M&A In the Time of COVID-19: Is It the Right Time to Sell?

Sell-side activity has recently rebounded since the start of the pandemic, but is now the right time to sell? Here are four factors clients should consider.

Businesses that were contemplating M&A processes before the lockdown brought on by COVID-19 have had to reassess the environment carefully. Many private equity and investment banking firms saw an initial pause in sell-side processes at the onset of COVID-19. However, launch activity has recently rebounded to pre-COVID levels and appears robust for the remainder of 2021.

Is it the right time for a middle-market company to sell? Here are four factors that could help clients decide whether to move forward or delay launches.

One, the business and recent financial results have not been materially affected by pandemic issues. While there is no exact metric to use (e.g., the percentage change in revenue or earnings before interest, taxes, depreciation, and amortization or EBITDA), financial performance that has remained in line with pre-pandemic performance or exhibited growth are good benchmarks.

Two, run-rate financial results have trended back to pre-pandemic levels, demonstrated through several months of consistent recovery. Three to six months of performance is typically enough to illustrate a trend.

Three, backlog or project work signal substantial recovery in future months or providing greater visibility

Four, positive financing is available for the business or industry sector. The willingness of lenders to provide financing to the business or sector is paramount.

If one or more of the factors above are met, this often portends an active M&A market.

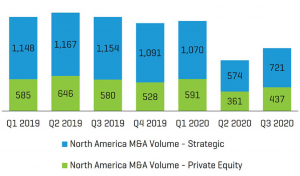

After witnessing a pause in activity during the late first quarter and the second quarter of 2020, financial investors/private equity (PE) and strategics resumed M&A activity. There is substantial capital available to investors. Debt financing has also largely recovered from second-quarter levels, though certain industries have seen continued weakness (e.g., energy, retail, and travel and hospitality), and asset-based lending represented a meaningful portion of activity immediately after the first wave of the pandemic (versus cash flow-based lending).

The marketing process itself has experienced relatively little change as this is typically managed via phone and email. Likewise, firm responsiveness has remained similar. One of the more challenging M&A process steps has centered around management presentations and site visits, subsequent to receiving initial indications of interest. A number of PE groups and strategics have restricted employee travel unless absolutely necessary.

In order to address these buyers’ health concerns, Stout has adopted a hybrid approach to enable the important introductions and discussions between buyers and sellers. This approach has included conducting socially distanced—and masked—management presentations to small groups of buyer representatives willing to travel to a meeting and conducting virtual Zoom presentations for larger groups unable to travel. Our M&A professionals and clients also offer site visits both in-person in very small groups or virtually through pre-recorded videos of plants and facilities. Finally, we also use data rooms to share information securely.

Getting to Closing

The past year has seen more change between signing a letter of intent and closing. Because travel has been restricted for many buyers and service providers, time to closing has typically increased in most transactions, but some deals are still closing on a “pre-COVID” timeline. Every Stout transaction that has closed during the pandemic has had at least one face-to-face meeting between buyers and sellers. In addition, most have required environmental surveys and site visits prior to closing. The logistics for these visits has required more robust advance planning.

Purchase Agreement Nuances

COVID-19 has also made buyers focus on certain areas of due diligence and created new conditions to closing. While buyers have consistently emphasized safety, they are evaluating workplace safety and health procedures more thoroughly. There has been renewed evaluation of employee interactions, given the potential for rapid spread among work groups and even company/customer interactions.

In addition, Paycheck Protection Program loans have become a key item of negotiation between buyers and sellers. Even if the loans are expected to be completely forgiven, a change of control may accelerate the loan and require it to be repaid at closing or that funds be escrowed in the remote chance it is not forgiven.

Other major changes in purchase agreement negotiations have included:

PPP Loans. Sellers may have to represent that the company was eligible for the PPP loan and that the proceeds were used in accordance with program guidelines. There is also the requirement that PPP loans be repaid prior to or at closing or have funds escrowed in the loan amount. If the loan is forgiven, escrowed funds would flow to the sellers.

Material Adverse Change and Other “Outs.” Sellers have added a MAC exclusion for COVID-19 issues. Buyers have added financing outs if “solely” related to impact of COVID-19.

Health-Related Conditions. Certain purchase agreements may include a condition that no more than a certain number of employees are sick with COVID-19 at closing. A number of jurisdictions are requiring companies with a threshold level of infections to close for a period of time. Buyers want to ensure that they do not close on a transaction where the target is effectively closed for several weeks

Navigating M&A processes during a pandemic has created new challenges and issues to consider, but proper planning and execution are paramount to success.

Todd Parsapour is managing director of investment banking for Stout, a global investment bank and advisory firm.