How Food Giants Are Outsourcing Innovation

There has been a marked increase in M&A activity as large food companies look to acquire entrepreneurial brands with fresh concepts.

Large food companies have struggled to generate growth in recent years, a reality that has created space for entrepreneur-led brands that may eventually become M&A targets for large acquirers.

Over the last three years, median annual revenue growth for major publicly traded food companies was negative, according to data from S&P Capital IQ. This is partly the result of a corporate hierarchy vested in decades-old business models. These legacy structures have made it difficult for large companies to refocus marketing and innovation efforts to take advantage of changing consumer demand and the rise of social media. This challenge has been compounded by recent pressures on marketing and innovation budgets. Many companies have benchmarked their spending against 3G Capital’s aggressive cuts at Kraft Heinz as it seeks to improve margins following the 2015 merger.

The inability of food industry giants to adequately address consumer trends has left a gap in the market. That void has been filled largely by entrepreneurial companies that in many cases attract financial support and operational guidance from venture capital and private equity. These smaller, more nimble companies are closer to the consumer and therefore better able to understand market needs without the bias of historical ways of doing business. Furthermore, they appear to be better versed in newer marketing methods and social media to influence consumer demand.

The most successful of these companies often see huge growth, achieving milestones of $20 million, $50 million and $100 million in annual sales in just a few years. Venture capital and private equity players focused on the consumer market—with money to invest and the ability to add value through operational and marketing resources and retail connections—actively look to back these companies and help get them to the next level.

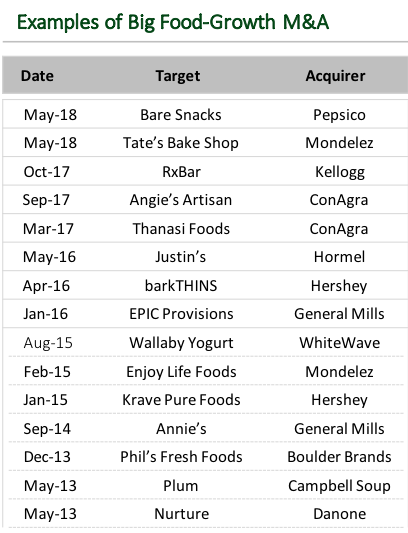

A natural and not unexpected outcome of these factors has been a marked increase in M&A activity in recent years as large food companies look to gain access to the innovation efforts of these smaller players. They wait to see which companies gain traction and success before they pursue an acquisition; in this way they effectively outsource successful innovation.

This M&A activity, often occurring in competitive auction situations, has been happening at very high valuation metrics. Sales-based multiples range from 2.5 times to as much as 7 times, which implies multiples of pro forma EBITDA often well in excess of 20 times. These extreme valuations are justified by large acquirers’ ability to utilize broad distribution and marketing capabilities to quickly ramp up sales and profitability. A representative sample of recent transactions, including PepsiCo’s purchase of Bare Foods and Mondelez’s acquisition of Tate’s Bake Shop, display an average transaction value of $285 million and an average multiple to sales of 4.2 times (based on estimates from public and private sources).

There are signs, however, that some of the trends behind this M&A activity may be shifting. For example, food giants such as ConAgra have achieved some traction from rejuvenated marketing and innovation efforts, and 3G’s cost-cutting efforts at Kraft Heinz recently have hit a wall amid stagnant last-12-months revenue growth. Regardless, it is likely that select entrepreneurial and private capital-backed growth companies will continue to find success capitalizing on consumer demand trends, leading to more growth-oriented M&A.

This story originally appeared in the September/October 2018 print edition of Middle Market Growth magazine. Read the full issue in the archive.

Jeffrey Robards leads the consumer foods sector focus in North America for Alantra, a global investment banking and asset management firm.