Investment Bankers Chart a New Path

Boutique and middle-market advisors are ramping up hiring, while bulge-bracket banks cut staff in a slow M&A environment

As investment bankers advance in their careers, the natural tendency is to work at ever-larger firms and on bigger deals. The incentives are obvious: larger fees and more clout. In a slow M&A year like 2023, however, some people bucked that trend and went down market instead.

Matt Brom, who joined Clearsight Advisors in May as a managing director in the boutique investment bank’s Government Services, Defense and Public Sector Technology Practice, says he was encouraged by the fact that Clearsight was seeing a decent amount of deal flow in a relatively slow year.

This section of the report originally appeared in the special edition Middle Market Growth 2024 Multiples Report. Read the full issue in the archive.

“They are still very active and have been closing a lot of deals,” says Brom. “Those in our buyer universe noted they’ve been impressed with the deal volume we’ve been able to maintain in this market.”

Brom was previously a director at Truist Securities, where he’d worked since 2020. Prior to that, he spent 10 years in a variety of roles at Truist’s predecessor, SunTrust Robinson Humphrey. When BB&T and SunTrust merged and rebranded as Truist in 2019, the bank’s goal was to go after more large-cap deals and public companies. Brom says that deal flow was especially light in this category in 2023, amid a flurry of market headwinds.

There were few deals in 2022 among public aerospace and defense companies. “If that was the market you were incentivized to chase, you were kind of starved,” Brom says.

Smaller companies are more likely to continue trading even in a slow environment, since founder- and family-owned businesses have other motivations to sell. “The middle market and lower-middle market are where most deals are still happening,” Brom says.

Waves of Cuts

The lower deal volume has prompted some large bulge-bracket and larger full-service banks to lay off staff in droves. Credit Suisse let go of most of its investment bankers after it merged with UBS; several other large banks, including Goldman Sachs, Morgan Stanley and Citi, announced thousands of staff cuts over the 2022-2023 time frame.

Story continues below.

Source: Selby Jennings Salary Guide: Investment Banking

Simon Lewis, managing director and founder of SLA Executive Search, describes the cuts as having come in waves. The first wave happened at the end of 2022 or beginning of 2023, when large banks cut about 10%-15% of deal execution staff “with the understanding that the market was going to be slower,” Lewis says. Some of this was a reality check after banks hired aggressively during the dealmaking boom of 2021, he adds.

After the first quarter of 2023, when it was clear deal volume wasn’t picking up, many banks conducted a second wave of layoffs involving deal execution staff, including people at the senior associate, director and sometimes managing director levels, Lewis explains. As the slow dealmaking environment continued to drag on, some banks engaged in a third wave of cuts. “These were people that they didn’t want to lose but had to let go of ” to cut costs, Lewis says.

About 300 middle-market investment bankers at the managing director or director level changed jobs in 2023 through September, according to SLA’s estimates. More announcements about investment banking hires—most of them from boutique and middle market-focused banks—began to crop up in the second half of the year.

A Lifestyle Change

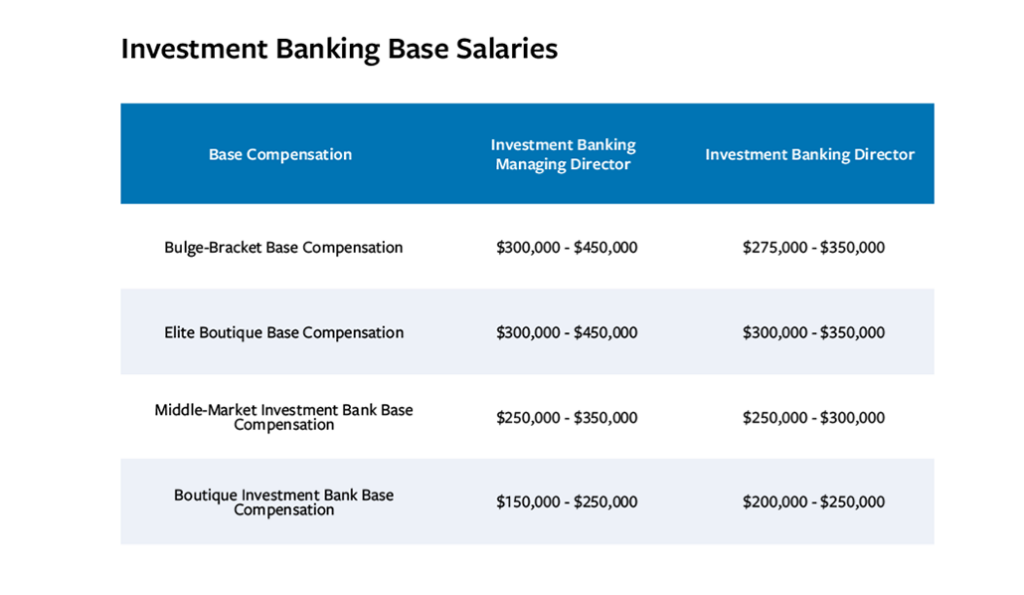

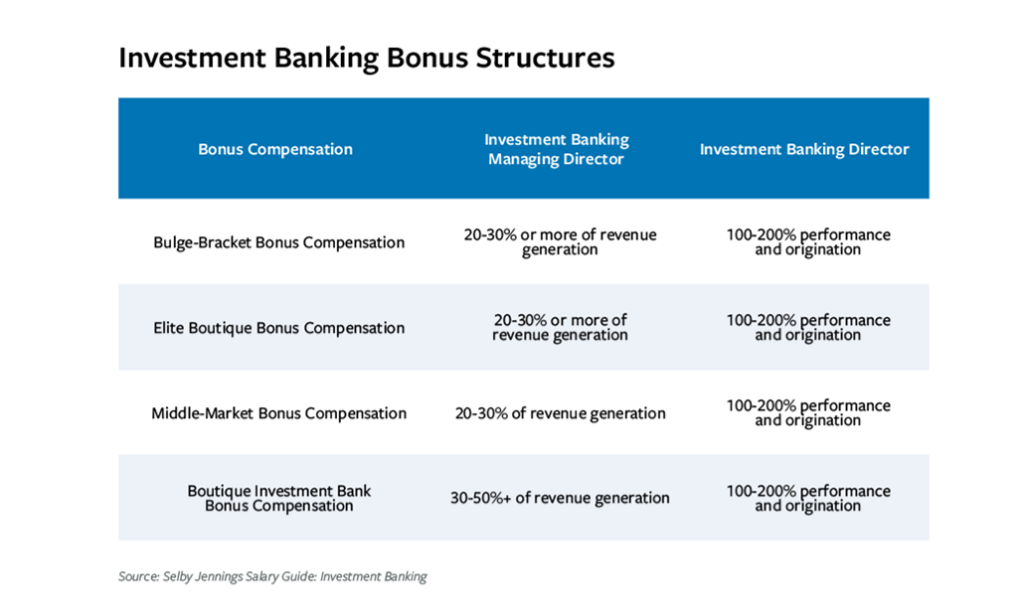

Smaller banking firms aren’t always able to match larger competitors’ base pay levels, but experienced bankers can still make similar amounts—if not more—at boutique firms with less overhead, experts say.

Related content: Rethinking the Investment Banker’s Role in a 2023 M&A Market

Brianne Sterling, head of corporate and investment banking at financial services talent firm Selby Jennings, says some boutique banks can offer a better work-life balance, stability and culture. Bankers moving from bulge-bracket or larger boutique outfits to middle-market firms effectively become “big fish in a small pond.”

“These firms can give the banker not only whiteboard space in their sector but also more transparency on compensation,” says SLA’s Lewis. There is often more autonomy and less bureaucracy at these organizations, he adds.

Ramsey Goodrich, managing partner at Southport, Connecticut-based investment bank Carter Morse & Goodrich, says the change is “a lifestyle question as much as a financial one.”

“If you close a few deals, you’ll actually make more money. But you might not have the fancy Wall Street brand name, the lavish perks or the full staff of junior professionals” often offered at large banks, Goodrich says. His firm works with multigenerational family businesses to prepare them for an eventual sale, which often takes several months, if not years. “Private equity-backed companies are built to sell. Family businesses are typically built to hold,” says Goodrich, “so the time to prepare just takes longer.”

Story continues below.

Source: ACG’s 2024 Middle-Market Outlook Survey. Based on responses from 49 investment bankers who took the survey.

With all the bankers who have been laid off over the last few months and the slowdown in M&A, smaller boutiques like Goodrich’s firm have “had a pick of the litter,” he says. “These are people who we wouldn’t traditionally have had access to, but we have been investing for the future—which is right around the corner.”

Carter Morse & Goodrich recently hired a vice president in M&A execution, John Papadopoulos, who was previously an associate director at UBS’ investment bank in the Global Industries Group. Goodrich says he plans to continue to add more staff at the associate level in the next few months.

Preparing for the Rebound

As M&A started to slowly rebound in the third quarter of 2023, banks wanted to be well positioned for the recovery. Some have been hiring opportunistically in more active subsectors like healthcare; aerospace, defense and government services; industrial technology; and transportation and logistics technology, Lewis says. Activity in consumer, manufacturing and auto has been on the decline, however. These have become areas where banks aren’t spending as much time right now. Debt advisory specialists at boutique banks who help buyers line up nontraditional financing through private credit or club deals are also in demand, Lewis says.

Above all, firms are interested in hiring senior managing directors with a track record of delivering deal flow. Selby Jennings’ Sterling says firms are looking for bankers who have closed more transactions and “will be able to plug-and-play” easily into their new employer’s workflow.

Lewis thinks middle-market banks will continue to ramp up hiring in 2024 as deal flow improves. “I’ve been talking to bankers and since Labor Day, pitch activity is up, especially in sectors where there’s strong private equity interest, such as industrials, business services, and food and beverage,” he says. Even if the macro environment and interest rates aren’t as favorable for dealmakers, investors can’t sit on the sidelines for too long. “Firms are now thinking: We want to be best positioned for a rebound,” Lewis adds.

I’ve been talking to bankers and since Labor Day, pitch activity is up, especially in sectors where there’s strong private equity interest, such as industrials, business services, and food and beverage.

Simon Lewis

SLA Executive Search

Stephen Rossi, managing director and head of investment banking at Los Angeles-based Palm Tree, says his firm is staffing up in preparation for an uptick in deal flow. In September, Palm Tree hired Tracy Albert as vice chairman of investment banking and David Barnes as a managing director and head of mergers and acquisitions. They previously held senior investment banking roles at JD Merit & Co. in Seattle. “We have more active engagements driving the need for growth,” says Rossi. “We anticipate the market picking up as we roll into 2024.”

He says there are increasing opportunities for special situations activity as some companies struggle to cope with rising interest rates. “Sellers are also getting comfortable with the new paradigm,” and it’s become easier for buyers and sellers to agree on valuation, says Rossi.

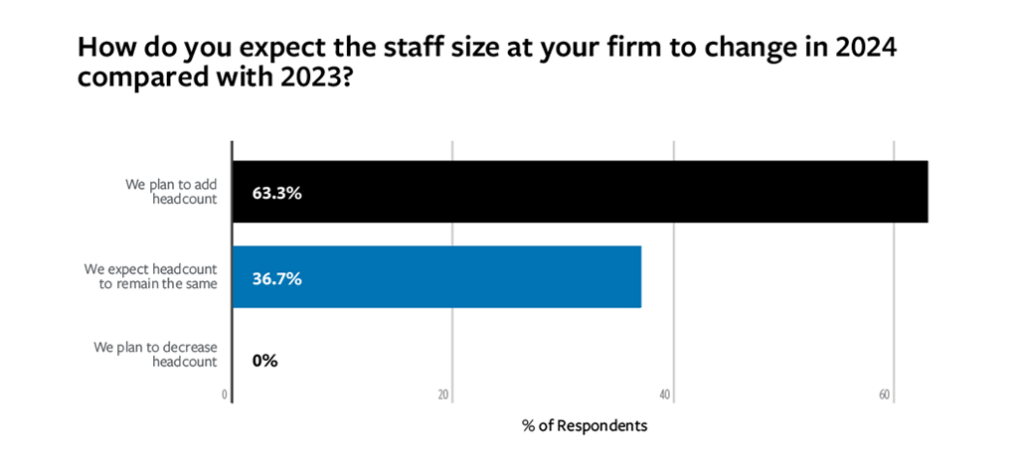

Out of 49 investment bankers who took ACG’s annual survey in the fall, 71% said that they expect to see more deal activity in 2024 as compared to 2023. A majority of the bankers polled (63%) said they expected to add headcount in 2024, while 37% expected headcount to remain the same. None said they plan to reduce their staff size.

Geographic Migration

Experts are also noticing geographic trends in banking talent. “New York, San Francisco and Chicago were the hot spots for investment banking, but now there is a lot of growth in Atlanta, Los Angeles, Austin and Miami,” says Lewis.

Related content: Investment Bankers Tackle the Intersection of Technology and Services

During the pandemic, many people moved away from big cities or to the South, and now bankers are often open to working in other locations. Selby Jennings’ Sterling says, “There are a few cities that are attractive to bankers, some of which have fully remote options and others where you come in once in a while.” Firms are also open to starting offices at new locations or hiring a managing director where he lives and building an office around him. Sterling agrees that cities like Miami, Atlanta and Dallas are attractive to bankers, due to their lower cost of living.

Palm Tree, which has 20 people in its investment banking group and offices in Los Angeles, Chicago, Dallas and Detroit, plans to add more investment banking staff to ramp up industry specialization over the next several years. The firm announced a new Dallas office in September. Rossi says the firm already has specialists in sectors like industrials, consumer and tech-enabled services but plans to divide up the specialties further into subsectors.

Rossi says the candidates the firm talks to are often either working in another area of finance and want to try something different, or they have been laid off from bulge-bracket banks. Others are motivated by geography. “Some people wound up elsewhere because of the pandemic, and now that companies are calling people back to the office, they don’t want to move back to their prior locations,” Rossi says.

Recent Investment Banking Hires

Baird hired RO BHANDARI and BEN PORT as managing directors in the Healthcare Investment Banking Group, with Bhandari focusing on medical technology and Port on provider services. The two were previously at rival investment banks: Bhandari joined from William Blair and Port from Moelis.

Brown Gibbons Lang & Co. appointed PETER FINN as a managing director to lead its Industrial Technology Investment Banking Team. He was previously a managing director at TD Cowen, leading the Industrial Technology Practice there.

Carter Morse & Goodrich added JOHN PAPADOPOULOS as a vice president focused on M&A transaction execution. He was previously an associate director at UBS in the Global Industries Group.

Cascadia Capital tapped RON RIVERA as a managing director in its Software/Technology Group. He joined from technology advisory firm Drake Star Partners.

Clearsight Advisors hired MATT BROM as managing director to lead its Government Services, Defense and Public Sector Technology Practice and STEPHEN SHANKMAN as a managing director to oversee the Information Services Practice. Brom was previously a director at Truist Securities, while Shankman joined from Jegi Clarity, a technology, media and telecommunications M&A advisory firm.

Harris Williams hired MICHAEL KIM as a managing director and co-head of the Technology Group. He previously served as global head of technology investment banking at Piper Sandler.

Houlihan Lokey appointed NICK PAVLIDIS as a managing director for its Consumer, Food & Retail Group. He was previously a managing director in the consumer sector at Baird.

Oppenheimer & Co. added RUPERT SADLER as a managing director in the firm’s Technology Investment Banking Group. He was previously a managing director in the Global Technology Group at Houlihan Lokey.

Palm Tree added TRACY ALBERT as vice chairman of investment banking and DAVID BARNES as head of mergers and acquisitions. The duo previously held senior investment banking roles at JD Merit and Co.

Raymond James tapped ERIC FRANCOIS as a managing director and RYAN LESSARD as a director in its Healthcare Investment Banking Group. Francois was previously the CFO of biotech company Scynexis, while Lessard held biotech-focused investment banking roles at Evercore and Jefferies.

Stephens added PETER GRANT as a managing director and head of technology. He was previously co-head of software investment banking at Cowen.

William Blair hired JEROME WALLACE and BRIAN WILLIAMS as managing directors and co-heads of the bank’s Private Capital Advisory business. Both hail from Credit Suisse, where they were on the leadership team of the Private Funds Group.

Anastasia Donde is Middle Market Growth’s senior editor.

Middle Market Growth is produced by the Association for Corporate Growth. To learn more about the organization and how to become a member, visit www.acg.org.