

Prior to Whole Foods, the company’s top acquisition, according to S&P Global Market Intelligence data, was an $894.6 million purchase of online shoe retailer Zappos from Venture Frogs LLC, Sequoia Capital, Tenaya Capital, Millennium and other shareholders for approximately $890 million in stock on July 22, 2009.

Prior to the recent Whole Foods deal, Amazon’s only other M&A deal this year was an agreement to acquire Middle East and North African e-commerce platform Souq.com FZ-LLC for approximately $650 million on March 28, 2017.

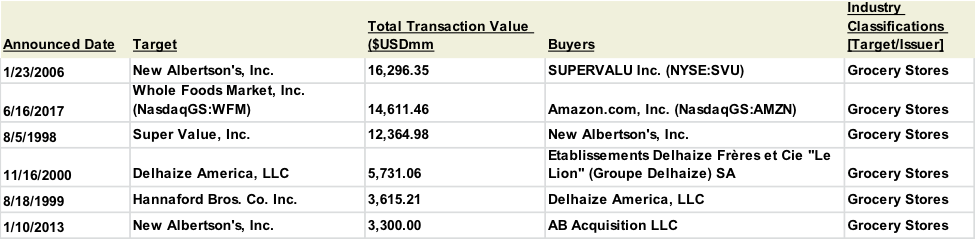

Aside from the value of the proposed deal, another significant aspect is that the transaction ranks as the second-largest U.S. M&A transaction ever announced in the grocery market and the largest since SUPERVALU Inc. entered into a definitive agreement to acquire Albertson’s Inc. in a deal valued at $16.3 billion (inclusive of assumed liabilities) on January 23, 2006.

To date this year, there have been 26 announced M&A deals involving targets in the U.S. grocery market with a total disclosed value of $14.6 billion. That dollar amount already exceeds the annual dollar amount of U.S. grocery store M&A transactions in each of the years between 2007 to 2015. Furthermore, if the current year ended at this time, it would stand as the third best year on record for U.S. grocery store M&A value, with only 2006’s total of $16.7 billion and 1998’s total of $18.5 billion being greater.

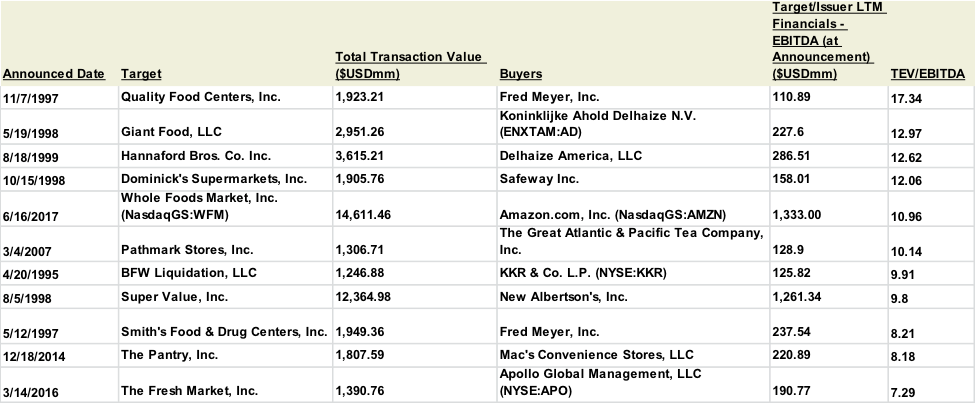

Additionally, in terms of valuation, based on Whole Foods’ EBITDA of $1.33 billion for the period of the last 12 months, the recent deal reveals a multiple of Total Enterprise Value/EBITDA of nearly 11 times. That stands as the fifth highest valuation among U.S. grocery store M&A deals above $1 billion in disclosed value.

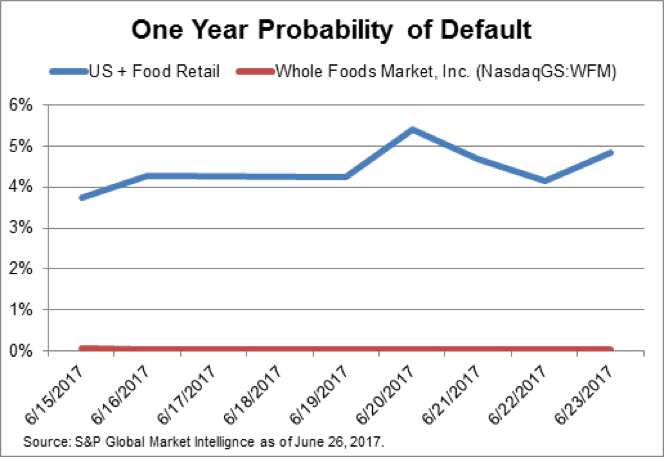

This proposed acquisition has also triggered a reaction in the market-perceived credit quality in the industry. The mean one-year probability of default, or PD, for the food retail industry within the United States, as measured by S&P Global Market Intelligence’s PD Model Market Signals, displayed a notable increase in risk immediately after the acquisition was announced and then climbed higher in the following week.

The median one-year PD sat at 3.73 percent on June 15, and deteriorated by 14 percent to 4.26 percent on June 16, finishing at 4.85 percent on June 23, a 30 percent rise overall.

This model, which is influenced by the company’s stock performance, as well as financial and systemic risk variables, demonstrates that the market is perhaps cautious about the prospects of the food retail industry in light of Amazon’s increasing footprint in the space. During this same period, the PD for Whole Foods saw an improvement of 63 percent, falling to .021 percent from .057 percent pre-announcement.

However, this is not necessarily a “done deal.” As of June 27, 2017, Whole Foods’ stock is trading above the $42 per share that Amazon offered, so a competing bid may emerge.

Prior to the recent Amazon announcement, a number of potential suitors–from private equity buyers to strategic buyers such as such grocers The Kroger Co. or Albertson Companies Inc.–were named as possible acquirers of Whole Foods. While, historically, competing or unsolicited M&A bids are often unsuccessful, the fact that the target’s current price stands above the buyer’s offer price suggests that the market may be looking for a rival bid for the company. We will be closely watching whether such a development occurs.

Richard Peterson is a principal analyst, financial institutions research, at S&P Global Market Intelligence.